Ca Sales Tax Alameda County

In the bustling state of California, understanding the intricacies of sales tax is crucial, especially for businesses and consumers alike. This comprehensive guide delves into the specifics of sales tax in Alameda County, providing an in-depth analysis to ensure compliance and financial clarity.

Unraveling the Complexities of Sales Tax in Alameda County

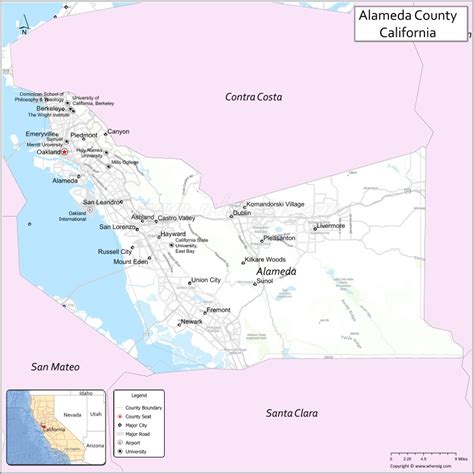

Alameda County, nestled in the heart of the San Francisco Bay Area, boasts a vibrant economy and a diverse range of businesses. With a thriving business landscape, it’s essential to navigate the complexities of sales tax regulations to ensure smooth operations and compliance with state and local laws.

The Legal Framework: Understanding California Sales Tax

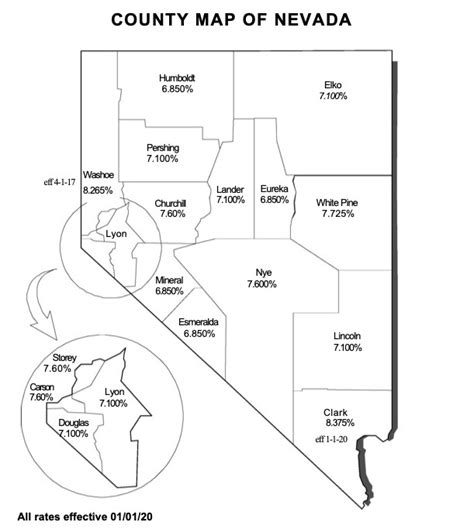

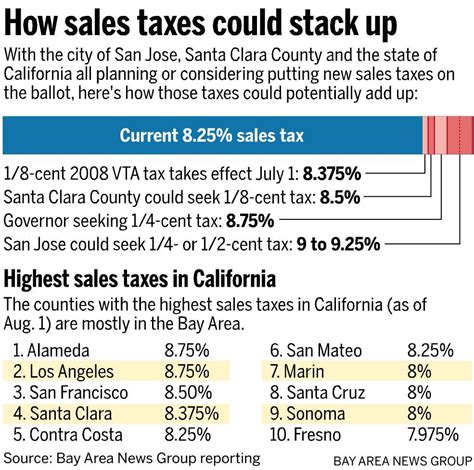

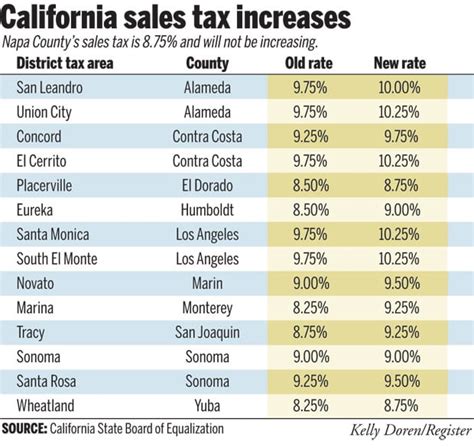

California’s sales and use tax system is governed by the Revenue and Taxation Code, which outlines the responsibilities of both businesses and consumers. The state sales tax rate is set at 7.25%, which serves as the foundation for all transactions. However, it’s the local jurisdictions, such as counties and cities, that add their own tax rates, creating a complex web of varying tax rates across the state.

In Alameda County, the sales tax structure is a reflection of this intricate system. The county adds a local tax rate, which, when combined with the state rate, determines the total sales tax applicable to various transactions. This local tax rate can vary depending on the specific city or area within the county, making it essential for businesses to stay updated with the latest tax rates to ensure accurate tax collection and remittance.

| Tax Jurisdiction | Total Sales Tax Rate |

|---|---|

| Alameda County (General) | 9.25% |

| Oakland | 9.75% |

| Fremont | 9.25% |

| Hayward | 9.25% |

| Berkeley | 9.5% |

The Practical Implications: Sales Tax Collection and Remittance

For businesses operating in Alameda County, the practical aspects of sales tax collection and remittance are critical. Here’s a step-by-step guide to ensure a smooth process:

- Determine the Applicable Tax Rate: As seen in the table above, tax rates can vary within the county. Identify the specific tax rate for your business location, whether it's the general county rate or a city-specific rate.

- Calculate Sales Tax: When a sale is made, calculate the sales tax by multiplying the total sale amount by the applicable tax rate. For example, if the total sale is $100 and the tax rate is 9.25%, the sales tax due would be $9.25.

- Display Tax Information: Ensure that tax information is clearly displayed at the point of sale. This transparency helps build trust with customers and ensures they understand the breakdown of their purchase.

- Collect and Record Sales Tax: When processing payments, collect the sales tax along with the purchase amount. Maintain accurate records of all sales, including the tax amount collected for each transaction.

- Remit Sales Tax: Businesses are required to remit the collected sales tax to the California State Board of Equalization on a regular basis. The frequency of remittance depends on the business's sales volume and can range from monthly to quarterly.

Compliance and Penalties: Navigating the Fine Print

While understanding the mechanics of sales tax collection is crucial, it’s equally important to be aware of the potential consequences of non-compliance. California takes sales tax compliance seriously, and businesses that fail to collect and remit sales tax correctly may face significant penalties and interest charges.

Penalties can range from a minimum of $500 to a maximum of 50% of the tax due, depending on the severity of the violation. Additionally, interest charges may accrue on the outstanding tax amount, further increasing the financial burden. It's essential to stay informed about the latest regulations and seek professional advice if needed to ensure compliance and avoid these penalties.

Future Outlook: Sales Tax Trends and Potential Changes

Sales tax regulations are subject to change, and staying updated is crucial for businesses to adapt and plan effectively. In recent years, there has been a growing trend of local jurisdictions proposing additional tax measures to fund specific initiatives or address budget concerns.

For instance, in certain areas of Alameda County, there have been discussions about implementing a local tax to support infrastructure development or provide additional funding for public services. While these proposals are still in the preliminary stages, they highlight the dynamic nature of sales tax regulations and the need for businesses to stay vigilant and engaged with local governance.

Furthermore, the ongoing debate surrounding online sales tax collection continues to shape the sales tax landscape. With the rise of e-commerce, states and local jurisdictions are exploring ways to ensure that online retailers collect and remit sales tax, leveling the playing field with brick-and-mortar businesses. This evolving landscape underscores the importance of staying informed and adapting to changing tax regulations.

What are the consequences of undercharging or overcharging sales tax?

+

Undercharging sales tax can result in penalties and interest charges, while overcharging may lead to refunds and potential legal issues. It’s crucial to accurately calculate and collect the correct sales tax to avoid these complications.

How often do sales tax rates change in Alameda County?

+

Sales tax rates can change annually or even more frequently, depending on local initiatives and budgetary needs. It’s essential to stay updated with official sources to ensure compliance with the latest rates.

Are there any sales tax exemptions or special considerations for certain industries in Alameda County?

+

Yes, certain industries like manufacturing or agriculture may be eligible for specific sales tax exemptions or reduced rates. It’s recommended to consult with tax professionals or refer to official guidelines to determine if your business qualifies for any exemptions.