Az State Taxes

Welcome to our comprehensive guide on Arizona state taxes. Understanding the tax landscape is crucial for individuals and businesses operating in Arizona, as it directly impacts financial planning and compliance. In this article, we delve into the intricacies of Arizona's tax system, providing you with valuable insights and practical information to navigate the state's tax obligations efficiently.

Unraveling the Arizona Tax Structure

Arizona’s tax system is designed to support the state’s economy and infrastructure. It encompasses a range of taxes, each serving a specific purpose. Let’s break down the key components and explore how they affect taxpayers.

Income Tax: Personalized Assessments

Arizona imposes an income tax on individuals and businesses, contributing to the state’s revenue stream. The income tax rates vary based on income brackets, with higher earners facing steeper taxes. For the fiscal year 2023, Arizona has implemented the following income tax brackets:

| Income Bracket | Tax Rate |

|---|---|

| 0 - $10,950 | 2.59% |

| $10,951 - $26,175 | 3.34% |

| $26,176 - $52,350 | 4.17% |

| $52,351 - $157,050 | 4.50% |

| $157,051 and above | 4.50% |

These rates are applicable for single filers, head of household, and married filing separately. For married couples filing jointly, the income brackets are doubled.

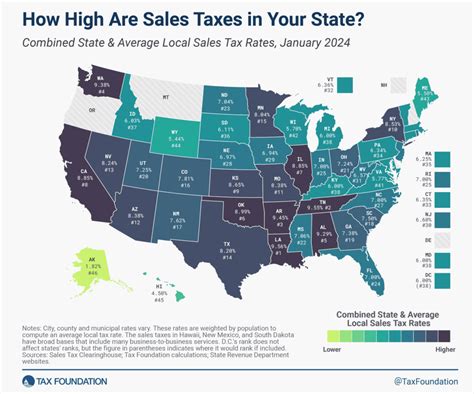

Sales Tax: Supporting Local Businesses

Arizona also imposes a sales tax on retail transactions, which helps fund state and local governments. The base state sales tax rate is set at 5.6%, but local jurisdictions may add additional taxes, resulting in varying rates across the state. For instance, in the city of Phoenix, the total sales tax rate stands at 8.35%, including the state and local components.

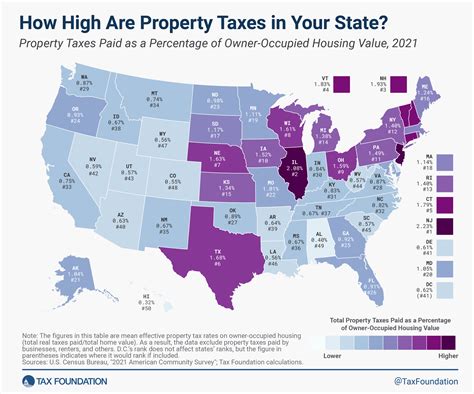

Property Tax: Assessing Real Estate Holdings

Property taxes are a significant source of revenue for local governments in Arizona. The tax is based on the assessed value of real estate properties, including land and improvements. The assessment ratio, which determines the taxable value, is set at 10% of the full cash value. This means that a property valued at 300,000 would have a taxable value of 30,000 for property tax purposes.

Corporate Tax: Supporting Business Operations

Arizona levies a corporate income tax on businesses operating within the state. The corporate tax rate stands at 4.9%, and it applies to net income earned from Arizona sources. Additionally, businesses with employees in Arizona are required to register for and pay unemployment insurance taxes, contributing to the state’s unemployment fund.

Other Taxes: A Comprehensive Overview

Arizona’s tax system extends beyond the aforementioned taxes. Here’s a glimpse at some other taxes that individuals and businesses may encounter:

- Transaction Privilege Tax (TPT): A privilege tax levied on the gross proceeds of sales or gross income derived from business activities.

- Use Tax: Applicable when goods are purchased outside Arizona but used, stored, or consumed within the state.

- Excise Taxes: Taxes on specific goods and services, such as tobacco, alcohol, and motor fuels.

- Inheritance and Estate Taxes: Taxes on the transfer of property upon an individual's death.

Compliance and Filing: A Step-by-Step Guide

Navigating the tax landscape requires careful planning and timely compliance. Here’s a simplified guide to help you stay on top of your Arizona state tax obligations:

Income Tax Filing

Individuals and businesses with income derived from Arizona sources must file income tax returns. The filing deadlines vary based on the type of taxpayer:

- Individuals: The deadline for filing individual income tax returns is typically April 15th of the following year. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day.

- Corporations: For C corporations, the deadline is the 15th day of the third month after the close of the tax year. For S corporations, the deadline is the 15th day of the third month after the close of the tax year or the due date of the shareholder's income tax return, whichever is later.

Sales and Use Tax Compliance

Businesses engaged in retail sales must register for a Transaction Privilege Tax (TPT) license and collect sales tax from customers. The frequency of sales tax returns depends on the business’s annual sales volume. Businesses with annual sales of $250,000 or more must file returns monthly, while those with lower sales volumes can file quarterly or annually.

Property Tax Assessments

Property owners receive their property tax assessments in late summer or early fall. These assessments are based on the previous year’s property values. Property owners have the right to appeal their assessments if they believe the value is inaccurate.

Corporate Tax and Unemployment Insurance

Corporations must file corporate income tax returns and pay the applicable tax rate. Additionally, businesses with employees must register for unemployment insurance and pay the required taxes to maintain coverage for their employees.

Strategies for Tax Efficiency

Understanding the tax landscape is the first step towards efficient tax planning. Here are some strategies to consider:

Maximizing Deductions and Credits

Arizona offers a range of tax deductions and credits to reduce the tax burden for individuals and businesses. These include deductions for mortgage interest, property taxes, and contributions to retirement accounts. Businesses can also benefit from various tax credits, such as the Research and Development Tax Credit and the Job Creation Tax Credit.

Efficient Record-Keeping

Maintaining accurate and organized financial records is crucial for tax compliance and planning. Proper record-keeping simplifies the tax filing process and provides a clear overview of financial transactions.

Consulting Tax Professionals

Tax laws can be complex, and seeking guidance from tax professionals can provide valuable insights. CPAs and tax attorneys can offer personalized advice, ensure compliance, and identify opportunities for tax savings.

The Impact of Arizona’s Tax System

Arizona’s tax system plays a vital role in supporting the state’s economy and public services. The revenue generated through taxes funds essential programs, including education, healthcare, infrastructure development, and public safety. It also contributes to the state’s economic growth and stability.

Economic Growth and Job Creation

Arizona’s tax structure aims to create a business-friendly environment, encouraging economic growth and job creation. The state’s competitive tax rates, particularly for corporations, attract businesses and foster a thriving business ecosystem.

Infrastructure Development

Tax revenues are invested in infrastructure projects, such as road improvements, public transportation, and utility upgrades. These investments enhance the quality of life for residents and create a more attractive business environment.

Education and Healthcare

A significant portion of tax revenues is allocated to education, ensuring access to quality education for Arizona’s youth. Additionally, tax funds support healthcare initiatives, improving healthcare infrastructure and accessibility.

Conclusion: A Comprehensive Approach to Tax Planning

Arizona’s tax system is a dynamic and evolving landscape that requires careful navigation. By understanding the various taxes, compliance requirements, and available strategies, individuals and businesses can effectively manage their tax obligations. Staying informed and proactive in tax planning ensures compliance, minimizes tax burdens, and contributes to the overall economic prosperity of Arizona.

What is the average income tax rate in Arizona for individuals?

+

The average income tax rate for individuals in Arizona varies based on income brackets. For the fiscal year 2023, the rates range from 2.59% to 4.50%, with higher earners facing steeper taxes.

Are there any tax incentives for businesses in Arizona?

+

Yes, Arizona offers various tax incentives to attract and support businesses. These include tax credits for research and development, job creation, and investment in certain industries. Consulting a tax professional can provide insights into available incentives.

How often do I need to file sales tax returns in Arizona?

+

The frequency of sales tax returns depends on your annual sales volume. Businesses with annual sales of $250,000 or more must file monthly, while those with lower sales volumes can file quarterly or annually.

Can I appeal my property tax assessment in Arizona?

+

Yes, if you believe your property tax assessment is inaccurate, you have the right to appeal. The process involves submitting an appeal to the county assessor’s office within a specified timeframe.

What is the corporate income tax rate in Arizona?

+

The corporate income tax rate in Arizona is set at 4.9%, applicable to net income earned from Arizona sources.