California State Solar Tax Credit

The California Solar Initiative, also known as the CSI Program, is a vital component of the state's renewable energy strategy, offering substantial incentives to residents and businesses alike. This initiative, aimed at promoting the adoption of solar power, has been a driving force behind California's clean energy transition. In this comprehensive guide, we delve into the intricacies of the California State Solar Tax Credit, exploring its benefits, eligibility criteria, and the significant impact it has had on the state's energy landscape.

Understanding the California Solar Initiative (CSI)

The CSI Program was launched in 2007 as a collaborative effort between the California Public Utilities Commission (CPUC) and the California Energy Commission (CEC). It is a pivotal element of the state’s Million Solar Roofs Initiative, a bold plan to install 3,000 megawatts (MW) of solar capacity by 2016. The CSI is divided into three distinct phases, each with its own set of incentives and goals.

CSI Phase 1

Phase 1, which began in 2007 and ended in 2013, focused on residential and commercial solar installations. During this period, the program offered rebates to homeowners and businesses, reducing the upfront costs of solar panel systems. These rebates were a significant incentive, encouraging widespread adoption of solar energy.

For instance, a typical residential system of 3 kilowatts (kW) in size could have received a rebate of up to $3,000, making solar power more accessible to California residents. The program's success during this phase led to a substantial increase in solar capacity across the state.

CSI Phase 2

Phase 2, spanning from 2014 to 2017, shifted the focus to larger-scale solar projects. The CPUC and CEC aimed to encourage the development of solar installations over 20 kW, targeting commercial and industrial sectors. This phase introduced performance-based incentives, rewarding system owners based on the actual energy production of their solar systems.

Under this model, system owners received cash payments for each kilowatt-hour (kWh) of electricity generated by their solar panels. This innovative approach not only incentivized the installation of larger systems but also promoted the efficient use of solar energy.

CSI Phase 3

The current phase, CSI Phase 3, began in 2018 and is scheduled to run until 2022 or until specific program goals are met. This phase continues to support both residential and commercial solar installations, with a particular emphasis on low-income communities. The program aims to make solar energy more accessible to underserved areas, promoting environmental justice and energy equity.

During Phase 3, the rebate structure has evolved to provide larger incentives for smaller systems, encouraging more homeowners to make the switch to solar. Additionally, the program has introduced financing options and solar loan programs to further reduce the financial barriers to solar adoption.

California State Solar Tax Credit: An Overview

The California State Solar Tax Credit, officially known as the California Solar Tax Credit (CSTC), is a vital component of the CSI Program. It provides a significant financial incentive to residents and businesses who install solar energy systems, helping to offset the initial costs and accelerate the payback period.

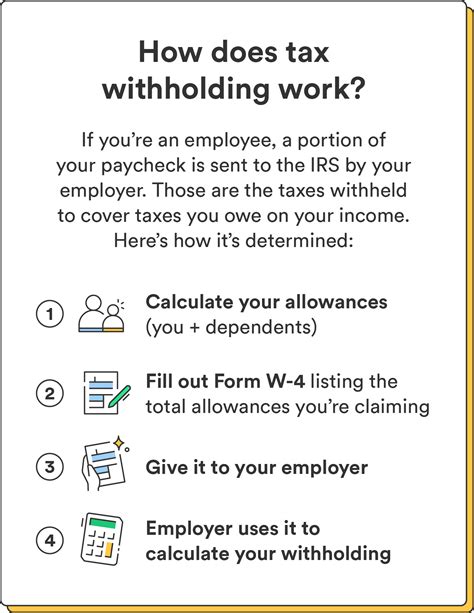

How the CSTC Works

The CSTC is a nonrefundable tax credit available to California taxpayers who have installed solar energy systems. The credit is calculated based on the cost of the solar system, with a maximum credit of 5,000</strong> for residential systems and <strong>250,000 for commercial systems. This credit can be claimed on the state income tax return and can be carried over for up to five years if the full credit cannot be used in a single tax year.

For instance, a homeowner who installs a $15,000 solar system can claim a $5,000 tax credit, reducing their state income tax liability. This credit, combined with federal incentives and utility rebates, can significantly reduce the overall cost of going solar.

Eligibility and Requirements

To be eligible for the California State Solar Tax Credit, taxpayers must meet the following criteria:

- The solar energy system must be installed in California and used to generate electricity for the taxpayer's home or business.

- The system must be certified by the California Energy Commission (CEC) and meet all applicable codes and standards.

- The taxpayer must be the owner of the solar system and responsible for its installation and maintenance.

- The system must be new and not previously used or installed.

- The taxpayer must have a valid Social Security Number or Taxpayer Identification Number.

Impact and Benefits of the CSTC

The California State Solar Tax Credit has had a profound impact on the state’s energy landscape, driving the growth of solar power and offering numerous benefits to residents and the environment.

Increased Solar Adoption

The CSTC has been instrumental in encouraging widespread adoption of solar energy across California. By offering substantial tax credits, the program has made solar power a more financially attractive option for homeowners and businesses. As a result, the state has seen a significant increase in solar installations, contributing to a cleaner and more sustainable energy mix.

| Year | Solar Capacity (MW) |

|---|---|

| 2015 | 7,795 |

| 2016 | 8,575 |

| 2017 | 9,425 |

| 2018 | 10,280 |

| 2019 | 11,130 |

The table above showcases the steady growth of solar capacity in California from 2015 to 2019, thanks in part to the CSTC and other solar incentives.

Environmental Benefits

The transition to solar power, facilitated by the CSTC, has led to significant environmental gains. Solar energy is a clean and renewable source, producing zero emissions during operation. As more Californians adopt solar, the state reduces its reliance on fossil fuels, leading to lower greenhouse gas emissions and improved air quality.

Additionally, the CSTC has contributed to the development of green jobs in the solar industry, fostering economic growth and sustainability.

Energy Independence and Cost Savings

Homeowners and businesses that install solar systems not only benefit from the CSTC but also from the long-term cost savings of solar energy. Solar power provides a stable and predictable energy source, reducing reliance on traditional utilities and their fluctuating energy prices. Over time, solar system owners can significantly reduce their electricity bills, leading to substantial savings.

Furthermore, the CSTC, combined with other incentives, can make the initial investment in solar more manageable, allowing more Californians to achieve energy independence.

Future of Solar in California

The California State Solar Tax Credit and the CSI Program have played a crucial role in shaping the state’s energy future. As California continues to lead the nation in clean energy adoption, the future of solar looks promising.

Ongoing Incentives and Support

The state’s commitment to renewable energy is evident in its ongoing support for solar incentives. While the CSTC is a key component, there are additional programs in place to encourage solar adoption, such as net metering, which allows solar system owners to sell excess energy back to the grid.

Furthermore, the CSI Program is expected to continue beyond 2022, with potential new phases and incentives to further drive solar growth.

Expanding Access to Solar

One of the key goals of the CSI Program, particularly in Phase 3, is to expand access to solar energy, especially in low-income and underserved communities. By making solar more affordable and accessible, the program aims to promote energy equity and ensure that all Californians can benefit from clean energy.

Integration with Other Renewable Sources

While solar power is a critical component of California’s renewable energy mix, the state is also investing in wind, hydropower, and other renewable technologies. The future of energy in California lies in a diverse and integrated renewable portfolio, with solar playing a central role.

Conclusion

The California State Solar Tax Credit is a vital tool in the state’s journey towards a cleaner and more sustainable energy future. By offering substantial incentives, the CSTC has encouraged widespread adoption of solar power, benefiting residents, businesses, and the environment alike. As California continues to lead the way in renewable energy, the CSTC and programs like the CSI will play a pivotal role in shaping a greener and more resilient energy landscape.

How do I claim the California State Solar Tax Credit on my tax return?

+

To claim the CSTC, you must complete and submit Form 350-SE with your California income tax return. This form requires information about your solar system, including its cost and installation date. You can find detailed instructions and the form on the California Franchise Tax Board’s website.

Are there any income restrictions for claiming the CSTC?

+

No, there are no income restrictions for claiming the CSTC. Any California taxpayer who has installed a qualifying solar energy system can claim the credit, regardless of their income level.

Can I combine the CSTC with other solar incentives?

+

Yes, the CSTC can be combined with other solar incentives, such as the federal Investment Tax Credit (ITC) and utility rebates. These incentives can further reduce the cost of going solar and accelerate the payback period.

How long does it take to receive the CSTC after installing a solar system?

+

The timeline for receiving the CSTC can vary. Typically, you will claim the credit on your annual income tax return for the year in which the solar system was installed. However, the exact timing may depend on when your installation is completed and when you file your taxes.

Are there any limitations on the number of times I can claim the CSTC?

+

The CSTC is a one-time credit, meaning you can claim it only once for each solar system you install. However, if your solar system is large enough, you may be able to claim the maximum credit and still have remaining costs eligible for other incentives like the federal ITC.