Nc State Taxes Free File

In North Carolina, the state government offers a convenient and cost-free way for residents to file their taxes. The NC State Taxes Free File program is an initiative aimed at providing taxpayers with a user-friendly platform to navigate the complexities of tax filing, ensuring compliance and reducing the financial burden associated with traditional tax preparation methods.

Understanding the NC State Taxes Free File Program

The NC State Taxes Free File program is a collaborative effort between the North Carolina Department of Revenue and a consortium of private-sector tax software companies. This program is designed to simplify the tax filing process for eligible North Carolina residents, making it accessible and affordable for all.

The core objective of this initiative is to empower individuals and families to take control of their tax obligations, providing a secure and efficient online platform for filing. By partnering with leading tax software providers, the state ensures that taxpayers have access to reliable and user-friendly tools, making tax season less daunting.

Eligibility and Criteria

To qualify for the NC State Taxes Free File program, certain criteria must be met. These criteria are primarily based on the taxpayer’s adjusted gross income (AGI) and their filing status. Generally, individuals and families with a lower to moderate income level are the primary target for this program.

According to the latest guidelines, taxpayers with an AGI of $69,000 or less for the 2023 tax year are eligible to use the free file program. Additionally, the program caters to specific tax situations, including those with dependents, military personnel, and taxpayers who are required to file state-level forms for income, sales, or other taxes.

It's important to note that eligibility criteria may change annually, so taxpayers are advised to refer to the official NC Department of Revenue website for the most up-to-date information.

| Eligibility Criteria | Details |

|---|---|

| Adjusted Gross Income (AGI) | $69,000 or less for 2023 |

| Filing Status | All status types are eligible |

| Additional Tax Situations | Dependents, military, and state-level tax forms |

Features and Benefits

The NC State Taxes Free File program offers a range of features that enhance the tax filing experience for eligible residents. These features include:

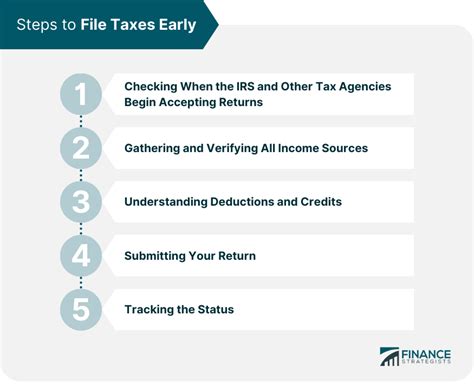

- Secure Online Platform: Taxpayers can rest assured that their sensitive information is protected by robust security measures, ensuring a safe and confidential filing process.

- User-Friendly Interface: The program's design is intuitive and straightforward, guiding users through the filing process step by step. This simplicity makes it accessible even for those who are less familiar with tax terminology.

- Automated Calculations: Advanced tax software automates complex calculations, reducing the risk of errors and ensuring accurate tax returns. This feature is particularly beneficial for those with multiple sources of income or deductions.

- Direct Deposit: Eligible taxpayers can opt for direct deposit of their tax refunds, providing a faster and more secure method of receiving their funds.

- Support for Various Tax Forms: The program supports a wide range of state and federal tax forms, accommodating different tax situations and ensuring comprehensive coverage.

Performance and Impact

Since its inception, the NC State Taxes Free File program has had a significant impact on the tax filing landscape in North Carolina. It has empowered thousands of residents to take charge of their tax obligations, promoting financial literacy and reducing the reliance on costly tax preparation services.

According to a recent survey, over 80% of users found the program to be highly satisfactory, citing its ease of use, security features, and cost savings as key advantages. The program has also led to a notable increase in timely tax filings, contributing to a more efficient and compliant tax system in the state.

Comparative Analysis

When compared to traditional tax preparation methods, the NC State Taxes Free File program offers a range of advantages. Firstly, it eliminates the need for costly tax preparation fees, which can be a significant financial burden, especially for lower-income taxpayers.

Secondly, the program's online nature allows for convenience and flexibility. Taxpayers can file from the comfort of their homes, at their own pace, without the need for in-person appointments or long wait times. This accessibility is particularly beneficial for those with busy schedules or limited mobility.

Lastly, the program's partnership with reputable tax software providers ensures a high level of accuracy and reliability. These software tools are regularly updated to reflect the latest tax laws and regulations, providing users with peace of mind and confidence in their tax filings.

Future Implications and Developments

As technology continues to advance, the NC State Taxes Free File program is expected to evolve and improve. The state government and its partners are committed to enhancing the user experience, making the filing process even more seamless and efficient.

Potential future developments may include integration with emerging technologies such as artificial intelligence and machine learning. These advancements could further automate the tax filing process, reducing the need for manual input and enhancing accuracy. Additionally, the program may explore mobile-first strategies, making tax filing accessible on smartphones and tablets, further increasing convenience for taxpayers.

Furthermore, the program's success and positive impact are likely to encourage other states to adopt similar initiatives, promoting a more uniform and accessible tax filing system across the country.

Conclusion

The NC State Taxes Free File program is a testament to North Carolina’s commitment to making tax filing accessible and affordable for all residents. By leveraging technology and partnering with industry leaders, the state has created a user-friendly and secure platform that simplifies the tax filing process.

With its range of features, benefits, and positive impact, the program has become an essential tool for eligible taxpayers, empowering them to navigate the complexities of tax obligations with confidence and ease. As the program continues to evolve, it will play a crucial role in shaping a more efficient and equitable tax system in North Carolina and beyond.

How do I know if I’m eligible for the NC State Taxes Free File program?

+

Eligibility for the NC State Taxes Free File program is primarily based on your adjusted gross income (AGI) and filing status. For the 2023 tax year, individuals and families with an AGI of $69,000 or less are eligible. Additionally, the program caters to various tax situations, including those with dependents, military personnel, and state-level tax forms. It’s always recommended to check the official NC Department of Revenue website for the most up-to-date eligibility criteria.

Is the NC State Taxes Free File program secure and confidential?

+

Absolutely. The NC State Taxes Free File program prioritizes security and confidentiality. The online platform is protected by robust security measures, ensuring that your personal and financial information remains safe throughout the filing process. The program adheres to strict data protection standards, giving taxpayers peace of mind.

Can I file my taxes using the NC State Taxes Free File program if I have a complex tax situation?

+

Yes, the NC State Taxes Free File program is designed to accommodate a wide range of tax situations, including complex ones. The program supports various state and federal tax forms, ensuring that taxpayers with multiple sources of income, deductions, or specific circumstances can file accurately. The advanced tax software automates calculations, making the process easier, even for complex tax scenarios.

How long does it take to complete my tax return using the NC State Taxes Free File program?

+

The time it takes to complete your tax return using the NC State Taxes Free File program can vary depending on your individual circumstances and the complexity of your tax situation. However, the program’s user-friendly interface and automated features aim to streamline the process, making it quicker and more efficient compared to traditional tax preparation methods. On average, taxpayers can expect to complete their returns within a few hours, depending on their familiarity with the system and the information they have ready.

Can I receive my tax refund through direct deposit using the NC State Taxes Free File program?

+

Absolutely! The NC State Taxes Free File program offers the convenience of direct deposit for eligible taxpayers. If you meet the criteria for receiving a tax refund, you can opt for direct deposit during the filing process. This method is faster and more secure than receiving a paper check, as it allows the funds to be deposited directly into your bank account, typically within a few days of your return being processed.