Proportional Tax Example

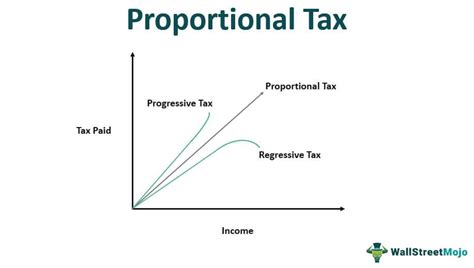

The concept of a proportional tax, also known as a flat tax, is an intriguing topic in the realm of economics and taxation. It is a system where individuals or entities pay a fixed percentage of their income or profits as tax, regardless of their income level. This type of tax structure has been a subject of debate and interest, with proponents and critics offering different perspectives. In this comprehensive article, we will delve into the world of proportional tax, exploring its definition, real-world examples, advantages, disadvantages, and its potential impact on various aspects of society and the economy.

Understanding the Proportional Tax System

A proportional tax system operates on the principle of uniformity, where the tax rate remains constant across all income brackets. In other words, whether you earn $10,000 or $1,000,000, you will pay the same percentage of your income as tax. This stands in contrast to progressive tax systems, where higher income earners pay a larger proportion of their income in taxes.

The simplicity of the proportional tax lies in its straightforward calculation. The tax liability is derived by multiplying the taxable income by the fixed tax rate. For instance, if the tax rate is 15%, an individual earning $50,000 would pay $7,500 in taxes. This simplicity can make tax administration more efficient and reduce the complexity often associated with progressive tax systems.

Real-World Proportional Tax Examples

While many countries employ progressive tax systems, some regions and jurisdictions have implemented or considered proportional tax models. Here are a few notable examples:

Hong Kong's Proportional Tax

Hong Kong is often cited as a prime example of a proportional tax system. The city has a straightforward tax structure where individuals pay a flat rate of 15% on their taxable income, with no deductions or exemptions. This system has been in place since 1947 and is widely regarded as contributing to Hong Kong's economic success and its status as a global financial hub.

Singapore's Personal Income Tax

Singapore's personal income tax system operates on a flat rate basis for residents. The tax rate is currently set at 22% for income above a certain threshold. This flat tax system, combined with other business-friendly policies, has made Singapore an attractive destination for businesses and investors.

Flat Tax Experiments in Eastern Europe

Several Eastern European countries, including Lithuania, Latvia, and Estonia, have experimented with flat tax systems in recent decades. These countries implemented flat tax rates to simplify their tax systems and attract foreign investment. While the flat tax rates have varied over time, they have generally been in the range of 10-20%.

Advantages of Proportional Taxation

Proponents of proportional tax systems argue that they offer several advantages, including:

- Simplicity and Transparency: Proportional taxes are easy to understand and calculate, reducing complexity and potential for errors or misinterpretation.

- Reduced Tax Evasion: The simplicity of the system may discourage tax evasion, as individuals and businesses have a clear understanding of their tax obligations.

- Encouraging Economic Growth: Proportional taxes can create a more favorable environment for business and investment by providing stability and predictability in tax liabilities.

- Promoting Equality: Some argue that proportional taxes treat all taxpayers equally, regardless of their income level, which can foster a sense of fairness.

Disadvantages and Considerations

However, proportional tax systems also come with their share of criticisms and potential drawbacks:

- Regressive Nature: Proportional taxes can be regressive, as they place a relatively higher burden on lower-income individuals compared to progressive tax systems. This can result in reduced disposable income for those who can least afford it.

- Limited Revenue Generation: Proportional taxes may not generate sufficient revenue to fund public services and social programs, especially in countries with large populations and diverse income levels.

- Impact on Social Welfare: Critics argue that proportional taxes can hinder social mobility and exacerbate income inequality, as they do not provide additional support for those in lower income brackets.

- Complexity in Tax Administration: While proportional taxes aim for simplicity, they may still face challenges in tax administration, especially when dealing with complex financial structures or international transactions.

Performance Analysis and Case Studies

To evaluate the effectiveness of proportional tax systems, we can examine case studies and analyze their impact on various economic indicators. For instance, let's consider the example of Hong Kong's proportional tax system.

| Year | GDP Growth Rate | Tax Revenue as % of GDP | Income Inequality (Gini Coefficient) |

|---|---|---|---|

| 2010 | 7.2% | 12.5% | 0.535 |

| 2015 | 2.4% | 11.8% | 0.538 |

| 2020 | -6.1% | 11.5% | 0.542 |

While Hong Kong's proportional tax system has been associated with strong economic growth and a stable tax revenue base, the data also suggests that income inequality may have increased over time. This highlights the need for a comprehensive evaluation of the system's impact on different segments of society.

Future Implications and Potential Reforms

The debate surrounding proportional tax systems is ongoing, and many countries are considering or implementing reforms to their tax structures. Some potential future implications and reforms could include:

- Hybrid Systems: Combining elements of proportional and progressive taxes, such as implementing a flat tax rate up to a certain income level and then transitioning to a progressive system for higher earners.

- Tax Credits and Deductions: Introducing targeted tax credits or deductions to alleviate the regressive impact of proportional taxes on lower-income individuals.

- Revenue Generation Strategies: Exploring alternative revenue sources, such as wealth taxes or environmental taxes, to complement a proportional tax system and fund public services.

- International Cooperation: Addressing tax evasion and ensuring a level playing field by fostering international cooperation and information sharing among tax authorities.

Frequently Asked Questions (FAQ)

How does a proportional tax system impact income inequality?

+Proportional tax systems can potentially exacerbate income inequality, as they do not provide additional support for lower-income earners. However, this impact can vary based on the design and implementation of the system, as well as the presence of other social welfare programs.

<div class="faq-item">

<div class="faq-question">

<h3>What are the key advantages of a flat tax system over a progressive tax system?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Advantages of a flat tax system include simplicity, transparency, and the potential for reduced tax evasion. Progressive tax systems, on the other hand, can provide more targeted support for lower-income individuals and address income inequality more effectively.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can a proportional tax system generate sufficient revenue for a country's needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The revenue-generating capacity of a proportional tax system depends on various factors, including the tax rate, the size of the economy, and the level of tax compliance. In some cases, proportional tax systems may require additional revenue sources to fund public services adequately.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the potential challenges of implementing a proportional tax system globally?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Implementing a proportional tax system globally could face challenges such as varying economic conditions across countries, differences in social safety nets, and the potential for tax evasion or avoidance through international transactions. International cooperation and harmonization efforts would be crucial.</p>

</div>

</div>

The concept of a proportional tax system continues to spark interest and debate among economists, policymakers, and the general public. While it offers simplicity and transparency, the potential trade-offs in terms of revenue generation and social welfare must be carefully considered. As countries navigate the complex landscape of taxation, finding a balance between efficiency and equity remains a critical challenge.