Tax Relief Scam Calls

In today's digital age, where communication is more interconnected than ever, it's crucial to stay vigilant against fraudulent activities, especially those that exploit sensitive topics like tax relief. Unfortunately, scam calls related to tax relief have become a persistent problem, causing financial distress and emotional turmoil for many individuals. This comprehensive guide aims to shed light on the intricacies of tax relief scam calls, providing an in-depth analysis to help you recognize, understand, and protect yourself from such scams.

Unraveling the Tax Relief Scam Calls Phenomenon

Tax relief scam calls are a form of fraudulent activity where callers impersonate government agencies or reputable tax relief companies to deceive individuals into believing they have unresolved tax issues. These scams often employ high-pressure tactics and manipulate victims’ fears and uncertainty about tax-related matters.

One of the primary tactics used in these scams is the threat of immediate legal action or severe financial penalties. Scammers may claim that the victim owes back taxes or has been involved in fraudulent activities, creating a sense of urgency and panic. They then offer a "solution" that involves paying a fee or providing personal and financial information, supposedly to resolve the issue.

Understanding the Impact and Scope

The impact of tax relief scam calls extends beyond financial loss. Victims often experience significant emotional distress, anxiety, and a sense of violation. Many individuals, especially those who are unfamiliar with tax procedures or have limited financial literacy, may fall prey to these scams, leading to a loss of trust in legitimate tax relief services.

The scope of these scams is vast, with reports indicating a significant increase in such fraudulent activities over the past few years. According to the Federal Trade Commission (FTC), tax-related scams are among the most prevalent forms of fraud, with millions of dollars lost annually. This highlights the urgency of raising awareness and providing comprehensive resources to combat these scams effectively.

Unveiling the Scam Techniques: A Detailed Breakdown

Scammers employ various sophisticated techniques to lure victims into their trap. Here’s a detailed breakdown of some common tactics used in tax relief scam calls:

- Impersonation: Scammers often pose as representatives from government agencies like the IRS (Internal Revenue Service) or legitimate tax relief companies. They may use fake names, titles, and even fake offices to add credibility to their claims.

- High-Pressure Tactics: These scammers create a sense of urgency by threatening legal consequences or immediate financial penalties. They may use aggressive language and demand immediate action, leaving little room for victims to think rationally.

- Phishing for Information: During the call, scammers will attempt to gather sensitive personal and financial information, including social security numbers, bank account details, and credit card information. They may also ask for login credentials to online accounts.

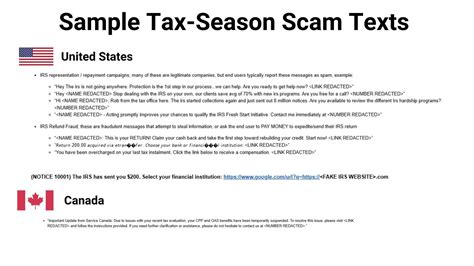

- Fake Websites and Email Scams: In some cases, scammers create fake websites or send phishing emails that appear to be from legitimate tax agencies. These platforms are designed to mimic official websites, tricking victims into providing their information or making payments.

- Pretexting: Scammers may use pretexting, a technique where they create a fake scenario to gain the victim's trust. For instance, they might claim to be a lawyer or accountant representing the victim's interests, offering a "special deal" to resolve the tax issue.

By understanding these techniques, individuals can develop a critical mindset and recognize the warning signs of a potential scam. It's crucial to remain vigilant and never provide personal or financial information over the phone, especially to unsolicited callers.

Real-Life Examples: Stories from Victims

To illustrate the real-world impact of tax relief scam calls, let’s delve into a few case studies of individuals who have fallen victim to these scams:

Case Study 1: Mr. Johnson’s Tale

Mr. Johnson, a retired senior citizen, received a call from an individual claiming to be an IRS agent. The caller informed Mr. Johnson that he owed a substantial amount in back taxes and threatened immediate legal action if the payment wasn’t made within 24 hours. Fearing the consequences, Mr. Johnson, despite his suspicions, wired a significant sum of money to the provided account.

However, soon after the transaction, Mr. Johnson realized he had been scammed. The IRS confirmed that they had not initiated any such communication, and Mr. Johnson's money was irrecoverable. This incident left him financially strained and emotionally devastated, highlighting the cruel nature of these scams.

Case Study 2: Ms. Davis’ Experience

Ms. Davis, a young professional, received an email claiming to be from a tax relief company offering a “special discount” on tax resolution services. Intrigued, she responded to the email, providing her contact details. Shortly after, she received a call from a “tax expert” who offered to help her reduce her tax burden.

Unaware of the scam, Ms. Davis shared her personal and financial information, believing it was a legitimate service. However, instead of receiving tax relief, she became a victim of identity theft, with her personal data being used for fraudulent activities. Ms. Davis had to go through a lengthy and stressful process to restore her identity and financial stability.

Protecting Yourself: Expert Strategies

To ensure your financial and personal security, it’s crucial to adopt a proactive approach and implement the following strategies:

- Verify, Verify, Verify: Always verify the identity of the caller or email sender. Legitimate tax agencies and companies will have official contact information readily available on their websites. Cross-check the provided details and never hesitate to contact the organization directly to confirm the authenticity of the communication.

- Never Share Sensitive Information: Refrain from providing personal or financial information over the phone or email, especially to unsolicited callers. Legitimate tax agencies will never ask for sensitive details over the phone or via email.

- Educate Yourself: Stay informed about the latest tax-related scams and fraud techniques. The IRS and other government agencies often provide resources and alerts to help individuals recognize and report potential scams. Regularly check their websites for updates.

- Use Secure Communication Channels: If you need to discuss tax-related matters, use secure communication channels such as official email addresses or encrypted messaging services. Avoid sharing sensitive information over public networks or unencrypted platforms.

- Report Suspicious Activity: If you receive a suspicious call or email, report it immediately to the appropriate authorities. The IRS has a dedicated hotline for reporting tax-related scams, and you can also file a complaint with the FTC. Reporting helps law enforcement agencies identify and track down these scammers.

The Role of Technology in Scam Prevention

Advancements in technology have both empowered scammers and provided tools for prevention. Here’s how technology can be utilized to combat tax relief scam calls:

- Call Blocking and Filtering: Utilize call blocking apps and services that can identify and filter out potential scam calls. These tools use databases of known scam numbers and can automatically block or flag suspicious calls.

- Email Security: Implement robust email security measures, including spam filters and antivirus software. These tools can detect and block phishing emails, reducing the risk of falling victim to online scams.

- Two-Factor Authentication (2FA): Enable 2FA for all your online accounts, especially those related to taxes and finances. This adds an extra layer of security, ensuring that even if your credentials are compromised, unauthorized access is prevented.

- Educational Resources and Awareness Campaigns: Support and participate in educational initiatives and awareness campaigns aimed at spreading knowledge about tax relief scams. By sharing information and experiences, we can collectively build a stronger defense against these fraudulent activities.

Future Implications and Industry Insights

As technology continues to evolve, so do the tactics employed by scammers. It’s crucial to stay ahead of the curve and anticipate future trends in tax relief scam calls. Here are some industry insights and predictions for the future:

Advanced Scams with AI Integration

With the advancements in artificial intelligence (AI), scammers may employ more sophisticated techniques. AI-powered chatbots and voice cloning technologies could be used to create even more convincing impersonations, making it harder for victims to differentiate between legitimate and fraudulent calls.

Increased Collaboration between Government Agencies and Tech Companies

To combat tax relief scams effectively, there is a growing need for collaboration between government agencies, tech companies, and cybersecurity experts. By combining their expertise, these entities can develop innovative solutions, such as advanced fraud detection systems and real-time scam alerts, to protect individuals from falling victim to scams.

Enhanced Consumer Education and Awareness

Education and awareness campaigns play a pivotal role in preventing tax relief scams. In the future, we can expect more comprehensive and accessible educational resources, including interactive workshops, online tutorials, and social media campaigns, to reach a wider audience and empower individuals with the knowledge to recognize and report scams.

Strengthened Legal Measures and Penalties

As the impact of tax relief scams becomes more evident, there is a growing call for stronger legal measures and penalties against scammers. Governments and regulatory bodies may implement stricter laws and increase enforcement efforts to deter and punish those involved in such fraudulent activities.

Collaborative Efforts for Global Scam Prevention

Tax relief scams are not limited to specific regions; they are a global issue. In the future, we can anticipate increased international collaboration and information sharing between law enforcement agencies and regulatory bodies to combat scams that span across borders. This collaborative approach can help identify and dismantle scam networks operating on a global scale.

Real-Time Scam Monitoring and Alerts

With the development of advanced analytics and machine learning technologies, real-time scam monitoring and alert systems can be implemented. These systems can identify patterns and trends in scam calls, allowing for swift action to be taken against scammers and providing timely alerts to potential victims.

Conclusion: Empowering Individuals with Knowledge

Tax relief scam calls are a complex and evolving issue that requires a multi-faceted approach to combat effectively. By understanding the tactics employed by scammers, recognizing the warning signs, and adopting proactive security measures, individuals can empower themselves against these fraudulent activities.

As we navigate the digital landscape, it's crucial to remain vigilant, educate ourselves, and support initiatives that aim to raise awareness and protect consumers. Together, we can create a safer and more secure environment, ensuring that tax relief scam calls become a thing of the past.

How can I verify the authenticity of a tax-related call or email?

+

To verify the authenticity of a tax-related call or email, you should always cross-check the provided information with official sources. Visit the official website of the agency or company in question and look for their contact details. Contact them directly and confirm whether they initiated the communication. Never rely solely on the information provided by the caller or email sender.

What should I do if I’ve fallen victim to a tax relief scam?

+

If you suspect or confirm that you’ve been scammed, take immediate action. Report the incident to the appropriate authorities, such as the IRS, FTC, or local law enforcement. They can provide guidance and support in recovering from the scam. Additionally, contact your financial institutions and credit bureaus to protect your finances and personal information.

Are there any legitimate tax relief services I can trust?

+

Yes, there are reputable tax relief companies and professionals who can provide legitimate services. When seeking tax relief assistance, always research and verify the company’s credentials and reviews. Look for licensed tax professionals and companies with a proven track record of success. It’s crucial to exercise caution and thoroughly investigate any service provider before sharing sensitive information.

Can I report a suspected tax relief scam anonymously?

+

Yes, you can report a suspected tax relief scam anonymously. The IRS and FTC provide options for anonymous reporting. You can visit their websites or contact their hotline numbers to provide information about the scam without revealing your identity. This helps law enforcement agencies gather intelligence and take action against scammers.