Do You Tip Before Or After Tax

In the realm of dining etiquette and financial transactions, the question of whether to tip before or after tax calculations is a pertinent one. This article aims to delve into the intricacies of tipping practices, offering a comprehensive guide for those navigating the delicate balance between service appreciation and financial prudence. Through an exploration of real-world scenarios and industry insights, we aim to provide a clear understanding of this often-confusing aspect of dining etiquette.

The Tipping Culture: A Global Perspective

Tipping, a practice deeply ingrained in many cultures, serves as a token of appreciation for service rendered. While its origins can be traced back centuries, modern tipping practices have evolved into a nuanced art, varying greatly across countries and even regions within those countries.

In the United States, for instance, tipping is an integral part of the dining experience. Waitstaff often rely heavily on tips as a significant portion of their income, with the customary tip ranging from 15% to 20% of the pre-tax total. This practice is so ingrained that it has become a societal norm, with many patrons automatically calculating the tip before even seeing the bill.

However, the tipping culture varies greatly internationally. In some European countries, tipping is less common, and it is often included in the bill as a service charge. In others, like Japan, tipping is rarely practiced and can even be considered rude. Understanding these cultural nuances is essential when traveling or hosting guests from different parts of the world.

The Role of Taxes in Tipping Calculations

The question of whether to tip before or after tax calculations arises due to the complex interplay between service charges, gratuities, and tax laws. This section aims to demystify this aspect, providing a clear guide for patrons and service industry professionals alike.

Understanding Service Charges and Gratuities

Service charges and gratuities are often used interchangeably, but they represent distinct aspects of the tipping culture. A service charge is a fixed amount or percentage added to the bill by the restaurant, typically for larger groups or special events. It is often included in the bill and is a mandatory payment, ensuring a fair distribution of tips among the staff.

On the other hand, a gratuity or tip is a voluntary payment, left at the discretion of the patron. It is a way to express appreciation for exceptional service and is usually calculated as a percentage of the pre-tax total. While gratuities are not mandatory, they are a crucial part of the service industry's economy, often making up a significant portion of a server's income.

| Term | Definition |

|---|---|

| Service Charge | A fixed amount or percentage added to the bill by the restaurant, often for larger groups or special events. |

| Gratuity | A voluntary payment left at the patron's discretion, usually calculated as a percentage of the pre-tax total. |

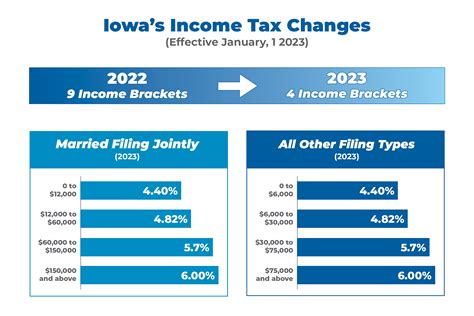

Tax Implications on Tipping

The tax implications of tipping can be complex, as they vary depending on the jurisdiction and the nature of the service provided. In some cases, tips are subject to income tax and must be reported by the recipient. This is particularly true for gratuities paid in cash, which can be more easily tracked by tax authorities.

However, when tips are added to the bill as a service charge, they may be treated differently for tax purposes. In such cases, the service charge is often considered part of the total bill and is subject to sales tax. This can lead to some confusion, as patrons may believe they have already paid a tip, when in fact, they are also paying tax on that amount.

When to Tip Before Tax and When to Tip After

The decision to tip before or after tax calculations is influenced by several factors, including personal preference, cultural norms, and the specific circumstances of the dining experience.

Tipping Before Tax

Tipping before tax is a common practice in many parts of the world, particularly in countries where tipping is an integral part of the dining culture. By calculating the tip as a percentage of the pre-tax total, patrons can ensure that the tip amount is not affected by any additional charges or taxes.

This method is particularly popular among those who prefer a simpler calculation process. By rounding up to the nearest dollar or applying a standard percentage (e.g., 15% or 20%), patrons can quickly arrive at a satisfactory tip amount without the need for complex calculations.

Tipping After Tax

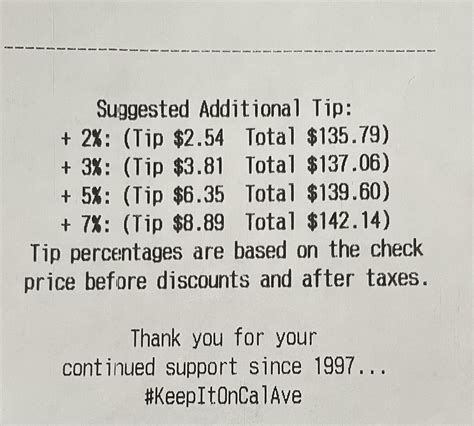

Tipping after tax is another widely accepted practice, especially in regions where service charges are common or where tax rates can vary significantly. By calculating the tip based on the post-tax total, patrons can ensure that the tip amount reflects the actual cost of the meal or service received.

This method is often preferred by those who want to ensure fairness in their tipping practices. By taking into account the total cost, including any applicable taxes or service charges, patrons can adjust their tip accordingly, ensuring that the server receives a fair share of the total expenditure.

The Impact of Technology on Tipping Practices

The rise of technology, particularly in the form of digital payment systems and tipping platforms, has had a significant impact on tipping practices. These innovations have not only simplified the tipping process but have also provided new avenues for patrons to express their appreciation for service.

Digital Payment Systems

Digital payment systems, such as those integrated into restaurant point-of-sale systems, have made tipping more convenient and accessible. Patrons can now add a tip directly to their payment, with the option to calculate it as a percentage of the total or as a fixed amount. This streamlines the payment process, eliminating the need for cash transactions or complex calculations.

Furthermore, digital payment systems often provide a clear breakdown of the total amount, including any service charges or taxes. This transparency can help patrons make more informed decisions about their tipping practices, ensuring that their tips are allocated fairly and accurately.

Tipping Platforms and Apps

The advent of tipping platforms and apps has revolutionized the way patrons express their gratitude for service. These platforms, often integrated with popular food delivery services, allow patrons to add a tip to their order, even for delivery or take-out meals. This ensures that delivery personnel and take-out staff, who often rely heavily on tips, are fairly compensated for their service.

Additionally, tipping platforms often provide a space for patrons to leave feedback and ratings, further enhancing the service experience. By combining tipping with feedback, these platforms encourage a culture of appreciation and continuous improvement within the service industry.

The Future of Tipping: A Look Ahead

As the service industry continues to evolve, so too will tipping practices. The increasing popularity of digital payment systems and tipping platforms suggests a shift towards more convenient and transparent tipping methods. Additionally, the growing awareness of the importance of fair wages and worker rights may lead to changes in tipping culture, potentially influencing how tips are calculated and distributed.

Furthermore, the impact of COVID-19 on the service industry cannot be understated. The pandemic has highlighted the importance of gratuities for service workers, many of whom have faced reduced hours or even job loss. As a result, there has been a renewed emphasis on the role of tipping in supporting the livelihoods of service industry professionals.

Looking ahead, it is likely that tipping will remain an integral part of the dining experience. However, the methods and practices surrounding tipping may continue to evolve, driven by technological advancements, changing societal attitudes, and the ever-present need to support those who dedicate their lives to serving others.

What is the customary tip percentage in the United States?

+The customary tip percentage in the United States typically ranges from 15% to 20% of the pre-tax total. However, this can vary based on the level of service and personal preference.

Are tips subject to income tax?

+In many jurisdictions, tips are considered part of a server’s income and are subject to income tax. However, the specific rules and regulations can vary depending on the country and its tax laws.

How do I calculate a tip when using a digital payment system?

+Digital payment systems often provide an option to add a tip directly to your payment. You can choose to calculate the tip as a percentage of the total or as a fixed amount. Some systems even offer a tip calculator to simplify the process.