Sales Tax Cars Nj

Sales tax on cars in New Jersey can be a complex topic, as it involves various factors and calculations. Understanding the sales tax implications is crucial for both consumers and businesses in the Garden State. This comprehensive guide aims to provide an in-depth analysis of the sales tax landscape for vehicles in New Jersey, offering insights into the rates, exemptions, and calculation methods.

Understanding Sales Tax Rates in New Jersey

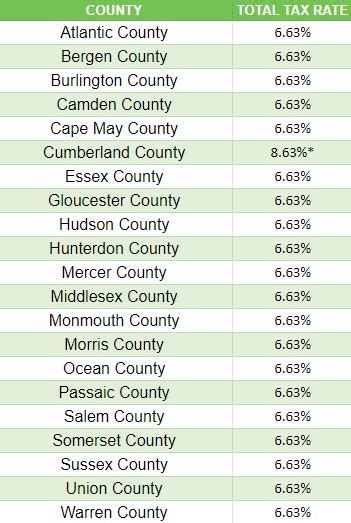

New Jersey, like many other states, imposes a sales tax on the purchase of vehicles. As of my last update in January 2023, the general sales tax rate in New Jersey is 6.625%. This rate is applicable to most tangible personal property, including vehicles. However, it’s important to note that the sales tax can vary depending on the specific location within the state, as some counties and municipalities have additional local taxes.

For instance, in the city of Newark, there is a 0.5% additional local sales tax, bringing the total rate to 7.125% for vehicle purchases. Similarly, other cities like Jersey City and Atlantic City have their own local sales tax rates, which can increase the overall tax burden on car buyers.

| Location | Sales Tax Rate |

|---|---|

| New Jersey Statewide | 6.625% |

| Newark | 7.125% (including local tax) |

| Jersey City | Varies (check local tax rate) |

| Atlantic City | Varies (check local tax rate) |

Local Sales Tax Variations

It’s crucial for car buyers to be aware of the local sales tax variations, as these can significantly impact the overall cost of the vehicle. For example, if a car is purchased in a county with a higher local sales tax rate, the buyer may end up paying a considerable amount in additional taxes. It’s advisable to research and compare the sales tax rates in different regions before finalizing a purchase.

Calculating Sales Tax on Vehicles

The sales tax on a vehicle in New Jersey is calculated based on the purchase price of the car. The formula is relatively straightforward: the sales tax rate is multiplied by the total cost of the vehicle. Here’s an example calculation:

Let's say you're purchasing a car with a sticker price of $30,000 in a county with a 7.125% sales tax rate (including state and local taxes). The sales tax amount can be calculated as follows:

$30,000 x 0.07125 = $2,137.50

So, in this scenario, the sales tax on the vehicle would be $2,137.50. This amount is typically added to the purchase price, bringing the total cost of the car to $32,137.50 in this case.

Sales Tax on Used Cars

When it comes to used car purchases, the sales tax calculation remains similar. The tax is still based on the purchase price, regardless of whether the vehicle is new or used. However, it’s worth noting that some states have specific regulations for used car sales, which may impact the tax calculation. In New Jersey, the same sales tax rate applies to both new and used vehicles.

Exemptions and Special Considerations

While the general sales tax rate applies to most vehicle purchases, there are certain exemptions and special considerations to be aware of in New Jersey.

Vehicle Type Exemptions

Certain types of vehicles are exempt from sales tax in New Jersey. These include:

- Motor vehicles used exclusively for farming purposes.

- School buses and vehicles used exclusively for educational purposes.

- Certain types of emergency vehicles, such as ambulances and fire trucks.

- Vehicles purchased for export out of the state.

Trade-Ins and Transfers

When trading in an old vehicle for a new one, the sales tax calculation can become more complex. In New Jersey, the sales tax is typically based on the difference between the trade-in value and the purchase price of the new vehicle. This ensures that the tax is calculated accurately, taking into account the value of the old car.

Additionally, if you're transferring a vehicle's title within your family or to a charitable organization, you may be eligible for certain exemptions or reduced tax rates. It's recommended to consult the official New Jersey Division of Taxation guidelines for more detailed information on these scenarios.

Future Implications and Tax Reforms

The sales tax landscape in New Jersey, like in many states, is subject to potential changes and reforms. While the current sales tax rate and regulations provide a stable framework for vehicle purchases, there have been discussions and proposals for tax reforms in recent years.

Proposed Changes and Their Impact

Some proposed changes include:

- Increasing the Sales Tax Rate: There have been discussions about raising the state sales tax rate to generate additional revenue. If implemented, this could result in higher costs for car buyers.

- Streamlining Tax Collection: New Jersey has considered implementing a “marketplace facilitator law,” which would require online retailers to collect and remit sales tax. This could impact the purchasing process for vehicles bought online.

- Exemptions and Credits: There are ongoing debates about introducing new exemptions or tax credits for certain types of vehicles, such as electric or hybrid cars. These changes could incentivize the adoption of environmentally friendly vehicles.

It's essential for car buyers and businesses to stay informed about any potential tax reforms, as they can significantly affect the overall cost of vehicle purchases in New Jersey.

Frequently Asked Questions

Are there any ways to reduce the sales tax burden on vehicle purchases in New Jersey?

+

While the sales tax rate is set by the state, there are a few strategies to potentially reduce the tax burden. One option is to consider purchasing a vehicle in a county with a lower local sales tax rate. Additionally, if you’re eligible for any exemptions or tax credits, such as those for electric vehicles, be sure to take advantage of them.

How often are sales tax rates reviewed and updated in New Jersey?

+

Sales tax rates are typically reviewed and adjusted periodically, often as part of the state’s budgetary process. While the state sales tax rate has remained relatively stable, local tax rates can change more frequently. It’s recommended to check the official government websites for the most up-to-date information on sales tax rates.

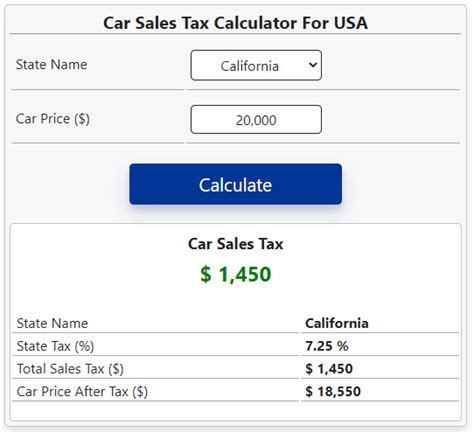

Are there any online resources to help calculate sales tax on vehicles in New Jersey?

+

Yes, there are several online calculators and tools available that can assist in estimating the sales tax on vehicles. These calculators often take into account the purchase price, sales tax rate, and any applicable discounts or exemptions. It’s a good idea to use these tools to get a rough estimate before finalizing a vehicle purchase.

What happens if I buy a car in a different state and register it in New Jersey?

+

When you purchase a vehicle out of state and register it in New Jersey, you may be required to pay use tax. Use tax is similar to sales tax and ensures that you pay the appropriate amount based on the state’s sales tax rate. It’s important to declare the purchase and pay any applicable taxes to avoid legal consequences.

Are there any ongoing discussions about sales tax reforms in New Jersey specifically for vehicles?

+

Yes, there are ongoing discussions and proposals related to sales tax reforms in New Jersey, particularly regarding the automotive industry. Some proposals focus on encouraging the adoption of electric vehicles by offering tax incentives or credits. It’s advisable to follow news and updates from the New Jersey government to stay informed about any potential changes.