Can You File Taxes Early

Tax season is a critical period for many individuals and businesses, and understanding when and how to file taxes is essential. One common question that arises is whether it's possible to file taxes early. In this comprehensive guide, we will delve into the intricacies of early tax filing, exploring the benefits, potential drawbacks, and the steps involved. Whether you're an individual taxpayer or a business owner, this article will provide you with valuable insights to navigate the tax landscape effectively.

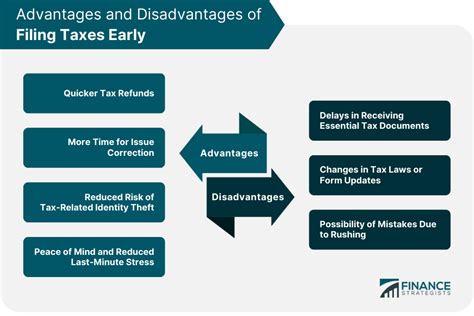

The Benefits of Early Tax Filing

Filing your taxes early offers several advantages that can streamline your financial processes and provide peace of mind. Here are some key benefits to consider:

Early Refunds

One of the most significant advantages of early tax filing is the potential for faster refunds. When you submit your tax return promptly, the Internal Revenue Service (IRS) can process your refund more efficiently. For individuals and businesses relying on tax refunds to manage their finances, this can be a significant boost.

For instance, consider the case of Jane, a small business owner who operates a local bakery. Jane typically files her taxes promptly each year, and as a result, she receives her refund within a few weeks. This early refund allows her to invest in new equipment, hire additional staff during the busy holiday season, and plan for future growth without financial strain.

Reduced Risk of Errors

Early tax filing provides an opportunity to review your financial records thoroughly and identify potential errors or discrepancies. By submitting your return promptly, you have more time to rectify any mistakes, ensuring an accurate and complete filing.

Imagine David, an individual taxpayer, who discovered a discrepancy in his tax documents while filing early. Upon closer inspection, he realized that his employer had reported an incorrect amount on his W-2 form. By filing early, David was able to promptly contact his employer and resolve the issue, avoiding potential penalties and ensuring an accurate tax return.

Improved Cash Flow Management

For businesses, early tax filing can be a strategic move to optimize cash flow. By filing promptly, businesses can gain access to tax refunds or credits, which can be reinvested into the company for growth initiatives or to cover operational expenses.

Take the example of TechPro Solutions, a technology consulting firm. By filing their taxes early each year, they ensure a steady cash flow, allowing them to invest in research and development, expand their team, and offer competitive pricing to clients. Early tax filing has become an integral part of their financial strategy, contributing to their success in the industry.

The Drawbacks of Early Filing

While early tax filing offers numerous benefits, it’s essential to consider potential drawbacks as well. Here are some factors to keep in mind:

Limited Time for Record-Keeping

One of the challenges of early tax filing is the limited time available for record-keeping and documentation. If you have complex financial transactions or multiple income sources, gathering all the necessary information within a short timeframe can be a daunting task.

Consider the scenario of Sarah, a freelance writer with multiple clients. Sarah relies on accurate record-keeping to track her income and expenses. When filing her taxes early, she found it challenging to gather all the necessary invoices, receipts, and expense reports within the limited window. This experience highlighted the importance of thorough record-keeping throughout the year to facilitate an efficient early tax filing process.

Potential for Missing Key Information

Another drawback of early tax filing is the risk of missing critical information or tax credits that may become available later in the tax season. Some tax deductions or credits are announced or clarified closer to the filing deadline, which could impact your overall tax liability.

For instance, Robert, a self-employed individual, discovered a new tax credit applicable to his industry during the latter part of the tax season. Had he filed early, he would have missed out on this valuable deduction, potentially increasing his tax burden. It's crucial to stay updated on tax changes and consider whether early filing aligns with your specific circumstances.

Possible Delays in Refund Processing

While early filing can lead to faster refunds, there are instances where the IRS may experience delays in processing returns. This can be due to various factors, including system updates, high volumes of returns, or specific issues with your tax return.

Imagine Emily, who filed her taxes early, expecting a quick refund. However, due to a complex issue with her return, the IRS required additional time to process her refund. While early filing offers potential benefits, it's important to be aware of potential delays and plan your finances accordingly.

When Can You File Taxes Early?

The tax filing season typically begins in January and extends until the deadline, which is usually in April. However, there are specific scenarios where you may be able to file your taxes early.

Early Filing with Tax Preparers

If you engage the services of a professional tax preparer or use tax preparation software, you may have the option to file your taxes early. These tools often provide early access to tax forms and enable you to start the filing process before the official tax season begins.

For example, popular tax preparation software like TurboTax and H&R Block often allow users to start their tax returns early. This early access to forms and the ability to save and continue later can be advantageous, especially for individuals with complex financial situations.

Special Circumstances and Early Filing

In certain special circumstances, you may be eligible to file your taxes early. These scenarios often involve specific life events or financial situations.

One such example is individuals who are expecting a significant tax refund and need the funds promptly. In these cases, the IRS may allow early filing to facilitate the timely processing of refunds. However, it's essential to consult with a tax professional or the IRS to understand the specific requirements and eligibility criteria.

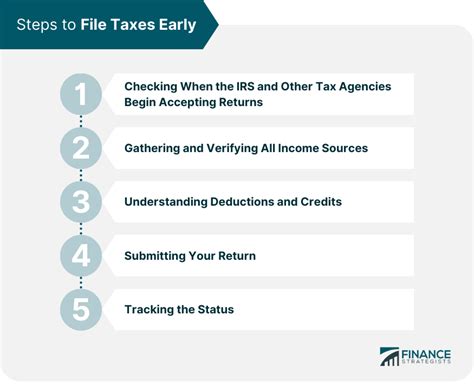

How to Prepare for Early Tax Filing

If you’re considering early tax filing, proper preparation is key to a smooth and successful process. Here are some essential steps to follow:

Gather All Necessary Documents

Start by collecting all the required documents for your tax return. This includes W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial records. Ensure that you have all the information you need before beginning the filing process.

Review Your Records and Deductions

Take the time to review your financial records and identify any potential deductions or credits you may be eligible for. Stay updated on tax changes and consult with a tax professional if needed. A thorough review can help maximize your tax savings and ensure an accurate return.

Choose Your Filing Method

Decide whether you will file your taxes manually or use tax preparation software. Consider your comfort level with technology and the complexity of your tax situation. Online tax preparation platforms often provide user-friendly interfaces and guidance, making the process more accessible.

Double-Check Your Return

Before submitting your tax return, double-check all the information for accuracy. Ensure that all calculations are correct, and verify that you’ve claimed all eligible deductions and credits. Mistakes can lead to delays or penalties, so thorough verification is crucial.

Maximizing Your Tax Savings

Early tax filing can be an effective strategy to maximize your tax savings. Here are some additional tips to consider:

Explore Tax Credits and Deductions

Stay informed about the latest tax credits and deductions available. Consult with a tax professional or use reliable online resources to identify opportunities to reduce your tax liability. Remember that early filing may not always be the best option, especially if you’re waiting for specific tax information to become available.

Consider Tax Planning Throughout the Year

Effective tax planning is an ongoing process. Throughout the year, keep track of your income, expenses, and any significant life changes that may impact your taxes. This proactive approach can help you make informed financial decisions and optimize your tax situation.

Seek Professional Guidance

If you have a complex financial situation or are unsure about your tax obligations, consider seeking professional guidance. Tax professionals can provide tailored advice, ensure compliance with tax laws, and help you navigate the early filing process efficiently.

| Key Takeaways |

|---|

| Early tax filing offers benefits such as faster refunds, reduced risk of errors, and improved cash flow management. |

| However, early filing may also present challenges like limited time for record-keeping and the potential for missing key information. |

| Special circumstances and the use of tax preparation tools can enable early filing. |

| Thorough preparation, including gathering documents and reviewing deductions, is essential for a successful early tax filing. |

| Maximizing tax savings involves exploring credits and deductions, year-round tax planning, and seeking professional guidance. |

Can I file my taxes early if I expect a large refund?

+Yes, if you’re expecting a significant tax refund and need the funds promptly, you may be eligible for early filing. However, it’s essential to consult with the IRS or a tax professional to understand the specific requirements and eligibility criteria.

What are some common tax deductions I should be aware of when filing early?

+Common tax deductions include contributions to retirement accounts, medical expenses, charitable donations, and certain education-related expenses. It’s important to stay updated on tax changes to ensure you claim all eligible deductions.

Is early tax filing suitable for everyone?

+Early tax filing may not be suitable for everyone. It’s essential to consider your specific circumstances, including the complexity of your financial situation and the potential for missing critical tax information. Consulting with a tax professional can help you make an informed decision.

How can I stay updated on tax changes and credits throughout the year?

+Staying informed about tax changes is crucial for effective tax planning. Consider subscribing to tax newsletters, following reputable tax websites, and consulting with tax professionals who can provide timely updates and guidance.