California Unclaimed Tax Refunds

Many Californians are unaware that they may be entitled to unclaimed tax refunds from the state government. These unclaimed funds often accumulate due to various reasons, such as moving without updating addresses, errors in tax filings, or simply forgetting to claim a refund. In this comprehensive guide, we will delve into the world of California's unclaimed tax refunds, exploring how to identify if you are eligible, the process of claiming your refund, and the potential impact on the state's economy.

The Extent of California’s Unclaimed Tax Refunds

The issue of unclaimed tax refunds is not unique to California; it is a nationwide problem. However, California’s size and diverse population make it a significant contributor to the overall unclaimed funds. According to the California Franchise Tax Board (FTB), the state holds over $9.8 billion in unclaimed tax refunds as of the latest estimates.

This staggering amount includes refunds from various tax types, including income tax, corporate tax, and even franchise and excise taxes. The FTB estimates that approximately one in five taxpayers is due a refund, yet many remain unaware or fail to take the necessary steps to claim their money.

The Causes of Unclaimed Refunds

There are several common reasons why tax refunds go unclaimed. One primary factor is address changes. When taxpayers move without updating their contact information with the FTB, they often miss the notification of their refund. As a result, the refund remains unclaimed, waiting to be reunited with its rightful owner.

Another reason is errors in tax filings. Mistakes or oversights in tax forms can lead to refunds being calculated incorrectly, causing some taxpayers to receive less than they are owed. In some cases, taxpayers may not even realize they are entitled to a refund, especially if the amount is relatively small.

| Tax Type | Estimated Unclaimed Amount |

|---|---|

| Individual Income Tax | $8.3 billion |

| Corporate Tax | $1.1 billion |

| Other Taxes (Franchise, Excise) | $0.4 billion |

Identifying Your Eligibility

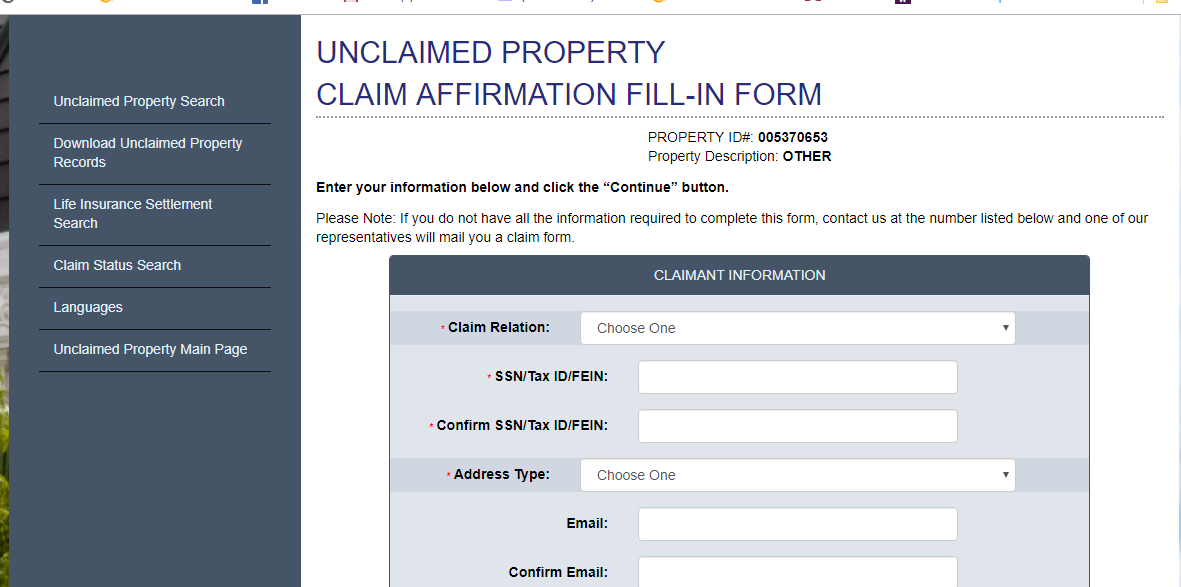

The first step in claiming your unclaimed tax refund is determining whether you are eligible. The FTB provides an online tool called the “Where’s My Refund” feature on its official website. This tool allows taxpayers to check the status of their refunds by entering basic information such as their Social Security Number, filing status, and expected refund amount.

If the tool indicates that you are due a refund, it will provide you with further instructions on how to claim it. However, it's important to note that this tool only covers the current tax year and the two previous years. If you believe you are eligible for a refund from earlier years, you will need to contact the FTB directly.

Documenting Your Refund Claim

When claiming your unclaimed tax refund, you will need to provide supporting documentation to verify your identity and the validity of your claim. This typically includes:

- A completed FTB Form 3519 (Claim for Refund or Credit)

- A copy of your original tax return for the year in question

- Any relevant supporting documents, such as W-2 forms or 1099 forms

- Proof of identity, such as a driver's license or passport

It's crucial to ensure that all the information you provide is accurate and up-to-date. Inaccurate or missing information can delay the processing of your refund claim.

The Process of Claiming Your Refund

Once you have gathered the necessary documentation, you can submit your claim to the FTB. The preferred method is to file electronically, as it is faster and more secure. The FTB’s website provides a step-by-step guide on how to submit your claim online.

If you prefer a more traditional approach, you can mail your claim to the FTB's processing center. However, this method may take significantly longer, and there is a higher risk of delays or errors.

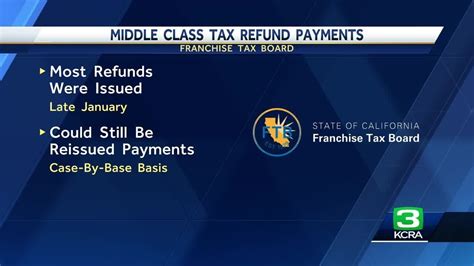

Processing Times and Payment Methods

After submitting your claim, the FTB will review your documentation and verify your eligibility. The processing time can vary depending on the complexity of your case and the volume of claims they are handling. In most cases, you can expect a response within 60 to 90 days from the date of submission.

If your claim is approved, the FTB will issue your refund via the payment method you specified. The most common methods include direct deposit, check, or a state-issued debit card. Direct deposit is the fastest and most secure option, as it eliminates the risk of lost or stolen checks.

| Payment Method | Processing Time |

|---|---|

| Direct Deposit | 3-5 business days |

| Check | 6-8 weeks |

| State-Issued Debit Card | 2-3 weeks |

The Impact on California’s Economy

While unclaimed tax refunds may seem like a minor issue for the state government, the cumulative effect can be significant. When taxpayers fail to claim their refunds, the state essentially receives an interest-free loan. This can impact the state’s budget and its ability to fund essential services and infrastructure projects.

On the other hand, when taxpayers successfully claim their refunds, it can have a positive impact on the economy. Refunds often lead to increased consumer spending, stimulating local businesses and boosting the overall economic growth of the state. According to a study by the National Bureau of Economic Research, every dollar of tax refund claimed results in $2.17 of additional economic activity.

The Potential for Economic Stimulus

Unclaimed tax refunds present an opportunity for California to stimulate its economy. By implementing strategies to increase awareness and simplify the refund claiming process, the state can encourage more taxpayers to claim their refunds. This, in turn, can lead to a significant influx of funds into the economy, benefiting both consumers and businesses.

The FTB has recognized the potential of unclaimed refunds as an economic stimulus and has launched various initiatives to reach out to taxpayers. These initiatives include public awareness campaigns, partnerships with community organizations, and improved online tools to make the claiming process more accessible.

Conclusion: Taking Action to Claim Your Refund

California’s unclaimed tax refunds present a unique opportunity for taxpayers to reclaim their money and contribute to the state’s economy. By understanding the process, identifying your eligibility, and taking the necessary steps, you can ensure that your hard-earned refund finds its way back to you.

Remember, staying informed and keeping your contact information updated with the FTB are crucial steps in ensuring you don't miss out on your refund. By taking action, you can not only benefit personally but also play a role in supporting California's economic growth.

How long does it take to receive my unclaimed tax refund after filing a claim?

+The processing time for unclaimed tax refund claims can vary. Generally, you can expect a response within 60 to 90 days from the date of submission. However, factors such as the complexity of your case and the volume of claims can affect the processing time. Direct deposit is the fastest method, taking around 3-5 business days, while checks and state-issued debit cards may take longer, typically 6-8 weeks and 2-3 weeks, respectively.

What if I believe I am eligible for an unclaimed tax refund from previous years?

+If you believe you are eligible for an unclaimed tax refund from previous years, you will need to contact the California Franchise Tax Board (FTB) directly. The FTB’s website provides contact information and guidance on how to initiate a claim for refunds from earlier tax years. It’s important to note that the FTB only retains unclaimed refunds for a limited period, typically 3-5 years, depending on the tax type.

Are there any penalties or fees associated with claiming an unclaimed tax refund?

+No, there are no penalties or fees associated with claiming an unclaimed tax refund in California. The FTB encourages taxpayers to claim their refunds and does not impose any additional charges. However, it’s important to ensure that you provide accurate and complete information to avoid any potential delays or complications.