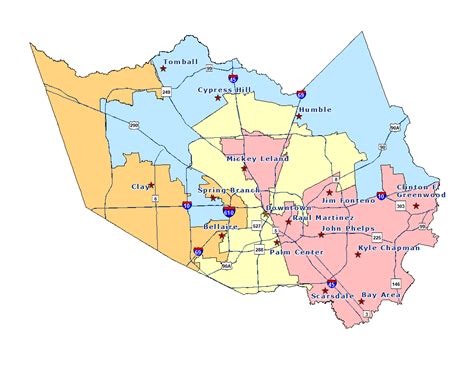

Harris County Tax Office Locations

The Harris County Tax Office is an essential service provider for residents and businesses in Harris County, Texas. It plays a crucial role in managing property taxes, vehicle registration, and various other tax-related services. With a diverse population and a vast geographical area, Harris County offers multiple tax office locations to ensure convenient access for taxpayers. This article aims to provide an in-depth guide to the Harris County Tax Office locations, their services, and how they cater to the unique needs of the community.

Harris County Tax Office Locations: A Comprehensive Overview

Harris County, the third-most populous county in the United States, is home to over 4.7 million residents. With such a large population, the Harris County Tax Office operates through multiple locations to provide efficient and accessible services. Let's delve into the details of each tax office location and understand the services they offer.

Harris County Tax Office - Main Office

The main office of the Harris County Tax Office is located at 1001 Preston St, Houston, TX 77002. This central location serves as the primary hub for tax-related inquiries and services. Here's a breakdown of the services offered at the main office:

- Property Tax Assessments and Payments: Taxpayers can visit the main office to discuss their property tax assessments, appeal values, and make payments. The office provides assistance with understanding property tax bills and offers various payment options.

- Vehicle Registration and Titling: Residents can register their vehicles, obtain titles, and renew registrations at the main office. The staff assists with title transfers, address changes, and provides information on vehicle-related taxes.

- Business Tax Services: The main office caters to businesses by offering business tax registration, renewals, and payment options. They provide guidance on business tax requirements and assist with filing taxes for various business entities.

- Specialty Tax Services: The main office also handles specialty taxes such as hotel occupancy tax, sales tax, and franchise tax. Taxpayers can receive guidance and assistance with these specific tax obligations.

- Taxpayer Assistance: The staff at the main office is dedicated to providing comprehensive assistance to taxpayers. They offer help with tax-related issues, answer inquiries, and provide resources for understanding complex tax matters.

The Harris County Tax Office - Main Office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding holidays. It is recommended to call ahead or visit their website for any specific service requirements and to check for any temporary closures or updates.

Harris County Tax Office - Branch Locations

In addition to the main office, the Harris County Tax Office operates several branch locations across the county to ensure convenient access for taxpayers. Here's an overview of the branch offices and their respective services:

| Branch Location | Address | Services Offered |

|---|---|---|

| Baytown Branch | 415 W. Defee Ave, Baytown, TX 77520 |

|

| Humble Branch | 700 Russell St, Humble, TX 77338 |

|

| Kingwood Branch | 22700 Loop 494, Kingwood, TX 77339 |

|

| Pasadena Branch | 2900 Burke Rd, Pasadena, TX 77504 |

|

| Pearland Branch | 3108 Business Center Dr, Pearland, TX 77584 |

|

| Spring Branch | 23903 I-45 N, Spring, TX 77388 |

|

Each branch office operates with specific hours, so it is advisable to check their website or call ahead for detailed opening times. Additionally, some branches may have limited services, and certain transactions might require a visit to the main office.

Services Offered by the Harris County Tax Office

The Harris County Tax Office provides a comprehensive range of services to meet the diverse needs of taxpayers. Here's an in-depth look at the key services they offer:

Property Tax Services

The tax office handles property tax assessments, payments, and appeals. Taxpayers can receive guidance on property tax values, exemptions, and discounts. They offer various payment options, including online payments, in-person payments, and payment plans for eligible taxpayers. The office also assists with property tax protests and provides resources to understand the property tax system in Harris County.

Vehicle Registration and Titling

Vehicle owners can visit the tax office for vehicle registration, titling, and related services. The office assists with initial registrations, renewals, title transfers, and address changes. They provide information on vehicle registration fees, emissions testing requirements, and the steps involved in registering a vehicle in Harris County.

Business Tax Services

The Harris County Tax Office caters to businesses by offering business tax registration, renewals, and filing assistance. They provide guidance on business tax requirements, such as sales tax, franchise tax, and hotel occupancy tax. The office assists with tax form filings, payment options, and offers resources to understand the complex business tax landscape.

Specialty Tax Services

In addition to property and business taxes, the tax office handles specialty taxes. This includes hotel occupancy tax, sales tax, and franchise tax. Taxpayers can receive assistance with understanding these taxes, filing requirements, and payment options. The office provides resources and guidance to ensure compliance with specialty tax obligations.

Taxpayer Assistance and Education

The Harris County Tax Office is committed to providing excellent taxpayer assistance. Their knowledgeable staff offers guidance on a wide range of tax-related matters. They provide resources, workshops, and educational materials to help taxpayers understand their rights, responsibilities, and the tax system. The office strives to make tax-related processes as transparent and accessible as possible.

Future Implications and Innovations

As technology advances, the Harris County Tax Office is continuously exploring ways to enhance taxpayer experiences. They are investing in digital transformation to improve online services, streamline processes, and provide more efficient and convenient options for taxpayers. The office aims to leverage technology to reduce wait times, offer remote assistance, and make tax-related transactions more accessible to all residents.

Additionally, the tax office is working towards expanding their outreach programs to ensure that taxpayers, especially those from underserved communities, have equal access to tax information and assistance. They aim to bridge any existing gaps and provide resources to empower taxpayers to make informed decisions regarding their tax obligations.

In conclusion, the Harris County Tax Office plays a vital role in managing property taxes, vehicle registration, and various other tax-related services for the residents of Harris County. With multiple locations and a dedicated team, they strive to provide accessible, efficient, and transparent services to all taxpayers. As the county continues to grow, the tax office remains committed to adapting and innovating to meet the evolving needs of the community.

What are the operating hours of the Harris County Tax Office locations?

+The operating hours for the Harris County Tax Office locations vary. The main office is open from 8:00 a.m. to 5:00 p.m., Monday through Friday, excluding holidays. Branch locations may have different hours, so it is advisable to check their respective websites or call ahead for specific opening times.

Can I make property tax payments at any Harris County Tax Office location?

+Yes, property tax payments can be made at most Harris County Tax Office locations. However, it is recommended to check with the specific office to ensure they offer this service. Some branch locations might have limited services, and certain transactions might require a visit to the main office.

How can I obtain a vehicle title transfer at the Harris County Tax Office?

+To obtain a vehicle title transfer, you can visit the Harris County Tax Office - Main Office or certain branch locations that offer this service. The process involves providing the necessary documentation, such as the title, registration, and identification. It is advisable to call ahead or check the office’s website for specific requirements and any necessary appointments.

What are the payment options available for property taxes at the Harris County Tax Office?

+The Harris County Tax Office offers various payment options for property taxes. These include online payments through their website, in-person payments at the tax office locations, and payment plans for eligible taxpayers. The office also accepts payments via mail and provides information on payment deadlines and penalties.

Can I renew my vehicle registration at any Harris County Tax Office branch location?

+Yes, you can renew your vehicle registration at most Harris County Tax Office branch locations. However, it is recommended to check with the specific branch to confirm if they offer this service. Some branches might have limited services, and certain transactions might require a visit to the main office.