Walworth County Property Tax

In the realm of real estate and financial management, understanding the intricacies of property taxes is crucial. Walworth County, nestled in the southeastern corner of Wisconsin, offers a unique blend of natural beauty and vibrant communities, making it an attractive location for homeowners and investors alike. As with any property ownership, the topic of taxes arises, and in this comprehensive guide, we will delve into the specifics of Walworth County property taxes, providing you with a detailed understanding of this essential aspect of homeownership.

Understanding Walworth County Property Taxes

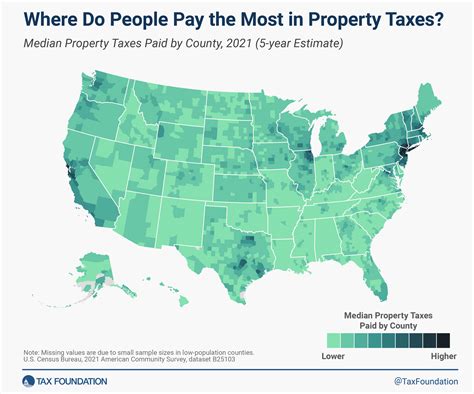

Property taxes in Walworth County are a vital source of revenue for the local government, funding essential services such as schools, roads, emergency services, and public infrastructure. These taxes are determined based on the assessed value of your property and are subject to change annually, reflecting fluctuations in the real estate market.

The assessment process in Walworth County involves a thorough evaluation of each property by the county assessor's office. This assessment takes into account various factors, including the property's location, size, improvements, and market trends. The assessed value is then used as a basis for calculating the property tax bill.

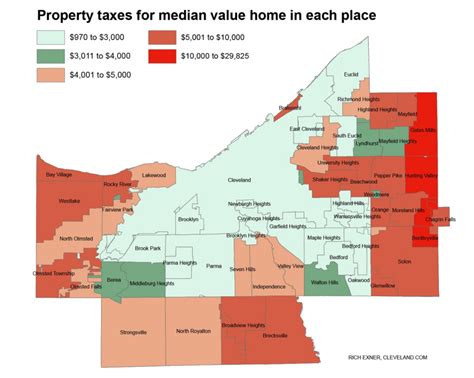

The property tax rate in Walworth County is determined by the local taxing authorities, which include the county, municipalities, school districts, and special assessment districts. These entities have the authority to set their tax rates, which are then applied to the assessed value of your property to calculate the total tax liability.

Property Tax Rates and Assessment

As of [insert most recent data available], the average property tax rate in Walworth County stands at [insert average rate]%. This rate is subject to change annually, as it is influenced by the budgetary needs of the local government and the assessed value of properties within the county.

| Taxing Authority | Tax Rate |

|---|---|

| Walworth County | [County Rate]% |

| Municipalities | Varies by Municipality |

| School Districts | Varies by District |

| Special Assessment Districts | Varies |

It's important to note that property tax rates can vary significantly within Walworth County due to the presence of multiple taxing authorities. Each municipality, school district, and special assessment district has its own tax rate, which can result in substantial differences in property tax liabilities for properties located in different areas of the county.

Assessed Value and Taxable Value

The assessed value of a property is determined through a comprehensive assessment process conducted by the Walworth County Assessor’s Office. This value is based on a variety of factors, including the property’s size, location, and recent sales of comparable properties in the area. The assessed value serves as the foundation for calculating the property tax liability.

However, it's crucial to understand that the assessed value is not necessarily the same as the taxable value. The taxable value of a property is often a fraction of the assessed value, determined by a state-mandated assessment ratio. In Wisconsin, the assessment ratio for residential properties is set at [insert assessment ratio]%, which means that the taxable value is typically lower than the assessed value.

Tax Exemptions and Deductions

Walworth County offers various tax exemptions and deductions to eligible property owners, providing relief from the burden of property taxes. These exemptions and deductions can significantly reduce the taxable value of a property, resulting in lower tax liabilities.

One common exemption is the Homestead Exemption, which provides a reduction in the taxable value of a property for primary residences. To qualify for this exemption, homeowners must meet certain residency requirements and file an application with the county assessor's office. The homestead exemption can vary in value, but it typically results in a substantial reduction in property taxes.

Additionally, Walworth County offers exemptions for certain types of properties, such as agricultural lands, veterans' properties, and properties owned by charitable organizations. These exemptions are designed to support specific sectors of the community and encourage the development of certain industries.

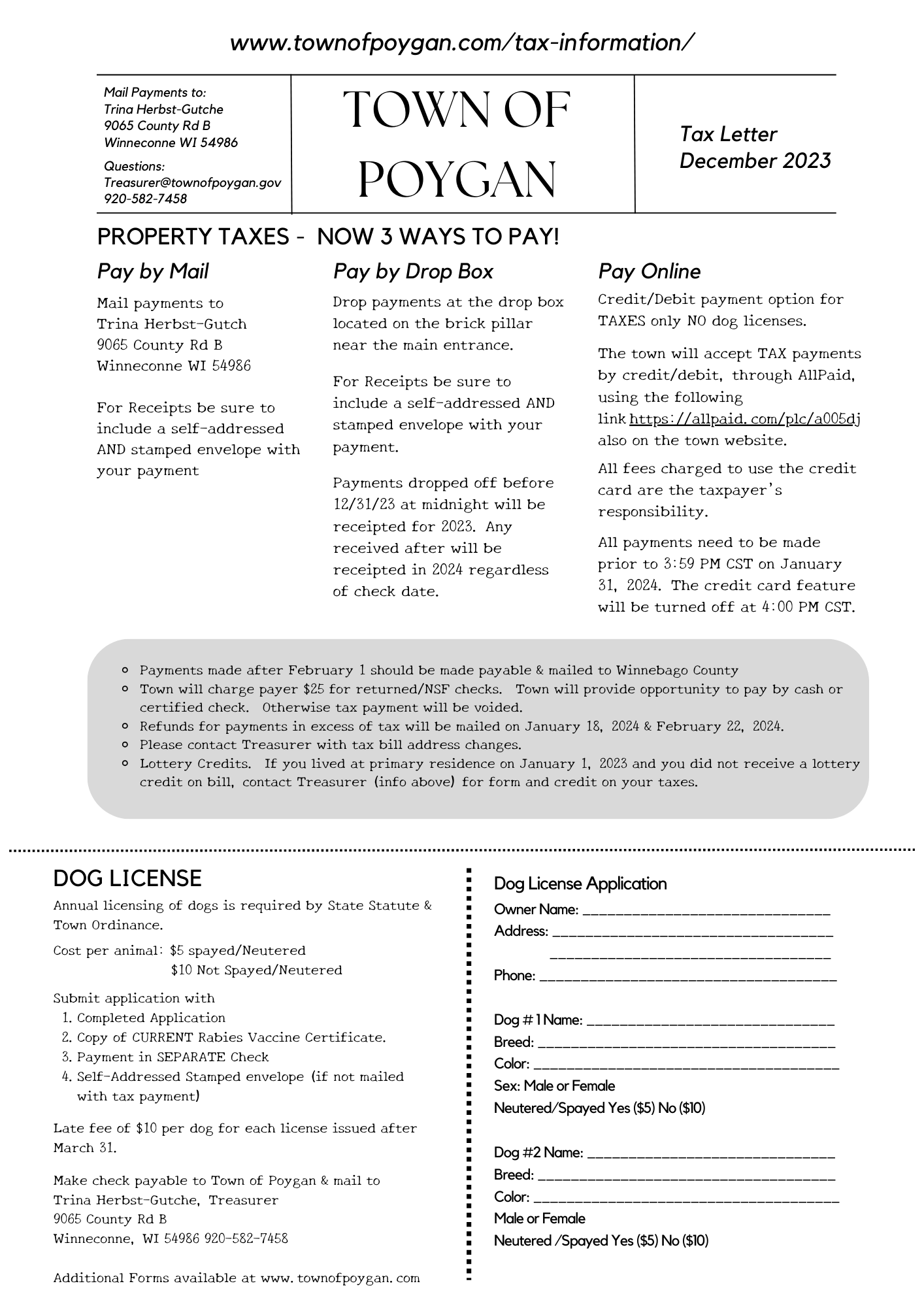

Tax Payment Options and Deadlines

Property taxes in Walworth County are typically due twice a year, with the first installment due in January and the second installment due in July. Taxpayers have the option to pay their taxes in full or make partial payments, as long as the total amount is settled by the respective deadlines.

Late payments are subject to penalties and interest, which can accumulate over time. It's crucial for property owners to stay informed about their tax due dates and payment options to avoid any unnecessary financial burdens.

Appealing Property Tax Assessments

If you believe that your property has been overvalued or if you have concerns about your tax assessment, you have the right to appeal the decision. The Walworth County Assessor’s Office provides a formal process for property owners to challenge their assessments. This process involves submitting an appeal application, providing supporting documentation, and potentially attending a hearing to present your case.

Appeals are typically based on factors such as errors in the assessment process, changes in property conditions, or discrepancies in the valuation compared to similar properties in the area. It's important to carefully review your assessment and gather evidence to support your appeal.

Impact of Property Taxes on Homeownership

Property taxes are an essential consideration for anyone looking to purchase a home in Walworth County. These taxes can significantly impact your monthly expenses and overall cost of homeownership. When evaluating a property, it’s crucial to consider not only the purchase price but also the potential tax liability.

For first-time homebuyers, understanding the property tax landscape can be a critical factor in their decision-making process. It's essential to research and estimate the potential tax burden associated with a property to ensure it aligns with their financial capabilities.

Financial Planning and Property Tax Management

Effective financial planning is key to managing property taxes. Homeowners should allocate a portion of their budget specifically for property tax payments to ensure they can meet their obligations without straining their finances.

One strategy to manage property taxes is to explore tax-efficient investments or savings plans that can provide additional funds to cover tax liabilities. Additionally, homeowners can consider refinancing their mortgage or exploring tax-deductible options to reduce their overall tax burden.

It's also beneficial to stay informed about any changes in tax rates or assessment processes within Walworth County. Being aware of potential increases or adjustments can help homeowners budget accordingly and plan for the future.

Community Impact and Property Tax Distribution

Property taxes play a crucial role in supporting the local community and its infrastructure. The revenue generated from property taxes is distributed among various local government entities, each responsible for providing essential services to residents.

School districts, for instance, rely heavily on property taxes to fund education programs, maintain school facilities, and support extracurricular activities. Similarly, municipalities use property tax revenue to improve roads, enhance public safety, and maintain parks and recreational areas. Special assessment districts also benefit from property taxes, funding specific projects or services within their designated areas.

By paying property taxes, homeowners contribute directly to the well-being and development of their community, ensuring the availability of essential services and infrastructure.

Conclusion: Navigating Walworth County Property Taxes

Understanding the intricacies of Walworth County property taxes is essential for both current and prospective homeowners. From the assessment process to tax payment options, having a comprehensive grasp of this topic empowers individuals to make informed decisions about their financial obligations and contributions to the community.

As you navigate the world of property taxes, remember that resources are available to assist you. The Walworth County Assessor's Office provides valuable information and guidance, and it's recommended to reach out to their team for any queries or concerns. Additionally, seeking advice from financial advisors or tax professionals can provide further clarity and support in managing your property tax responsibilities.

By staying informed and proactive, you can ensure that your experience with Walworth County property taxes is seamless and aligned with your financial goals.

How often are property tax assessments conducted in Walworth County?

+

Property tax assessments in Walworth County are typically conducted every two years, although certain circumstances, such as new construction or significant property improvements, may trigger an assessment outside of this cycle.

Are there any online resources to estimate property tax liabilities in Walworth County?

+

Yes, the Walworth County Assessor’s Office provides an online property tax estimator tool. This tool allows property owners to estimate their potential tax liability based on their property’s assessed value and applicable tax rates. It’s a valuable resource for preliminary calculations and financial planning.

What happens if I miss a property tax payment deadline in Walworth County?

+

Missing a property tax payment deadline can result in late fees, penalties, and interest charges. It’s crucial to stay informed about payment due dates and make timely payments to avoid any additional financial burdens. The Walworth County Treasurer’s Office provides information on late payment policies and procedures.

Are there any property tax relief programs available for low-income homeowners in Walworth County?

+

Yes, Walworth County offers a Property Tax Relief Program for eligible low-income homeowners. This program provides a reduction in property taxes based on income and property value. Homeowners can apply for this program through the county assessor’s office, and upon approval, they will receive a tax credit or refund.

Can I deduct my property taxes from my federal income taxes?

+

Yes, under certain circumstances, you may be able to deduct a portion of your property taxes from your federal income taxes. This deduction is subject to specific criteria and limitations, and it’s advisable to consult with a tax professional to determine your eligibility and the potential benefits.