Florida Sales Tax Miami Dade

Sales tax in Florida is an essential aspect of the state's revenue generation, playing a crucial role in funding various public services and infrastructure. In this comprehensive guide, we will delve into the intricacies of sales tax in Miami-Dade County, exploring its rates, exemptions, and implications for both residents and businesses.

Understanding Sales Tax in Miami-Dade County

Miami-Dade County, located in the southeastern part of Florida, is renowned for its vibrant culture, diverse economy, and bustling tourism industry. The sales tax structure in this county is a key component of its fiscal framework, impacting a wide range of goods and services.

The Basics of Sales Tax

Sales tax is a consumption tax levied on the sale of goods and services. It is typically calculated as a percentage of the purchase price and is collected by the seller, who then remits the tax to the appropriate taxing authority. In Florida, sales tax is administered by the Florida Department of Revenue (FDOR), which sets the state-wide sales tax rate and oversees its implementation.

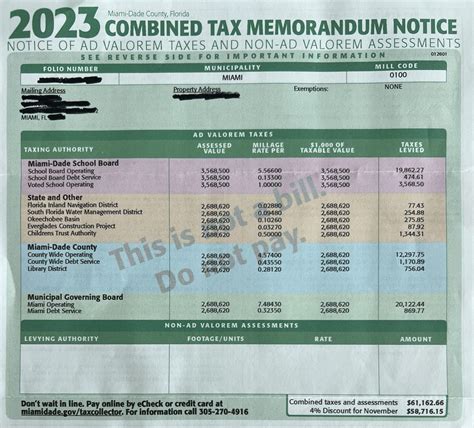

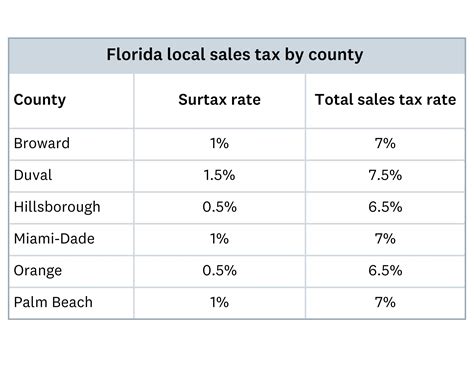

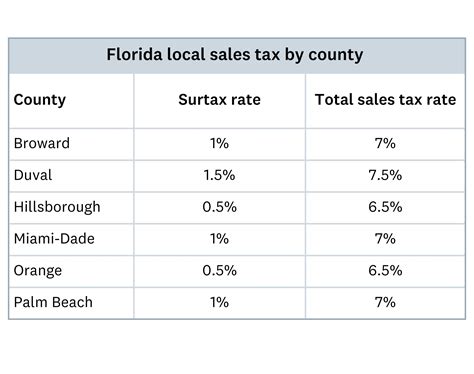

The state sales tax rate in Florida is currently set at 6%. However, it's important to note that local governments, such as counties and municipalities, have the authority to impose additional sales tax rates on top of the state rate. This results in varying total sales tax rates across different regions of the state.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of Florida | 6% |

| Miami-Dade County | 1.5% |

| Municipalities within Miami-Dade County | Varies (up to 1%) |

In Miami-Dade County, the county-wide sales tax rate is 1.5%, bringing the total sales tax rate to 7.5% when combined with the state rate. Additionally, some municipalities within the county may impose their own local sales tax, which can increase the total rate further. These local tax rates are determined by individual city or town governments and can vary significantly.

Sales Tax Exemptions and Special Considerations

While sales tax is applied to a wide range of goods and services, there are certain exemptions and special considerations in Miami-Dade County. These exemptions are designed to promote specific industries, support certain populations, or alleviate the tax burden on essential items.

- Groceries and Food Products: In Florida, including Miami-Dade County, most food items intended for human consumption are exempt from sales tax. This exemption covers groceries, produce, meat, dairy, and other essential food items. However, prepared foods, meals, and beverages served in restaurants or similar establishments are subject to sales tax.

- Prescription Drugs: Sales tax is not applicable to prescription drugs and certain medical devices. This exemption aims to make essential healthcare more accessible to residents.

- Manufacturing Machinery and Equipment: To support the manufacturing sector, sales tax is waived on the purchase of machinery and equipment used directly in the manufacturing process.

- Educational Materials: Textbooks, educational supplies, and certain technology used for educational purposes are exempt from sales tax, encouraging investment in education.

- Resale Items: When a business purchases goods with the intention of reselling them, the sales tax is typically not incurred at the time of purchase. Instead, the tax is collected from the end consumer during the resale.

The Impact of Sales Tax on Businesses and Consumers

Sales tax has a significant impact on both businesses and consumers in Miami-Dade County. Understanding these implications can help businesses navigate their tax obligations and consumers make informed purchasing decisions.

Implications for Businesses

For businesses operating in Miami-Dade County, sales tax compliance is a critical aspect of their financial management. Here are some key considerations:

- Registration and Remittance: Businesses are required to register with the FDOR and obtain a sales tax permit. They must then collect sales tax from customers and remit it to the FDOR on a regular basis. The frequency of remittance depends on the business's sales volume.

- Record-Keeping: Accurate record-keeping is essential for sales tax compliance. Businesses must maintain detailed records of sales transactions, including the tax collected, to ensure they can accurately report their sales tax liabilities.

- Pricing Strategies: Sales tax can impact a business's pricing strategies. Some businesses choose to absorb the tax into their prices, while others may display prices excluding tax and add the tax at the point of sale. The chosen strategy can influence customer perception and purchasing behavior.

- Sales Tax Audits: The FDOR conducts audits to ensure businesses are correctly collecting and remitting sales tax. Businesses should be prepared for these audits and have the necessary documentation ready to demonstrate their compliance.

Implications for Consumers

Consumers in Miami-Dade County also feel the impact of sales tax on their daily lives and purchasing decisions. Here are some key points to consider:

- Cost of Living: Sales tax contributes to the overall cost of living in the county. When making large purchases, such as appliances, electronics, or vehicles, the sales tax can significantly impact the final cost.

- Online Shopping: Online retailers are required to collect sales tax from customers in Miami-Dade County, even if the retailer is located outside the state. This ensures that online purchases are not tax-free and helps level the playing field for local businesses.

- Comparing Prices: When shopping, consumers should consider the impact of sales tax on the total cost. Comparing prices between different retailers, including the sales tax, can help make more informed purchasing decisions.

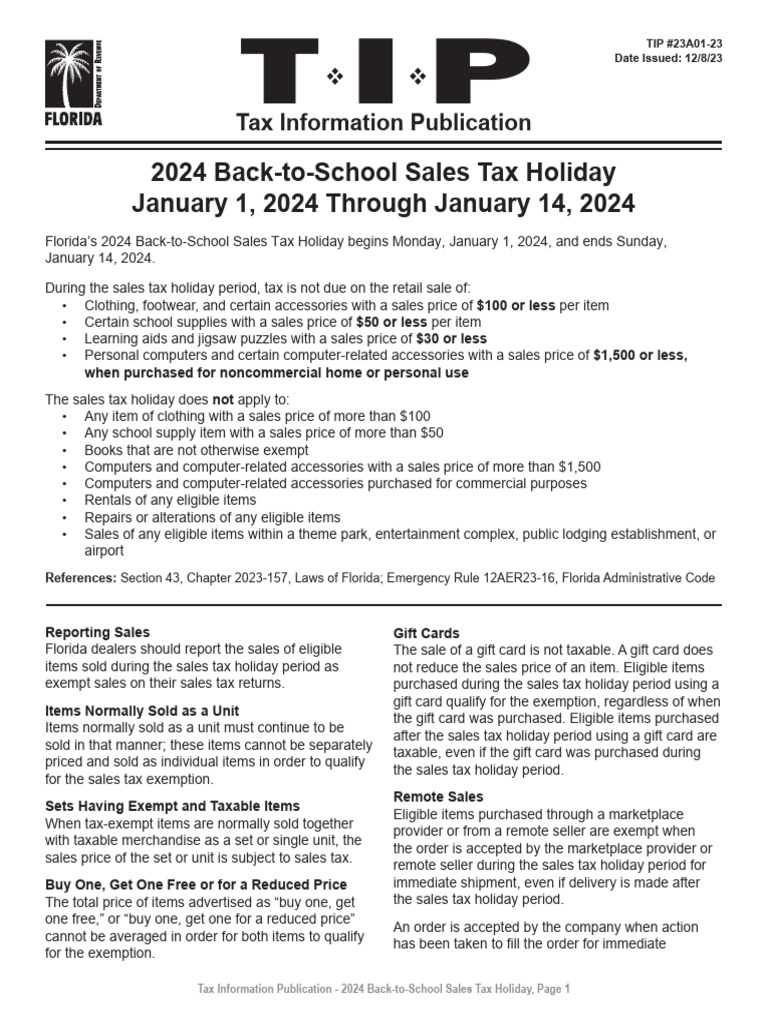

- Tax-Free Holidays: Florida occasionally offers tax-free holidays for specific items, such as school supplies or hurricane preparedness items. These periods provide an opportunity for consumers to save on essential purchases.

Compliance and Enforcement

Ensuring compliance with sales tax regulations is crucial for both businesses and consumers. The FDOR has established various measures to enforce sales tax laws and hold non-compliant entities accountable.

Sales Tax Audits

The FDOR conducts sales tax audits to verify that businesses are correctly collecting and remitting sales tax. These audits can be random or targeted, based on various factors such as sales volume, industry, or past compliance history. During an audit, the FDOR examines a business’s sales records, tax returns, and other financial documents to assess its compliance.

If a business is found to be non-compliant, it may face penalties and interest charges on any underpaid or unremitted sales tax. In some cases, the FDOR may also pursue criminal charges for willful evasion of sales tax obligations.

Consumer Awareness and Reporting

Consumers play a vital role in maintaining sales tax compliance. They can help by reporting suspected tax evasion or non-compliance to the FDOR. This can be done anonymously through the FDOR’s website or by contacting their local FDOR office.

By encouraging consumer awareness and reporting, the FDOR can identify and address instances of tax evasion, ensuring a fair and equitable tax system for all.

Future Outlook and Potential Changes

The sales tax landscape in Miami-Dade County, like any other jurisdiction, is subject to potential changes and reforms. Here are some factors that could influence the future of sales tax in the county:

Economic Growth and Development

As Miami-Dade County continues to grow and develop economically, the need for public services and infrastructure also increases. This may lead to discussions about adjusting sales tax rates to fund these expanding needs.

Legislative Changes

The Florida Legislature has the authority to amend sales tax laws, including rates and exemptions. Any proposed changes would need to go through the legislative process, which involves public hearings, debates, and ultimately, a vote by elected officials.

Changing Consumer Behavior

The rise of e-commerce and online shopping has challenged traditional sales tax collection methods. As consumer behavior continues to evolve, the FDOR may need to adapt its enforcement strategies to ensure compliance in the digital realm.

Tax Reform Initiatives

Tax reform initiatives, both at the state and local levels, can lead to significant changes in sales tax rates and structures. These initiatives may aim to simplify the tax system, address fairness concerns, or generate additional revenue for specific purposes.

Conclusion

Sales tax in Miami-Dade County is a complex yet crucial aspect of the local economy and public finance. It impacts businesses, consumers, and the overall cost of living in the region. By understanding the rates, exemptions, and implications of sales tax, residents and businesses can navigate this system more effectively and contribute to the county’s fiscal health.

Staying informed about sales tax regulations and compliance requirements is essential for all stakeholders. Whether you're a business owner, a consumer, or simply a resident of Miami-Dade County, being aware of your sales tax obligations and rights ensures a fair and equitable system for everyone.

What is the current sales tax rate in Miami-Dade County?

+The current sales tax rate in Miami-Dade County is 7.5%, which includes the state sales tax rate of 6% and the county sales tax rate of 1.5%. Additionally, some municipalities within the county may impose their own local sales tax, increasing the rate further.

Are there any sales tax exemptions in Miami-Dade County?

+Yes, there are several sales tax exemptions in Miami-Dade County. These include groceries and food products, prescription drugs, manufacturing machinery and equipment, educational materials, and resale items. These exemptions aim to promote certain industries and support essential needs.

How often do businesses need to remit sales tax to the FDOR?

+The frequency of sales tax remittance depends on a business’s sales volume. Generally, businesses with higher sales volumes are required to remit sales tax more frequently. The FDOR provides guidelines and schedules for businesses to follow based on their sales.

Can consumers claim a refund for sales tax paid on eligible items?

+In certain cases, consumers may be eligible for a refund of sales tax paid on eligible items. For example, if a consumer purchases an item that is later found to be exempt from sales tax, they may be able to claim a refund. However, the refund process can be complex, and consumers should consult with the FDOR or a tax professional for guidance.