Property Taxes For Lake County Il

Welcome to a comprehensive guide on understanding and managing property taxes in Lake County, Illinois. This article aims to provide valuable insights and practical information for homeowners, real estate investors, and anyone interested in navigating the complex world of property taxation. With Lake County's diverse communities and vibrant real estate market, staying informed about property taxes is crucial for making smart financial decisions.

Understanding Property Taxes in Lake County

Property taxes are a significant aspect of homeownership and are an essential revenue source for local governments in Illinois. These taxes fund vital services like public schools, road maintenance, emergency services, and community development projects. As a Lake County resident, it’s essential to grasp the fundamentals of property taxation to ensure you’re prepared for the financial responsibilities associated with owning property.

How Are Property Taxes Calculated in Lake County?

In Lake County, property taxes are determined through a comprehensive assessment process. The Lake County Assessor’s Office plays a pivotal role in evaluating properties and determining their assessed values. Here’s a simplified breakdown of the property tax calculation process:

- Property Assessment: The Assessor's Office assesses the value of all properties within the county. This includes residential, commercial, and industrial properties. Assessors consider factors such as location, size, improvements, and market trends to determine the fair market value of each property.

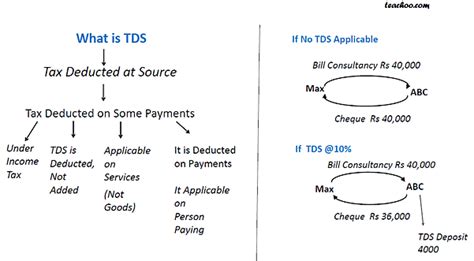

- Equalization Factor: After the initial assessment, the Illinois Department of Revenue applies an equalization factor to ensure fairness across different counties. This factor accounts for variations in assessment practices and ensures that property owners are taxed equitably within the state.

- Tax Rate Determination: Local taxing bodies, such as school districts, municipalities, and special districts, set their tax rates based on the assessed values. These rates are expressed as a percentage and determine the amount of tax owed per dollar of assessed value.

- Tax Calculation: To calculate your property taxes, the assessed value of your property is multiplied by the applicable tax rate. The result is the tax amount due for the year. It's important to note that tax rates can vary significantly depending on the taxing body and the services they provide.

For example, if your property is assessed at $200,000 and the combined tax rate for your area is 3%, your annual property tax bill would be $6,000. However, it's crucial to remember that tax rates can change annually, influenced by factors such as budget requirements and property value fluctuations.

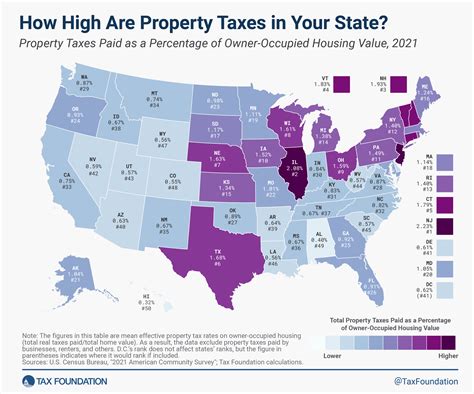

Lake County’s Property Tax Rates

Lake County’s property tax rates can vary depending on the specific location within the county. Generally, the tax rates are expressed as a percentage of the property’s assessed value. While it’s challenging to provide a precise tax rate due to the dynamic nature of assessments and tax rates, we can offer a general overview.

| Location | Estimated Tax Rate |

|---|---|

| Lake Forest | 2.5% - 3.5% |

| Highland Park | 2.8% - 3.8% |

| Waukegan | 3.2% - 4.2% |

| Libertyville | 2.6% - 3.6% |

| Buffalo Grove | 2.7% - 3.7% |

It's important to note that these tax rates are estimates and can vary based on individual circumstances and specific tax codes. To obtain an accurate tax rate for your property, it's advisable to contact the Lake County Assessor's Office or your local taxing authority.

Managing Property Taxes Effectively

Understanding your property taxes is the first step; managing them effectively is the key to optimizing your financial well-being. Here are some practical strategies to consider when navigating property taxes in Lake County:

1. Stay Informed

Keep yourself updated on the latest property tax news and regulations. The Lake County Assessor’s Office provides valuable resources and notifications regarding assessment processes and tax rate changes. Staying informed allows you to anticipate potential increases and plan your finances accordingly.

2. Review Your Assessment

Regularly review your property assessment to ensure accuracy. If you believe your property’s assessed value is higher than it should be, you have the right to appeal. The assessment appeal process in Lake County is straightforward and can potentially lead to a reduction in your property taxes.

3. Explore Tax Relief Programs

Lake County offers various tax relief programs to assist eligible homeowners. These programs include the Senior Citizen Homestead Exemption, the Disabled Persons Homestead Exemption, and the Senior Citizen Assessment Freeze Homestead Exemption. Researching and applying for these programs can provide significant savings on your property taxes.

4. Optimize Your Property’s Value

While it may seem counterintuitive, improving your property’s value can sometimes lead to tax savings. By making strategic improvements or upgrades, you may increase your property’s market value, which could result in a higher assessed value. However, it’s essential to consider the long-term benefits and ensure that the improvements align with your financial goals.

5. Consider Tax Strategies

Consulting with a tax professional or financial advisor can provide valuable insights into tax-efficient strategies. They can help you understand the implications of property ownership, tax deductions, and potential tax savings opportunities specific to your situation. It’s always beneficial to seek expert advice to optimize your tax planning.

Future Outlook and Considerations

As Lake County continues to thrive, property values and tax rates are expected to remain dynamic. Keeping a close eye on economic trends, real estate market fluctuations, and local government budgets is essential for anticipating potential changes in property taxes. Additionally, stay informed about any proposed legislation or initiatives that may impact property taxation in the region.

Key Considerations for the Future:

- Economic Growth and Development: Lake County’s strong economic growth may lead to increased property values, potentially impacting tax rates.

- Budgetary Considerations: Local governments’ financial decisions, such as funding for public services, can influence tax rates and assessments.

- Community Initiatives: Keep an eye on community projects and initiatives that may impact property taxes, such as infrastructure developments or environmental initiatives.

- Tax Policy Changes: Stay informed about any proposed changes to tax laws or regulations at the state and local levels.

By staying engaged and proactive, you can navigate the evolving landscape of property taxes in Lake County with confidence. Regularly reviewing your tax situation and staying connected with local resources will ensure you make informed decisions regarding your financial obligations as a property owner.

Conclusion

Understanding and managing property taxes in Lake County is a crucial aspect of responsible homeownership. By grasping the fundamentals of property tax calculation, staying informed about local tax rates, and implementing effective strategies, you can optimize your financial well-being. Remember, property taxes are an essential investment in the community’s growth and development, and staying proactive ensures you contribute to the vibrant Lake County landscape.

How often are property taxes assessed in Lake County, IL?

+Property taxes in Lake County, IL, are assessed annually. The assessment process occurs once a year, typically during a specific assessment period. It’s essential to stay updated on the assessment schedule to ensure you receive accurate information about your property’s value.

Can I appeal my property’s assessed value in Lake County?

+Yes, if you believe your property’s assessed value is incorrect, you have the right to appeal. The Lake County Assessor’s Office provides an appeals process where you can present evidence and arguments to support your case. It’s advisable to gather relevant documentation and seek professional advice if needed.

What tax relief programs are available in Lake County for homeowners?

+Lake County offers several tax relief programs to assist eligible homeowners. These include the Senior Citizen Homestead Exemption, the Disabled Persons Homestead Exemption, and the Senior Citizen Assessment Freeze Homestead Exemption. Each program has specific eligibility criteria, so it’s essential to review the requirements to determine your eligibility.

How can I stay updated on property tax news and changes in Lake County?

+Staying informed is crucial for managing your property taxes effectively. You can subscribe to newsletters or alerts from the Lake County Assessor’s Office, follow local news sources, and engage with community groups to receive updates on property tax-related matters. Additionally, attending public meetings and workshops can provide valuable insights.