Virginia Tax Return Status

When filing your Virginia state tax return, it's important to stay informed about the status of your return and any potential refunds or liabilities. The Virginia Department of Taxation provides various resources and tools to help taxpayers track their return status and stay up-to-date with their tax obligations. This article aims to provide an in-depth guide to understanding and checking the status of your Virginia tax return.

Understanding the Virginia Tax Return Process

Before diving into the status check process, let’s first understand the typical timeline and steps involved in filing a Virginia state tax return.

Filing Deadlines

The deadline for filing your Virginia state tax return generally aligns with the federal tax deadline. For most taxpayers, this means the return must be filed by April 15th of the year following the tax year in question. However, it’s important to note that this deadline may vary for certain taxpayers, such as those who request an extension or have unique filing circumstances.

Filing Methods

Virginia taxpayers have several options for filing their state tax returns. The Virginia Department of Taxation encourages electronic filing, which is not only faster but also more secure and accurate. Electronic filing options include:

- eFile: This method allows taxpayers to file their return directly through the Virginia Department of Taxation’s website. It is a user-friendly option that guides taxpayers through the filing process step by step.

- Software: Various tax preparation software providers offer the option to file Virginia state tax returns electronically. These software programs often integrate with federal tax return data, making the process more efficient.

- Professional Preparers: Taxpayers can also choose to engage the services of a professional tax preparer who can assist with filing both federal and state tax returns.

For those who prefer traditional methods, paper filing is still an option. However, it's worth noting that paper returns generally take longer to process and may result in delayed refunds.

Processing and Refund Timeline

Once your Virginia tax return is filed, the processing timeline can vary depending on several factors, including the filing method, accuracy of the return, and any potential issues identified during processing. Here’s a general timeline to expect:

| Timeframe | Expected Outcome |

|---|---|

| 2-3 Weeks | For returns filed electronically, refunds are typically issued within this timeframe. Paper returns may take slightly longer. |

| 4-6 Weeks | If your return is more complex or requires additional review, it may take up to 6 weeks for processing and refund issuance. |

| 8-12 Weeks | In rare cases, returns with significant issues or errors may require manual processing, resulting in extended processing times. |

Checking Your Virginia Tax Return Status

Now that we have a better understanding of the Virginia tax return process, let’s explore the various methods for checking the status of your return.

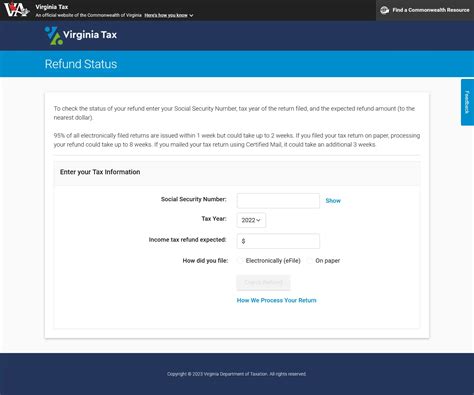

Online Status Check

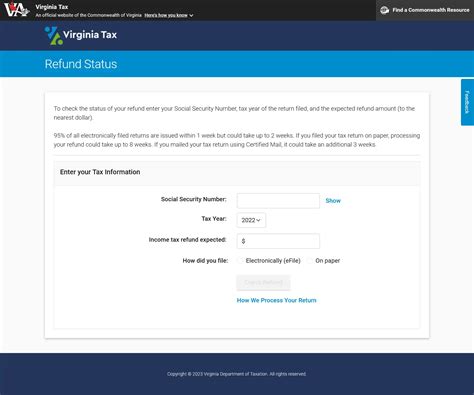

The most convenient and efficient way to check the status of your Virginia tax return is through the Virginia Tax Online Status Check tool provided by the Virginia Department of Taxation. This tool allows taxpayers to quickly and securely access the status of their returns and refunds.

How to Use the Online Status Check Tool

- Visit the Official Website: Go to the Virginia Department of Taxation website and navigate to the “Check Your Return Status” section.

- Enter Your Information: You will need to provide your Social Security Number, Date of Birth, and the Return Filing Status (single, married filing jointly, etc.).

- Submit Your Request: Click the “Submit” button to retrieve the status of your tax return.

The online status check tool will display the current status of your return, such as "Return Received", "Processing", or "Refund Issued". It also provides an estimated timeline for when you can expect a refund, if applicable.

Telephone Inquiry

If you prefer not to use the online status check tool or if you encounter any issues with it, you can inquire about your Virginia tax return status over the phone.

Contact Information

The Virginia Department of Taxation provides a dedicated Taxpayer Assistance Line for status inquiries and general tax-related questions. You can reach them at (804) 367-8031 or (800) 888-3034 (toll-free for in-state callers). The line is typically open from 8:00 AM to 5:00 PM Eastern Time, Monday through Friday.

What to Expect

When calling the Taxpayer Assistance Line, be prepared to provide the following information:

- Your Social Security Number

- Your Date of Birth

- The Tax Year for which you are inquiring about the status

- Your Return Filing Status (single, married filing jointly, etc.)

A customer service representative will assist you in checking the status of your return and provide any additional information or guidance you may need.

Mail Inquiry

While less common and less efficient than the online or telephone methods, you can also inquire about your Virginia tax return status via mail.

Address for Inquiries

To inquire about your tax return status via mail, send a written request to the following address:

Virginia Department of Taxation

P.O. Box 1786

Richmond, VA 23218-1786

What to Include in Your Mail Inquiry

When writing to the Virginia Department of Taxation, be sure to include the following information:

- Your Name and Address

- Your Social Security Number

- The Tax Year for which you are inquiring about the status

- Your Return Filing Status (single, married filing jointly, etc.)

- A brief description of your inquiry, such as “Request for Tax Return Status Update”

Please allow additional time for a response when using the mail method.

Understanding Your Virginia Tax Return Status

Once you have checked the status of your Virginia tax return, it’s important to understand the various status indicators and what they mean.

Common Status Indicators

- “Return Received”: This status indicates that the Virginia Department of Taxation has successfully received your tax return. It means your return is in the initial stages of processing.

- “Processing”: Your return is currently being processed by the department. This status typically indicates that your return is being reviewed for accuracy and any potential issues are being addressed.

- “Refund Issued”: This is the most favorable status, indicating that your refund has been approved and processed. It means you can expect to receive your refund soon, either by direct deposit or check.

- “Additional Information Required”: In some cases, the department may require additional information or documentation from you to complete the processing of your return. This status will be accompanied by a request for specific documents or explanations.

Resolving Status Issues

If you encounter any issues with your Virginia tax return status, such as delays, errors, or missing information, it’s important to address them promptly. Here are some steps to consider:

- Review Your Return: Carefully review your tax return for any errors or omissions. Ensure that all required information and supporting documents have been provided.

- Contact the Department: Reach out to the Virginia Department of Taxation through the Taxpayer Assistance Line or via email (taxpayerassistance@tax.virginia.gov) to discuss any issues or concerns. They can provide guidance and assist in resolving any problems.

- Provide Additional Information: If the department requests additional information, respond promptly with the required documents or explanations. This will help expedite the processing of your return.

Tips for a Smooth Virginia Tax Return Process

To ensure a smooth and efficient tax return process, consider the following tips:

- File Electronically: Electronic filing is not only faster but also more secure and accurate. It reduces the risk of errors and ensures a quicker refund process.

- Use Direct Deposit: Opt for direct deposit for your refund. It is a faster and more secure method of receiving your refund compared to a paper check.

- Keep Records: Maintain good records of your income, deductions, and any supporting documents. This will make it easier to file accurately and resolve any issues that may arise.

- Seek Professional Help: If you have complex tax situations or are unsure about certain aspects of your return, consider seeking the assistance of a tax professional. They can provide guidance and ensure your return is filed correctly.

Conclusion

Understanding and checking the status of your Virginia tax return is an essential part of the tax filing process. By utilizing the online status check tool, telephone inquiry, or mail inquiry methods, you can stay informed about the progress of your return and any potential refunds. Remember to file your return accurately and promptly, and seek assistance if needed. With a little preparation and the right tools, the Virginia tax return process can be a smooth and stress-free experience.

Frequently Asked Questions

How long does it typically take to receive a refund for my Virginia state tax return?

+

For electronic returns, refunds are typically issued within 2-3 weeks. Paper returns may take slightly longer, around 4-6 weeks. However, in rare cases, it may take up to 8-12 weeks if there are significant issues or errors with the return.

Can I check the status of my Virginia tax return online?

+

Yes, the Virginia Department of Taxation provides an online status check tool that allows taxpayers to securely access the status of their returns and refunds. Simply visit the official website, enter your information, and submit your request.

What should I do if I encounter issues with my Virginia tax return status?

+

If you encounter any issues with your return status, such as delays or errors, it’s important to take prompt action. Review your return for any errors, contact the Virginia Department of Taxation for guidance, and provide any additional information they may request.

Can I file my Virginia state tax return electronically?

+

Yes, the Virginia Department of Taxation encourages electronic filing as it is faster, more secure, and accurate. You can file electronically through the department’s website or use tax preparation software that supports Virginia state tax returns.

How can I receive my Virginia tax refund faster?

+

To receive your Virginia tax refund faster, opt for electronic filing and direct deposit. Electronic filing reduces processing time, and direct deposit ensures a quicker and more secure refund compared to a paper check.