South Carolina Vehicle Taxes

Vehicle ownership and registration is a vital aspect of personal finance and legal compliance for residents of South Carolina. Understanding the state's vehicle taxation system is essential for managing expenses and ensuring adherence to local regulations. This comprehensive guide delves into the intricacies of South Carolina's vehicle taxes, offering a detailed analysis of the process, rates, and potential deductions.

Vehicle Taxation in South Carolina: An In-Depth Overview

South Carolina imposes various taxes on vehicle ownership, which serve as a significant source of revenue for the state. These taxes are crucial for maintaining infrastructure, funding law enforcement, and supporting essential services. Let's explore the key aspects of vehicle taxation in the Palmetto State.

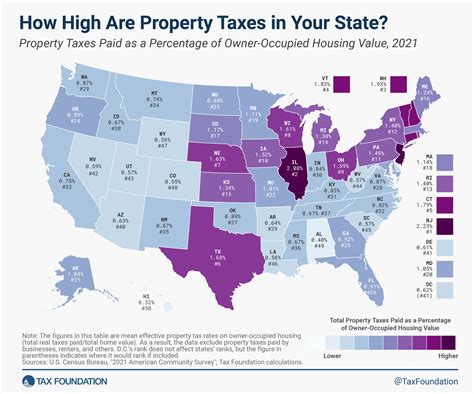

Property Taxes: A Core Component

One of the primary taxes levied on vehicles in South Carolina is the property tax. This tax is based on the assessed value of the vehicle and is typically due annually. The assessed value is determined by the county in which the vehicle is registered, and it takes into account factors such as the vehicle's make, model, age, and condition.

| County | Property Tax Rate |

|---|---|

| Greenville County | 6.4% |

| Charleston County | 6.0% |

| Horry County | 5.7% |

The property tax rate can vary from county to county, as each county sets its own rate. It's essential for vehicle owners to understand the specific rate applicable to their county of residence.

Registration Fees: Annual Costs

In addition to property taxes, vehicle owners in South Carolina must also pay annual registration fees. These fees cover the cost of maintaining the state's vehicle registration system and ensuring compliance with safety and emission standards.

| Vehicle Type | Registration Fee |

|---|---|

| Passenger Car | $70 |

| Motorcycle | $20 |

| Truck (under 26,000 lbs) | $40 |

The registration fees are determined by the vehicle's classification and are generally due annually. It's crucial to stay up-to-date with registration renewals to avoid penalties and maintain legal compliance.

Sales Tax: Applicable to New Vehicles

When purchasing a new vehicle in South Carolina, buyers are subject to sales tax. The sales tax rate varies depending on the county where the vehicle is purchased and registered. Here's a breakdown of sales tax rates for some major counties:

| County | Sales Tax Rate |

|---|---|

| Greenville County | 7.0% |

| Charleston County | 7.5% |

| Spartanburg County | 7.0% |

Sales tax is calculated based on the purchase price of the vehicle and is typically paid at the time of purchase. It's important to consider this tax when budgeting for a new vehicle.

Title Fees and Transfer Taxes

When transferring vehicle ownership, South Carolina residents are required to pay title fees and transfer taxes. These fees cover the cost of processing the title transfer and updating the vehicle's registration.

| Title Fee | Transfer Tax |

|---|---|

| $10 | 1% of the vehicle's value |

The title fee is a standard charge, while the transfer tax is calculated based on the vehicle's value at the time of transfer.

Fuel Taxes: Impact on Vehicle Owners

South Carolina imposes fuel taxes on gasoline and diesel, which directly impact vehicle owners. These taxes contribute to the state's transportation infrastructure and maintenance funds. The current fuel tax rates are as follows:

| Fuel Type | Tax Rate |

|---|---|

| Gasoline | $0.16 per gallon |

| Diesel | $0.18 per gallon |

Vehicle owners should consider these fuel taxes when budgeting for fuel costs, as they can significantly impact overall vehicle expenses.

Potential Deductions and Exemptions

While South Carolina's vehicle taxes can be substantial, there are certain deductions and exemptions that vehicle owners may be eligible for.

Senior Citizen Exemption

Senior citizens aged 65 and above may qualify for an exemption from property taxes on their vehicles. To be eligible, individuals must meet specific income requirements and own the vehicle as their primary residence. This exemption can provide significant savings for eligible seniors.

Disabled Veteran ExemptionVeterans with service-connected disabilities may be eligible for a total exemption from property taxes on their vehicles. This exemption is a way for the state to show gratitude and support to those who have served in the military.

Low-Income Exemption

South Carolina offers a low-income exemption for individuals who meet certain income criteria. This exemption can reduce or eliminate property taxes on vehicles for those who qualify. It's an essential relief measure for low-income earners.

Green Vehicle Tax Credits

To encourage the adoption of environmentally friendly vehicles, South Carolina offers tax credits for the purchase of electric, hybrid, and alternative fuel vehicles. These credits can significantly reduce the overall cost of owning a green vehicle and promote sustainability.

Performance Analysis and Future Implications

South Carolina's vehicle taxation system has evolved to address the state's infrastructure needs and promote environmental sustainability. The state's focus on property taxes and registration fees ensures a steady revenue stream for essential services.

Looking ahead, the state may continue to explore ways to incentivize the adoption of electric and hybrid vehicles through tax credits and incentives. Additionally, with the increasing focus on infrastructure development, vehicle taxes may play a crucial role in funding these initiatives.

Vehicle owners in South Carolina should stay informed about tax rates, exemptions, and potential changes to ensure they remain compliant and take advantage of any applicable deductions.

How often do I need to pay vehicle taxes in South Carolina?

+Vehicle taxes, including property taxes and registration fees, are typically due annually. It’s important to stay updated with the payment schedule to avoid penalties.

Are there any ways to reduce my vehicle tax burden in South Carolina?

+Yes, there are several exemptions and deductions available. Senior citizens, disabled veterans, and low-income individuals may qualify for reduced or exempted property taxes. Additionally, purchasing a green vehicle can lead to tax credits.

What happens if I fail to pay my vehicle taxes on time?

+Late payment of vehicle taxes can result in penalties and interest charges. It’s crucial to stay current with your tax obligations to avoid these additional expenses.