Taxes In Las Vegas Nevada

When it comes to taxes, Las Vegas, Nevada, offers a unique and attractive proposition for individuals and businesses alike. Nevada is renowned for its low tax burden, making it an appealing destination for those seeking tax-friendly jurisdictions. In this article, we delve into the world of taxes in Las Vegas, exploring the various aspects that make it a financially advantageous choice.

A Tax Haven in the Desert

Las Vegas, the entertainment capital of the world, is not only famous for its vibrant nightlife, casinos, and world-class shows but also for its tax structure. Nevada has a long-standing reputation for its business-friendly environment, and this extends to its tax policies. Let’s uncover the intricacies of taxes in Las Vegas and understand why it is often considered a tax haven.

State Taxes: Low and Local

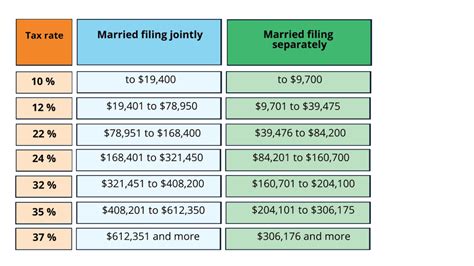

One of the most notable features of Nevada’s tax system is the absence of a state income tax. Yes, you read that right! Nevada is one of the few states in the U.S. that does not impose a personal income tax on its residents. This means that individuals living and working in Las Vegas can keep more of their earnings, making it an attractive destination for high-income earners and entrepreneurs.

However, it's important to note that while the state does not levy an income tax, local governments in Nevada, including Las Vegas, have the authority to impose a local income tax. The city of Las Vegas, for instance, has a gross receipts tax which is applied to businesses operating within its jurisdiction. This tax is based on the gross revenue generated by the business and varies depending on the industry.

Tax Rates and Structures

The gross receipts tax rate in Las Vegas ranges from 0.05% to 0.45%, depending on the business activity. For example, a professional service business may be subject to a lower rate compared to a retail business. This tax is calculated on the total revenue of the business, excluding certain exempt items such as sales tax and certain deductions.

In addition to the gross receipts tax, businesses in Las Vegas also need to consider other local taxes such as the business license tax, which is based on the number of employees and the location of the business. These local taxes contribute to the city's revenue and fund essential services.

| Tax Type | Tax Rate | Applicable To |

|---|---|---|

| Gross Receipts Tax | 0.05% - 0.45% | Businesses operating in Las Vegas |

| Business License Tax | Varies based on employee count and location | Businesses with employees |

Sales and Use Taxes

Another area where Las Vegas offers a competitive advantage is its sales and use tax rates. Nevada has a statewide sales tax rate of 6.85%, which is lower than many other states. However, it’s important to note that local governments, including Las Vegas, have the authority to impose additional sales taxes. In the case of Las Vegas, the city has a local sales tax rate of 2.65%, bringing the total sales tax rate to 9.50% for goods and services purchased within the city limits.

Sales tax in Nevada is collected by businesses and remitted to the state and local governments. It applies to a wide range of tangible personal property and certain services. The sales tax rate can vary depending on the specific jurisdiction, so it's essential for businesses to understand the applicable rates for their locations.

Use Tax and E-Commerce

Nevada also has a use tax, which is similar to a sales tax but applies to purchases made outside the state and brought into Nevada for use. This tax ensures that all purchases are taxed, regardless of where they are made. With the rise of e-commerce, this tax becomes increasingly relevant as it captures online purchases made by Nevada residents.

| Tax Type | State Rate | Local Rate (Las Vegas) | Total Rate |

|---|---|---|---|

| Sales Tax | 6.85% | 2.65% | 9.50% |

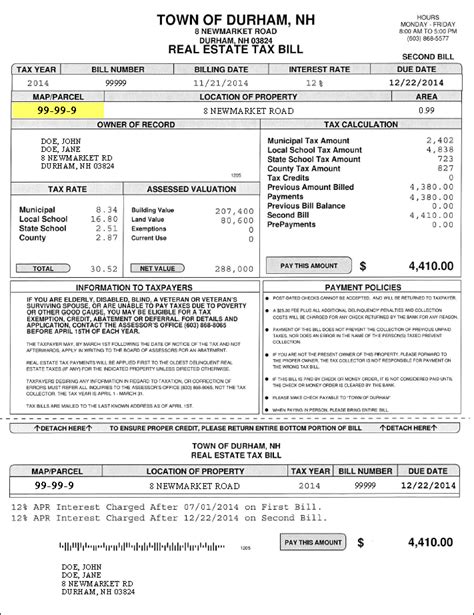

Property Taxes: A Balancing Act

Property taxes in Nevada are determined at the county level, and each county sets its own tax rates. Clark County, where Las Vegas is located, has a property tax rate of 0.96% for residential properties and 1.15% for commercial properties. This rate is applied to the assessed value of the property, which is typically around 35% of the fair market value.

While property taxes in Las Vegas are relatively low compared to some other areas, it's important for homeowners and business owners to stay informed about any changes in assessment values and tax rates. Property tax bills are typically issued annually, and understanding the assessment process and appeal options can be crucial for managing property tax liabilities.

Tax Incentives for Businesses

Nevada offers various tax incentives and programs to attract and support businesses. These incentives aim to promote economic development, job creation, and investment in the state. Some notable tax incentives include:

- Enterprise Zones: Designated areas within the state offer reduced tax rates and other incentives to businesses that locate or expand their operations within these zones.

- Research and Development Tax Credits: Nevada provides tax credits for eligible research and development activities, encouraging innovation and technological advancements.

- Sales and Use Tax Abatements: In certain cases, businesses may qualify for sales and use tax abatements, reducing their tax liabilities for a specified period.

Conclusion: A Tax-Smart Choice

Las Vegas’s tax environment offers a compelling proposition for individuals and businesses seeking to minimize their tax burdens. From the absence of a state income tax to competitive sales tax rates and a range of business-friendly incentives, Nevada provides a favorable climate for personal and professional growth. As with any tax strategy, it’s essential to consult with tax professionals and stay informed about the latest regulations and opportunities.

Whether you're an individual looking to maximize your earnings or a business aiming to thrive in a low-tax jurisdiction, Las Vegas presents a unique and advantageous opportunity. The city's vibrant culture, coupled with its tax-friendly policies, creates a compelling destination for those seeking financial freedom and success.

What are the advantages of Nevada’s tax system for businesses?

+Nevada’s tax system offers several advantages for businesses, including no state income tax, competitive sales tax rates, and a range of tax incentives such as Enterprise Zones and Research and Development Tax Credits. These factors contribute to a business-friendly environment, promoting economic growth and job creation.

How does Las Vegas’s gross receipts tax work?

+The gross receipts tax in Las Vegas is imposed on businesses operating within the city limits. It is calculated based on the gross revenue generated by the business, with rates ranging from 0.05% to 0.45%. The tax rate depends on the business activity and industry. This tax provides a stable revenue source for the city while keeping business tax liabilities manageable.

Are there any tax incentives for starting a business in Las Vegas?

+Absolutely! Nevada offers a variety of tax incentives to encourage business growth and investment. These include Enterprise Zones, which provide reduced tax rates for businesses operating in designated areas, and tax credits for research and development activities. Additionally, Las Vegas has a vibrant startup ecosystem and a supportive business community.