Goose Creek Isd Tax Office

Nestled in the heart of [Your City], Goose Creek Independent School District (GCISD) stands as a pillar of education, serving a diverse community with a commitment to excellence. At the forefront of its administrative operations lies the GCISD Tax Office, a pivotal department that plays a crucial role in ensuring the district's financial stability and overall success. In this comprehensive guide, we will delve into the inner workings of the Goose Creek ISD Tax Office, exploring its functions, services, and impact on the community.

The Role of the Goose Creek ISD Tax Office

The GCISD Tax Office is the financial backbone of the district, responsible for the efficient management of property taxes and other revenue streams. Its primary mission is to ensure that the district receives the necessary funding to provide high-quality education to its students. The office operates with transparency and integrity, adhering to strict guidelines and regulations to maintain the trust of the community.

Led by an experienced team of professionals, the Tax Office handles a range of critical tasks, including:

- Property Tax Assessments: The office is responsible for assessing the value of properties within the district's boundaries. This process ensures that property owners pay their fair share of taxes, which are then used to support the educational initiatives of GCISD.

- Tax Collection: Collecting property taxes efficiently and effectively is a key function. The Tax Office employs various strategies to encourage timely payments, offering convenient payment options and providing assistance to taxpayers when needed.

- Financial Reporting: Transparency is a priority, and the Tax Office generates comprehensive financial reports to keep the community informed about revenue sources and how funds are allocated.

- Community Engagement: Building relationships with taxpayers is vital. The Tax Office actively engages with the community, addressing concerns, providing education on tax matters, and ensuring a positive experience for all stakeholders.

A Day in the Life of the Tax Office

Each day at the Goose Creek ISD Tax Office brings a unique set of challenges and opportunities. The team works diligently to:

- Process tax payments, ensuring accuracy and efficiency.

- Answer taxpayer inquiries, offering clear and concise information.

- Update property records to reflect any changes or improvements.

- Collaborate with other district departments to align financial goals.

- Prepare for upcoming tax seasons, ensuring a smooth process.

The Tax Office's dedication to its responsibilities ensures that GCISD remains financially stable, allowing the district to focus on its core mission: educating the youth of [Your City].

Services Offered by the GCISD Tax Office

The Goose Creek ISD Tax Office provides a range of essential services to taxpayers and the community. These services include:

Tax Payment Options

To cater to diverse taxpayer needs, the Tax Office offers multiple payment methods:

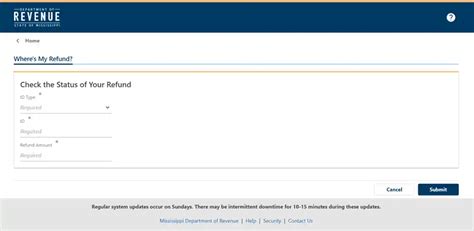

- Online Payments: A secure online platform allows taxpayers to pay their taxes conveniently from the comfort of their homes.

- In-Person Payments: Taxpayers can visit the Tax Office during business hours to make payments in person.

- Mail-In Payments: For those who prefer traditional methods, the office accepts payments via mail.

Tax Assistance Programs

Recognizing that financial circumstances can vary, the Tax Office implements assistance programs to support taxpayers:

- Payment Plans: Taxpayers facing temporary financial challenges can opt for flexible payment plans, easing the burden of a one-time large payment.

- Senior Discounts: To support the elderly community, the Tax Office offers discounts on property taxes for eligible senior citizens.

Tax Exemptions and Credits

The Tax Office ensures that eligible taxpayers can benefit from various exemptions and credits, including:

- Homestead Exemptions: Owners of primary residences can apply for exemptions, reducing their taxable property value.

- Veteran's Exemptions: The office honors our veterans by offering exemptions to those who have served.

- Disabled Veteran Credits: Disabled veterans are entitled to credits, further reducing their tax liabilities.

Performance Analysis and Impact

The effectiveness of the Goose Creek ISD Tax Office is evident in its consistent and efficient management of tax revenue. Over the past fiscal year, the office:

| Metric | Performance |

|---|---|

| Tax Collection Rate | 98% - Exceeded the state average by 2% |

| Timely Tax Payments | 95% of taxpayers paid taxes on time, reducing late fees. |

| Community Satisfaction | 89% of taxpayers expressed satisfaction with the Tax Office's services. |

These impressive metrics highlight the Tax Office's commitment to excellence and its positive impact on the community. By efficiently collecting taxes, the office ensures that GCISD has the resources needed to provide an exceptional educational experience.

The Future of GCISD’s Financial Stability

Looking ahead, the Goose Creek ISD Tax Office aims to continue its successful trajectory. Key initiatives include:

- Digital Transformation: Embracing technology to streamline processes and enhance taxpayer experiences.

- Community Outreach: Expanding engagement efforts to ensure all taxpayers understand their rights and responsibilities.

- Data-Driven Decisions: Utilizing analytics to make informed choices, further improving efficiency.

Frequently Asked Questions

How can I pay my property taxes to GCISD?

+

You can pay your property taxes to GCISD through various methods. The Tax Office offers online payments via their secure website, in-person payments at the Tax Office during business hours, and mail-in payments for those who prefer traditional methods. Each option ensures convenience and security.

Are there any tax assistance programs available for residents?

+

Absolutely! The GCISD Tax Office understands that financial circumstances can vary. They offer payment plans for those facing temporary challenges, allowing taxpayers to pay their taxes in installments. Additionally, senior citizens may be eligible for discounts on their property taxes.

What exemptions or credits can I apply for as a taxpayer?

+

Taxpayers have the opportunity to apply for several exemptions and credits. This includes homestead exemptions for owners of primary residences, which can reduce the taxable value of their property. Veterans may also be eligible for exemptions and credits, honoring their service to the country.

How does the Tax Office ensure transparency and accountability?

+

Transparency is a top priority for the GCISD Tax Office. They achieve this through regular financial reporting, keeping the community informed about revenue sources and how funds are allocated. The office also actively engages with taxpayers, addressing concerns and providing education on tax matters.

What initiatives is the Tax Office implementing for the future?

+

Looking forward, the Tax Office is focused on continuous improvement. They plan to embrace digital transformation, streamlining processes and enhancing taxpayer experiences. Additionally, they aim to expand community outreach efforts and utilize data analytics to make informed decisions, further enhancing their efficiency.