City Of Detroit Mi Property Taxes

Welcome to a comprehensive exploration of the property taxes in the vibrant city of Detroit, Michigan. As one of the largest cities in the Midwest, Detroit has a unique tax system that plays a crucial role in its economic landscape. This guide aims to demystify the intricacies of property taxation in the Motor City, providing an in-depth analysis for homeowners, investors, and anyone interested in understanding this essential aspect of Detroit's real estate market.

Understanding Detroit's Property Tax Landscape

The city of Detroit, like many other municipalities in the United States, relies heavily on property taxes to fund its operations and public services. These taxes are a significant source of revenue, contributing to the maintenance of roads, schools, public safety, and various community programs. The property tax system in Detroit is governed by state laws and local regulations, creating a complex yet vital framework for the city's fiscal health.

Detroit's property tax system is based on the assessed value of a property, which is determined by the city's assessors. This value is then used to calculate the tax liability for each property owner. The process involves a series of assessments, appeals, and adjustments to ensure fairness and accuracy. It's a crucial component of the city's overall tax structure, impacting not only homeowners but also commercial property owners and investors.

Key Components of Detroit Property Taxes

Several factors influence the property tax landscape in Detroit, including:

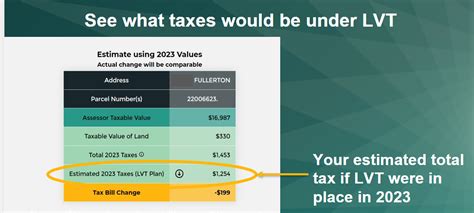

- Assessment Process: Properties are typically assessed every 18 months in Detroit. This process involves evaluating the property's value based on factors such as location, size, condition, and recent sales data. The assessment determines the property's taxable value, which forms the basis for tax calculations.

- Tax Rates: Detroit's tax rates are set by the city and county governments. These rates are expressed as a millage rate, which is the number of dollars in taxes owed per $1,000 of taxable value. The tax rate can vary based on the property's location and the type of tax district it falls under.

- Tax Districts: Detroit is divided into various tax districts, each with its own millage rate. These districts can include city-wide taxes, school district taxes, and special assessment districts for specific services or improvements. Understanding the tax districts is crucial for accurate tax estimation.

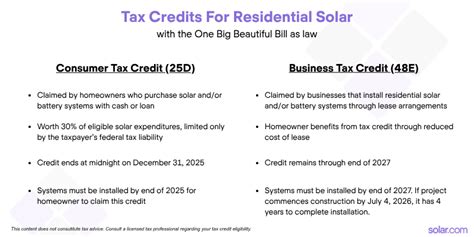

- Tax Exemptions and Credits: Detroit offers several tax exemptions and credits to eligible property owners. These can include homestead exemptions, senior citizen exemptions, and tax credits for energy-efficient improvements. Such incentives can significantly reduce a property owner's tax liability.

- Appeal Process: Property owners who believe their assessment is incorrect can initiate an appeal. The process involves a review by the city's tax tribunal, which can adjust the assessment if deemed necessary. This step ensures fairness and provides a mechanism for property owners to challenge their tax obligations.

| Tax District | Millage Rate | Taxable Value Range |

|---|---|---|

| City of Detroit | 17.60 mills | $100,000 - $200,000 |

| Detroit Public Schools | 2.30 mills | $150,000 - $250,000 |

| Wayne County | 7.60 mills | $200,000 - $300,000 |

| Special Assessment District | Varies | Based on district-specific improvements |

The Impact of Property Taxes on Detroit's Real Estate Market

Property taxes are an essential consideration for anyone involved in Detroit's real estate market, whether buying, selling, or investing. They directly influence the cost of ownership and can significantly impact a property's overall financial performance.

How Property Taxes Affect Buyers and Sellers

For buyers, property taxes are a crucial factor in the decision-making process. Understanding the tax liability associated with a property can impact the overall affordability and long-term financial planning. Sellers, on the other hand, must consider the tax implications of their sale, including potential capital gains taxes and the transfer of tax liabilities to the new owner.

The property tax system in Detroit can also influence market dynamics. Properties with lower tax burdens may be more attractive to buyers, potentially impacting the demand and pricing of such properties. Conversely, properties with higher taxes might face challenges in attracting potential buyers, leading to longer listing periods or the need for price adjustments.

Impact on Rental Properties and Investors

Investors and rental property owners in Detroit face unique challenges when it comes to property taxes. The tax liability can significantly affect the profitability of their investments. For instance, a property with a high tax burden might require a higher rental income to maintain profitability, potentially impacting the property's occupancy rate and tenant turnover.

Moreover, investors need to consider the impact of tax incentives and exemptions when acquiring properties. Understanding these incentives can lead to strategic decisions, such as targeting specific tax districts or properties that offer reduced tax burdens. This knowledge can enhance the overall return on investment and improve the financial outlook for rental properties in Detroit.

Strategies for Managing Property Taxes in Detroit

Navigating Detroit's property tax landscape can be complex, but several strategies can help homeowners and investors manage their tax obligations effectively.

Understanding Assessments and Tax Bills

Property owners should thoroughly understand their assessment and tax bill. This includes reviewing the assessment for accuracy, ensuring that the property's features and improvements are correctly reflected. Any discrepancies should be addressed promptly to avoid overpayment of taxes.

Additionally, staying informed about tax district changes and adjustments is crucial. Detroit's tax landscape can evolve, and understanding these changes can help property owners anticipate and plan for potential tax fluctuations.

Maximizing Tax Exemptions and Credits

Detroit offers a range of tax exemptions and credits, and taking advantage of these can significantly reduce tax liabilities. Property owners should explore eligibility for homestead exemptions, senior citizen discounts, and other incentives. Consulting with tax professionals or the city's tax department can provide valuable guidance on maximizing these benefits.

Appealing Assessments

If a property owner believes their assessment is incorrect, they have the right to appeal. This process involves gathering evidence, such as comparable sales data or property condition reports, to support the appeal. A successful appeal can result in a reduced assessment and, consequently, lower tax obligations.

It's important to note that the appeal process can be complex and time-consuming. Engaging a professional tax consultant or attorney who specializes in property tax appeals can increase the chances of a successful outcome.

Conclusion: Navigating Detroit's Property Tax Landscape

Detroit's property tax system is a vital component of the city's fiscal health and real estate dynamics. Understanding this system is crucial for homeowners, buyers, sellers, and investors alike. By comprehending the assessment process, tax rates, and available exemptions, property owners can make informed decisions and effectively manage their tax obligations.

The impact of property taxes on Detroit's real estate market is significant, influencing pricing, demand, and investment strategies. Whether you're a first-time homebuyer, a seasoned investor, or a long-time resident, staying informed about Detroit's property tax landscape is essential for financial success and peace of mind.

Frequently Asked Questions

How often are properties assessed for tax purposes in Detroit?

+Properties in Detroit are typically assessed every 18 months. This process involves evaluating the property's value based on factors like location, size, and recent sales data.

<div class="faq-item">

<div class="faq-question">

<h3>What is the average property tax rate in Detroit?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>The average property tax rate in Detroit varies depending on the tax district. It can range from 17.60 mills to 7.60 mills for city-wide and county taxes, respectively. Special assessment districts may have varying rates based on specific improvements.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax exemptions or credits available in Detroit?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Detroit offers a range of tax exemptions and credits. These include homestead exemptions, senior citizen discounts, and tax credits for energy-efficient improvements. Property owners should explore their eligibility for these incentives.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I appeal my property assessment in Detroit?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To appeal your property assessment in Detroit, you'll need to gather evidence such as comparable sales data or property condition reports. You can then file an appeal with the city's tax tribunal. It's advisable to seek professional guidance for a successful appeal.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What impact do property taxes have on Detroit's real estate market?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Property taxes in Detroit directly influence the cost of ownership and can impact market dynamics. Properties with lower tax burdens may be more attractive to buyers, potentially affecting demand and pricing. Investors should consider tax implications when making real estate decisions.</p>

</div>

</div>

</div>