Tax Rate In Los Angeles California

When discussing the tax landscape of a major metropolis like Los Angeles, California, it's crucial to consider the intricate web of tax regulations that govern the city and the state. Understanding the tax rate structure is essential for both residents and businesses, as it directly impacts financial planning and economic decisions. This article aims to provide a comprehensive overview of the tax rates applicable in Los Angeles, shedding light on the various taxes that residents and entities encounter.

Navigating the Tax Landscape of Los Angeles

The City of Los Angeles, nestled in the heart of California, boasts a diverse economy and a vibrant cultural scene. However, its complex tax system can present challenges for taxpayers. This section aims to demystify the tax environment by breaking down the key components and providing a clear understanding of the tax obligations for individuals and businesses.

Personal Income Tax: A City-Wide Perspective

Los Angeles, like the rest of California, follows a progressive tax system for personal income tax. This means that the tax rate increases as your income rises. As of the latest tax year, the state of California has set its income tax rates at the following levels:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $9,064 | 1% |

| $9,065 - $20,133 | 2% |

| $20,134 - $37,318 | 4% |

| $37,319 - $56,628 | 6% |

| $56,629 - $278,867 | 8% |

| $278,868 - $566,839 | 9.3% |

| $566,840 and above | 10.3% |

These rates are applied to taxable income, which is the income after deductions and exemptions. It's important to note that these rates are subject to change annually, so it's advisable to refer to the latest tax guidelines issued by the Franchise Tax Board for the most accurate information.

The City’s Sales and Use Tax: A Dynamic Perspective

Sales and use tax in Los Angeles, like most of California, is levied on the sale of goods and some services. The tax rate is composed of a base state rate and additional local rates, which can vary based on the jurisdiction where the sale or purchase occurs. As of the latest tax period, the sales and use tax rate in Los Angeles County is composed of the following components:

| Tax Jurisdiction | Tax Rate |

|---|---|

| State | 7.25% |

| City of Los Angeles | 1.25% |

| County of Los Angeles | 0.25% |

| Los Angeles MTA (Transportation) | 0.5% |

| Total | 9.25% |

The above rates are applied to the retail price of goods and services, with some exemptions and special rules for certain industries. For instance, certain groceries and prescription drugs are exempt from sales tax. It's essential to consult the specific regulations and guidelines provided by the California Department of Tax and Fee Administration for detailed information on sales and use tax.

Property Taxes: A Stable Foundation

Property taxes in Los Angeles, as in the rest of California, are assessed based on the value of the property and are primarily used to fund local services and infrastructure. The tax rate is set annually by the local government and is generally a fixed percentage of the assessed value of the property. As of the most recent assessment, the average property tax rate in Los Angeles County is approximately 1.01%, which includes the state property tax rate of 0.1898% and additional local rates. This rate is applied to the taxable value of the property, which is often lower than the market value due to Proposition 13, a California law that limits property tax increases.

Corporate Tax Obligations: A Complex Landscape

For businesses operating in Los Angeles, the tax landscape is multifaceted. The state of California imposes a corporate income tax, which is separate from personal income tax. The corporate tax rate is a flat rate of 8.84% of the taxable income. This rate is applied to the net income of the corporation after deductions and exemptions. Additionally, there are various local taxes that businesses may be subject to, such as business license taxes and gross receipts taxes, which can vary depending on the city and county in which the business operates.

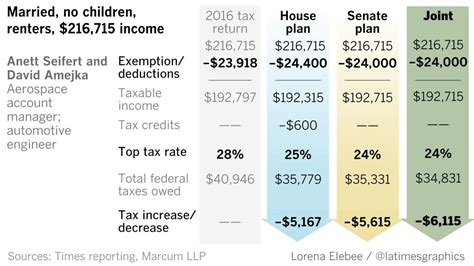

Understanding the Impact of Tax Rates

The tax rates in Los Angeles can have a significant impact on the financial decisions of both individuals and businesses. High income tax rates can influence earning potential and savings strategies, while sales and use taxes can impact the cost of living and doing business. Property taxes, although generally stable, can still affect the affordability of real estate and the cost of homeownership. For businesses, the corporate tax rate and additional local taxes can impact profitability and the decision to expand or relocate.

Strategies for Tax Optimization

Navigating the tax landscape of Los Angeles requires a strategic approach. For individuals, understanding the progressive nature of the income tax system can guide financial planning and tax-efficient savings strategies. Taking advantage of deductions and exemptions can help reduce the taxable income and lower the overall tax liability. Similarly, for businesses, a comprehensive understanding of the corporate tax structure and local tax obligations can inform strategic decisions, such as business structure and expansion plans.

Furthermore, staying informed about tax changes and regulations is crucial. The tax landscape can evolve with legislative changes, and staying abreast of these changes can ensure compliance and potentially identify opportunities for tax optimization. Consulting with tax professionals or utilizing reputable tax preparation software can provide valuable insights and guidance in navigating the complex tax environment of Los Angeles.

Conclusion

In conclusion, the tax rate structure in Los Angeles, California, is multifaceted and dynamic. From personal income taxes to sales and use taxes, property taxes, and corporate taxes, each component plays a crucial role in the financial landscape of the city. Understanding these tax rates and their implications is essential for both individuals and businesses, as it directly impacts financial planning, decision-making, and overall financial health. By staying informed and adopting strategic tax planning approaches, taxpayers can navigate the complex tax environment and optimize their financial outcomes.

How often do tax rates change in Los Angeles?

+Tax rates can change annually based on legislative decisions and economic factors. It’s important to stay updated with the latest tax guidelines to ensure compliance and accuracy in tax planning.

Are there any tax incentives or credits available in Los Angeles for individuals?

+Yes, Los Angeles offers various tax credits and incentives for individuals, such as the California Earned Income Tax Credit and the California Tax Credit for Elderly or Disabled Low-Income Persons. These credits can reduce the tax liability for eligible individuals.

How do I calculate my sales tax obligation as a business in Los Angeles?

+Businesses in Los Angeles can use the California Department of Tax and Fee Administration’s sales and use tax calculator to determine their sales tax obligations based on their specific business activities and location. This tool provides an accurate calculation of the applicable tax rate and tax liability.