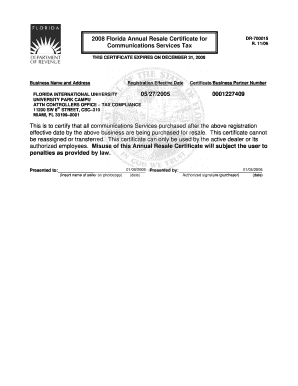

Resale Tax Certificate Florida

The process of obtaining a Resale Tax Certificate in Florida is an essential step for businesses engaging in taxable sales and leases. This certificate plays a crucial role in ensuring compliance with the state's tax regulations and is particularly important for businesses operating in the retail sector. In this comprehensive guide, we will delve into the specifics of acquiring a Resale Tax Certificate in Florida, covering the requirements, application process, and its significance in the context of state tax laws.

Understanding the Resale Tax Certificate in Florida

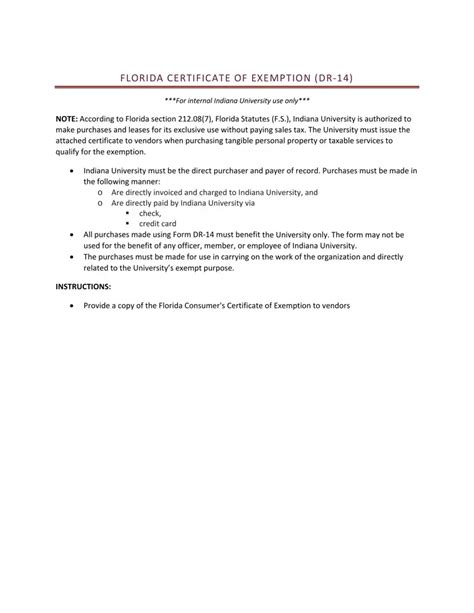

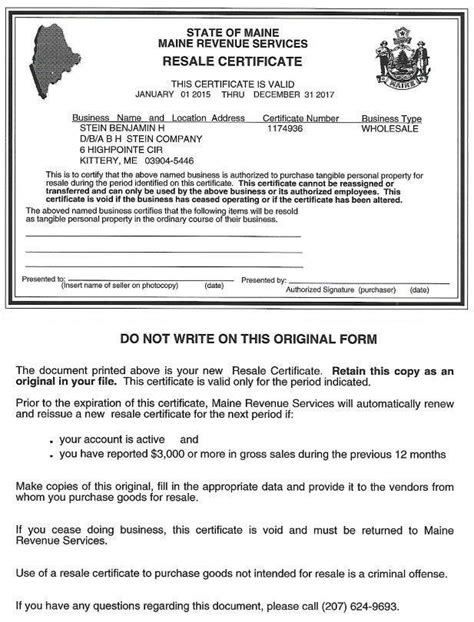

A Resale Tax Certificate, often referred to as a Resale Certificate, is a document issued by the Florida Department of Revenue (DOR) that authorizes a business to make purchases without paying sales tax on items that will be resold or leased. This certificate is a vital tool for businesses to manage their tax obligations effectively and maintain compliance with state tax laws.

In the state of Florida, sales tax is applicable to the retail sale, rental, lease, or consumption of tangible personal property, as well as certain services. The Resale Tax Certificate is designed to facilitate tax-free purchases for businesses that will subsequently pass on the tax to their customers through the sale or lease of the goods. This ensures a fair and equitable tax system while simplifying the tax collection process for businesses.

Eligibility and Requirements for Obtaining a Resale Tax Certificate

To be eligible for a Resale Tax Certificate in Florida, a business must meet specific criteria outlined by the Florida Department of Revenue. Here are the key requirements:

Business Registration

The first step towards obtaining a Resale Tax Certificate is to register your business with the Florida DOR. This registration process involves providing essential business details, such as the legal name, physical address, and contact information. It is a prerequisite for any business engaging in taxable activities within the state.

Active Business Status

Your business must be active and operating in the state of Florida. This means that it should have a valid business license, permit, or other authorization to conduct business activities within the state. Inactive or dormant businesses are typically not eligible for a Resale Tax Certificate.

Tax Identification Number (TIN)

A Tax Identification Number, often referred to as an Employer Identification Number (EIN), is a unique identifier assigned to your business by the Internal Revenue Service (IRS). This number is essential for tax purposes and is required for various business transactions, including obtaining a Resale Tax Certificate.

Compliance with Tax Laws

To be eligible for a Resale Tax Certificate, your business must be in compliance with all applicable tax laws in Florida. This includes being up-to-date with tax filings and payments for any previously registered tax types. Any outstanding tax liabilities or non-compliance issues must be resolved before applying for the certificate.

Resale Activities

The primary purpose of a Resale Tax Certificate is to facilitate tax-free purchases for goods that will be resold or leased. Therefore, your business must be engaged in activities that involve the resale or lease of tangible personal property. This excludes businesses primarily engaged in service-based activities, as they typically do not qualify for this certificate.

The Application Process: Step-by-Step Guide

Now that we’ve covered the eligibility requirements, let’s walk through the step-by-step process of obtaining a Resale Tax Certificate in Florida.

Step 1: Online Application

The most convenient and recommended way to apply for a Resale Tax Certificate in Florida is through the Florida Department of Revenue’s online portal. This portal offers a user-friendly interface and streamlines the application process.

To initiate the application, visit the Florida Department of Revenue Registration Portal and select the option for "Resale Tax Certificate Application." You will be guided through a series of forms and prompts to provide the necessary information.

Step 2: Provide Business Details

In this step, you will be required to provide detailed information about your business. This includes the legal name, physical address, contact information, and the primary business activity. Ensure that all the information is accurate and up-to-date.

Step 3: Tax Identification Number (TIN)

As mentioned earlier, a Tax Identification Number (TIN) is essential for the application process. You will need to enter your business’s TIN, which can be obtained from the IRS. If you do not have a TIN, you can apply for one through the IRS website before proceeding with the Resale Tax Certificate application.

Step 4: Business Activities and Use of Certificate

In this section, you will need to specify the primary business activities for which you require the Resale Tax Certificate. This is an important step, as it determines the scope and validity of the certificate. You will also need to declare the intended use of the certificate, whether for resale, lease, or both.

Step 5: Review and Submit

Before submitting your application, carefully review all the information you have provided. Ensure that it is accurate and complete. Once you are satisfied, click on the “Submit” button to send your application to the Florida DOR for processing.

Step 6: Processing and Approval

After submitting your application, the Florida DOR will review it for completeness and eligibility. The processing time can vary, but typically, it takes a few business days to receive a decision. If your application is approved, you will receive your Resale Tax Certificate electronically, which you can download and print for future use.

The Role and Importance of a Resale Tax Certificate

A Resale Tax Certificate serves multiple crucial purposes in the context of Florida’s tax system.

Tax Compliance and Collection

By requiring businesses to obtain a Resale Tax Certificate, the Florida DOR ensures that businesses engaged in taxable activities are identified and monitored. This helps the department track sales tax collections more effectively and prevents tax evasion. The certificate acts as a tool to maintain compliance and fairness in the tax system.

Simplified Tax Management for Businesses

For businesses, a Resale Tax Certificate simplifies the tax management process. With this certificate, businesses can purchase goods tax-free, which reduces their tax liability and administrative burden. This streamlined approach allows businesses to focus more on their core operations and customer service.

Fair Competition and Market Efficiency

The Resale Tax Certificate system ensures a level playing field for businesses operating in Florida. By requiring all businesses engaged in resale or lease activities to obtain this certificate, the state promotes fair competition. It prevents businesses from gaining an unfair advantage by evading tax obligations, thereby maintaining a healthy business environment.

Renewal and Updates: Maintaining Compliance

A Resale Tax Certificate is typically valid for a specific period, often a year. To maintain compliance with tax laws, businesses must renew their certificates before the expiration date. The renewal process is similar to the initial application, and it is crucial to stay updated with any changes in business activities or contact information to ensure uninterrupted tax compliance.

Conclusion: Navigating the Tax Landscape with Confidence

Obtaining a Resale Tax Certificate in Florida is a critical step for businesses to navigate the state’s tax landscape effectively. By understanding the eligibility requirements, following the application process, and recognizing the importance of this certificate, businesses can ensure compliance with tax laws and streamline their tax management processes. With a Resale Tax Certificate, businesses can focus on their core operations and contribute to the state’s economy with confidence.

What is the validity period of a Resale Tax Certificate in Florida?

+A Resale Tax Certificate in Florida is typically valid for a period of one year from the date of issuance. It is important to renew the certificate before its expiration to maintain tax compliance.

Can a sole proprietor obtain a Resale Tax Certificate?

+Yes, sole proprietors engaged in resale or lease activities can apply for and obtain a Resale Tax Certificate in Florida. The application process and requirements are the same as for other business entities.

Are there any penalties for not having a Resale Tax Certificate in Florida?

+Businesses operating without a valid Resale Tax Certificate may face penalties and fines for non-compliance. It is crucial to obtain and renew the certificate to avoid legal issues and maintain a good standing with the Florida Department of Revenue.