Maryland Tax Calculator

Welcome to this comprehensive guide on the Maryland Tax Calculator, an essential tool for residents and businesses operating within the state of Maryland. This article aims to provide an in-depth analysis of the tax system in Maryland, offering valuable insights into how the calculator works, its significance, and its impact on individuals and enterprises. By the end of this article, you will have a thorough understanding of the tax landscape in Maryland and how the tax calculator plays a pivotal role in navigating it.

Unraveling the Complexity of Maryland’s Tax System

Maryland, often referred to as the “Free State,” boasts a rich history and a diverse economy. With its strategic location and robust industries, the state’s tax system plays a crucial role in shaping its economic landscape. Understanding the intricacies of Maryland’s tax structure is key to effective financial planning and compliance.

The Maryland Tax Calculator: An Overview

The Maryland Tax Calculator is a digital tool designed to simplify the process of estimating tax liabilities for residents and businesses. It serves as a user-friendly interface, allowing individuals and entities to input relevant financial data and receive an estimate of their tax obligations. This calculator is a vital resource for anyone looking to navigate the complex world of Maryland taxation.

Key Features of the Maryland Tax Calculator include:

- Income Tax Calculation: The calculator facilitates the estimation of income taxes based on individual or business income brackets.

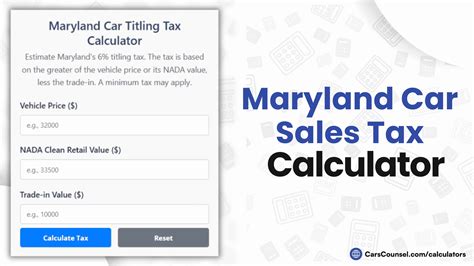

- Sales Tax Estimation: Users can input sales figures to determine the applicable sales tax rates and amounts.

- Property Tax Assessment: This feature provides an estimate of property taxes based on property values and location.

- Tax Credits and Deductions: The calculator considers various tax credits and deductions, offering a more accurate tax liability estimate.

Why Use the Maryland Tax Calculator?

The Maryland Tax Calculator offers numerous benefits to taxpayers. Firstly, it provides a convenient and efficient way to estimate tax liabilities, saving time and effort. By inputting relevant data, users can quickly assess their tax obligations, aiding in financial planning and budgeting.

Secondly, the calculator ensures accuracy. It incorporates the latest tax rates, regulations, and rules, reducing the risk of errors and ensuring compliance with Maryland's tax laws. This is particularly beneficial for businesses, as accurate tax estimation is crucial for financial reporting and strategic decision-making.

Lastly, the calculator promotes transparency. By offering a clear breakdown of tax components, users can understand how their tax liability is calculated. This transparency builds trust and confidence in the tax system, fostering a positive relationship between taxpayers and the state.

A Deep Dive into Maryland’s Tax Landscape

Maryland’s tax system is multifaceted, encompassing various tax types and rates. Understanding these components is essential for accurate tax calculation and compliance.

Income Tax: A Progressive Approach

Maryland follows a progressive income tax structure, meaning tax rates increase as income levels rise. This approach ensures that higher-income earners contribute a larger proportion of their income towards taxes. The state currently has five income tax brackets, ranging from 2% to 5.75%, with specific thresholds for each bracket.

| Income Bracket | Tax Rate | Threshold (Single Filers) | Threshold (Married Filing Jointly) |

|---|---|---|---|

| 1 | 2% | $0 - $1,000 | $0 - $1,500 |

| 2 | 3% | $1,001 - $3,000 | $1,501 - $4,500 |

| 3 | 4% | $3,001 - $10,000 | $4,501 - $15,000 |

| 4 | 5% | $10,001 - $125,000 | $15,001 - $250,000 |

| 5 | 5.75% | Over $125,000 | Over $250,000 |

Sales and Use Tax: A Dynamic Landscape

Maryland imposes a sales and use tax on the sale of goods and certain services. The standard sales tax rate is 6%, but it can vary based on the type of product or service and the location of the transaction. For instance, certain jurisdictions have additional local taxes, leading to higher overall sales tax rates.

The Maryland Tax Calculator takes into account these variations, allowing users to input specific sales data and receive an accurate estimate of their sales tax liability. This is particularly useful for businesses operating in multiple jurisdictions within the state.

Property Tax: Assessing Real Estate

Property tax is a significant component of Maryland’s tax system. It is a local tax, meaning the rate and assessment methods can vary between counties and municipalities. The state’s Department of Assessments and Taxation (SDAT) plays a crucial role in determining property values and tax assessments.

The Maryland Tax Calculator provides an estimate of property taxes based on the property's assessed value and the applicable tax rate for the specific location. This feature is invaluable for homeowners and real estate investors looking to understand their tax obligations.

Maximizing Benefits: Tax Credits and Deductions

Maryland offers a range of tax credits and deductions to promote economic growth, support specific industries, and provide relief to certain taxpayer groups. These incentives can significantly impact tax liabilities and are a key consideration when using the tax calculator.

Key Tax Credits and Deductions

- Research and Development Tax Credit: This credit encourages businesses to invest in research and development activities, offering a tax credit of up to 10% of eligible expenses.

- Historic Tax Credit: Maryland provides a tax credit for the rehabilitation of historic properties, aiming to preserve the state’s architectural heritage.

- Low-Income Housing Tax Credit: This credit supports the development of affordable housing, providing a boost to real estate investors and developers.

- Education Deduction: Maryland residents can deduct a portion of their qualified education expenses, including tuition and fees, from their taxable income.

Navigating Tax Credits with the Calculator

The Maryland Tax Calculator allows users to input information about their eligibility for tax credits and deductions. By considering these incentives, the calculator provides a more accurate estimate of tax liabilities, ensuring taxpayers can maximize their savings.

Performance Analysis: The Impact of the Tax Calculator

The introduction and widespread adoption of the Maryland Tax Calculator have had a significant impact on the state’s tax system and its taxpayers. By analyzing its performance, we can understand its effectiveness and potential areas for improvement.

Increased Compliance and Efficiency

One of the primary benefits of the tax calculator is its contribution to improved tax compliance. By providing a user-friendly interface, the calculator simplifies the tax estimation process, making it more accessible to taxpayers. This increased accessibility leads to better compliance rates, as individuals and businesses can more easily understand and fulfill their tax obligations.

Economic Impact and Revenue Generation

The calculator’s accuracy in estimating tax liabilities has a direct impact on the state’s revenue generation. By ensuring taxpayers accurately report their income, sales, and property taxes, the state can effectively forecast and manage its budget. This stability is crucial for funding essential public services and infrastructure projects.

Enhancing Transparency and Trust

The transparency offered by the Maryland Tax Calculator has fostered a more positive relationship between taxpayers and the state. By providing a clear breakdown of tax components and the reasoning behind tax calculations, the calculator builds trust. This trust is essential for maintaining a healthy tax system and encouraging voluntary compliance.

Future Implications and Innovations

As technology continues to advance, the Maryland Tax Calculator is poised for further enhancements and innovations. By staying ahead of the curve, the calculator can continue to meet the evolving needs of taxpayers and the state’s tax system.

Potential Future Developments

- Integration with Financial Software: The calculator could integrate with popular financial management software, streamlining the data input process and enhancing accuracy.

- Real-Time Data Updates: Implementing a real-time data feed would ensure that the calculator always reflects the latest tax rates and regulations, providing up-to-date estimates.

- Machine Learning for Tax Planning: Utilizing machine learning algorithms could offer personalized tax planning suggestions, optimizing tax liabilities for individuals and businesses.

Ensuring Long-Term Relevance

To maintain its relevance and effectiveness, the Maryland Tax Calculator must adapt to changing tax landscapes and emerging technologies. Regular updates and improvements are essential to ensure the calculator remains a trusted and reliable tool for taxpayers.

Conclusion: A Powerful Tool for Tax Navigation

The Maryland Tax Calculator is a powerful resource for navigating the complexities of Maryland’s tax system. By offering a user-friendly interface, accurate estimates, and transparency, the calculator empowers taxpayers to understand and manage their tax obligations effectively. As Maryland continues to thrive economically, the tax calculator will play a pivotal role in ensuring a fair and efficient tax system.

Frequently Asked Questions

What are the current income tax rates in Maryland for the 2023 tax year?

+

Maryland’s income tax rates for the 2023 tax year are as follows: 2% for the first 1,000 of income, 3% for the next 2,000, 4% for the next 7,000, 5% for income between 10,001 and 125,000, and 5.75% for income over 125,000.

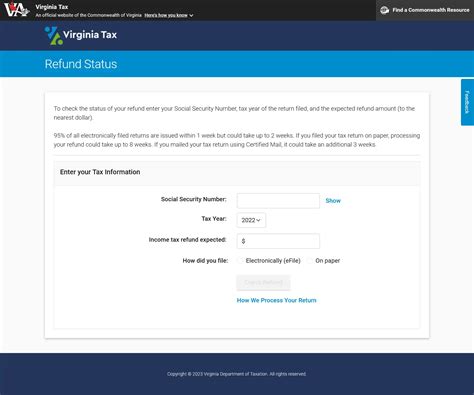

How often are tax rates updated in Maryland, and where can I find the latest information?

+

Tax rates in Maryland are typically updated annually. The latest tax rates and information can be found on the official website of the Comptroller of Maryland, which provides detailed tax guides and updates.

Are there any special tax incentives or credits available for specific industries in Maryland?

+

Yes, Maryland offers various tax incentives and credits to promote economic development and support specific industries. These include tax credits for research and development, historic preservation, and low-income housing, among others. It’s advisable to consult the state’s tax incentives guide for comprehensive details.

How does the Maryland Tax Calculator handle complex tax scenarios, such as multiple sources of income or business structures?

+

The Maryland Tax Calculator is designed to handle complex tax situations. It allows users to input multiple income sources and business details, considering various tax brackets and applicable deductions. The calculator provides a comprehensive estimate based on the information provided.

Can the Maryland Tax Calculator assist with tax planning strategies, or is it solely for estimation purposes?

+

While the primary purpose of the Maryland Tax Calculator is to provide tax estimates, it can indirectly assist with tax planning. By offering accurate estimates and considering tax credits and deductions, the calculator helps individuals and businesses understand their tax liabilities, which is a crucial step in effective tax planning.