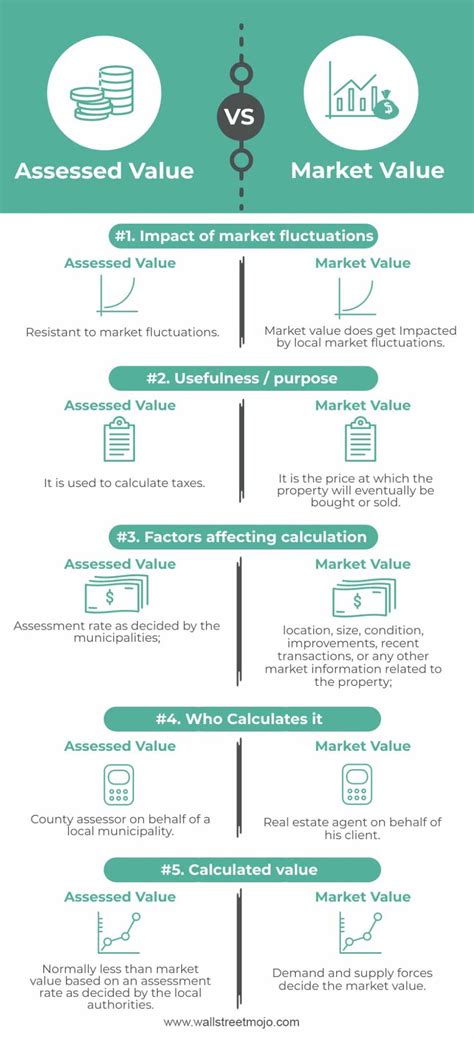

Tax Value Vs Market Value

Understanding the difference between tax value and market value is crucial for homeowners, investors, and anyone dealing with property-related matters. These two values, while interconnected, serve distinct purposes and can significantly impact financial decisions and planning. Let's delve into the intricacies of tax value and market value, exploring their definitions, calculations, and the reasons behind their disparities.

Tax Value: The Basis of Property Taxation

The tax value of a property is a figure determined by the local government or tax assessor’s office. It represents the value of the property for the sole purpose of calculating property taxes. Tax values are typically derived from a mass appraisal process, where assessors evaluate a large number of properties within a jurisdiction to assign uniform tax rates. This process ensures that property owners pay their fair share of taxes based on their property’s worth.

How Tax Value is Calculated

The calculation of tax value involves several factors, including:

- Assessment Ratio: Most jurisdictions use an assessment ratio, which is a percentage of the property’s full market value. For instance, if the assessment ratio is 80%, the tax value is calculated as 80% of the market value.

- Property Characteristics: Assessors consider various features of the property, such as size, age, location, improvements, and comparable sales data. These factors help determine the property’s overall value for tax purposes.

- Tax Assessment Schedule: Local governments often publish tax assessment schedules, which outline the process and criteria used to determine tax values. These schedules ensure transparency and consistency in the assessment process.

Tax Value Limitations

While tax value serves an essential role in property taxation, it may not always align with the property’s true market value. Here are a few limitations to consider:

- Periodic Updates: Tax values are typically updated periodically, often every few years. During this time, the property’s market value may change significantly, leading to a discrepancy between the tax value and the property’s actual worth.

- Local Market Fluctuations: Market values can fluctuate based on local economic conditions, supply and demand, and other factors. Tax values may not always reflect these market fluctuations promptly.

- Individual Property Differences: Each property is unique, and its value can be influenced by various factors. Tax assessors may not capture all these nuances, resulting in an inaccurate tax value.

Market Value: The Real-World Worth of a Property

The market value of a property is the price for which it could reasonably be expected to sell on the open market. It represents the actual worth of the property based on current market conditions and the property’s specific characteristics. Market value is influenced by supply and demand, economic factors, and the willingness of buyers and sellers to transact.

Determining Market Value

Market value is typically determined through a combination of:

- Appraisal: A professional appraiser conducts a thorough analysis of the property, considering its features, location, and recent sales of similar properties (comparable sales). This process results in an estimated market value.

- Sales Comparison Approach: This method involves comparing the property to similar recently sold properties in the area. Adjustments are made for differences in size, condition, and other factors to estimate the subject property’s value.

- Income Approach: For income-producing properties like rental properties or commercial buildings, the market value is often determined based on the property’s income potential. This approach considers factors such as rental income, operating expenses, and capitalization rates.

Factors Influencing Market Value

Several factors can impact a property’s market value, including:

- Location: The property’s neighborhood, proximity to amenities, and local economic conditions can significantly influence its value.

- Property Condition: Well-maintained properties with modern amenities and upgrades tend to have higher market values.

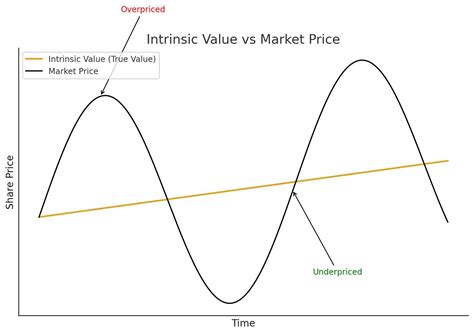

- Market Trends: Overall market trends, such as rising or falling property values in the area, can affect the market value of individual properties.

- Supply and Demand: A property’s value is influenced by the balance between the number of buyers and available properties in the market.

The Discrepancy Between Tax Value and Market Value

The disparity between tax value and market value is a common occurrence and can be attributed to several factors. Here’s a closer look at why these values often diverge:

Periodic Updates

As mentioned earlier, tax values are updated periodically, while market values can fluctuate more frequently. This time lag can lead to a significant difference between the two values, especially in dynamic real estate markets.

Market Conditions

Market conditions play a crucial role in determining property values. A property’s market value can rise or fall based on local economic factors, interest rates, and buyer sentiment. Tax values may not capture these rapid market changes, resulting in a discrepancy.

Assessment Techniques

The methods used to assess tax value and market value differ significantly. Tax assessors often rely on mass appraisal techniques, which may not consider all the unique features of individual properties. In contrast, market value assessments are more detailed and tailored to each property.

Tax Incentives and Exemptions

Some properties may be eligible for tax incentives or exemptions, such as homestead exemptions or agricultural assessments. These programs can further reduce the tax value of a property, widening the gap between tax and market values.

Implications and Considerations

The difference between tax value and market value can have several implications for property owners and investors:

Property Taxes

Property taxes are calculated based on the tax value of the property. If the tax value is significantly lower than the market value, property owners may pay lower taxes. However, this can also lead to disparities in tax burdens between properties with similar market values.

Buying and Selling Properties

For buyers, a property’s market value is the primary consideration when making an offer. Sellers, on the other hand, often base their asking price on recent sales of similar properties. The discrepancy between tax value and market value can create challenges in pricing and negotiating property sales.

Refinancing and Home Equity Loans

When refinancing a mortgage or applying for a home equity loan, lenders typically rely on the property’s market value. If the market value has increased significantly since the last appraisal, borrowers may be eligible for better loan terms.

Insurance Coverage

Insurance companies often use the replacement cost of a property to determine insurance coverage. The replacement cost is closely tied to the property’s market value, not its tax value. Understanding this distinction is crucial when reviewing insurance policies.

Conclusion

Tax value and market value are two distinct concepts that serve different purposes in the world of real estate. While tax value is crucial for property taxation, market value represents the property’s true worth in the open market. Understanding the nuances of these values and their relationship is essential for making informed decisions regarding property ownership, investments, and financial planning.

How often are tax values updated?

+Tax values are typically updated every few years, depending on the jurisdiction. Some areas may reassess properties annually, while others may do so less frequently.

Can property owners contest their tax value assessment?

+Yes, property owners have the right to appeal their tax value assessment if they believe it is inaccurate or unfair. The process varies by location but often involves submitting evidence and attending a hearing.

Do tax values impact property insurance rates?

+No, tax values are not directly used to determine property insurance rates. Insurance companies primarily consider the property’s replacement cost, which is based on market value and construction costs.