Illinois Sales Tax On Cars

In the state of Illinois, sales tax is applied to various transactions, including the purchase of vehicles. The sales tax system in Illinois can be complex, with rates varying depending on several factors. Understanding the intricacies of Illinois sales tax on cars is essential for both buyers and sellers to ensure compliance and make informed financial decisions.

Understanding Illinois Sales Tax Rates

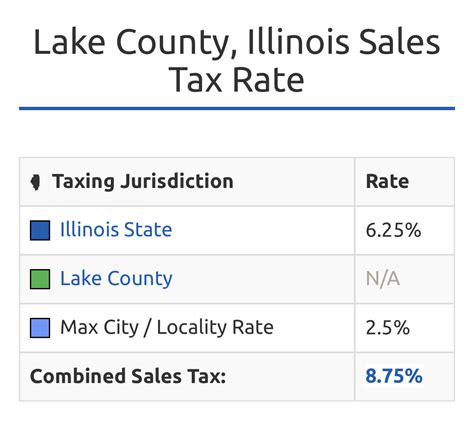

The sales tax rate in Illinois is comprised of two components: the state sales tax and the local sales tax. The state sales tax is a uniform rate applied across the state, while the local sales tax varies by county and sometimes even by municipality. This unique structure means that the total sales tax rate can differ significantly depending on the location of the purchase.

As of my last update in January 2023, the state sales tax rate in Illinois is 6.25%. However, it's crucial to note that this rate is subject to change, and buyers should verify the current rate at the time of their purchase. The local sales tax rates can range from 0% to approximately 4%, with the average rate being around 1.8%. These local rates are added on top of the state rate, resulting in a combined sales tax rate that can vary significantly across the state.

For instance, in Chicago, the total sales tax rate for cars is 10.25%, including the state sales tax and the local sales tax rate of 4%. In contrast, a county like Carroll may have a lower local sales tax rate, resulting in a combined rate closer to 8.05%.

How Sales Tax is Calculated for Car Purchases

When purchasing a car in Illinois, the sales tax is typically calculated based on the purchase price of the vehicle. This price includes the base price of the car, as well as any additional costs, such as dealer-installed options, accessories, and delivery fees. However, it’s important to note that certain costs, like sales commissions, are not included in the taxable amount.

For example, if you purchase a new car with a base price of $30,000 and add $1,500 worth of dealer-installed options, the total purchase price would be $31,500. Applying the sales tax rate of 10.25% in Chicago, the sales tax on this purchase would amount to $3,236.25. This calculation is a crucial step in understanding the total cost of purchasing a vehicle in Illinois.

Exemptions and Special Cases

While most vehicle purchases in Illinois are subject to sales tax, there are certain situations where exemptions or special considerations may apply. It’s essential to be aware of these scenarios to ensure you are accurately calculating and paying the correct sales tax.

Leased Vehicles

When leasing a vehicle in Illinois, the sales tax is typically calculated based on the capitalized cost of the lease. This amount is determined by the leasing company and includes the vehicle’s purchase price, any additional fees, and estimated depreciation. However, it’s important to note that the sales tax on a leased vehicle may be calculated differently depending on the lease term and other factors.

Trade-Ins and Used Cars

If you are trading in your old vehicle as part of the purchase, the sales tax calculation can become more complex. In this case, the sales tax is typically applied to the difference between the trade-in value and the purchase price of the new car. It’s crucial to have an accurate understanding of your trade-in value to ensure the sales tax is calculated correctly.

For used car purchases, the sales tax is generally calculated based on the purchase price, similar to new car purchases. However, it's important to note that if the used car was previously registered in Illinois, the sales tax may have already been paid. In such cases, the buyer may be eligible for a credit or exemption from paying sales tax on the used car purchase.

The Impact of Sales Tax on Car Buying

The sales tax on car purchases in Illinois can significantly impact the overall cost of the vehicle. For instance, in Chicago, with a sales tax rate of 10.25%, a 30,000</strong> car would result in a sales tax amount of <strong>3,075, bringing the total cost to $33,075. This additional cost should be carefully considered when budgeting for a vehicle purchase.

Additionally, the varying sales tax rates across different counties in Illinois can influence buying decisions. Buyers may strategically choose to purchase their vehicle in a county with a lower sales tax rate to save money. However, it's essential to balance this consideration with the convenience and other factors associated with purchasing from a specific dealer or location.

Sales Tax Registration and Compliance

For car dealerships and businesses selling vehicles in Illinois, it’s crucial to understand the sales tax registration process and compliance requirements. Failure to properly collect and remit sales tax can result in significant penalties and legal consequences.

Dealers must obtain a sales tax license from the Illinois Department of Revenue and ensure they are properly registered for sales tax collection. They must also accurately calculate and collect the appropriate sales tax rate for each transaction, considering the location of the sale and any applicable exemptions.

Regular sales tax filings and remittances are required, typically on a monthly or quarterly basis. These filings should accurately report the total sales tax collected during the specified period. Failure to file on time or inaccurate reporting can lead to penalties and interest charges.

Future Considerations and Trends

Looking ahead, there are several factors that may influence the sales tax landscape for car purchases in Illinois. One significant trend is the growing popularity of electric vehicles (EVs). Currently, there is a state incentive in Illinois that provides a $4,000 tax credit for the purchase of new EVs. This incentive, coupled with the potential for lower maintenance and operating costs, is making EVs an increasingly attractive option for consumers.

Additionally, with the ongoing advancements in autonomous vehicle technology, we may see a shift in the way vehicles are owned and utilized. This could lead to new business models and potentially impact the sales tax structure for vehicles in the future. As technology evolves and consumer preferences change, it's important for both buyers and sellers to stay informed about any updates or changes to the sales tax system in Illinois.

Frequently Asked Questions

What is the current state sales tax rate in Illinois for car purchases?

+

As of my knowledge cutoff in January 2023, the state sales tax rate in Illinois is 6.25%. However, it’s important to verify the current rate at the time of your purchase, as it may be subject to change.

Are there any counties in Illinois with a sales tax rate lower than the state rate?

+

Yes, some counties in Illinois have a local sales tax rate of 0%, resulting in a combined sales tax rate lower than the state rate. These counties include DeKalb, Kane, Kendall, and Will, among others.

How is sales tax calculated for leased vehicles in Illinois?

+

For leased vehicles, the sales tax is typically calculated based on the capitalized cost of the lease, which includes the vehicle’s purchase price, estimated depreciation, and any additional fees.

Are there any exemptions for sales tax on used car purchases in Illinois?

+

Yes, if a used car was previously registered in Illinois and the sales tax was paid at the time of the initial purchase, the buyer may be eligible for a credit or exemption from paying sales tax on the used car purchase.

What are the consequences for dealerships that fail to comply with sales tax regulations in Illinois?

+

Dealers who fail to properly collect and remit sales tax can face significant penalties and interest charges. In severe cases, they may also be subject to legal action and revocation of their sales tax license.