Cost Of Tax Preparation

The cost of tax preparation is a significant consideration for individuals and businesses alike. With tax laws being complex and ever-evolving, seeking professional assistance to ensure compliance and take advantage of available deductions and credits is common. This article delves into the factors influencing the cost of tax preparation, exploring the various avenues available and the potential expenses associated with each.

Understanding the Landscape: Tax Preparation Services

Tax preparation services offer a range of options, each catering to different needs and budgets. These services can be broadly categorized into three main types: online tax preparation software, traditional accounting firms, and independent tax preparers.

Online Tax Preparation Software

Online tax preparation software has gained popularity for its convenience and affordability. These user-friendly platforms guide users through the tax preparation process, offering step-by-step instructions and personalized forms. While basic versions are often free, more comprehensive packages may require a fee, typically ranging from 20 to 150, depending on the complexity of the tax situation and the features required.

One notable benefit of online software is its accessibility; users can prepare and file their taxes from anywhere with an internet connection. Additionally, these platforms often provide customer support and resources to assist with any tax-related queries.

Traditional Accounting Firms

Traditional accounting firms offer a more personalized approach to tax preparation. These firms employ certified public accountants (CPAs) and enrolled agents (EAs), who are well-versed in tax laws and can provide expert advice. The cost of hiring an accounting firm can vary significantly, influenced by factors such as the size and complexity of the tax situation, the location of the firm, and the experience of the professionals involved.

On average, the cost of tax preparation by a traditional accounting firm can range from 150 to 500 for straightforward individual tax returns, while more complex returns or those involving business taxes can exceed 1,000. Some firms offer flat-rate pricing, while others charge by the hour, which can range from 100 to $400 per hour.

The advantage of working with a traditional accounting firm is the expertise and personalized service they provide. CPAs and EAs can offer strategic tax planning advice and represent their clients before the IRS, ensuring a more comprehensive tax preparation experience.

Independent Tax Preparers

Independent tax preparers are individuals who specialize in tax preparation but may not have the same credentials as CPAs or EAs. They often work on a freelance basis or through tax preparation chains. The cost of using an independent tax preparer can vary widely, typically ranging from 50 to 300 for individual tax returns, depending on the complexity of the return and the preparer’s experience.

While independent tax preparers may not have the same credentials as CPAs or EAs, they can still provide valuable assistance, especially for individuals with straightforward tax situations. However, it’s essential to ensure that the preparer is reputable and has adequate knowledge of tax laws to avoid potential issues.

Factors Influencing Tax Preparation Costs

The cost of tax preparation is influenced by several factors, each playing a crucial role in determining the final expense.

Complexity of Tax Situation

The complexity of an individual’s or business’s tax situation is a significant determinant of the cost of tax preparation. Factors such as multiple sources of income, investments, rental properties, or business ownership can increase the complexity of the tax return, thus impacting the cost. More complex returns require more time and expertise to prepare, resulting in higher fees.

For instance, a simple individual tax return with a single source of income and no additional deductions may cost around 100 to prepare, while a complex return involving multiple businesses, investments, and foreign income could easily exceed 1,000.

Type of Tax Return

The type of tax return being prepared also affects the cost. Individual tax returns, whether for single filers, married filing jointly, or head of household, generally cost less than business tax returns. Business tax returns, especially for corporations or partnerships, tend to be more complex and require specialized knowledge, leading to higher preparation fees.

Location and Market Rates

The cost of tax preparation can vary significantly based on geographic location. Larger cities or areas with a higher cost of living often have higher tax preparation fees compared to rural areas. Additionally, market demand and competition can influence the rates charged by tax preparers. In areas with a high demand for tax preparation services, rates may be higher.

Experience and Reputation of the Preparer

The experience and reputation of the tax preparer or firm can impact the cost of tax preparation. Highly experienced professionals with a strong reputation for expertise and quality service may charge premium rates. Conversely, less experienced preparers or those with a limited reputation may offer more competitive pricing.

Additional Services and Features

The cost of tax preparation can also be influenced by additional services or features offered by the preparer or software. These may include audit support, tax planning advice, or access to advanced features such as prior year tax return import or investment income calculation. These add-ons can increase the overall cost of tax preparation but may provide valuable benefits to the taxpayer.

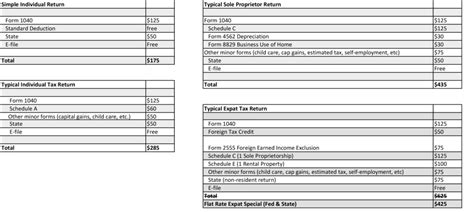

Analyzing Tax Preparation Costs: A Comparative Overview

To gain a clearer understanding of the cost differences, let’s compare the average costs of tax preparation across the three main service types.

| Service Type | Average Cost Range |

|---|---|

| Online Tax Preparation Software | $20 - $150 |

| Traditional Accounting Firms | $150 - $1,000+ (or $100 - $400 per hour) |

| Independent Tax Preparers | $50 - $300 |

It's important to note that these ranges are estimates and can vary significantly based on the factors mentioned earlier. Additionally, while cost is a crucial consideration, it should not be the sole factor when choosing a tax preparation service. The expertise, reliability, and reputation of the preparer or firm are equally important to ensure accurate and compliant tax returns.

Maximizing Value: Tips for Cost-Effective Tax Preparation

To ensure you receive the best value for your tax preparation needs, consider the following tips:

- Assess Your Needs: Evaluate the complexity of your tax situation and choose a service that aligns with your requirements. For straightforward tax returns, online software or independent preparers may suffice, while more complex situations may warrant the expertise of a traditional accounting firm.

- Compare Prices: Research and compare prices across different service providers. Look for deals or discounts, especially during tax season, to save costs.

- Utilize Free Resources: Take advantage of free tax preparation services offered by some organizations, especially for low-income individuals or those with simple tax returns.

- Ask for Discounts: Don't hesitate to inquire about discounts, especially if you're a returning customer or have multiple tax-related needs.

- Negotiate: If you're hiring a traditional accounting firm or an independent preparer, negotiate the fees based on your specific requirements and budget.

- Stay Organized: Keep your financial records organized throughout the year. This can simplify the tax preparation process and reduce the time and cost involved.

Future Implications: The Evolving Landscape of Tax Preparation

The tax preparation industry is continually evolving, driven by technological advancements and changing consumer preferences. Here are some key trends and future implications to consider:

Rise of AI and Automation

Artificial Intelligence (AI) and automation are expected to play an increasingly significant role in tax preparation. These technologies can streamline the process, reduce errors, and improve efficiency. AI-powered tax preparation software can analyze large amounts of data, identify potential deductions, and offer personalized tax planning advice.

Shift Towards Digital Solutions

The COVID-19 pandemic accelerated the shift towards digital tax preparation solutions. Many taxpayers now prefer the convenience and safety of online tax preparation platforms. This trend is expected to continue, with an increasing focus on user-friendly interfaces and robust cybersecurity measures.

Integration of Blockchain Technology

Blockchain technology, known for its security and transparency, is being explored for tax preparation. It has the potential to revolutionize the way tax data is stored, shared, and verified, enhancing security and reducing fraud risks.

Emphasis on Tax Planning and Financial Wellness

Tax preparation services are increasingly offering holistic financial wellness solutions. Beyond just preparing tax returns, these services aim to provide comprehensive financial planning advice, helping individuals and businesses optimize their financial strategies and achieve long-term goals.

Continued Regulatory Compliance

As tax laws continue to evolve, tax preparation services must stay abreast of the latest regulations. This includes ensuring compliance with data privacy laws and implementing robust cybersecurity measures to protect sensitive taxpayer information.

Growing Importance of Tax Representation

With the increasing complexity of tax laws, the role of tax representatives, such as CPAs and EAs, is becoming more crucial. These professionals can provide expert advice, represent taxpayers before the IRS, and ensure compliance with the ever-changing tax landscape.

What are the potential risks of using a low-cost tax preparer or software?

+While cost is an important consideration, opting for the cheapest option may come with risks. Low-cost preparers or software may lack the expertise to handle complex tax situations, leading to errors or omissions in the tax return. This could result in penalties, interest charges, or even an audit by the IRS. It’s crucial to strike a balance between cost and quality to ensure accurate and compliant tax preparation.

How can I find a reputable tax preparer or accounting firm?

+Research and referrals are key. Look for preparers or firms with a strong reputation and positive reviews. Check their credentials and ensure they are licensed or certified. You can also verify their credentials with professional organizations such as the National Association of Enrolled Agents (NAEA) or the American Institute of CPAs (AICPA). Additionally, consider asking for references or reading testimonials from previous clients.

Are there any tax preparation services specifically for small businesses?

+Yes, many tax preparation services offer specialized packages for small businesses. These packages typically cater to the unique tax needs of small business owners, including business income, expenses, and deductions. Some online software platforms also provide business-specific features and guidance. Alternatively, traditional accounting firms can provide comprehensive business tax preparation and planning services.