Sales Tax In Wa

Sales tax is an essential component of the revenue system in the United States, with each state implementing its own set of rules and regulations. Washington State, commonly referred to as "WA," has a unique approach to sales tax, offering a blend of simplicity and complexity. This article delves into the intricacies of sales tax in WA, providing a comprehensive guide for businesses and individuals alike.

Understanding Sales Tax in WA

Washington State imposes a sales and use tax on the retail sale, lease, and rental of tangible personal property, as well as some services. The state’s Department of Revenue is responsible for administering and enforcing these taxes, ensuring compliance across various industries.

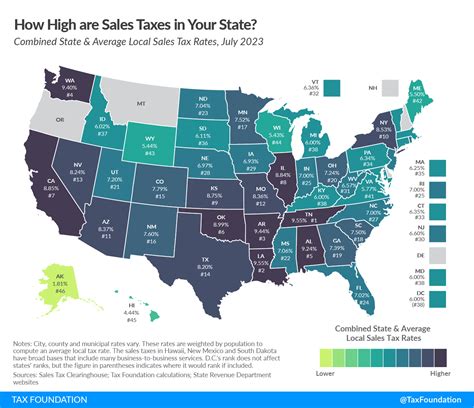

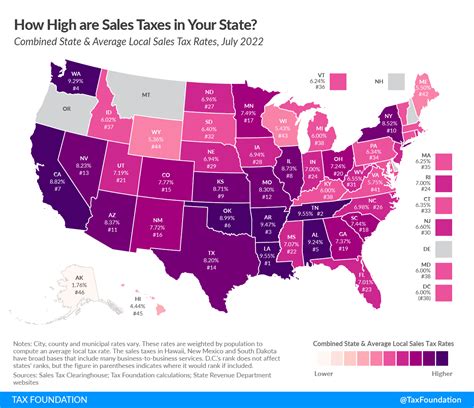

What sets WA's sales tax apart is its single, state-level rate. Unlike many other states that have both state and local sales taxes, WA has a consistent rate across the entire state. As of [date], the sales tax rate in WA stands at 6.5%, making it one of the lower rates in the country. However, it's important to note that this rate can change, so staying updated with the latest information is crucial.

Sales Tax Exemptions

WA offers various sales tax exemptions, providing relief to specific industries and purchases. These exemptions are designed to promote certain sectors and reduce the tax burden on consumers. Some common exemptions include:

- Food and prescription drugs: Most unprepared food items, including groceries, are exempt from sales tax in WA. This exemption aims to reduce the cost of living for residents.

- Clothing and footwear: Sales tax is not applicable to clothing and footwear items priced below a certain threshold. This encourages spending on essential items without the added tax burden.

- Manufacturing and reselling: Businesses engaged in manufacturing or reselling tangible personal property often benefit from specific exemptions, simplifying their tax obligations.

It's worth mentioning that while these exemptions provide significant benefits, they also come with certain criteria and restrictions. Understanding these exemptions thoroughly is crucial for businesses to ensure compliance and maximize their tax advantages.

| Exemption Category | Applicable Items |

|---|---|

| Food and Drugs | Unprepared food, prescription drugs |

| Clothing and Footwear | Clothing, footwear below a certain price |

| Manufacturing | Raw materials, components for manufacturing |

Sales Tax Registration and Compliance

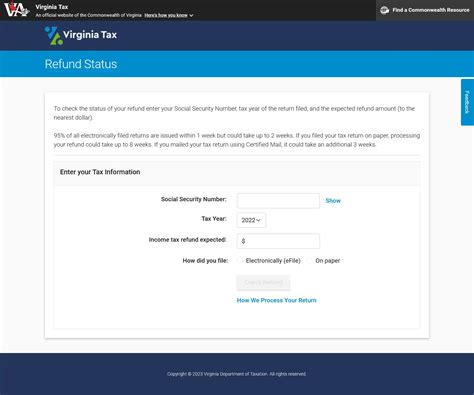

For businesses operating in WA, sales tax registration is a crucial step. The Department of Revenue requires businesses to register for a Business License and obtain a Sales and Use Tax Permit. This process ensures that businesses can collect and remit sales tax accurately.

Registration Process

To register for sales tax in WA, businesses must follow these steps:

- Apply for a Business License: This can be done online through the WA Secretary of State’s website. The license ensures compliance with various state regulations.

- Obtain a Sales and Use Tax Permit: After obtaining the Business License, businesses can apply for the Sales and Use Tax Permit. This permit authorizes the collection of sales tax from customers.

- Collect and Remit Sales Tax: Once registered, businesses must collect sales tax from customers at the point of sale. The collected tax must be remitted to the Department of Revenue at regular intervals.

Failure to register and remit sales tax can result in penalties and interest charges. Therefore, it is crucial for businesses to stay compliant with WA's sales tax regulations.

Compliance Challenges

While WA’s sales tax system is relatively straightforward, compliance can still pose challenges. Some common issues include:

- Online Sales: With the rise of e-commerce, businesses selling online must navigate the complexities of sales tax across different states. WA has specific rules for remote sellers, and staying updated with these regulations is essential.

- Record-keeping: Accurate record-keeping is crucial for sales tax compliance. Businesses must maintain records of sales, purchases, and tax payments to avoid audits and potential penalties.

- Taxable vs. Non-taxable Transactions: Distinguishing between taxable and non-taxable transactions can be complex. Understanding the nuances of WA’s sales tax law is necessary to avoid errors and ensure compliance.

To overcome these challenges, businesses can leverage sales tax automation tools and seek guidance from tax professionals. Staying informed and proactive is key to successful sales tax compliance in WA.

Impact on Businesses and Consumers

Sales tax has a direct impact on both businesses and consumers in WA. For businesses, sales tax collection and compliance are integral parts of their operations. It influences pricing strategies, cash flow management, and overall financial planning.

From a consumer perspective, sales tax affects purchasing decisions and the overall cost of goods and services. While WA's lower sales tax rate can make certain items more affordable, it's essential to consider the cumulative impact of sales tax on various purchases.

Pricing Strategies

Businesses in WA often incorporate sales tax into their pricing strategies. Some businesses choose to absorb the sales tax into their prices, providing a more transparent and competitive pricing structure. Others may opt to display prices excluding tax, allowing customers to understand the exact tax amount at checkout.

The approach to pricing can vary based on industry, target audience, and competitive landscape. Regardless of the strategy, businesses must ensure that their pricing remains competitive and aligns with customer expectations.

Consumer Behavior and Sales Tax

Sales tax can influence consumer behavior in WA. For instance, consumers may choose to shop in areas with lower sales tax rates or take advantage of tax-free periods. Additionally, the sales tax rate can impact online shopping habits, with consumers opting for out-of-state purchases to avoid WA’s sales tax.

Businesses must consider these consumer behaviors when formulating their sales and marketing strategies. Offering competitive pricing, promotions, and incentives can help mitigate the impact of sales tax on consumer choices.

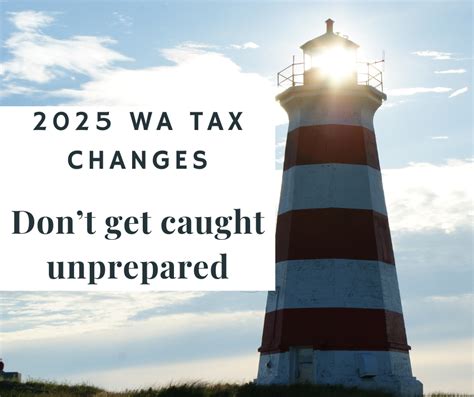

Future of Sales Tax in WA

As the business landscape evolves, so too will WA’s sales tax system. The state’s government continuously evaluates the sales tax structure, considering potential changes to rates, exemptions, and regulations.

Potential Changes and Their Impact

Here are some potential changes that could impact sales tax in WA:

- Rate Increase: With changing economic conditions, there is a possibility of a sales tax rate increase. While this could boost state revenue, it may also impact consumer spending and business operations.

- Expansion of Exemptions: The government may consider expanding sales tax exemptions to promote specific industries or reduce the tax burden on certain goods and services. This could provide relief to businesses and consumers alike.

- Online Sales Taxation: As e-commerce continues to grow, the state may implement stricter regulations for online sales. This could impact remote sellers and change the dynamics of online retail in WA.

Staying informed about potential changes is crucial for businesses and consumers. Being proactive and adapting to these changes can ensure continued success and compliance.

Conclusion

Sales tax in WA is a dynamic and crucial aspect of the state’s revenue system. With its single-rate structure and various exemptions, WA offers a unique approach to sales taxation. For businesses and consumers, understanding and navigating this system is essential for success and compliance.

As WA's sales tax landscape continues to evolve, staying informed and proactive is key. By staying updated with the latest regulations and leveraging available resources, businesses and individuals can thrive in this ever-changing environment.

How often do sales tax rates change in WA?

+Sales tax rates in WA can change periodically, typically to adjust for inflation or economic factors. The frequency of changes varies, but it’s advisable to check for updates at least annually.

Are there any upcoming changes to sales tax in WA?

+As of [date], there are no announced changes to the sales tax rate in WA. However, it’s essential to stay informed as the state’s government may propose amendments at any time.

How can businesses stay updated with sales tax regulations in WA?

+Businesses can subscribe to updates from the WA Department of Revenue and follow reputable tax resources. Additionally, consulting with tax professionals can provide valuable insights and guidance.