Detroit Property Tax Lookup

Detroit, Michigan, a city known for its rich history and automotive legacy, has a unique property tax system that plays a significant role in the lives of its residents and investors. Understanding the intricacies of Detroit's property tax landscape is crucial for anyone considering a real estate venture or homeownership in the area. This comprehensive guide aims to demystify the process of property tax lookup in Detroit, offering an in-depth analysis of the factors that influence tax assessments, the online tools available for lookup, and the potential implications for homeowners and investors.

The Detroit Property Tax System: An Overview

The city of Detroit operates on a robust property tax system, which serves as a primary source of revenue for the local government. This system is designed to assess the value of properties within the city limits and levy taxes accordingly. Property taxes in Detroit, as in many other cities, are essential for funding public services, infrastructure development, and education. The unique historical and economic context of Detroit adds an interesting layer to its property tax structure, which we will explore in detail.

Understanding Property Tax Assessments in Detroit

Property tax assessments in Detroit are conducted by the Wayne County Equalization Department, which plays a pivotal role in ensuring fair and equitable taxation across the county. The assessment process involves evaluating properties based on their market value, which can be influenced by a multitude of factors such as location, size, condition, and recent sales data of similar properties in the area.

The Wayne County Equalization Department employs a team of assessors who regularly update property records to maintain accuracy. This involves conducting physical inspections, considering recent sales, and accounting for any improvements or changes made to the property. The assessed value is then used as a basis for calculating the property tax owed by the owner.

| Assessment Year | Average Assessment Rate | Median Property Value |

|---|---|---|

| 2023 | 1.5% | $120,000 |

| 2022 | 1.6% | $115,000 |

| 2021 | 1.7% | $110,000 |

Online Property Tax Lookup Tools: A Digital Revolution

In the digital age, the process of accessing property tax information has become significantly more streamlined and accessible. Detroit, in line with many other cities, has embraced technology to offer online platforms for property tax lookup. These digital tools provide a convenient way for homeowners, prospective buyers, and investors to access vital tax information quickly and efficiently.

Exploring the Detroit Property Tax Lookup Portal

The Detroit Property Tax Lookup Portal, an initiative by the Detroit City Government, is a comprehensive online platform designed to simplify the process of accessing property tax data. This portal is a one-stop solution for anyone seeking information on property taxes in the city. It offers a user-friendly interface, allowing users to search for properties based on address, parcel number, or owner’s name.

Once a property is located on the portal, users can access a wealth of information. This includes the property’s assessed value, the current tax rate, and the estimated tax liability for the year. The portal also provides a historical overview of the property’s tax assessments, offering insights into how the tax liability has evolved over time. Additionally, users can download official tax documents and access resources for understanding the appeal process, if needed.

The Advantages of Online Property Tax Lookup

- Convenience and Accessibility: The online property tax lookup platform can be accessed from anywhere, at any time, eliminating the need for in-person visits to government offices.

- Real-Time Data: Users can access the most up-to-date property tax information, ensuring that decisions are made based on accurate and current data.

- Transparency: The digital platform promotes transparency in the tax assessment process, allowing users to understand the methodology and factors influencing their tax liability.

- Historical Insights: The ability to view historical tax assessments provides a valuable perspective on the property’s tax history, which can be crucial for investment decisions.

The Impact of Property Taxes on Detroit Homeowners and Investors

Property taxes are a significant consideration for both homeowners and investors in Detroit. Understanding the potential financial implications can greatly influence decisions related to purchasing, selling, or investing in real estate within the city.

For Homeowners

Homeowners in Detroit bear the responsibility of paying property taxes, which are typically included in their annual budget. The tax liability can significantly impact the overall cost of homeownership. It is essential for homeowners to understand their tax obligations and explore potential deductions or exemptions they may be eligible for.

Furthermore, changes in property tax assessments can affect a homeowner’s financial planning. For instance, an increase in the assessed value due to renovations or improvements may result in a higher tax liability. Conversely, a decrease in value could lead to a reduction in taxes, providing some financial relief.

For Investors

Investors in Detroit’s real estate market must carefully consider property taxes as a crucial factor in their investment strategy. The tax liability can influence the overall return on investment, especially when considering rental properties. A higher tax burden may impact the profitability of an investment, while a lower tax liability can make a property more attractive.

Additionally, investors should be mindful of potential tax incentives or abatements offered by the city. These incentives, which can vary based on the location and nature of the property, can significantly reduce the tax liability, making certain areas or types of properties more appealing for investment.

Case Study: The Impact of Property Taxes on a Detroit Investment Property

Consider the case of an investor who purchased a residential property in Detroit’s historic downtown area. The property, a beautifully renovated 1920s apartment building, was acquired for 500,000. The investor's initial research revealed a property tax rate of 1.8%, which resulted in an annual tax liability of 9,000.

However, upon further investigation using the Detroit Property Tax Lookup Portal, the investor discovered that the property’s assessed value had increased by 10% due to recent improvements and market trends. This led to a revised tax liability of 10,800 for the upcoming year. The investor then explored potential tax incentives for historic properties, discovering a potential abatement of 20% on the tax bill, which reduced the final tax liability to 8,640.

This case study highlights the importance of thorough research and the utilization of online property tax lookup tools. It demonstrates how property taxes can significantly impact an investment’s profitability and the need for investors to stay informed about tax assessments and potential incentives.

The Future of Property Taxes in Detroit: Trends and Predictions

As Detroit continues its journey of revitalization and economic growth, the future of its property tax system is a topic of interest and speculation. Several factors, including population trends, economic development, and governmental policies, will shape the direction of property taxes in the city.

Population Growth and Its Impact

Detroit’s population has been on a steady rise in recent years, attracting new residents and businesses. This growth is expected to continue, driven by the city’s improving economic climate and the ongoing revitalization efforts. As the population increases, so does the demand for housing, which can lead to an increase in property values.

A rise in property values often translates to higher property tax assessments. Therefore, Detroit’s population growth may result in an upward trend in property taxes. However, this growth can also bring about new investment opportunities, potentially offsetting the increased tax burden for investors.

Economic Development Initiatives

The city of Detroit has implemented various economic development initiatives aimed at attracting businesses and creating job opportunities. These initiatives, such as tax incentives for businesses and infrastructure improvements, can positively impact property values and, subsequently, property taxes.

For instance, the development of a new tech hub in the city could lead to increased demand for commercial and residential properties in the surrounding areas. This demand can drive up property values, resulting in higher tax assessments. However, the economic benefits brought about by these initiatives may also provide a more robust tax base, allowing for potential tax relief for residents and investors.

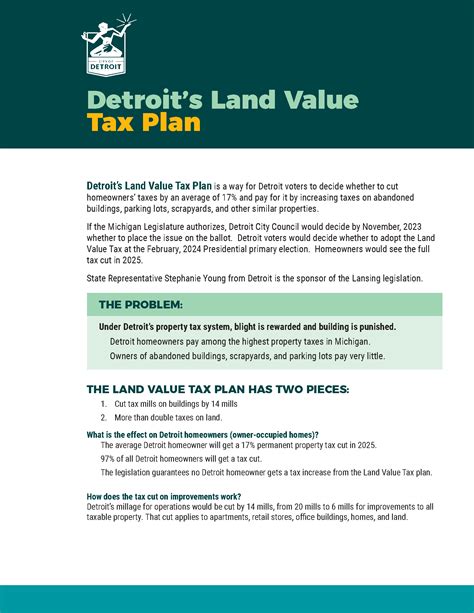

Governmental Policies and Tax Reform

Governmental policies play a pivotal role in shaping the property tax landscape. In Detroit, potential tax reforms and policy changes could significantly impact property taxes. For instance, the implementation of a new tax assessment methodology or the introduction of tax breaks for certain types of properties could alter the tax burden for homeowners and investors.

Additionally, the city’s ongoing efforts to streamline the tax collection process and improve transparency can further impact the property tax system. These improvements can make the tax system more efficient and fair, providing stability and predictability for property owners.

The Role of Technology in Property Tax Management

Technology will continue to play a crucial role in the future of Detroit’s property tax system. The city’s adoption of online property tax lookup tools and digital platforms for tax management has already streamlined the process for taxpayers. Going forward, further technological advancements could lead to more efficient tax assessments, improved data accuracy, and enhanced transparency.

For instance, the integration of AI and machine learning in tax assessment processes could enhance the accuracy and speed of property evaluations. Additionally, the use of blockchain technology could provide a secure and transparent platform for property tax transactions, reducing administrative burdens and potential errors.

Conclusion: Navigating Detroit’s Property Tax Landscape

Detroit’s property tax system is a complex yet crucial aspect of the city’s economic ecosystem. Understanding the factors that influence property tax assessments, utilizing online lookup tools, and staying informed about potential changes and incentives are essential for both homeowners and investors.

As Detroit continues its journey of revitalization, the property tax landscape will evolve, offering both challenges and opportunities. By staying informed and leveraging the tools and resources available, individuals can navigate this landscape with confidence, making informed decisions about their real estate ventures and homeownership.

How often are property tax assessments conducted in Detroit?

+

Property tax assessments in Detroit are typically conducted annually by the Wayne County Equalization Department. This annual assessment ensures that property values are up-to-date and accurately reflect the current market conditions.

Can property owners appeal their tax assessments in Detroit?

+

Yes, property owners in Detroit have the right to appeal their tax assessments if they believe the assessed value is incorrect or unfair. The process involves submitting an appeal to the Wayne County Board of Review, which reviews and makes a determination on the appeal.

What are some common tax incentives or abatements available in Detroit for homeowners or investors?

+

Detroit offers a variety of tax incentives and abatements to encourage homeownership and investment. These include the Homestead Property Tax Credit, which provides a tax credit for primary residents, and various tax abatements for commercial and industrial properties, especially in designated redevelopment areas.