Income Tax Notice Section 142 1

The Indian Income Tax Department is responsible for administering and enforcing the provisions of the Income Tax Act, 1961. One of the crucial aspects of this process is the issuance of notices to taxpayers, especially under Section 142 of the Act. This article aims to delve into the intricacies of Section 142(1) notices, shedding light on their purpose, implications, and the steps taxpayers should take upon receiving such a notice.

Understanding Section 142(1) Notices

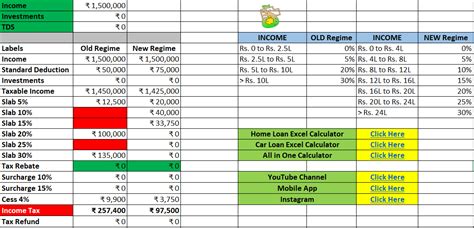

Section 142(1) of the Income Tax Act empowers the Income Tax Department to issue notices to taxpayers for the purpose of obtaining information or documents that are deemed necessary for the assessment or computation of taxable income. These notices are a formal request for specific details and are an integral part of the tax compliance process.

The Income Tax Department may issue a Section 142(1) notice when it believes that a taxpayer's records or information provided are insufficient or inaccurate. This notice serves as a request for additional details, clarifications, or supporting documents to ensure that the tax liability is correctly determined.

The scope of a Section 142(1) notice can vary depending on the nature of the tax assessment. It may include requests for financial statements, transaction details, investment proofs, or any other information relevant to the taxpayer's income and tax obligations.

Key Features of Section 142(1) Notices

- Legal Basis: Section 142(1) of the Income Tax Act provides the legal framework for issuing such notices. It is a crucial tool for the tax authorities to ensure compliance and accurate tax assessment.

- Specificity: These notices are tailored to the taxpayer’s circumstances and typically outline the specific information or documents required.

- Timeframe: A Section 142(1) notice will specify a reasonable timeframe within which the taxpayer must respond. Failure to comply within the given time may result in penalties or further legal consequences.

It is important for taxpayers to understand that receiving a Section 142(1) notice does not necessarily imply wrongdoing. It is a routine process that allows the tax department to gather the necessary information for a comprehensive tax assessment.

The Impact of Section 142(1) Notices

The receipt of a Section 142(1) notice can have several implications for taxpayers, both in terms of their immediate actions and long-term tax planning.

Immediate Actions

- Response Preparation: Upon receiving a Section 142(1) notice, taxpayers should promptly gather the requested information and documents. It is crucial to ensure that all relevant details are provided accurately and within the specified timeframe.

- Professional Assistance: Depending on the complexity of the notice and the taxpayer’s situation, seeking guidance from tax professionals or chartered accountants can be beneficial. They can help in understanding the notice, preparing the response, and ensuring compliance.

- Document Retention: Taxpayers should maintain proper records and documentation related to their financial affairs. This practice aids in timely and accurate responses to such notices.

Long-Term Tax Planning

Section 142(1) notices highlight the importance of tax compliance and accurate record-keeping. Taxpayers can use this as an opportunity to enhance their tax planning strategies and ensure that their financial affairs are in order.

- Record-Keeping Practices: Developing a systematic approach to record-keeping can simplify the process of responding to tax notices. This includes maintaining digital or physical records of financial transactions, investments, and tax-related documents.

- Regular Tax Consultations: Engaging with tax professionals on a regular basis can help taxpayers stay updated with the latest tax regulations and plan their financial strategies accordingly. It ensures that their tax obligations are met efficiently.

- Understanding Tax Laws: Taxpayers should strive to have a basic understanding of the tax laws applicable to their income sources and investments. This knowledge can prevent potential compliance issues and simplify the response process when notices are received.

Responding to Section 142(1) Notices

When a taxpayer receives a Section 142(1) notice, it is essential to respond promptly and accurately. Here are the key steps to follow:

Step 1: Understanding the Notice

Carefully read and comprehend the notice. Identify the specific information or documents requested. If any part of the notice is unclear, seek clarification from the tax department or a tax professional.

Step 2: Gathering Information

Compile the required information and documents. Ensure that all details are accurate and complete. If there are any challenges in obtaining certain documents, communicate with the tax department to seek guidance.

Step 3: Response Preparation

Prepare a detailed response, ensuring that it addresses all the points raised in the notice. Organize the information in a clear and concise manner. If necessary, engage a tax professional to assist in drafting the response.

Step 4: Submission and Follow-Up

Submit the response within the specified timeframe. Keep a record of the submission, including the date and any reference numbers provided. If the notice requires a physical submission, ensure that it reaches the designated tax office.

After submitting the response, taxpayers should follow up with the tax department to confirm the receipt of their response. This can be done by contacting the relevant tax officer or checking the status online, if such facilities are available.

Conclusion: A Comprehensive Approach to Tax Compliance

Section 142(1) notices are an integral part of the Indian tax system, serving as a mechanism to ensure accurate tax assessments. Taxpayers should view these notices as an opportunity to enhance their tax compliance and record-keeping practices. By responding promptly and accurately, taxpayers can maintain a positive relationship with the tax department and ensure a smooth tax assessment process.

Understanding the implications of Section 142(1) notices and adopting a proactive approach to tax compliance can help individuals and businesses navigate the complex world of income tax with confidence and ease.

What should I do if I receive a Section 142(1) notice?

+Upon receiving a Section 142(1) notice, promptly gather the requested information and documents. Seek professional guidance if needed. Respond within the specified timeframe, ensuring accuracy and completeness. Follow up with the tax department to confirm receipt.

Are Section 142(1) notices a sign of tax evasion?

+Not necessarily. Section 142(1) notices are issued to gather additional information for accurate tax assessment. They are a routine process to ensure compliance. Taxpayers should not assume wrongdoing but rather view it as an opportunity to enhance their tax practices.

How can I improve my tax compliance after receiving a Section 142(1) notice?

+Improve tax compliance by adopting systematic record-keeping practices, consulting tax professionals regularly, and staying updated with tax laws. Use the notice as a learning opportunity to ensure future compliance.