Sales Tax Tacoma

Sales tax is an integral part of any transaction for goods and services in Tacoma, Washington. It is a crucial aspect of the city's revenue generation and economic system. This article aims to provide an in-depth understanding of sales tax in Tacoma, covering its rates, exemptions, collection processes, and its impact on businesses and consumers alike.

Understanding Sales Tax in Tacoma

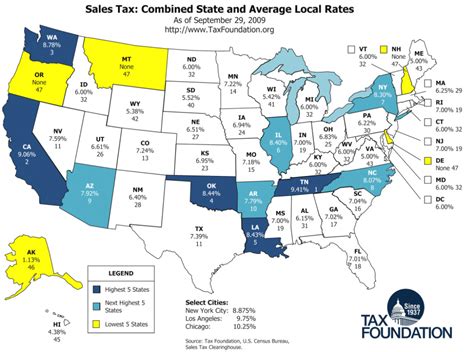

Tacoma, like many other cities in Washington, operates within the state’s sales tax framework. The state of Washington has a unique approach to sales tax, as it does not impose a general sales tax at the state level. Instead, it is the responsibility of local jurisdictions, such as cities and counties, to determine and implement their own sales tax rates.

Tacoma's sales tax is comprised of several components, including the city's own rate, a county rate, and various other optional tax rates that may be levied by special purpose districts within the city.

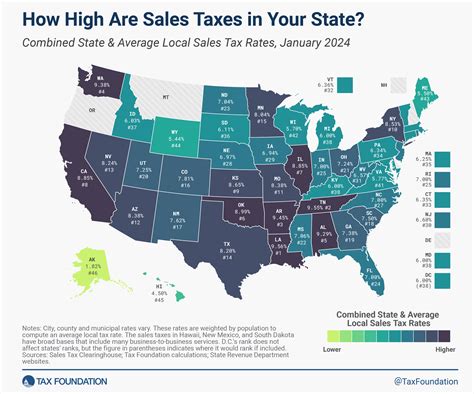

Sales Tax Rates in Tacoma

As of [current date], the sales tax rate in Tacoma is set at [specific rate]%. This rate is subject to change based on local legislation and economic conditions. It is essential for businesses and consumers to stay updated on any alterations to the sales tax rate to ensure compliance and accurate pricing.

| Tax Jurisdiction | Sales Tax Rate (%) |

|---|---|

| City of Tacoma | [City Rate] |

| Pierce County | [County Rate] |

| Special Districts (e.g., Transit, Stadium) | [District Rates] |

The combined sales tax rate in Tacoma is the total of all these individual rates, resulting in the overall tax burden on consumers.

Exemptions and Special Considerations

Not all goods and services are subject to sales tax in Tacoma. The state of Washington has a list of exempt items that are not taxed, which includes essential items like food for home consumption, prescription drugs, and certain medical devices. Additionally, some services, such as professional services like legal and medical advice, are generally exempt from sales tax.

Tacoma, like other cities, may also have specific exemptions or special considerations for certain industries or situations. For instance, there might be tax incentives for new businesses or exemptions for certain types of economic development projects. These exemptions and considerations can greatly impact a business's financial planning and should be thoroughly researched.

Sales Tax Collection and Remittance

The process of collecting and remitting sales tax is a crucial responsibility for businesses operating in Tacoma. Here’s a breakdown of the process:

Point of Sale

When a sale is made, businesses are required to calculate the applicable sales tax rate based on the customer’s location and the nature of the transaction. This involves applying the correct rates for the city, county, and any relevant special districts.

Record Keeping

Businesses must maintain detailed records of all sales transactions, including the date, amount, and applicable tax rates. These records are essential for accurate reporting and auditing purposes.

Remittance

Businesses are typically required to remit sales tax to the appropriate tax authorities on a regular basis, often monthly or quarterly. This process involves submitting a sales tax return, which details the total sales and the calculated tax liability. The tax is then paid to the relevant tax authority, which in Tacoma’s case, includes the city, county, and any special districts.

Compliance and Audits

Ensuring compliance with sales tax regulations is crucial for businesses to avoid penalties and legal issues. Tax authorities may conduct audits to verify the accuracy of sales tax records and returns. Businesses should maintain proper documentation and be prepared to demonstrate their compliance with sales tax laws.

Impact on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in Tacoma. Understanding these impacts is essential for effective financial planning and decision-making.

Impact on Businesses

For businesses, sales tax is a significant cost of doing business in Tacoma. It affects their pricing strategies, as they must consider the tax burden when setting prices. Additionally, the complexity of sales tax regulations can add administrative burdens, especially for small businesses that may not have dedicated accounting or tax teams.

Businesses also face the challenge of staying updated on any changes to sales tax rates and regulations. This requires regular monitoring of local legislation and a proactive approach to tax compliance. Non-compliance can lead to penalties and legal issues, which can be detrimental to a business's reputation and financial health.

Impact on Consumers

Consumers in Tacoma bear the direct brunt of sales tax in the form of higher prices for goods and services. The sales tax rate directly influences the cost of living and the affordability of products. Higher sales tax rates can make it more expensive to purchase essential items, especially for low-income households.

However, sales tax also contributes to the overall economic health of the city by funding essential services and infrastructure. It is a key revenue stream for local governments, which use the tax to invest in public projects, maintain public services, and support economic development initiatives.

Future Implications and Trends

Sales tax in Tacoma, like any tax system, is subject to ongoing changes and developments. Here are some key future implications and trends to consider:

Economic Development Initiatives

Local governments may use sales tax as a tool to incentivize economic development. This could involve offering tax breaks or exemptions to attract new businesses or encourage the expansion of existing ones. Such initiatives can lead to a more dynamic and diverse business landscape in Tacoma.

Technology and E-Commerce

The rise of e-commerce and online sales presents unique challenges for sales tax collection. Tacoma, like other cities, may need to adapt its tax regulations to accommodate online sales and ensure fair tax collection from remote sellers. This could involve implementing new tax collection mechanisms or partnering with e-commerce platforms.

Community Engagement and Awareness

Building awareness and understanding of sales tax among the community can be a powerful tool for local governments. Educating consumers and businesses about the purpose and impact of sales tax can foster a sense of community involvement and support for local initiatives funded by sales tax revenue.

Regional Cooperation

Tacoma, being part of the larger Pierce County and Puget Sound region, may explore opportunities for regional cooperation in sales tax matters. This could involve harmonizing tax rates or regulations across neighboring jurisdictions to simplify compliance for businesses operating in multiple areas.

Conclusion

Sales tax in Tacoma is a complex yet essential component of the city’s economic ecosystem. It affects businesses and consumers alike, influencing pricing, compliance, and community development. By understanding the rates, exemptions, and collection processes, businesses and consumers can navigate the sales tax landscape effectively.

As Tacoma continues to evolve and adapt to changing economic conditions, the role of sales tax will remain a critical aspect of its financial framework. Staying informed and engaged with sales tax regulations is key to ensuring a thriving business environment and a vibrant community.

What is the current sales tax rate in Tacoma?

+The current sales tax rate in Tacoma is [specific rate]% as of [current date]. This rate is comprised of city, county, and special district taxes.

Are there any sales tax exemptions in Tacoma?

+Yes, Tacoma, like the rest of Washington, has a list of exempt items that are not subject to sales tax. This includes essential items like food for home consumption and prescription drugs. Additionally, certain services, like legal and medical advice, are generally exempt.

How often do businesses need to remit sales tax in Tacoma?

+Businesses typically remit sales tax on a monthly or quarterly basis. The exact schedule may depend on the business’s tax liability and the requirements set by the tax authorities.

What happens if a business fails to remit sales tax on time in Tacoma?

+Failure to remit sales tax on time can result in penalties and interest charges. In severe cases, it may also lead to legal action and revocation of business licenses. It is crucial for businesses to stay compliant with sales tax regulations to avoid such consequences.