Wisconsin Sales Tax Calculator

Calculating sales tax is an essential aspect of running a business, especially for those operating in states like Wisconsin, which has a unique tax system. Wisconsin's sales tax structure is known for its complexity, with varying rates across different counties and additional fees that can be imposed. This article aims to provide a comprehensive guide to help businesses and individuals understand how to calculate Wisconsin sales tax accurately.

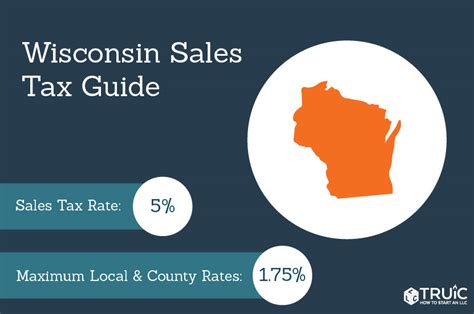

Understanding Wisconsin Sales Tax Rates

Wisconsin has a state-wide sales tax rate of 5%, which is applied uniformly across the state. However, it’s important to note that Wisconsin also allows local governments, such as cities and counties, to impose additional sales taxes. These local taxes can vary significantly, ranging from 0% to 0.5% or more in certain areas.

The combination of the state tax rate and any applicable local tax rates determines the total sales tax percentage that businesses need to charge their customers. For example, in Milwaukee County, the local tax rate is 0.5%, resulting in a total sales tax of 5.5% for all taxable goods and services.

County-Specific Sales Tax Rates in Wisconsin

Here’s a table showcasing the additional local sales tax rates for some of Wisconsin’s major counties:

| County | Local Sales Tax Rate | Total Sales Tax Rate |

|---|---|---|

| Milwaukee | 0.5% | 5.5% |

| Dane | 0.5% | 5.5% |

| Brown | 0.5% | 5.5% |

| Kenosha | 0.5% | 5.5% |

| Racine | 0.5% | 5.5% |

Calculating Wisconsin Sales Tax: Step-by-Step Guide

To calculate the sales tax for a transaction in Wisconsin, follow these steps:

- Determine the base price of the goods or services you are selling. This is the pre-tax price.

- Identify the applicable sales tax rate for the county in which the transaction is taking place. This includes the state-wide rate of 5% and any local additions.

- Multiply the base price by the applicable tax rate (in decimal form). For example, if the total sales tax rate is 5.5%, multiply the base price by 0.055.

- The result of the multiplication is the sales tax amount.

- Add the sales tax amount to the base price to arrive at the total transaction value, which includes tax.

Let's illustrate this with an example:

You're selling a product for $100 in Milwaukee County, where the total sales tax rate is 5.5%.

Sales Tax Amount = $100 x 0.055 = $5.50

Total Transaction Value = $100 + $5.50 = $105.50

Wisconsin Sales Tax Exemptions and Special Considerations

While most goods and services in Wisconsin are subject to sales tax, there are certain exemptions and special considerations to be aware of:

Sales Tax Exemptions

Certain items are exempt from sales tax in Wisconsin. These include:

- Prescription medications

- Groceries (including non-prepared food items)

- Clothing and footwear

- Certain agricultural products

- Manufacturing and industrial machinery

Businesses should ensure they are aware of the specific criteria for each exemption to avoid overcharging customers or facing legal repercussions.

Special Considerations for Specific Industries

Wisconsin’s sales tax system has special provisions for certain industries. For example, restaurants and food service businesses often need to calculate sales tax on both food and beverage sales. Additionally, businesses involved in the sale of construction materials may be subject to unique tax considerations.

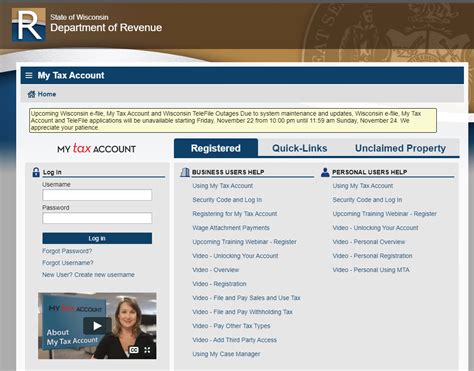

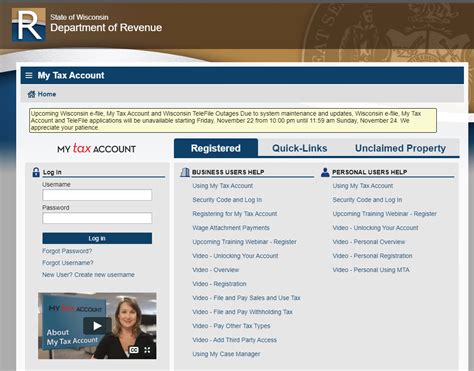

Wisconsin Sales Tax Filing and Compliance

Once sales tax has been accurately calculated and collected, businesses are responsible for filing and remitting the collected taxes to the Wisconsin Department of Revenue. Failure to comply with tax filing requirements can result in significant penalties and interest charges.

Sales Tax Registration

Businesses operating in Wisconsin are required to register for a Sales and Use Tax Permit with the Department of Revenue. This permit allows businesses to legally collect and remit sales tax.

Filing Frequency and Due Dates

The frequency of sales tax filing in Wisconsin depends on the business’s sales volume. Generally, businesses with higher sales volumes are required to file more frequently. The filing due dates are typically the 20th day of the month following the reporting period.

The Future of Wisconsin Sales Tax

Wisconsin’s sales tax system is subject to change and evolution, influenced by political, economic, and social factors. As the state’s economy and population continue to grow, the tax landscape may adapt to meet new demands and challenges.

Currently, there are ongoing discussions about potential reforms to Wisconsin's sales tax structure. Some proposed changes include simplifying the tax code, harmonizing tax rates across counties, and expanding the scope of sales tax to include additional services.

Staying informed about these potential changes is crucial for businesses to ensure they remain compliant and adaptable to any future tax modifications.

Conclusion: A Precise Approach to Wisconsin Sales Tax

Calculating Wisconsin sales tax accurately is a critical aspect of doing business in the state. With its unique combination of state and local tax rates, understanding and applying the correct tax rates is essential for compliance and customer satisfaction.

By following the step-by-step guide provided and staying aware of the latest tax regulations and exemptions, businesses can navigate Wisconsin's sales tax system with confidence. Accurate sales tax calculation not only ensures legal compliance but also fosters trust and transparency with customers.

What is the Wisconsin state-wide sales tax rate as of 2023?

+The state-wide sales tax rate in Wisconsin is 5% as of 2023.

Are there any counties in Wisconsin with a sales tax rate higher than the state-wide rate?

+Yes, some counties in Wisconsin have local sales tax rates that add to the state-wide rate. For example, Milwaukee County has a local sales tax rate of 0.5%, resulting in a total sales tax rate of 5.5%.

What are some common sales tax exemptions in Wisconsin?

+Common sales tax exemptions in Wisconsin include prescription medications, groceries, clothing, footwear, certain agricultural products, and manufacturing machinery.