What Is Withholding Tax Everfi

Welcome to a comprehensive guide on the concept of withholding tax, as explained by Everfi, a leading provider of financial education and online learning solutions. Withholding tax is an essential aspect of personal finance and taxation, and understanding its implications is crucial for individuals and businesses alike. In this article, we delve into the specifics of withholding tax, exploring its definition, purpose, and practical applications.

Understanding Withholding Tax: A Key Component of Financial Management

Withholding tax, often simply referred to as “withholding,” is a method employed by governments to collect taxes at the source of income. This process involves deducting taxes from an individual’s earnings, wages, or payments before they receive the full amount. Everfi, with its expertise in financial literacy, emphasizes the significance of withholding tax as a fundamental tool for governments to ensure timely tax collection and promote compliance.

The concept of withholding tax is not limited to a specific country or region. It is a widely adopted practice globally, with variations in rates and applicability based on the tax laws of each jurisdiction. Everfi's educational resources often highlight the importance of understanding withholding tax for individuals operating in a globalized economy, where cross-border transactions and remote work are becoming increasingly common.

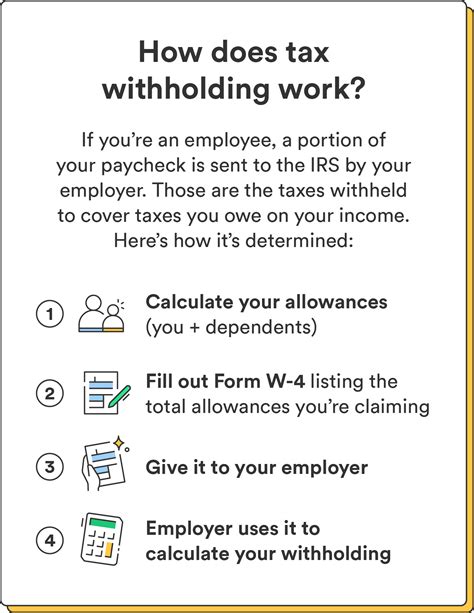

The Mechanics of Withholding Tax: How It Works

Withholding tax operates on a straightforward principle: taxes are deducted from income at the point of payment. This can occur in various scenarios, such as:

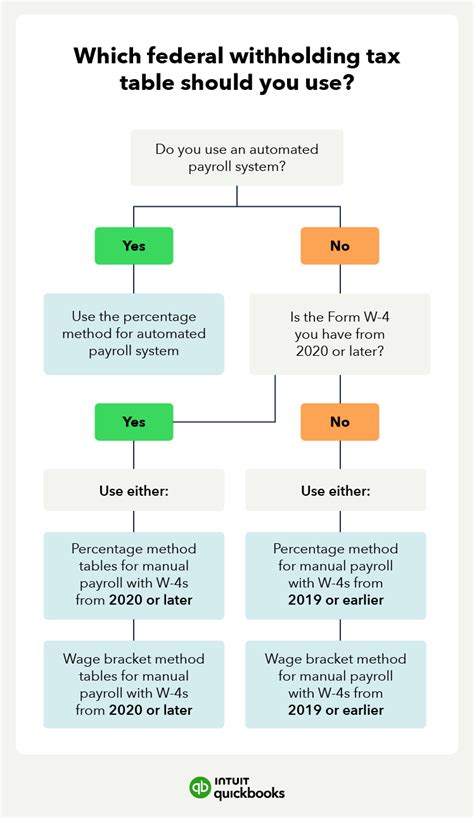

- Employee Wages: Employers are responsible for withholding taxes from their employees' salaries. The amount withheld depends on factors like income level, marital status, and the number of allowances claimed on tax forms.

- Freelance Income: When hiring freelancers or independent contractors, businesses often withhold a certain percentage of the payment as tax. This ensures that the freelancer's income is taxed appropriately.

- Investment Income: Withholding tax also applies to income derived from investments, such as dividends, interest, or capital gains. Financial institutions are required to withhold a portion of these earnings before distributing them to investors.

- Gambling and Lottery Winnings: In some jurisdictions, a portion of lottery or gambling winnings is withheld as tax. This practice ensures that individuals do not avoid their tax obligations on these often substantial sums.

Everfi's educational content often includes real-world examples to illustrate the practical application of withholding tax. For instance, it might cite a scenario where an employee's tax withholding is adjusted based on their W-4 form choices, demonstrating how personal financial decisions impact tax obligations.

| Income Source | Withholding Tax Application |

|---|---|

| Employee Wages | Taxes withheld based on pay period and employee tax status. |

| Freelance Income | Businesses withhold a percentage of the payment as tax. |

| Investment Income | Financial institutions withhold tax on dividends, interest, and capital gains. |

| Gambling Winnings | A portion of lottery or gambling winnings is withheld as tax in certain jurisdictions. |

The Role of Everfi in Financial Education

Everfi’s mission is to empower individuals with the financial knowledge and skills necessary to navigate complex economic landscapes. Their educational programs cover a wide range of topics, including personal finance, investment strategies, and, crucially, tax management. By incorporating real-world scenarios and interactive learning, Everfi aims to make financial education engaging and accessible.

When it comes to withholding tax, Everfi's resources offer a comprehensive understanding of the topic. They provide detailed explanations of the mechanics, rates, and implications of withholding tax, helping individuals make informed decisions about their financial future. Everfi's platform often includes interactive tools and simulations, allowing users to practice calculating withholding tax and exploring its impact on their financial situations.

Benefits of Understanding Withholding Tax

Gaining a solid understanding of withholding tax offers numerous advantages, as highlighted by Everfi’s educational materials:

- Financial Planning: Individuals can make more accurate financial plans by accounting for the impact of withholding tax on their income.

- Tax Compliance: Understanding withholding tax ensures individuals meet their tax obligations and avoid penalties for non-compliance.

- Investment Strategies: Withholding tax considerations can influence investment decisions, especially regarding dividends and capital gains.

- Business Operations: Businesses can ensure they comply with tax regulations by understanding their withholding tax responsibilities when hiring contractors or making payments.

Future Implications and Trends

The landscape of withholding tax is constantly evolving, influenced by changing tax laws and economic conditions. Everfi stays abreast of these developments, ensuring their educational content remains current and relevant. Some key trends and future implications include:

- Digitalization of Tax Systems: With the rise of digital technologies, tax systems are becoming more automated and efficient. Everfi predicts that this trend will continue, with more governments adopting digital platforms for tax collection and reporting.

- Global Tax Harmonization: As cross-border transactions increase, there is a growing push for global tax harmonization. Everfi suggests that individuals and businesses may face a more standardized approach to withholding tax in the future, simplifying international financial operations.

- Data-Driven Tax Policies: Advanced analytics and data science are being used to optimize tax systems. Everfi highlights that this trend may lead to more precise withholding tax calculations, ensuring a fairer distribution of tax obligations.

Everfi's commitment to financial education extends beyond the classroom, with a focus on preparing individuals for the financial challenges of the future. By staying informed about withholding tax and its evolving nature, individuals can make more confident financial decisions and contribute to a more stable economic environment.

FAQs

How does withholding tax impact my take-home pay?

+

Withholding tax directly affects your take-home pay by reducing the amount you receive. The tax withheld is based on your income level and tax status, and it’s an advance payment towards your annual tax obligations. The remaining amount is your net pay or take-home pay.

Are there any strategies to reduce the impact of withholding tax on my income?

+

Yes, there are strategies to optimize your tax situation. Everfi recommends staying informed about tax laws, adjusting your tax withholding allowances on your W-4 form (in the US), and exploring tax-efficient investment strategies. However, it’s important to consult a tax professional for personalized advice.

How does withholding tax affect my tax refund or liability?

+

Withholding tax can impact your tax refund or liability. If too much tax is withheld throughout the year, you may receive a refund when you file your tax return. Conversely, if not enough tax is withheld, you may owe money to the government at tax time.