Arkansas Personal Property Taxes

Personal property taxes in Arkansas are an important aspect of the state's revenue system and impact property owners across the state. These taxes are levied on tangible personal property, including vehicles, boats, and various types of business assets. Understanding the intricacies of Arkansas' personal property tax system is crucial for both individual and business taxpayers to ensure compliance and manage their financial obligations effectively.

Overview of Arkansas Personal Property Taxes

Arkansas imposes an annual personal property tax on most tangible personal property owned by individuals, businesses, and other entities. The tax is a significant source of revenue for local governments, including counties, cities, and school districts, allowing them to fund essential services and infrastructure.

The state's personal property tax system is administered by the Arkansas Department of Finance and Administration (DFA). The DFA provides guidelines and assistance to local assessors and taxpayers to ensure a fair and efficient tax assessment and collection process.

Taxable Property and Exemptions

Arkansas personal property taxes are assessed on a wide range of tangible personal property. This includes:

- Vehicles: All motor vehicles, including cars, trucks, motorcycles, and trailers, are subject to personal property tax.

- Boats and Watercraft: Boats, yachts, and other watercraft are taxed based on their value and usage.

- Business Assets: Businesses must pay personal property taxes on equipment, machinery, furniture, and other tangible assets used in their operations.

- Leased Property: Property leased for business use is also taxable, with the responsibility often falling on the lessee.

However, certain types of property are exempt from personal property taxes in Arkansas. These exemptions include:

- Residential Property: Personal residences, including single-family homes, apartments, and mobile homes, are exempt from personal property taxes.

- Inventory and Stocks: Merchandise held for sale, such as inventory in a retail store, is not taxable as personal property.

- Intangible Property: Investments, stocks, bonds, and other financial assets are not subject to personal property taxes.

- Certain Agricultural Property: Agricultural equipment and livestock used in farming operations may be exempt or have reduced tax rates.

Assessment and Valuation Process

The assessment and valuation of personal property for tax purposes are conducted by local assessors in each county. These assessors are responsible for determining the fair market value of taxable property based on factors such as age, condition, and market value.

The assessment process typically involves:

- Notification: Property owners receive a notice from their county assessor informing them of the assessment process and any necessary actions.

- Property Inspection: Assessors may conduct physical inspections of property to verify its existence, condition, and use.

- Valuation: Assessors use various valuation methods, including cost approaches, market data, and income approaches, to determine the property's taxable value.

- Appeals: Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. Appeals are typically made to the county board of equalization.

Tax Rates and Calculations

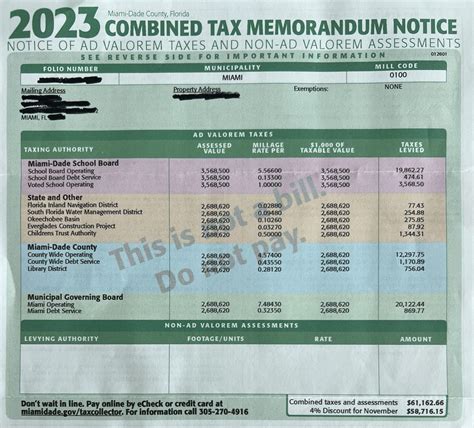

The tax rate for personal property in Arkansas is determined by the taxing jurisdiction, which can include counties, cities, and school districts. These jurisdictions set their tax rates based on their budgetary needs and the level of services they provide.

The tax rate is expressed as a percentage and is applied to the assessed value of the property. For example, if a jurisdiction has a tax rate of 1.5%, and a vehicle is assessed at $10,000, the personal property tax due would be $150.

| Jurisdiction | Tax Rate (%) |

|---|---|

| Benton County | 1.0 |

| Pulaski County | 1.2 |

| Washington County | 1.1 |

Payment and Due Dates

Personal property tax bills are typically mailed to property owners in the spring or early summer. The due date for payment is set by each jurisdiction, and late payments may incur penalties and interest.

Taxpayers have the option to pay their personal property taxes online, by mail, or in person at the county tax collector's office. Payment plans or installment options may be available for those who cannot afford to pay the full amount at once.

Challenges and Considerations for Property Owners

Arkansas’ personal property tax system presents several challenges and considerations for property owners:

Valuation Accuracy

Ensuring that the assessed value of personal property is accurate is crucial for taxpayers. Overvaluation can lead to higher tax bills, while undervaluation may result in missed tax benefits or penalties for underreporting.

Tax Rate Variations

The variation in tax rates across jurisdictions means that the same property may be taxed differently depending on its location. This can create complexities for businesses with assets spread across multiple counties.

Compliance and Recordkeeping

Maintaining accurate records of personal property ownership and value is essential for compliance. Property owners must ensure that they report all taxable property accurately and on time to avoid penalties and audits.

Appeals Process

Understanding the appeals process is vital for property owners who believe their assessed value is incorrect. The appeals process can be complex, and seeking professional advice or assistance may be beneficial.

Impact on Local Communities

Arkansas’ personal property taxes play a significant role in funding local government services and infrastructure. The revenue generated from these taxes supports essential functions such as:

- Education: Personal property taxes contribute to funding public schools, ensuring that students receive the resources they need for a quality education.

- Public Safety: Tax revenue helps maintain police and fire departments, ensuring the safety and security of local communities.

- Infrastructure: Personal property taxes are used to maintain and improve roads, bridges, and other critical infrastructure.

- Social Services: These taxes also support social programs, healthcare services, and community development initiatives.

Future Trends and Reforms

The Arkansas personal property tax system is subject to ongoing review and potential reforms. Some of the key trends and considerations for the future include:

Online Assessment and Payment

The state is exploring ways to enhance the efficiency and accessibility of the personal property tax system. This includes developing online platforms for assessment, valuation, and payment, making the process more convenient for taxpayers.

Fairness and Equity

Ensuring fairness and equity in the tax system is a continuous focus. Efforts are being made to address any discrepancies in tax rates and valuation practices across counties to create a more uniform and transparent system.

Tax Relief and Incentives

Arkansas is considering various tax relief measures and incentives to support businesses and encourage economic growth. This may include tax breaks for specific industries or property types to attract investment and create jobs.

Data Integration and Analysis

The state is investing in data integration and analytics to improve the accuracy and efficiency of personal property tax assessments. This includes using advanced technologies to streamline the valuation process and identify potential errors or inconsistencies.

Frequently Asked Questions

What happens if I don’t pay my personal property taxes in Arkansas?

+

Failure to pay personal property taxes can result in penalties, interest, and potential legal consequences. In some cases, the taxing jurisdiction may place a lien on the property, and if the taxes remain unpaid, the property could be subject to seizure and sale.

Can I appeal my personal property tax assessment in Arkansas?

+

Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. Appeals are typically made to the county board of equalization. It is advisable to consult with a tax professional or attorney to understand the appeals process and prepare a strong case.

Are there any tax relief programs for low-income property owners in Arkansas?

+

Arkansas offers several tax relief programs for low-income property owners. These include the Circuit Breaker Tax Credit, which provides a credit against personal property taxes for eligible low-income seniors and disabled individuals, and the Homestead Credit, which reduces the taxable value of primary residences for qualifying homeowners.

How often do personal property tax assessments occur in Arkansas?

+

Personal property tax assessments in Arkansas typically occur annually. Property owners should expect to receive a notice from their county assessor each year, informing them of the assessment process and any necessary actions.

Can I pay my personal property taxes online in Arkansas?

+

Yes, most counties in Arkansas offer online payment options for personal property taxes. Property owners can typically access their tax bills and make payments through the county’s official website. It is important to note that payment methods and processing times may vary by county.