Delaware Real Estate Taxes

Delaware, known for its business-friendly environment and vibrant coastal communities, offers a unique landscape for property ownership and investment. A critical aspect of this state's real estate market is the taxation system, which plays a significant role in the overall cost of homeownership. Understanding Delaware's real estate taxes is essential for prospective buyers, investors, and existing homeowners alike. This article aims to provide a comprehensive guide to Delaware's real estate tax system, offering an in-depth analysis of the rates, assessments, and exemptions, along with practical tips and insights for managing these expenses.

Understanding Delaware’s Real Estate Tax Structure

Delaware’s real estate tax system is a significant consideration for homeowners and investors, impacting the overall cost of owning property in the state. This section provides an in-depth exploration of the key components of Delaware’s real estate tax structure, including tax rates, assessment processes, and the factors influencing these taxes.

Tax Rates and Assessment Process

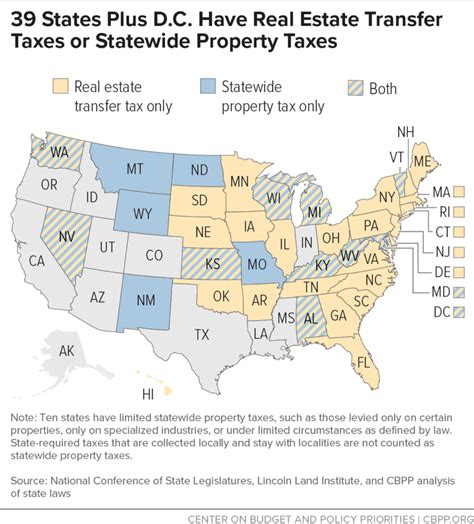

Delaware’s real estate tax rates are determined by each of the state’s three counties: New Castle, Kent, and Sussex. These counties set their own tax rates, resulting in varying property tax burdens across the state. The rates are typically expressed in terms of millage rates, which represent the amount of tax owed per 1,000 of assessed property value. For instance, a millage rate of 250 mills would equate to 250 in taxes for every $1,000 of assessed value.

The assessment process in Delaware involves evaluating the property's fair market value. This value is then multiplied by the county's assessment ratio, which is set by the State Tax Department. The resulting figure represents the property's assessed value for tax purposes. It's important to note that assessment ratios can vary between residential and commercial properties, with residential properties often assessed at a lower ratio.

| County | Assessment Ratio (Residential) | Assessment Ratio (Commercial) |

|---|---|---|

| New Castle | 23.5% | 32.5% |

| Kent | 25% | 35% |

| Sussex | 25% | 35% |

For example, let's consider a residential property in New Castle County with a fair market value of $300,000. The assessed value for tax purposes would be calculated as follows: $300,000 x 0.235 = $69,900.

Influencing Factors and Exemptions

Several factors can influence the real estate tax rates in Delaware. These include the county’s budget requirements, the cost of providing local services, and the state’s overall economic conditions. Additionally, certain properties may be eligible for exemptions or reduced tax rates. For instance, senior citizens and disabled homeowners can benefit from the Delaware Senior Citizens Real Estate Tax Relief program, which provides a partial or full exemption from real estate taxes based on income and property value.

Furthermore, Delaware offers a homestead exemption, which reduces the assessed value of a primary residence by up to $25,000. This exemption is particularly beneficial for homeowners, as it can significantly lower their tax burden. It's important to note that these exemptions may have specific eligibility criteria and income limits, so homeowners should consult with their local tax authorities or a tax professional to understand their eligibility.

Managing Real Estate Taxes in Delaware

Navigating Delaware’s real estate tax landscape requires a strategic approach to ensure that homeowners and investors are managing their tax obligations effectively. This section offers practical tips and insights for managing real estate taxes in Delaware, covering key aspects such as tax payment schedules, tax appeals, and strategies for minimizing tax burdens.

Tax Payment Schedules and Due Dates

In Delaware, real estate taxes are typically paid in two installments. The payment schedule and due dates can vary depending on the county and the specific municipality. It’s essential for homeowners to be aware of these schedules to ensure timely payments and avoid late fees or penalties. Here’s a general overview of the tax payment schedules in Delaware’s counties:

| County | Payment Schedule | Due Dates |

|---|---|---|

| New Castle | Bi-annual | July 31st and January 31st |

| Kent | Bi-annual | August 1st and February 1st |

| Sussex | Semi-annual | July 31st and January 31st |

Homeowners should also be aware that failure to pay taxes on time can result in interest charges and, in some cases, a tax lien on the property. It's crucial to stay informed about the payment schedules and set up reminders to ensure timely payments.

Tax Appeals and Assessment Challenges

If a homeowner believes that their property’s assessed value is incorrect or too high, they have the right to appeal the assessment. In Delaware, the process for challenging property assessments involves filing an appeal with the county’s Board of Assessment Appeals. This process typically requires providing evidence, such as recent sales data of similar properties, to support the claim that the assessed value is inaccurate.

It's advisable for homeowners to consult with a tax professional or an attorney who specializes in real estate tax appeals to ensure that their case is presented effectively. The appeal process can be complex, and having expert guidance can increase the chances of a successful outcome. Additionally, homeowners should be aware of the deadlines for filing appeals, as missing these deadlines can result in a missed opportunity to challenge the assessment.

Strategies for Minimizing Tax Burdens

While real estate taxes are a necessary part of homeownership, there are strategies that homeowners can employ to minimize their tax burdens. Here are some practical tips:

- Take Advantage of Exemptions and Deductions: As mentioned earlier, Delaware offers various exemptions and deductions that can reduce the taxable value of a property. Homeowners should review these options annually to ensure they are maximizing their eligibility.

- Consider Tax-Efficient Property Improvements: Certain home improvements can increase the property's value but may not significantly impact the assessed value for tax purposes. For instance, energy-efficient upgrades or renovations that enhance the overall functionality of the home might not be fully reflected in the assessment, providing a tax advantage.

- Explore Rental Income Options: If a homeowner has a spare room or an accessory dwelling unit on their property, renting it out can provide additional income. This income can be used to offset some of the real estate tax expenses.

- Stay Informed About Tax Incentives: Delaware, like many other states, offers various tax incentives for specific types of properties or developments. Homeowners should stay updated on these incentives, as they can provide substantial savings on real estate taxes.

Managing real estate taxes in Delaware requires a proactive approach. By staying informed about tax rates, understanding the assessment process, and utilizing available exemptions and strategies, homeowners can effectively manage their tax obligations and make the most of their investment in Delaware real estate.

The Impact of Real Estate Taxes on Delaware’s Housing Market

Delaware’s real estate tax system plays a pivotal role in shaping the state’s housing market dynamics. This section explores the impact of real estate taxes on various aspects of Delaware’s housing market, including home affordability, investment opportunities, and the overall economic landscape.

Home Affordability and Real Estate Taxes

Real estate taxes are a significant component of a homeowner’s overall housing costs. In Delaware, the varying tax rates across counties can have a notable impact on home affordability. For instance, a higher tax rate in one county might make it less attractive for first-time homebuyers, as it increases the overall cost of homeownership. On the other hand, counties with lower tax rates may be more appealing to buyers seeking affordable housing options.

Additionally, real estate taxes can influence a homeowner's decision to sell or stay in their current property. If a homeowner's financial situation changes, or if they feel that their tax burden is becoming excessive, they may consider selling their property and moving to a lower-tax county within the state. This dynamic can create a fluid housing market, with properties changing hands more frequently in certain areas due to tax considerations.

Investment Opportunities and Tax Strategies

For real estate investors, Delaware’s varying tax landscape presents both challenges and opportunities. Investors may seek out counties with lower tax rates to maximize their return on investment. However, they must also consider other factors, such as the availability of desirable properties, rental market conditions, and the overall economic health of the county.

Investors can employ various tax strategies to optimize their returns. For instance, they might structure their investments to take advantage of Delaware's favorable business tax environment, particularly for LLCs and corporations. Additionally, investors can explore the state's tax incentives for certain types of developments, such as historic preservation or affordable housing projects, which can provide tax credits or other benefits.

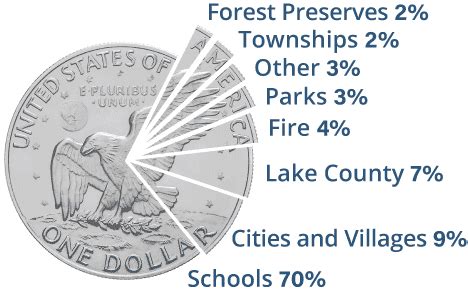

Economic Impact and Community Development

Real estate taxes are a significant source of revenue for Delaware’s counties and municipalities. This revenue is crucial for funding local services, infrastructure development, and community initiatives. As such, the real estate tax system plays a vital role in shaping the economic landscape of the state.

Counties with robust tax bases can invest more in community development projects, such as improving public transportation, enhancing recreational facilities, or revitalizing downtown areas. These improvements can make the county more attractive to residents and businesses, further boosting the local economy. Conversely, counties with lower tax bases may face challenges in funding essential services, which can impact the overall quality of life in the community.

Moreover, the real estate tax system can influence business development and job creation. Lower tax rates can make a county more appealing to businesses, encouraging them to establish operations and create jobs. This, in turn, can drive economic growth and enhance the overall prosperity of the region.

In conclusion, Delaware's real estate tax system is a complex yet crucial aspect of the state's housing market. It influences home affordability, investment strategies, and the overall economic landscape. By understanding the nuances of Delaware's tax system, homeowners, investors, and policymakers can make informed decisions that benefit the state's communities and residents.

How are Delaware’s real estate tax rates determined?

+Delaware’s real estate tax rates are set by each of the state’s three counties: New Castle, Kent, and Sussex. These counties have the authority to determine their own tax rates, resulting in varying property tax burdens across the state.

What is the assessment process for determining property value in Delaware?

+The assessment process involves evaluating a property’s fair market value. This value is then multiplied by the county’s assessment ratio, set by the State Tax Department, to determine the property’s assessed value for tax purposes. Assessment ratios can vary between residential and commercial properties.

Are there any exemptions or reduced tax rates for specific properties in Delaware?

+Yes, Delaware offers various exemptions and reduced tax rates for certain properties. These include the Delaware Senior Citizens Real Estate Tax Relief program for seniors and disabled homeowners, and the homestead exemption, which reduces the assessed value of a primary residence.

What is the tax payment schedule for real estate taxes in Delaware?

+Real estate taxes in Delaware are typically paid in two installments. The payment schedule and due dates can vary depending on the county and municipality. New Castle and Sussex counties have bi-annual payments due on July 31st and January 31st, while Kent County has payments due on August 1st and February 1st.

How can homeowners appeal their property assessments in Delaware?

+Homeowners can appeal their property assessments by filing with the county’s Board of Assessment Appeals. This process requires providing evidence, such as recent sales data of similar properties, to support the claim that the assessed value is inaccurate. It is advisable to consult with a tax professional or attorney for expert guidance.