Nys Income Tax Return Status

Welcome to this comprehensive guide on the New York State (NYS) Income Tax Return Status. Filing taxes is an essential part of financial responsibility, and understanding the status of your tax return is crucial for managing your finances effectively. In this article, we will delve into the various aspects of the NYS Income Tax Return Status, providing you with expert insights and practical information.

Understanding the NYS Income Tax Return Process

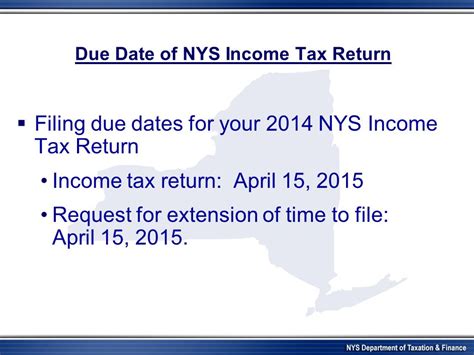

The NYS Income Tax Return process is a critical step for individuals and businesses operating within the state of New York. It involves calculating and reporting income, deductions, and credits to the New York State Department of Taxation and Finance. This process ensures that taxpayers comply with state tax laws and contribute to the state’s revenue.

The tax return status indicates the current stage of your tax filing journey. It provides valuable information about the progress of your return, potential issues, and the estimated time for processing and refund (if applicable). Staying informed about your tax return status is essential for making informed financial decisions and resolving any tax-related matters promptly.

Key Stages of the NYS Income Tax Return Status

The NYS Income Tax Return Status undergoes several stages, each with its own significance. Understanding these stages can help you navigate the process more effectively:

- Return Received: This stage indicates that the Department of Taxation and Finance has successfully received your tax return. It is the initial step in the process, and it confirms that your return has been acknowledged.

- Return Processing: Once your return is received, it enters the processing stage. During this phase, the department reviews your tax information, validates the data, and applies the appropriate tax laws and regulations. This stage may involve further scrutiny and potential adjustments.

- Refund Issued: If you are entitled to a refund, the Department of Taxation and Finance will issue it during this stage. The refund amount and processing time can vary based on factors such as the complexity of your return, the method of filing (electronic or paper), and the timing of your filing.

- Notice of Deficiency: In some cases, the department may identify issues or discrepancies in your tax return. If this occurs, you will receive a Notice of Deficiency, which outlines the specific concerns and provides an opportunity for you to respond and resolve the issues.

- Return Accepted: After addressing any deficiencies or issues, your tax return will be accepted. This stage signifies that your return has met all the necessary requirements and is considered complete.

- Payment Due: If your tax return indicates a balance due, this stage will notify you of the amount owed and the payment deadline. It is crucial to make the payment by the due date to avoid penalties and interest charges.

- Return Filed: This final stage indicates that your tax return has been officially filed and processed. It marks the completion of the tax filing process for the current tax year.

By familiarizing yourself with these stages, you can better understand the progress of your NYS Income Tax Return and take appropriate actions based on your specific status.

Checking Your NYS Income Tax Return Status

Staying informed about your tax return status is made convenient by the online tools and resources provided by the New York State Department of Taxation and Finance. Here’s how you can easily check your NYS Income Tax Return Status:

Online Status Check

The Department of Taxation and Finance offers an online service that allows taxpayers to access their tax return status conveniently. To check your status online, follow these steps:

- Visit the New York State Department of Taxation and Finance website.

- Navigate to the Online Services section and select the Check Your Refund Status option.

- Enter your Social Security Number, Date of Birth, and Return Year as prompted.

- Click Submit to retrieve your tax return status information.

This online service provides a quick and efficient way to stay updated on the progress of your tax return. It displays the current status, estimated refund amount (if applicable), and any relevant notifications or messages.

Telephone Inquiry

If you prefer a more personalized approach or encounter issues with the online status check, you can contact the Department of Taxation and Finance directly by telephone. The department’s customer service representatives are available to assist you with your tax return status inquiries.

To reach the Department of Taxation and Finance by phone, you can call the following number:

Toll-Free Number: 1-800-322-32NY (1-800-322-3269)

When calling, have your tax return information readily available to provide accurate and timely assistance.

Common NYS Income Tax Return Issues

While the NYS Income Tax Return process is generally straightforward, there may be instances where taxpayers encounter issues or face challenges. Being aware of common issues can help you prepare and resolve them efficiently.

Missing or Incomplete Information

One of the most common issues with tax returns is missing or incomplete information. This can occur when taxpayers forget to include essential documents, such as W-2 forms, 1099 forms, or supporting schedules. It is crucial to carefully review your tax return before submission to ensure all required information is present.

Errors in Calculations

Calculation errors are another common issue. Taxpayers may make mistakes when calculating their income, deductions, or credits. These errors can lead to discrepancies in the tax amount owed or the refund amount. Double-checking your calculations and using reliable tax preparation software or seeking professional assistance can help minimize the risk of errors.

Identity Verification

In some cases, the Department of Taxation and Finance may require additional identity verification measures. This is particularly common when there are discrepancies or potential fraud indicators in the tax return. Identity verification ensures the security and integrity of the tax system. If you receive a request for identity verification, promptly respond with the necessary documentation to avoid delays in processing your return.

Processing Delays

Processing delays can occur for various reasons, such as high volume during peak tax season, system updates, or issues with your tax return. While delays are generally rare, it is essential to stay patient and monitor your tax return status regularly. If you notice significant delays, you can contact the Department of Taxation and Finance for further assistance.

Tips for a Smooth NYS Income Tax Return Process

To ensure a seamless and stress-free NYS Income Tax Return process, consider implementing the following tips:

- Start Early: Begin gathering your tax documents and organizing your financial information well in advance of the filing deadline. Starting early reduces the risk of last-minute rushes and allows you to identify any potential issues.

- Use Reliable Tax Software: Utilize reputable tax preparation software or engage the services of a professional tax preparer. These tools can simplify the process, reduce errors, and provide accurate calculations.

- Keep Records: Maintain a well-organized record of your financial transactions, receipts, and tax-related documents. This practice ensures that you have the necessary information readily available during the tax filing process and for future reference.

- Review and Double-Check: Before submitting your tax return, thoroughly review it for accuracy and completeness. Double-checking your calculations and ensuring all required information is included can help avoid potential issues.

- Stay Informed: Stay updated on the latest tax laws, regulations, and changes that may impact your tax return. The Department of Taxation and Finance provides resources and updates on their website to keep taxpayers informed.

- Seek Professional Help: If you have complex tax situations or are unsure about specific aspects of your return, consider consulting a tax professional. They can provide expert guidance and ensure compliance with tax laws.

Conclusion

Understanding and monitoring your NYS Income Tax Return Status is an essential part of managing your finances and ensuring compliance with state tax laws. By familiarizing yourself with the various stages of the tax return process, checking your status regularly, and being aware of common issues, you can navigate the process with confidence. Remember to start early, utilize reliable resources, and seek professional assistance when needed. With a well-prepared tax return and a proactive approach, you can successfully navigate the NYS Income Tax Return process and stay on top of your financial obligations.

What happens if I don’t receive a refund within the estimated timeframe?

+If you don’t receive your refund within the estimated timeframe provided by the Department of Taxation and Finance, it’s advisable to contact them for further assistance. They can investigate the status of your refund and provide an update. It’s important to note that refund processing times can vary based on various factors, including the complexity of your return and the volume of tax returns being processed.

Can I check my tax return status if I filed jointly with my spouse?

+Yes, you can check the tax return status for a joint return using the online service provided by the Department of Taxation and Finance. Simply enter the Social Security Number, Date of Birth, and Return Year for either spouse, and you will be able to retrieve the status information for the joint return.

What should I do if I receive a Notice of Deficiency?

+If you receive a Notice of Deficiency, it’s crucial to carefully review the notice and address the issues raised. The notice will provide specific instructions and guidance on how to respond. You may need to provide additional documentation or information to resolve the deficiencies. Responding promptly and accurately is essential to avoid potential penalties or delays in processing your tax return.

Can I amend my NYS Income Tax Return if I discover an error?

+Yes, you can amend your NYS Income Tax Return if you discover an error. The process involves filing an amended return using Form IT-20X. It’s important to note that you should only amend your return if you identify a mistake or have additional information that affects your tax liability. Review the instructions for Form IT-20X and follow the guidelines to ensure a successful amendment.

How can I stay informed about changes in NYS tax laws and regulations?

+To stay informed about changes in NYS tax laws and regulations, it’s recommended to regularly visit the New York State Department of Taxation and Finance website. They provide up-to-date information, news releases, and publications that outline any modifications to tax laws, new tax initiatives, or important deadlines. Subscribing to their email notifications or following their social media accounts can also ensure you receive timely updates.