Virginia County Income Tax Rates

The Commonwealth of Virginia, nestled along the east coast of the United States, operates a unique income tax system that varies based on the county of residence. This system, while offering a level of customization, can be intricate and often leaves taxpayers with questions. In this comprehensive guide, we'll delve into the world of Virginia's county income tax rates, exploring the specifics, nuances, and implications for residents across the state.

Understanding Virginia’s County Income Tax Structure

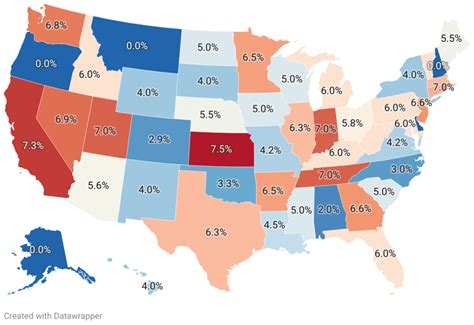

Virginia is distinctive in its approach to income taxation, empowering individual counties to establish their own income tax rates. This local control means that residents of different counties can face varying tax burdens, even within the same state. The state government, however, does impose a uniform income tax rate on all residents for income derived from sources outside the state.

The county-level income tax rates are determined by the local government, typically through a combination of property taxes and income taxes. These taxes contribute to funding essential services such as education, public safety, and infrastructure development within the county. As a result, the tax rates can vary significantly from one county to another.

Key Factors Influencing County Tax Rates

Several factors come into play when determining county tax rates in Virginia. These include the county’s budget needs, the cost of providing local services, and the overall economic climate. Counties with higher expenses, such as those with extensive road networks or a large population requiring extensive educational facilities, may opt for higher tax rates to meet these demands.

Additionally, counties with a higher cost of living may choose to implement higher tax rates to maintain the quality of life for their residents. On the other hand, counties with a more modest cost of living might opt for lower tax rates to attract residents and businesses, fostering economic growth.

| County | Income Tax Rate |

|---|---|

| Arlington County | 3.5% |

| Fairfax County | 2.8% |

| Loudoun County | 2.0% |

| Prince William County | 2.5% |

| Stafford County | 1.5% |

In the table above, we see a glimpse of the varying tax rates across different counties in Virginia. These rates can significantly impact a resident's tax liability, making it crucial to understand the specific tax environment in one's county of residence.

Navigating the Complexity: A Step-by-Step Guide

Given the intricate nature of Virginia’s county income tax system, it’s essential to approach tax planning with a strategic mindset. Here’s a step-by-step guide to help you navigate this landscape effectively.

Step 1: Determine Your County’s Income Tax Rate

Start by researching the income tax rate applicable to your county. This information is typically available on the official website of your county’s government or on dedicated tax information platforms. Ensure you are referring to the most up-to-date rate, as these can change annually based on budgetary requirements.

Step 2: Understand the State’s Uniform Tax Rate

As mentioned earlier, Virginia imposes a uniform income tax rate on all residents for out-of-state income. This rate is currently set at 5.75% and is applied uniformly across the state. Understanding this rate is crucial, especially if you have sources of income from outside Virginia.

Step 3: Calculate Your Tax Liability

With your county’s income tax rate and the state’s uniform tax rate in hand, you can now calculate your total tax liability. This involves determining your taxable income and applying the relevant rates. For instance, if you live in a county with a 3.5% income tax rate and have 50,000 in taxable income, your county tax liability would be 1,750. On top of that, you would pay the state’s 5.75% on any out-of-state income.

Step 4: Explore Tax Planning Strategies

Given the variability in tax rates across counties, it’s worth exploring tax planning strategies to optimize your financial situation. This could involve strategic investments, retirement planning, or utilizing tax-efficient savings accounts. Consulting a tax professional can provide personalized advice based on your unique circumstances.

The Impact of County Income Taxes on Residents

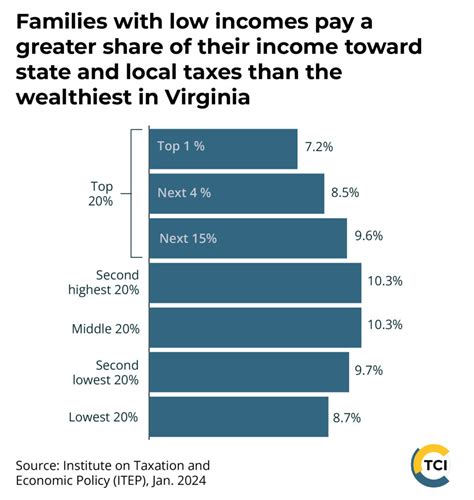

The implementation of county income taxes in Virginia has a profound impact on the lives of its residents. These taxes directly influence the financial planning and decision-making processes of individuals and families, shaping their overall financial health and well-being.

Financial Planning and Budgeting

With varying county tax rates, residents must carefully consider their financial plans and budgets. The difference in tax rates between counties can result in significantly different tax liabilities for individuals with similar incomes. This variation requires residents to be vigilant in monitoring their financial situation and ensuring that their income and expenses align with their county’s tax rate.

Impact on Cost of Living

The county income tax rates also contribute to the overall cost of living for residents. Higher tax rates can lead to increased expenses for basic necessities, impacting the financial stability of households. Conversely, counties with lower tax rates may be more attractive to residents seeking to reduce their tax burden, thereby influencing population dynamics and economic growth within the state.

Economic Development and Local Services

County income taxes play a crucial role in funding essential local services and infrastructure. The revenue generated from these taxes enables counties to invest in education, public safety, healthcare, and other vital areas. This direct link between tax rates and the quality of local services underscores the importance of county income taxes in shaping the overall well-being of communities.

| County | Income Tax Rate | Budget Allocation |

|---|---|---|

| Arlington County | 3.5% | Education: 40%, Public Safety: 25%, Infrastructure: 15% |

| Fairfax County | 2.8% | Education: 35%, Healthcare: 20%, Social Services: 10% |

| Loudoun County | 2.0% | Infrastructure: 30%, Economic Development: 20%, Education: 15% |

The table above provides a glimpse into how different counties allocate their budget based on their tax rates. These allocations directly impact the quality of life for residents and the overall economic health of the county.

Future Implications and Potential Reforms

As Virginia’s county income tax system continues to evolve, there are ongoing discussions and considerations for potential reforms. The current system, while offering local control and flexibility, also presents challenges and complexities for taxpayers.

Proposed Reforms

Some proposed reforms aim to simplify the tax system by standardizing rates across counties or implementing a state-wide income tax. These proposals aim to reduce the administrative burden on taxpayers and provide a more consistent tax environment. However, such reforms face opposition from counties that benefit from higher tax rates and the revenue they generate.

Impact on Taxpayers and Businesses

Any changes to the county income tax system would have a significant impact on taxpayers and businesses alike. Standardizing rates could lead to either increased or decreased tax burdens, depending on the current rates in individual counties. Businesses, in particular, may face challenges in adapting to new tax structures, especially if they operate in multiple counties.

The Need for Balance

Finding the right balance between local control and a simplified tax system is a complex task. While standardization may provide benefits in terms of simplicity and consistency, it could also limit the ability of counties to respond to their unique budgetary needs. Striking this balance will be crucial in shaping the future of Virginia’s tax landscape.

How often do county income tax rates change in Virginia?

+County income tax rates in Virginia are subject to change annually. Counties review their budgets and tax rates based on various factors, including economic conditions, budget needs, and the cost of providing local services. As such, residents should stay informed about any changes to their county’s tax rate, which are typically announced at the beginning of the fiscal year.

Are there any counties in Virginia without an income tax?

+No, all counties in Virginia impose an income tax. While the rates vary across counties, every county in the state has an established income tax rate to fund local services and infrastructure.

How do county income taxes impact property values in Virginia?

+County income taxes can indirectly influence property values in Virginia. Higher tax rates may lead to increased costs for residents, which could potentially impact the demand for housing and, consequently, property values. On the other hand, counties with lower tax rates may attract more residents, driving up property values due to increased demand.