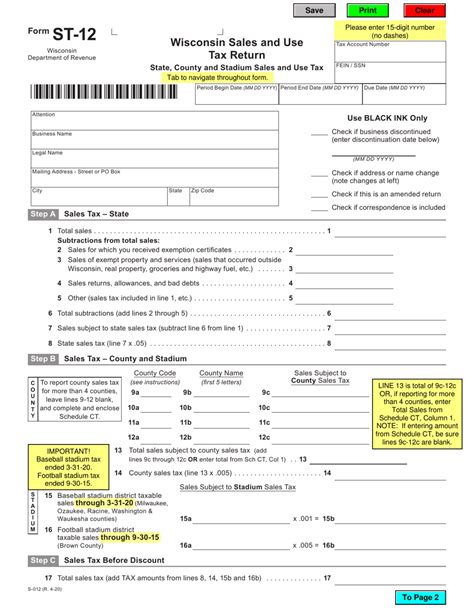

What Are the Current Sales Tax Rates in Wisconsin?

Imagine navigating through a labyrinth of fiscal regulations, only to find that one of the most commonly encountered yet intricately layered elements is sales tax—specifically, the current rates in Wisconsin. As sales tax policies reflect broader economic priorities, political shifts, and regional disparities, understanding what is levied today requires a nuanced exploration. Could you ponder—how do Wisconsin’s sales tax rates compare to neighboring states, and what might future changes indicate about fiscal strategies? Unraveling these questions involves diving into legal statutes, local ordinances, and the economic impacts for consumers and businesses alike.

Understanding Wisconsin’s Sales Tax Framework

Wisconsin’s sales tax system is characterized by a state-level base rate combined with additional local surcharges that vary geographically. As of 2024, the fundamental question emerges: what is the exact rate that applies to most retail transactions? Typically, knowing the baseline rate is crucial—not merely for consumers but also for business operators who need precise compliance data. So, what is the state’s primary sales tax rate today, and how does this influence the overall cost of goods and services? Analyzing this, we find that Wisconsin’s statewide rate is set at 5%.

The Composition of the Sales Tax Rate in Wisconsin

Are there circumstances under which the total sales tax surpasses this baseline? Certainly. Local municipalities may impose additional taxes, often designated for specific funding initiatives such as transportation, education, or healthcare. With this in mind, what is the maximum combined rate currently attainable in Wisconsin—could it reach, say, 7.5% or higher? The answer varies depending on local levies.

| Relevant Category | Substantive Data |

|---|---|

| Statewide Base Rate | 5% (as of 2024), consistent since 1986 |

| Maximum Local Option | Up to 2.75%, depending on municipality |

| Total Max Rate | Approximately 8% |

Key Points

- Wisconsin’s baseline sales tax rate is currently 5%.

- Local jurisdictions can impose additional taxes, raising the total rate to approximately 8%.

- Regional disparities in sales tax rates significantly affect retail pricing and consumer spending patterns.

- Changes in local tax authority proposals can influence future rates; monitoring legislative activities is essential.

- Understanding these rates is pivotal for compliance and strategic planning for businesses operating within the state.

Regional Variations and Local Option Taxes

What does the landscape look like across Wisconsin’s diverse counties and municipalities? Historically, some regions have leveraged local options to support projects like road repairs or public transit. For instance, Milwaukee County has authorized an additional 0.5% sales tax, raising its total to roughly 5.5%. Such adjustments—are they permanent fixtures or subject to renewal votes? Frequently, local referendums and legislative decisions dictate these figures—highlighting that sales tax in Wisconsin is not static but a living framework responsive to community priorities.

Mechanisms for Local Tax Authorization

In what ways can local governments implement or modify their sales tax rates? Typically, through county or city council resolutions, often requiring voter approval for new levies or rate increases. How might this democratic process influence the stability or volatility of sales tax rates? Considering the recent history, local measures pass or fail based on economic conditions, political climate, and public opinion—making Wisconsin’s sales tax landscape inherently dynamic.

Question: How do these regional variations impact cross-border commerce, especially in urban versus rural areas?

Answer: Consumers may choose to shop in jurisdictions with lower rates, incentivizing businesses to consider tax-inclusive pricing strategies, and encouraging regional competitive positioning.

Implications for Consumers and Businesses

For residents and visitors alike, what does a 5% baseline plus potential local surcharges translate into practically? On an average purchase of 100, the baseline tax would add 5, but in areas with combined rates exceeding 7%, the tax could be $7 or more—affecting disposable income and retail margins. Are there exemptions or special rates that might reduce the burden in specific sectors? Indeed, groceries, prescription drugs, and certain medical devices are exempt or taxed at reduced rates—yet, complexities arise with how these exemptions are applied across local jurisdictions.

Tax Policy and Economic Development

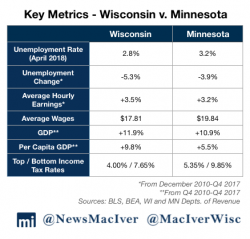

In the broader context, how does Wisconsin’s sales tax rate compare with neighboring states like Illinois, Minnesota, and Iowa? For instance, Illinois’s combined rate often exceeds 8%, making Wisconsin comparatively attractive for certain shoppers. Does this disparity influence regional shopping patterns, potentially diverting sales from neighboring states? Furthermore, how might future rate adjustments—either increases to fund infrastructure projects or decreases to stimulate retail—reshape economic development strategies?

| Comparison with Adjacent States | Current Sales Tax Rate |

|---|---|

| Illinois | 8.25% |

| Minnesota | 7.125% |

| Iowa | 6% |

| Wisconsin | 5% (statewide rate) |

Legal and Policy Considerations for Future Adjustments

What governance mechanisms are in place to modify Wisconsin’s sales tax rates? Legislature voting, gubernatorial approval, and voter referendums constitute the primary channels. Are there political pressures expected to drive changes in the near future? Recent proposals suggest a potential increase to support transportation infrastructure, but resistance from certain districts highlights the contentious nature of tax policy. How might emerging economic challenges—such as inflation, remote work trends, or automation—pressure policymakers to reconsider the rates? Could new technological frameworks, like digital sales tracking, streamline compliance and influence future policy directions?

Anticipating Changes and Preparing Strategically

What steps should businesses and consumers take to stay ahead of possible rate shifts? Staying informed through legislative bulletins, engaging with local chambers of commerce, and utilizing strategic financial planning are critical. How does this proactive approach help mitigate risk and capitalize on emerging opportunities? The ability to adapt swiftly depends heavily on ongoing education about policy developments and regional economic indicators.

What is the current sales tax rate in Wisconsin?

+Currently, Wisconsin’s statewide base sales tax rate is 5%. Local jurisdictions may impose additional taxes, raising the total up to approximately 8% in some areas.

How do local taxes influence the overall sales tax rate across Wisconsin?

+Local authorities can add up to 2.75% or more, leading to regional variations that significantly impact total sales tax rates depending on your location within the state.

Are there exemptions or special rates for certain goods in Wisconsin?

+Yes, essentials like groceries, prescription medications, and medical devices are often exempt or taxed at reduced rates, but regional differences may apply in how these exemptions are implemented.