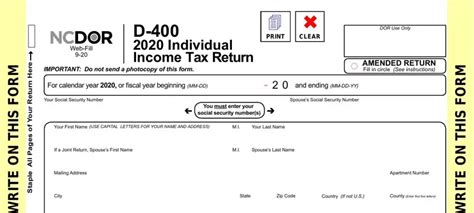

Ncdor Estimated Tax Payment

The North Carolina Department of Revenue (NCDOR) requires certain taxpayers to make estimated tax payments throughout the year. This system is designed to ensure that individuals and businesses pay their taxes in a timely manner and in accordance with their income and revenue streams. Estimated tax payments are particularly relevant for individuals with income not subject to withholding, such as independent contractors, freelancers, and business owners. In this article, we will delve into the details of NCDOR estimated tax payments, exploring the requirements, due dates, payment methods, and potential penalties to help taxpayers navigate this process effectively.

Understanding NCDOR Estimated Tax Payments

NCDOR estimated tax payments are quarterly payments made by individuals and businesses to cover their anticipated tax liability for the year. These payments are typically required when the total tax liability exceeds certain thresholds, as determined by the NCDOR. The purpose of estimated tax payments is to ensure a more consistent flow of revenue for the state and to prevent taxpayers from facing a large tax bill at the end of the year.

It's important to note that estimated tax payments are not a separate tax; rather, they are advance payments towards the taxpayer's annual tax liability. These payments are then credited against the taxpayer's final tax return, with any overpayments refunded or applied to future liabilities.

Who is Required to Make Estimated Tax Payments?

The NCDOR requires estimated tax payments from individuals and businesses who meet specific criteria. Generally, estimated tax payments are mandatory for taxpayers whose expected tax liability for the year exceeds $1,000 and who expect to have a tax liability after all applicable credits and withholdings. This includes:

- Self-employed individuals and independent contractors

- Business owners, including sole proprietors, partners, and shareholders

- Trusts and estates

- Individuals with income from rentals, royalties, or other sources not subject to withholding

However, certain exceptions and exemptions may apply. For instance, individuals whose total tax liability for the previous year was less than $1,000 or whose total tax liability for the current year is expected to be less than $1,000 are generally not required to make estimated tax payments.

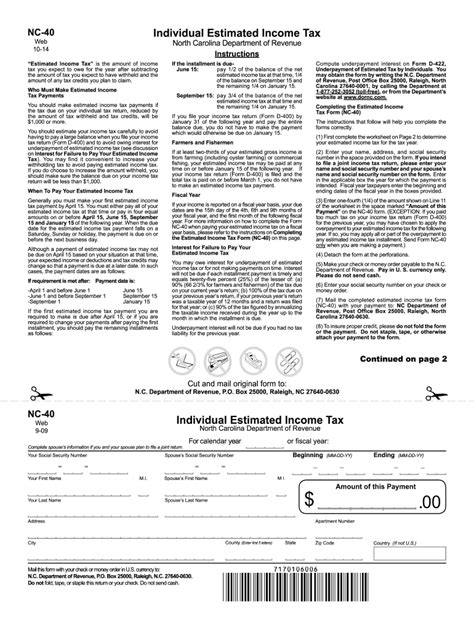

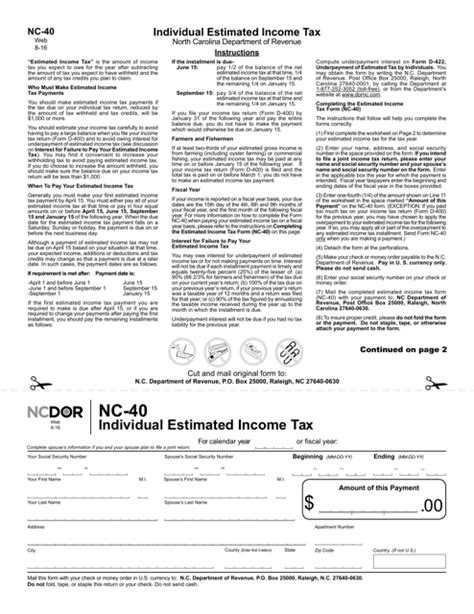

Due Dates and Payment Schedule

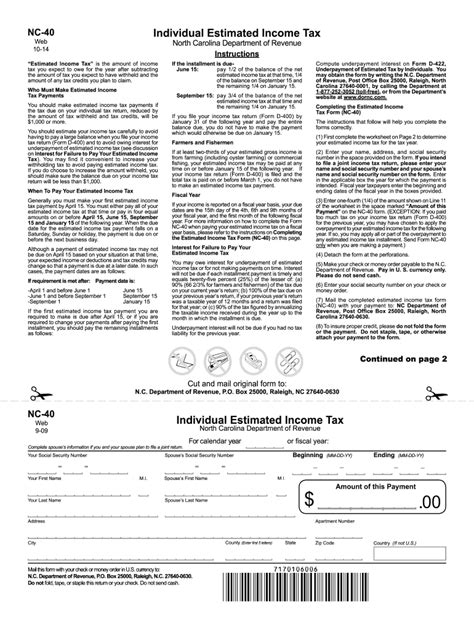

NCDOR estimated tax payments are due on a quarterly basis, with four payment deadlines throughout the year. The payment schedule is as follows:

| Quarter | Due Date |

|---|---|

| 1st Quarter | April 15 |

| 2nd Quarter | June 15 |

| 3rd Quarter | September 15 |

| 4th Quarter | January 15 of the following year |

It's crucial to note that these due dates are non-negotiable, and late payments may result in penalties and interest charges. To avoid penalties, taxpayers should aim to make their estimated tax payments on time or consider adjusting their withholding or estimated tax payments throughout the year to align with their actual income and tax liability.

Methods of Payment

NCDOR provides various methods for taxpayers to make their estimated tax payments. Taxpayers can choose the option that best suits their needs and preferences:

Online Payment

The NCDOR offers an online payment portal, NC TaxPay, which allows taxpayers to make secure payments using their credit or debit cards. This method is convenient and provides a quick and easy way to meet the estimated tax payment deadlines. Additionally, taxpayers can set up payment plans and manage their tax obligations through the NC TaxPay portal.

Electronic Funds Transfer (EFT)

Taxpayers can also make estimated tax payments via Electronic Funds Transfer (EFT). This method involves transferring funds directly from the taxpayer’s bank account to the NCDOR’s account. To use EFT, taxpayers must complete an Authorization Agreement for Automatic Withdrawal of Taxes form and provide their banking details. EFT payments are processed on the due date, ensuring timely payment without the need for manual intervention.

Check or Money Order

For those who prefer traditional methods, estimated tax payments can be made by check or money order. Taxpayers should make the check or money order payable to the North Carolina Department of Revenue and include their taxpayer identification number on the payment instrument. The payment should be mailed to the address provided by the NCDOR for estimated tax payments.

Paying in Person

In certain circumstances, taxpayers may choose to pay their estimated taxes in person. The NCDOR has local offices across North Carolina where taxpayers can visit and make their payments. This option may be beneficial for those who prefer face-to-face interactions or have unique payment circumstances.

Calculating and Adjusting Estimated Tax Payments

Calculating the correct amount for estimated tax payments is crucial to avoid underpayment penalties. The NCDOR provides resources and tools to assist taxpayers in determining their estimated tax liability. Generally, estimated tax payments should be based on the taxpayer’s expected income and tax liability for the year.

To calculate estimated tax payments, taxpayers can refer to the North Carolina Individual Estimated Tax Worksheet or use the NC Individual Income Tax Estimator tool available on the NCDOR website. These resources guide taxpayers through the process of estimating their tax liability and determining the appropriate payment amount for each quarter.

It's important to note that estimated tax payments are not set in stone and can be adjusted throughout the year. If a taxpayer's income or tax liability changes significantly, they can adjust their estimated tax payments accordingly. This ensures that taxpayers are not overpaying or underpaying their taxes, which could lead to penalties or interest charges.

Penalty for Underpayment

The NCDOR imposes a penalty for underpayment of estimated taxes. This penalty is designed to encourage taxpayers to make accurate and timely payments. The penalty is calculated as the lesser of 10% of the underpayment or the interest charged on the underpayment amount. To avoid this penalty, taxpayers should aim to make estimated tax payments that are at least equal to the smaller of:

- 90% of the current year's tax liability

- 100% of the previous year's tax liability

Taxpayers who are unable to meet these thresholds may qualify for an exception if their tax liability is primarily due to business-related income or certain other specific circumstances.

Tips and Strategies for Effective Estimated Tax Payments

Navigating the estimated tax payment process can be complex, but with the right strategies, taxpayers can ensure compliance and avoid penalties. Here are some tips and strategies to consider:

Accurate Record-Keeping

Maintaining accurate and organized financial records is essential for estimating tax liability and making informed payment decisions. Taxpayers should keep track of their income, expenses, and any relevant deductions or credits throughout the year. This helps in calculating the correct estimated tax payments and ensures that taxpayers have the necessary documentation to support their tax returns.

Quarterly Reviews

Conducting regular reviews of income and expenses on a quarterly basis allows taxpayers to make adjustments to their estimated tax payments as needed. By reviewing their financial situation at the end of each quarter, taxpayers can ensure that their payments align with their actual tax liability, preventing underpayment penalties and reducing the risk of overpayment.

Consider Professional Assistance

For taxpayers who find the estimated tax payment process complex or who have unique financial circumstances, seeking professional assistance from a tax advisor or accountant can be beneficial. These professionals can provide guidance on estimating tax liability, choosing the right payment method, and ensuring compliance with NCDOR requirements.

Explore Payment Options

Taxpayers should explore the various payment options offered by the NCDOR and choose the method that best suits their needs. Whether it’s the convenience of online payments, the security of EFT, or the familiarity of traditional check payments, taxpayers have the flexibility to select the option that aligns with their preferences and financial situation.

Future Implications and Potential Changes

The landscape of tax regulations and requirements is subject to change, and taxpayers should stay informed about potential updates or modifications to the estimated tax payment process. The NCDOR regularly provides updates and announcements regarding tax laws, deadlines, and payment procedures. Staying informed ensures that taxpayers can adapt to any changes and continue to meet their tax obligations effectively.

Additionally, taxpayers should be aware of potential changes in tax rates, brackets, and deductions, as these can impact their estimated tax payments. Keeping up with tax reforms and proposals at both the state and federal levels can help taxpayers anticipate and plan for any adjustments to their tax liability and estimated tax payments.

Conclusion

NCDOR estimated tax payments are an essential component of the tax system in North Carolina, ensuring that taxpayers meet their tax obligations throughout the year. By understanding the requirements, due dates, and payment methods, taxpayers can navigate this process with confidence and avoid penalties. Accurate record-keeping, quarterly reviews, and professional assistance can further enhance the estimated tax payment experience, ensuring compliance and peace of mind.

As taxpayers continue to navigate the complexities of tax regulations, staying informed and adapting to changes will be key to successful tax management. With the right strategies and a proactive approach, taxpayers can effectively manage their estimated tax payments and contribute to the state's revenue stream.

Can I make estimated tax payments if my income is below the threshold?

+While estimated tax payments are generally required for taxpayers with expected tax liabilities exceeding 1,000, individuals with lower tax liabilities may still make voluntary estimated tax payments. This can be beneficial for those who prefer to pay their taxes throughout the year or who anticipate an increase in income or tax liability in the future.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What happens if I miss an estimated tax payment deadline?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Missing an estimated tax payment deadline can result in penalties and interest charges. To avoid this, taxpayers should aim to make their payments on time or consider adjusting their withholding or estimated tax payments to ensure compliance. The NCDOR may also offer payment plans for taxpayers facing financial difficulties.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Can I use a credit card to make estimated tax payments?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, the NCDOR accepts credit card payments for estimated taxes through the NC TaxPay portal. This option provides convenience and flexibility for taxpayers, allowing them to make payments quickly and securely using their credit cards.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any exceptions to the estimated tax payment requirements?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, certain exceptions and exemptions apply to the estimated tax payment requirements. Taxpayers whose total tax liability for the previous year was less than 1,000 or whose expected tax liability for the current year is expected to be less than $1,000 are generally exempt from making estimated tax payments. Additionally, certain income sources, such as gambling winnings, may have specific rules regarding estimated tax payments.