What Is A Carbon Tax

The concept of a carbon tax is an increasingly relevant topic in today's world, as governments, organizations, and individuals seek innovative ways to combat climate change and reduce greenhouse gas emissions. A carbon tax is a powerful economic tool designed to address these environmental concerns by placing a price on carbon dioxide (CO2) and other greenhouse gas emissions. It is a vital component of the global effort to transition towards a more sustainable and low-carbon future.

Understanding the Carbon Tax Mechanism

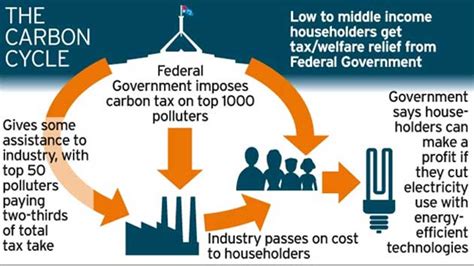

A carbon tax is a levy imposed on the carbon content of fuels, primarily targeting fossil fuels such as coal, oil, and natural gas. It is based on the principle that the entity responsible for emitting carbon should bear the cost of the associated environmental impact. This economic instrument aims to incentivize a shift towards cleaner energy sources and reduce carbon-intensive activities.

The tax is typically applied at various points in the production or consumption chain. For instance, it can be levied on the extraction or production of fossil fuels, their import or export, or even at the point of consumption. The specific implementation can vary depending on a country's energy sector and emissions profile.

The Impact on Industries and Consumers

For industries, a carbon tax adds an additional cost to their operations, particularly for those heavily reliant on fossil fuels. This can encourage a transition to more energy-efficient technologies and processes, as well as the adoption of renewable energy sources. In the long term, it can drive innovation and create a more sustainable industrial landscape.

For consumers, the impact of a carbon tax is often felt through higher prices for carbon-intensive goods and services. This can encourage individuals to make more environmentally conscious choices, such as reducing energy consumption, opting for public transportation, or investing in energy-efficient appliances. However, to ensure social equity, many carbon tax systems include measures to offset the potential burden on low-income households.

Carbon Tax Design and Implementation

The design and implementation of a carbon tax can vary significantly depending on the country’s economic, political, and environmental goals. Some key considerations include:

- Tax Rate: The tax rate can be set at a flat rate or vary based on the carbon intensity of different fuels and activities. A higher tax rate can lead to more significant emissions reductions but may also have a greater impact on the economy and consumers.

- Revenue Use: Governments can choose to use the revenue generated from a carbon tax in various ways. It can be used to reduce other taxes, fund clean energy initiatives, support affected industries and communities, or even provide direct rebates to citizens.

- Border Adjustments: To prevent carbon leakage, where industries relocate to jurisdictions with less stringent carbon policies, some countries implement border adjustments. This involves adjusting the tax based on the carbon content of imported goods, ensuring a level playing field for domestic and foreign producers.

Real-World Examples of Carbon Tax

Several countries and regions have implemented carbon taxes with varying degrees of success. For instance, Sweden has had a carbon tax since 1991, starting at 15 per ton of CO2 and gradually increasing to over 125 per ton today. This has contributed to a significant reduction in emissions and a shift towards renewable energy sources.

British Columbia, Canada, introduced a revenue-neutral carbon tax in 2008. The tax is set at $40 per ton of CO2 and is used to reduce other taxes, such as corporate and personal income taxes. This approach has been successful in reducing emissions while also stimulating the economy.

The Effectiveness of Carbon Tax

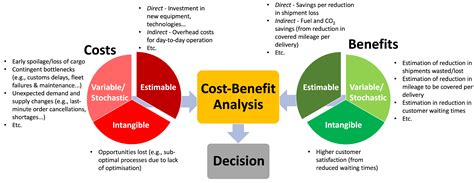

The effectiveness of a carbon tax in reducing emissions and driving the transition to a low-carbon economy depends on several factors, including the tax rate, the use of revenue, and the overall design of the tax system. Studies have shown that a well-designed carbon tax can lead to significant emissions reductions while also generating economic benefits through increased innovation and job creation in the clean energy sector.

However, it is essential to note that a carbon tax is just one tool in the arsenal of climate change mitigation strategies. It should be complemented by other policies and incentives, such as renewable energy subsidies, energy efficiency standards, and investment in low-carbon technologies, to create a comprehensive and effective climate action plan.

Addressing Climate Change through Carbon Pricing

Carbon pricing, of which a carbon tax is a key component, is a crucial strategy in the global fight against climate change. By placing a price on carbon emissions, it sends a clear signal to industries and consumers, encouraging a shift towards more sustainable practices and investments. This market-based approach has the potential to drive significant emissions reductions while also stimulating economic growth in the clean energy sector.

| Country/Region | Carbon Tax Rate (USD/ton CO2) | Year Implemented |

|---|---|---|

| Sweden | $125 | 1991 |

| British Columbia, Canada | $40 | 2008 |

| Switzerland | $90 | 2008 |

The Future of Carbon Taxation

As the world moves towards a more sustainable future, the role of carbon taxation is likely to become increasingly prominent. Many countries are already exploring and implementing carbon pricing mechanisms, and the success stories mentioned above are paving the way for further adoption.

However, challenges remain, particularly in ensuring that carbon taxation is implemented equitably and does not disproportionately burden vulnerable communities. Additionally, international cooperation and harmonization of carbon pricing policies will be crucial to preventing carbon leakage and ensuring a level playing field for industries globally.

In conclusion, a carbon tax is a critical tool in the fight against climate change, offering a market-based approach to incentivize emissions reductions and drive the transition to a low-carbon economy. With careful design, implementation, and revenue allocation, it can be a powerful instrument for environmental protection and economic growth.

What is the primary goal of a carbon tax?

+The primary goal of a carbon tax is to reduce greenhouse gas emissions, particularly carbon dioxide (CO2), by placing a price on these emissions. This economic incentive encourages industries and individuals to transition to cleaner energy sources and more sustainable practices.

How does a carbon tax impact the economy?

+A carbon tax can have both positive and negative economic impacts. On the positive side, it can drive innovation and the development of clean technologies, creating new job opportunities and stimulating economic growth in the renewable energy sector. However, it can also increase production costs for industries and lead to higher prices for consumers, potentially impacting certain sectors and households disproportionately.

What are the potential environmental benefits of a carbon tax?

+A well-designed carbon tax can lead to significant reductions in greenhouse gas emissions, contributing to global efforts to mitigate climate change. It can also encourage the adoption of renewable energy sources and more energy-efficient practices, which can have additional environmental benefits beyond emissions reductions.