Trump National Sales Tax

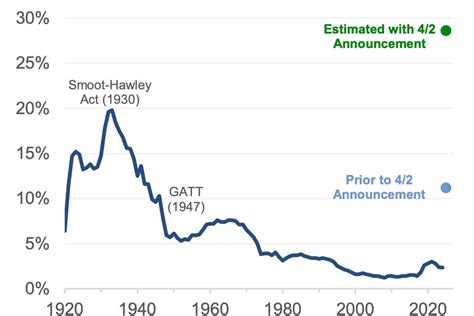

In recent years, the idea of implementing a national sales tax has gained traction among policymakers and economists, with the Trump administration also exploring this potential revenue-raising measure. The concept, often referred to as a Value-Added Tax (VAT) or a Goods and Services Tax (GST), is a consumption tax levied on the sale of goods and services. While the United States currently relies primarily on income taxes, proponents of a national sales tax argue that it could provide a more stable and efficient source of revenue, simplify the tax system, and promote economic growth. However, the proposal has also sparked intense debates, with critics raising concerns about its regressive nature and potential impact on low-income households.

Understanding the Trump National Sales Tax Proposal

The Trump administration’s interest in a national sales tax was part of a broader tax reform agenda aimed at overhauling the U.S. tax system. The proposal, as outlined in various policy discussions and think tank reports, suggested replacing the existing federal income tax with a national sales tax. The key idea was to eliminate the complexities associated with income tax filings and instead tax consumption at the point of sale.

Proponents of this approach argued that a national sales tax would encourage savings and investment, as individuals would only be taxed on the money they spend rather than on their earnings. They further claimed that it would reduce tax evasion, as sales taxes are harder to avoid compared to income taxes. Additionally, a national sales tax could provide a more stable revenue stream for the government, as consumption tends to be more consistent than income levels, especially during economic downturns.

Potential Benefits and Challenges

A national sales tax, if implemented, could bring several advantages. Firstly, it would significantly simplify the tax code, reducing the need for extensive tax preparation and compliance. Secondly, it could enhance economic growth by encouraging investment and reducing the tax burden on businesses. Lastly, a sales tax could generate substantial revenue, potentially replacing a significant portion of the income tax revenue.

However, the proposal also faced several challenges. Critics argue that a national sales tax would disproportionately affect low-income households, as they tend to spend a larger portion of their income on consumables. This regressive nature could lead to increased economic inequality. Additionally, the implementation of a sales tax would require careful consideration of essential items to ensure that basic necessities remain affordable for all.

| Advantages | Challenges |

|---|---|

| Simplifies tax code | Regressive nature |

| Encourages investment | Impact on low-income households |

| Stable revenue source | Need for essential item exemptions |

International Perspectives and Lessons

Many countries around the world have successfully implemented VAT or GST systems, providing valuable insights for the U.S. context. For instance, the European Union has a VAT system in place, with rates varying across member states. Countries like Germany and Sweden have demonstrated the effectiveness of a well-designed VAT in funding public services and promoting economic growth.

However, the U.S. context differs significantly from these European examples. The U.S. has a federal system with a diverse range of state and local taxes, which would need to be carefully integrated with a national sales tax. Additionally, the U.S. has a larger informal economy, making tax evasion a more significant concern.

Learning from International Experiences

Studying international VAT systems can offer valuable lessons for the U.S. Firstly, countries with successful VAT systems often have robust tax administration and compliance mechanisms in place. Secondly, many countries exempt essential items like food and healthcare from VAT to protect vulnerable populations. Lastly, some countries, like Canada, have a harmonized sales tax (HST) that combines the federal and provincial sales taxes, providing a potential model for the U.S. to consider.

While international experiences provide guidance, the U.S. context requires a tailored approach. The unique characteristics of the U.S. economy, tax system, and social safety net mean that any national sales tax proposal would need to be carefully designed to address specific American challenges and priorities.

Designing a Fair and Effective National Sales Tax

To address the concerns surrounding a national sales tax, careful design and consideration are essential. Here are some key considerations for creating a fair and effective tax system:

- Progressive Rates: Implementing progressive tax rates, similar to income tax, could help mitigate the regressive nature of a sales tax. Higher rates on luxury items and lower rates on essential goods could make the tax more equitable.

- Exemptions and Rebates: Exempting essential items like groceries, healthcare, and education from the tax could protect low-income households. Additionally, providing rebates or credits to vulnerable populations could ensure that they are not disproportionately burdened.

- Administrative Efficiency: A well-designed tax system should be easy to administer and enforce. Streamlined tax collection processes and robust compliance mechanisms are crucial for the success of a national sales tax.

- Revenue Neutrality: The tax should be designed to be revenue neutral, ensuring that it does not lead to an overall increase in the tax burden. This could involve carefully calibrating tax rates and considering the impact on different income groups.

Balancing Act: Equity and Efficiency

Designing a national sales tax that is both equitable and efficient is a complex task. While progressive rates and exemptions can make the tax more fair, they also add complexity to the system. Balancing these considerations requires a nuanced understanding of the trade-offs involved and a commitment to ensuring that the tax system serves the best interests of all Americans.

The Road Ahead: Political and Economic Considerations

The implementation of a national sales tax would require significant political will and consensus. It would involve navigating complex political dynamics and addressing concerns from various stakeholder groups. Additionally, the economic impact of such a tax reform needs careful evaluation to ensure that it promotes economic growth and does not exacerbate existing inequalities.

Navigating Political and Stakeholder Concerns

The political landscape in the U.S. is diverse, with varying interests and priorities. Gaining support for a national sales tax would require extensive outreach and education. Addressing concerns from low-income communities, businesses, and advocacy groups would be crucial for a successful implementation.

Furthermore, the tax reform would need to navigate existing tax policies at the state and local levels. Coordinating with state governments to ensure a consistent and fair tax system across the country would be a significant challenge. The success of the reform would depend on building a broad coalition of support and addressing the unique needs of different regions and communities.

Economic Impact Assessment

A comprehensive economic impact assessment is essential before implementing a national sales tax. This assessment should evaluate the potential effects on consumer spending, investment, and economic growth. It should also consider the distributional impact, ensuring that the tax reform does not disproportionately burden certain income groups or regions.

Furthermore, the assessment should analyze the potential impact on different industries and sectors. Certain industries, such as retail and tourism, might be more affected by a sales tax, while others, like manufacturing, could benefit from reduced tax burdens. A nuanced understanding of these impacts is crucial for designing a tax system that promotes economic competitiveness and growth.

Conclusion: A Complex Yet Promising Path Forward

The idea of a national sales tax, as proposed by the Trump administration, presents a complex yet promising path forward for U.S. tax reform. While it offers potential benefits such as simplified tax code and increased revenue, it also faces significant challenges, particularly regarding its regressive nature. However, by learning from international experiences and carefully designing the tax system, it is possible to create a fair and effective national sales tax.

The road ahead is challenging, requiring careful consideration of economic, political, and social factors. By engaging in open dialogue, conducting thorough impact assessments, and prioritizing the needs of all Americans, the U.S. can potentially transform its tax system into a more efficient and equitable one.

Frequently Asked Questions

How does a national sales tax compare to the existing income tax system in terms of revenue generation?

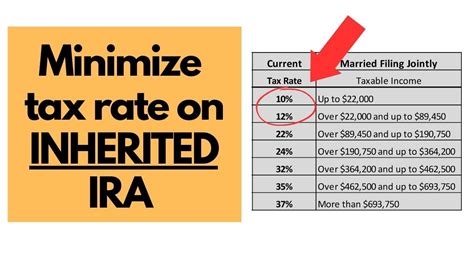

+A national sales tax has the potential to generate significant revenue, potentially rivaling or even surpassing the income tax system. However, the exact revenue generation would depend on the tax rate and the consumption patterns of the population. In many countries with a VAT system, the revenue generated is substantial and often forms a significant portion of the government’s total tax revenue.

What are the key differences between a national sales tax and a value-added tax (VAT)?

+While both a national sales tax and a VAT are types of consumption taxes, they differ in their administration and impact. A national sales tax is typically levied at the point of sale, making it simpler to administer but potentially regressive. On the other hand, a VAT is levied on the value added at each stage of production and distribution, making it more complex to administer but potentially more progressive, as it can be designed with exemptions and rebates for essential items.

How can a national sales tax be designed to minimize its impact on low-income households?

+To minimize the impact on low-income households, a national sales tax can be designed with progressive rates, similar to income tax. This means that higher rates would be applied to luxury items, while lower rates or even exemptions could be applied to essential goods like groceries and healthcare. Additionally, rebates or credits could be provided to vulnerable populations to offset any increased tax burden.

What are the potential benefits of a national sales tax for businesses and the economy as a whole?

+A national sales tax could provide several benefits for businesses and the economy. Firstly, it could simplify the tax system, reducing compliance costs for businesses. Secondly, by encouraging investment and savings, it could promote economic growth. Lastly, a sales tax could provide a more stable revenue source for the government, reducing the need for frequent tax adjustments and providing certainty for businesses.

How can the implementation of a national sales tax be coordinated with existing state and local taxes?

+Coordinating a national sales tax with existing state and local taxes would require careful planning and collaboration. One potential approach is to allow states to collect the national sales tax on behalf of the federal government, similar to how some states collect federal income tax. This would streamline administration and ensure a consistent tax system across the country. Additionally, states could be given the flexibility to impose their own sales taxes on top of the national tax, ensuring a balanced approach that respects state autonomy.