Missouri State Sales Tax

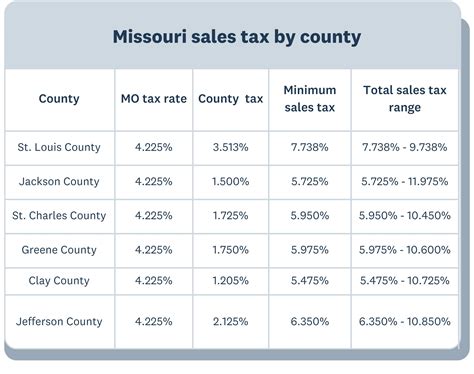

Missouri's sales and use tax system is an essential component of the state's revenue stream, contributing significantly to the funding of various public services and infrastructure projects. This tax, levied on the sale of tangible personal property and certain services, is a crucial aspect of the state's fiscal policy and economic framework. The state sales tax rate in Missouri stands at 4.225%, with additional local taxes applied in various counties and municipalities, resulting in a range of tax rates across the state.

Understanding the intricacies of Missouri's sales tax system is vital for both consumers and businesses operating within the state. It is important to grasp the different rates, exemptions, and collection processes to ensure compliance with the law and to make informed financial decisions. This article aims to provide a comprehensive guide to Missouri's state sales tax, exploring its rates, regulations, and real-world implications.

Sales Tax Rates in Missouri

Missouri’s sales tax structure is unique, as it combines a state-level sales tax with additional local taxes. The state sales tax rate of 4.225% is consistent across the state, ensuring a uniform base rate for all businesses and consumers. However, local taxing jurisdictions, such as counties and municipalities, have the authority to impose additional sales taxes, creating a diverse landscape of tax rates.

| Locality | Additional Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| City of St. Louis | 3.225% | 7.45% |

| St. Louis County | 1% | 5.225% |

| Jackson County | 1% | 5.225% |

| Greene County | 0.5% | 4.725% |

| Franklin County | 0.5% | 4.725% |

| Jefferson County | 0.5% | 4.725% |

| More than 100 other counties | Up to 1% | 5.225% |

The varying local tax rates create a complex system, where the total sales tax a consumer pays can differ significantly depending on their location. For instance, in the City of St. Louis, the total sales tax rate is 7.45%, a stark contrast to the 4.225% base rate. This complexity underscores the importance of understanding local tax rates for both businesses and consumers, especially those operating or shopping in multiple jurisdictions.

Special Tax Districts and Sales Tax Rates

In addition to county and municipal taxes, Missouri also has special tax districts that impose their own sales taxes. These districts are typically formed to fund specific projects or initiatives, such as transportation improvements or economic development initiatives. The sales tax rates in these districts can vary, often ranging from 0.5% to 2%.

For example, the Bi-State Development Agency (also known as Metro) operates a special tax district covering parts of St. Louis City and St. Louis County. This district imposes a 0.5% sales tax to support public transit improvements. Similarly, the Land Clearance for Redevelopment Authority of the City of St. Louis (LRA) has a special tax district with a 0.5% sales tax to fund urban redevelopment projects.

Businesses operating within these special tax districts must collect and remit the additional sales tax, ensuring accurate reporting to the Missouri Department of Revenue. This complexity in the sales tax structure requires businesses to stay informed about the tax rates in their specific locations to ensure compliance and avoid potential penalties.

Sales Tax Exemptions and Special Considerations

While Missouri’s sales tax applies broadly to the sale of tangible personal property and certain services, there are several notable exemptions and special considerations within the state’s tax code.

Exemptions from Sales Tax

Missouri exempts certain goods and services from sales tax. These exemptions include:

- Food for Home Consumption: Grocery items and food purchased for home consumption are exempt from sales tax in Missouri. This exemption applies to items like fresh produce, dairy products, meats, bread, and other staple foods.

- Prescription Drugs: Sales of prescription drugs and medicines are exempt from sales tax. This exemption covers both over-the-counter and prescription medications.

- Residential Rent: Rent for residential properties, including apartments and houses, is exempt from sales tax. This exemption applies to both long-term and short-term rentals.

- Manufacturing Equipment: Sales of manufacturing equipment and machinery used directly in the manufacturing process are exempt from sales tax. This exemption is designed to encourage investment in manufacturing industries.

- Agricultural Equipment: Sales of agricultural equipment, machinery, and supplies used directly in agricultural production are exempt from sales tax. This exemption supports the state’s agricultural sector.

Special Considerations for Sales Tax

In addition to exemptions, Missouri’s sales tax regulations include several special considerations:

- Sales Tax Holidays: Missouri occasionally holds sales tax holidays, during which certain items are exempt from sales tax for a limited time. These holidays often apply to back-to-school supplies, energy-efficient appliances, or specific types of merchandise. These events are intended to stimulate consumer spending and provide temporary tax relief.

- Use Tax: Missouri imposes a use tax on the storage, use, or consumption of tangible personal property or certain services purchased outside the state but brought into Missouri for use or consumption. This tax is designed to prevent tax evasion and ensure that all goods and services are taxed, regardless of where they are purchased.

- Sales Tax on Services: While Missouri primarily taxes the sale of tangible personal property, certain services are also subject to sales tax. These include services like repair and maintenance, storage, and certain professional services. The taxability of services can be complex, and businesses should consult the Missouri Department of Revenue for guidance.

Sales Tax Registration and Collection

Businesses operating in Missouri must navigate the state’s sales tax registration and collection process. This process involves several key steps:

Sales Tax Registration

Businesses must register with the Missouri Department of Revenue to obtain a Seller’s Permit, also known as a Sales Tax Registration Certificate. This permit authorizes the business to collect and remit sales tax on behalf of the state. The registration process involves completing an application, providing business details, and obtaining a unique identification number.

Sales Tax Collection

Once registered, businesses are responsible for collecting sales tax from customers at the point of sale. The sales tax is calculated based on the total purchase amount, including any applicable local taxes. Businesses must clearly display the sales tax amount on sales receipts and ensure accurate calculation to avoid consumer confusion and potential complaints.

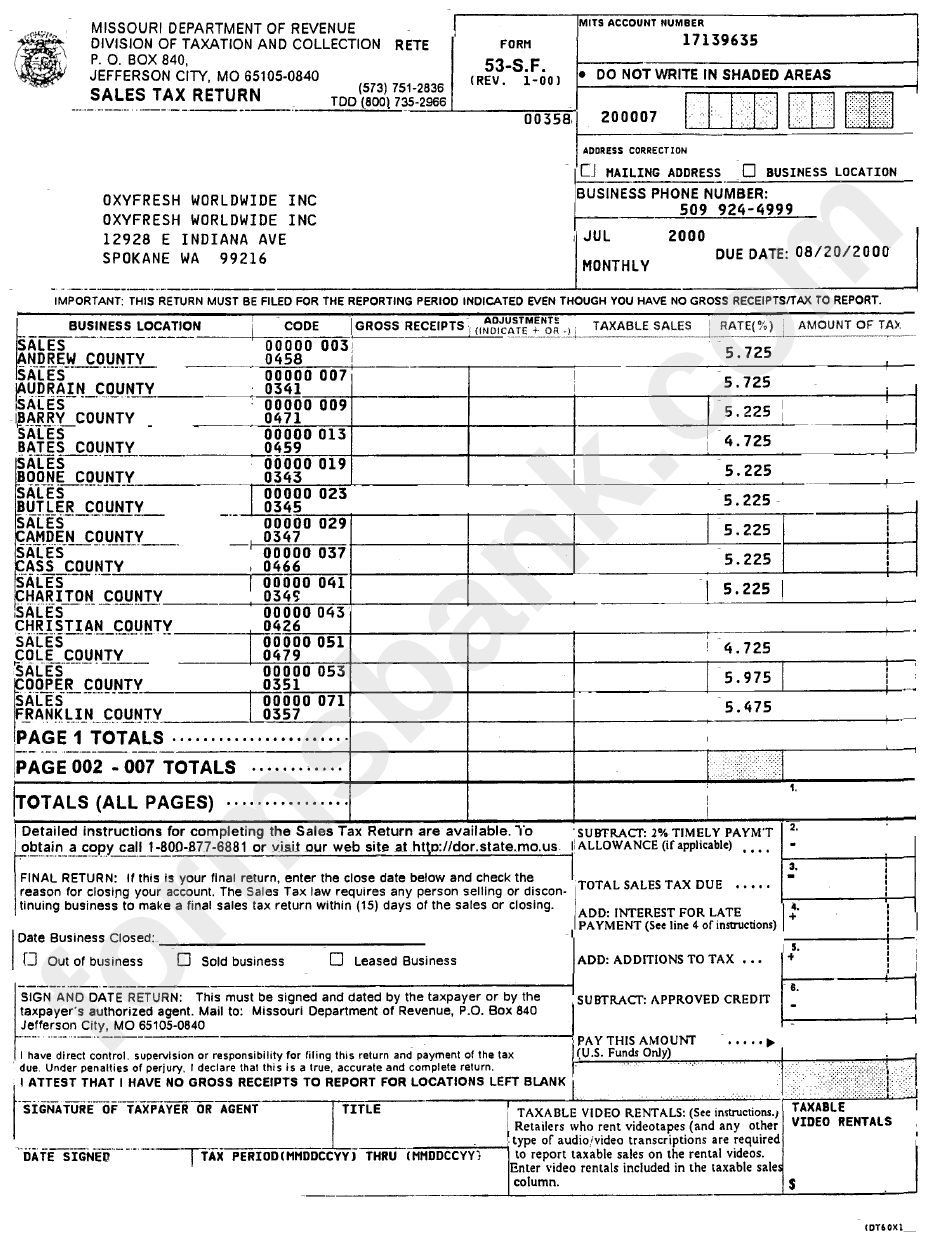

Sales Tax Remittance

Businesses are required to remit the collected sales tax to the Missouri Department of Revenue on a regular basis. The frequency of remittance depends on the business’s sales volume and can range from monthly to quarterly. The remittance process involves completing a sales tax return, providing sales and tax data, and making the tax payment by the due date.

Sales Tax Filing

In addition to remittance, businesses must file sales tax returns with the Missouri Department of Revenue. These returns provide detailed information about sales, taxable items, and the calculated sales tax. The filing process is typically done online through the department’s website, ensuring convenience and efficiency for businesses.

Sales Tax Compliance and Penalties

Compliance with Missouri’s sales tax regulations is critical for businesses to avoid legal and financial consequences. The state imposes penalties for non-compliance, including late payment penalties, interest on unpaid taxes, and potential fines for intentional non-compliance or fraud.

Late Payment Penalties

Missouri imposes a penalty for late payment of sales tax. The penalty is calculated as a percentage of the unpaid tax and increases over time. The specific penalty rates and timelines are outlined in the state’s tax regulations, and businesses should be aware of these to ensure timely payments and avoid additional fees.

Interest on Unpaid Taxes

In addition to late payment penalties, Missouri also charges interest on unpaid sales taxes. The interest accrues from the due date of the tax payment until the date of payment. The interest rate is based on the federal short-term rate, ensuring that it aligns with current market conditions.

Fines for Non-Compliance

Missouri can impose fines on businesses for various forms of non-compliance, such as failure to register, failure to collect sales tax, or intentional underreporting of sales. These fines can be significant and may also result in the revocation of the business’s Seller’s Permit. The state takes a serious approach to tax compliance, and businesses should prioritize adherence to sales tax regulations to avoid these consequences.

The Impact of Sales Tax on Businesses and Consumers

Missouri’s sales tax system has a significant impact on both businesses and consumers within the state. Understanding these impacts can help businesses make informed decisions about pricing, sales strategies, and tax planning, while consumers can make more informed purchasing decisions.

Impact on Businesses

For businesses, sales tax is a critical consideration in their financial planning and pricing strategies. Here are some key ways in which sales tax impacts businesses in Missouri:

- Pricing Strategy: Sales tax can influence a business’s pricing strategy. Some businesses may choose to absorb the sales tax in their pricing to make their products more competitive, while others may pass the tax directly to the consumer. This decision often depends on the business’s competitive position and its relationship with its customer base.

- Cash Flow Management: Sales tax collection and remittance can impact a business’s cash flow. Businesses must carefully manage their cash flow to ensure they have sufficient funds to remit sales tax on time. Failure to do so can result in late payment penalties and interest charges, which can strain a business’s finances.

- Compliance Costs: Compliance with sales tax regulations can incur costs for businesses. These costs include the time and resources required for registration, collection, remittance, and filing. Additionally, businesses may need to invest in accounting software or services to ensure accurate sales tax calculations and reporting.

- Impact on Sales: Sales tax can influence consumer behavior and, consequently, a business’s sales. Consumers may be more or less likely to purchase certain products depending on the sales tax rate. For example, higher sales tax rates could lead to reduced sales in certain categories or a shift in consumer behavior towards tax-free or discounted items.

Impact on Consumers

Sales tax also has a direct impact on consumers in Missouri. Here are some key ways in which sales tax affects consumers:

- Price Transparency: Sales tax adds to the total price of a purchase, impacting price transparency for consumers. While businesses are required to display the sales tax amount on sales receipts, consumers should be aware that the final price they pay includes this tax. This transparency is essential for consumers to make informed purchasing decisions and compare prices accurately.

- Budgeting and Financial Planning: Sales tax can impact a consumer’s budgeting and financial planning. Consumers may need to account for sales tax when planning major purchases, especially in areas with higher sales tax rates. This consideration is particularly important for consumers on a tight budget or those saving for specific goals.

- Shopping Behavior: Sales tax can influence consumer shopping behavior. Consumers may choose to shop in areas with lower sales tax rates or take advantage of sales tax holidays to save money. Additionally, consumers may opt for online shopping, which can sometimes provide tax benefits, especially for out-of-state purchases.

Future Outlook and Potential Changes to Missouri’s Sales Tax

Missouri’s sales tax system is subject to ongoing review and potential changes. These changes can be driven by various factors, including economic conditions, legislative priorities, and the state’s fiscal needs. Here are some potential future developments to watch for:

Tax Rate Changes

The state sales tax rate or local tax rates could change in response to economic conditions or legislative decisions. For example, the state could increase the sales tax rate to generate additional revenue or decrease it to stimulate consumer spending. Similarly, local jurisdictions may adjust their tax rates to fund specific projects or address budgetary concerns.

Expansion or Contraction of Exemptions

Missouri’s list of sales tax exemptions could be expanded or contracted in the future. The state may choose to exempt additional goods or services from sales tax to encourage certain behaviors, such as healthy eating or energy conservation. Conversely, the state could remove exemptions to broaden the tax base and increase revenue.

Implementation of New Taxes

The state could introduce new taxes, such as a gross receipts tax or a value-added tax (VAT), to generate additional revenue. These taxes could complement or replace the current sales tax system, potentially impacting businesses and consumers differently.

Sales Tax Simplification Efforts

Missouri could undertake efforts to simplify its sales tax system, such as harmonizing local tax rates or streamlining the registration and remittance process. These initiatives could make it easier for businesses to comply with sales tax regulations and reduce the administrative burden associated with sales tax collection and remittance.

Conclusion

Missouri’s sales tax system is a complex but vital component of the state’s fiscal policy. It plays a crucial role in funding public services and infrastructure while also impacting businesses and consumers. Understanding the intricacies of Missouri’s sales tax, including its rates, exemptions, and collection processes, is essential for both businesses and consumers to navigate the state’s tax landscape effectively.

As Missouri's sales tax system continues to evolve, staying informed about potential changes and their implications is crucial for businesses and consumers alike. By keeping abreast of developments in sales tax regulations, businesses can ensure compliance and make strategic decisions, while consumers can make informed purchasing choices. Ultimately, a deep understanding of Missouri's sales tax system empowers both businesses and consumers to thrive within the state's economic landscape.

What is the current state sales tax rate in Missouri?

+The current state sales tax rate in Missouri is 4.225% as of [current year]. This base rate applies uniformly across the state, serving as a foundation for the total sales tax rate, which can vary based on additional local taxes.

Are there any counties in Missouri with a total sales tax rate above 5%?

+Yes, several counties in Missouri have a total sales tax rate above 5%. For instance, the City of St. Louis has a total sales tax rate of 7.45%, which includes a local tax of 3.225% in addition to the state tax rate. This rate is one of the highest in the state.

Are there any sales tax holidays in Missouri, and what items are typically exempt during these periods?

+Missouri occasionally holds sales tax holidays, during which specific items are exempt from sales tax for a limited time. These holidays often apply to back-to-school supplies, energy-efficient appliances, or other items as designated by the state. The dates and items eligible for exemption vary each year and are announced by the Missouri Department of Revenue.

What is the process for businesses to register for sales tax in Missouri, and how often must they remit sales tax to the state?

+Businesses must register with the Missouri Department of Revenue to obtain a Seller’s Permit. The registration process involves completing an application and providing business details. The frequency of sales tax remittance depends on the business’s sales volume and can range from monthly to quarterly. Businesses should consult the Department of Revenue for specific remittance schedules based on their sales.