State Capital Gains Tax

Capital gains tax is a complex and often confusing topic, but understanding it is crucial for individuals and businesses alike, especially when it comes to state-specific regulations. This article aims to provide a comprehensive guide to State Capital Gains Tax, delving into the intricacies of how capital gains are taxed at the state level, the differences across states, and the implications for taxpayers.

Unraveling State Capital Gains Tax: A Comprehensive Overview

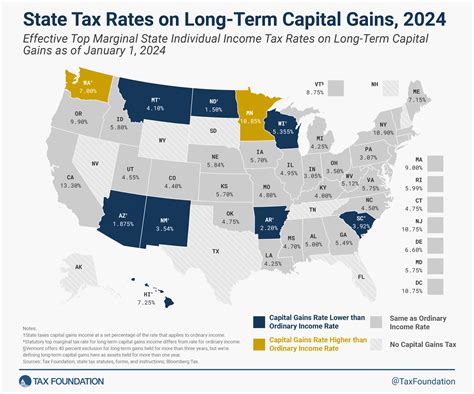

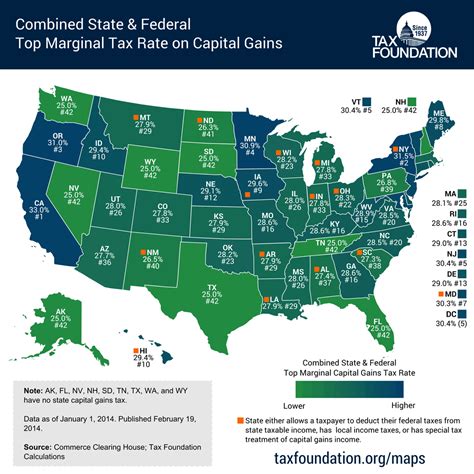

In the United States, the taxation of capital gains is a multifaceted system, with both federal and state governments playing a role. While federal capital gains tax rates are uniform across the country, state capital gains tax rates and regulations can vary significantly, adding an extra layer of complexity to tax planning.

Capital gains arise when an asset is sold for a profit. These assets can range from stocks and bonds to real estate and even collectibles. The tax implications depend on the holding period of the asset and the state in which the taxpayer resides. Understanding these nuances is vital for effective financial planning and tax optimization.

The Diversity of State Capital Gains Tax Regimes

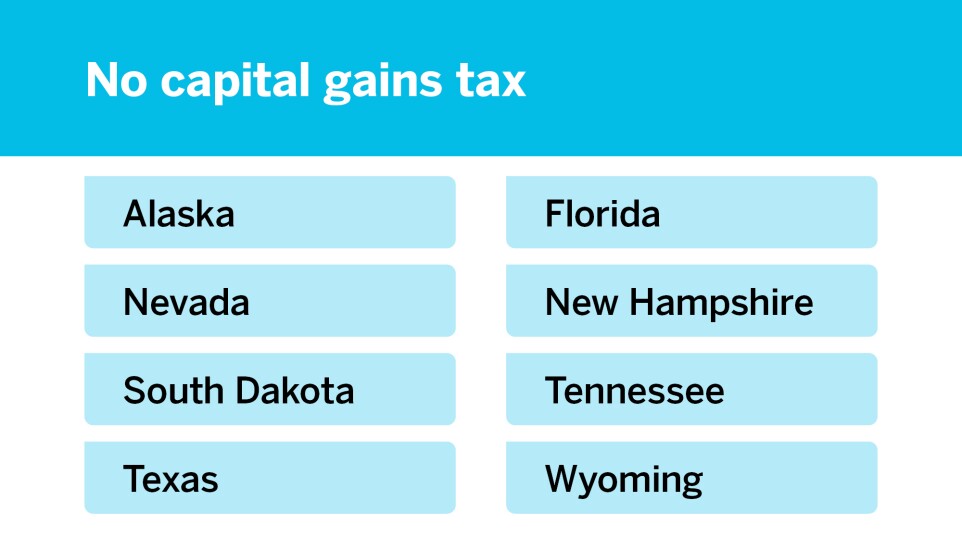

Each state in the US has its own unique approach to capital gains taxation. Some states, like Texas and Washington, do not impose any state-level income tax, including capital gains tax. This makes them attractive destinations for investors looking to minimize their tax liabilities. However, most states do levy some form of capital gains tax, and the rates and rules can vary widely.

For instance, California, a state known for its high tax rates, has a top capital gains tax rate of 13.3%, making it one of the highest in the nation. On the other hand, states like Florida and Nevada not only have no state income tax but also no capital gains tax, making them favorable jurisdictions for investors seeking tax-efficient environments.

The variations don't stop there. Some states, such as New York, apply different tax rates based on the type of capital gain. New York, for example, has a 4% tax rate for long-term gains on collectibles and a 6.85% rate for short-term gains on collectibles. These nuances can significantly impact an investor's after-tax returns and should be carefully considered in tax planning.

| State | Capital Gains Tax Rate |

|---|---|

| California | 13.3% |

| New York | 6.85% (short-term), 4% (long-term collectibles) |

| Florida | 0% |

| Nevada | 0% |

Understanding the Taxable Event: Capital Gains Realization

A capital gain is typically realized when an asset is sold or exchanged, resulting in a profit. However, it’s important to note that not all gains are taxable. For instance, if an asset is donated to a qualified charity, the gain may not be subject to capital gains tax. Additionally, certain types of assets, like life insurance proceeds or certain retirement account distributions, may be exempt from capital gains tax.

The taxable amount of a capital gain is calculated by subtracting the asset's basis (usually its purchase price, but it can be adjusted for improvements or depreciation) from the sale price. This difference is the gain, and it's this amount that is subject to capital gains tax. The tax rate applied depends on the holding period of the asset and the taxpayer's income bracket.

Long-Term vs. Short-Term Capital Gains: A Critical Distinction

Capital gains are classified as either long-term or short-term, depending on the duration for which the asset was held. Generally, assets held for more than one year are considered long-term, while those held for a year or less are short-term. This distinction is crucial because long-term capital gains often benefit from lower tax rates compared to short-term gains.

For instance, the federal tax rate for long-term capital gains is 0%, 15%, or 20%, depending on the taxpayer's income bracket. In contrast, short-term capital gains are taxed at the taxpayer's ordinary income tax rate, which can be as high as 37% for the highest income earners.

State tax rates for long-term and short-term capital gains also vary, and some states, like New York, apply different tax rates based on this distinction. Therefore, it's essential to understand the holding period of assets to optimize tax liabilities.

State Tax Implications for Real Estate Capital Gains

Real estate transactions often involve significant capital gains, and these are subject to state-level taxation. The tax treatment of real estate capital gains can vary depending on the state and the nature of the transaction. For instance, some states exempt primary residence sales from capital gains tax, while others apply the tax to all real estate transactions.

In states like California, where the top capital gains tax rate is 13.3%, selling a primary residence can result in a substantial tax liability. However, California does offer a generous exclusion of $500,000 for single filers and $1 million for joint filers, allowing taxpayers to exclude a significant portion of their gain from taxation.

In contrast, states like Texas, which have no state income tax, also do not tax capital gains on real estate sales. This can make Texas an attractive destination for real estate investors looking to minimize their tax burden.

State Capital Gains Tax: A Comparison

To provide a comprehensive view, let’s compare the capital gains tax rates of various states:

| State | Capital Gains Tax Rate | Key Notes |

|---|---|---|

| California | 13.3% | Highest in the nation, but offers a generous primary residence exclusion. |

| New York | 6.85% (short-term), 4% (long-term collectibles) | Applies different rates based on gain type. |

| Florida | 0% | No state income tax, making it attractive for investors. |

| Nevada | 0% | No state income tax, including capital gains. |

| Texas | 0% | No state income tax, exempting real estate gains as well. |

| Washington | 0% | No state income tax, but some local governments may impose a tax. |

Navigating State Capital Gains Tax: Strategies and Tips

Given the complexity of state capital gains tax regulations, effective tax planning is essential. Here are some strategies to consider:

- Research and Compare: Before making investment decisions, research the state capital gains tax rates and regulations. Compare the potential tax liabilities across different states to choose the most tax-efficient location.

- Consider Holding Period: The distinction between long-term and short-term capital gains is significant. Holding an asset for more than a year can result in a lower tax rate, so plan your investment timeline accordingly.

- Utilize Exemptions and Deductions: Many states offer exemptions or deductions for certain types of capital gains, such as gains on primary residences. Understand these exemptions and deductions to maximize your tax savings.

- Seek Professional Advice: The tax landscape is complex, and state regulations can be intricate. Consider seeking advice from a tax professional who can provide personalized guidance based on your specific circumstances.

The Future of State Capital Gains Tax: Implications and Trends

The landscape of state capital gains tax is dynamic and subject to change. As states grapple with budgetary constraints and economic challenges, we may see shifts in tax policies, including changes to capital gains tax rates and regulations. Here are some potential implications and trends to watch:

- Increasing Tax Rates: With states facing revenue shortfalls, there may be a push to increase capital gains tax rates to boost revenue. This could make certain states less attractive for investors seeking tax-efficient environments.

- Differentiated Tax Rates: States may adopt more nuanced approaches, differentiating tax rates based on asset type, holding period, or taxpayer income. This could lead to more complex tax planning strategies.

- Exemptions and Incentives: To attract businesses and investors, states may offer targeted exemptions or incentives for specific types of capital gains, such as gains from certain industries or innovative sectors.

- Tax Reform: As part of broader tax reform initiatives, states may consider simplifying their tax codes, which could impact capital gains tax structures. This could lead to either more streamlined or more complex regulations.

Conclusion: State Capital Gains Tax - A Crucial Consideration

In conclusion, state capital gains tax is a critical aspect of financial planning and investment strategy. The variations in tax rates and regulations across states can significantly impact an investor’s after-tax returns. By understanding these nuances and staying informed about potential changes, investors can make more informed decisions about where to invest and live.

As the tax landscape continues to evolve, staying ahead of the curve and adapting to changing regulations will be key to optimizing tax liabilities and maximizing returns. For investors and taxpayers, staying informed and seeking expert advice can be invaluable in navigating the complex world of state capital gains tax.

What is the difference between federal and state capital gains tax rates?

+Federal capital gains tax rates are uniform across the country, while state capital gains tax rates can vary significantly. This means that the effective tax rate on capital gains can differ greatly depending on where an individual lives and invests.

Are there any states with no capital gains tax?

+Yes, several states, including Texas, Washington, Florida, and Nevada, do not impose a state-level income tax, including capital gains tax. This makes these states attractive destinations for investors seeking tax-efficient environments.

How are long-term capital gains taxed differently from short-term gains?

+Long-term capital gains often benefit from lower tax rates compared to short-term gains. Federal tax rates for long-term capital gains are 0%, 15%, or 20%, depending on the taxpayer’s income bracket, while short-term gains are taxed at the taxpayer’s ordinary income tax rate, which can be as high as 37%.

Are there any strategies to minimize state capital gains tax liabilities?

+Yes, effective tax planning strategies can help minimize state capital gains tax liabilities. These include researching and comparing state tax rates, considering the holding period of assets, utilizing exemptions and deductions, and seeking professional tax advice.