Miami Fl Sales Tax

The city of Miami, nestled in the vibrant state of Florida, presents a unique blend of culture, tourism, and economic opportunities. One crucial aspect of doing business in Miami is understanding the sales tax system, which plays a significant role in the local economy and consumer behavior. In this comprehensive guide, we will delve into the intricacies of Miami's sales tax, exploring its rates, exemptions, and the impact it has on various industries and consumers.

Understanding Miami’s Sales Tax Landscape

Miami, being a bustling metropolis with a diverse economy, has a sales tax structure that reflects its unique characteristics. The sales tax in Miami is composed of both state and local taxes, creating a complex but essential revenue stream for the city and its surrounding areas.

The State Sales Tax

Florida, known for its sunny beaches and tax-friendly environment, imposes a state sales tax of 6% on most tangible personal property and certain services. This rate is a fundamental part of the state’s revenue generation, contributing significantly to the overall economic stability.

The state sales tax is applicable to a wide range of goods and services, from retail purchases to certain rentals and admissions. However, it's important to note that certain items, such as non-prepared food, prescription drugs, and certain agricultural products, are exempt from this tax.

Local Sales Tax in Miami

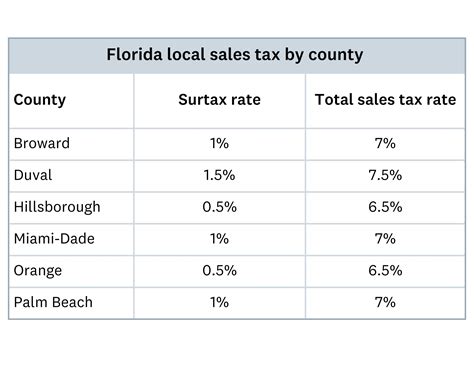

In addition to the state sales tax, Miami and its surrounding counties impose their own local option taxes, which vary depending on the specific jurisdiction. These local taxes are often implemented to fund specific projects or services within the community, adding an extra layer of complexity to the sales tax landscape.

For instance, Miami-Dade County, where the city of Miami is located, imposes an additional 1% sales tax, bringing the total sales tax rate to 7% within the county. This local tax contributes to essential services and infrastructure development, ensuring the city's growth and sustainability.

| Jurisdiction | Local Sales Tax Rate |

|---|---|

| Miami-Dade County | 1% |

| Miami City | 0% |

| Other Counties (e.g., Broward, Palm Beach) | Varies |

It's worth noting that while the city of Miami itself does not impose a local sales tax, the surrounding areas, including other cities and counties, may have different rates. This variability is crucial for businesses operating across multiple jurisdictions, as it impacts pricing strategies and consumer expectations.

Sales Tax Exemptions and Special Considerations

Navigating the sales tax landscape in Miami involves understanding not only the rates but also the various exemptions and special considerations that can impact tax liabilities. These exemptions are designed to support specific industries, promote economic growth, and alleviate financial burdens on certain goods and services.

Exemptions for Essential Goods

Miami, like the rest of Florida, exempts certain essential goods from sales tax to reduce the financial burden on consumers. This includes non-prepared food items, such as groceries and produce, which are crucial for daily sustenance. Additionally, prescription drugs and certain medical devices are exempt, ensuring that healthcare-related expenses are more affordable for residents.

Furthermore, the state extends exemptions to agricultural products, recognizing the importance of the agricultural sector in Florida's economy. This includes items like farm equipment, certain livestock, and raw agricultural commodities.

Taxation of Services

The sales tax in Miami extends beyond tangible goods to certain services as well. While the state and local taxes primarily focus on retail sales, some services are subject to taxation. These include admission fees to certain entertainment venues, rental charges for equipment and vehicles, and lodging services like hotel stays.

However, it's important to note that not all services are taxable. Professional services, such as legal and medical consultations, are generally exempt from sales tax. This distinction is crucial for businesses offering these services, as it impacts their pricing strategies and compliance requirements.

Special Considerations for Tourism

Miami, being a premier tourist destination, has unique sales tax considerations for the tourism industry. The city imposes a tourist development tax on short-term rentals and certain recreational activities. This tax is designed to support tourism-related infrastructure and promotions, enhancing the overall visitor experience.

Additionally, Miami's proximity to the cruise ship industry has led to specific sales tax exemptions for cruise lines and related services. These exemptions are intended to foster the growth of the cruise industry, which plays a significant role in the local economy.

Impact on Industries and Consumers

The sales tax landscape in Miami has a profound impact on both local industries and consumers. Understanding these effects is crucial for businesses looking to thrive in this dynamic market and for consumers making informed purchasing decisions.

Industries Navigating Sales Tax

For businesses operating in Miami, sales tax compliance is a critical aspect of their operations. The varying rates and exemptions require careful consideration when pricing goods and services. Retailers, in particular, must ensure they accurately collect and remit sales tax to avoid legal consequences.

Additionally, industries like hospitality and tourism are directly impacted by the sales tax structure. The additional taxes on lodging and recreational activities influence the pricing strategies of hotels, resorts, and tourist attractions. Proper management of these taxes is essential for maintaining a competitive edge in the market.

Consumer Perspective

Consumers in Miami play a vital role in the local economy, and their understanding of sales tax is crucial for making informed choices. The sales tax rates directly impact the final cost of goods and services, influencing consumer behavior and spending patterns.

For instance, the exemption of non-prepared food items encourages consumers to purchase groceries and essential items without the added tax burden. Similarly, the exemption on prescription drugs and medical devices makes healthcare more accessible and affordable for residents.

On the other hand, consumers need to be aware of the local sales tax rates when making significant purchases. The variability in rates across different jurisdictions can impact their overall spending, especially for those residing near county borders.

Sales Tax Compliance and Reporting

Compliance with sales tax regulations is a critical aspect of doing business in Miami. Businesses operating in the city and its surrounding areas must adhere to the complex sales tax structure to avoid penalties and maintain their reputation.

Registration and Permits

To collect and remit sales tax, businesses must first obtain the necessary permits and registrations. In Miami, this typically involves registering with the Florida Department of Revenue and obtaining a sales and use tax permit. This permit allows businesses to legally collect and remit sales tax on behalf of the state and local governments.

Sales Tax Calculation and Remittance

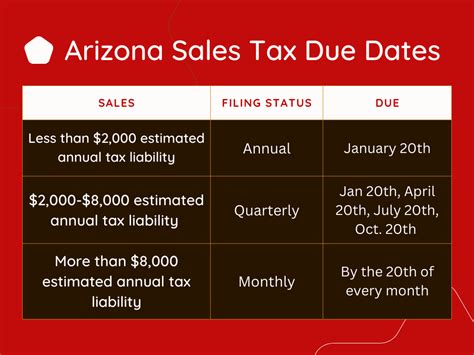

Calculating sales tax accurately is essential for businesses to ensure compliance. This involves applying the appropriate rates to taxable goods and services and ensuring that exemptions are properly applied. Businesses must then remit the collected sales tax to the relevant taxing authorities, typically on a monthly or quarterly basis.

It's crucial for businesses to maintain accurate records of sales transactions and tax remittances to avoid audits and potential penalties. Proper record-keeping practices, including the use of reliable accounting software, can greatly simplify this process.

Sales Tax Audits and Penalties

The Florida Department of Revenue, along with local tax authorities, has the authority to conduct sales tax audits to ensure compliance. These audits can be random or triggered by suspicious activities or non-compliance reports. Businesses found to be non-compliant may face penalties, interest charges, and even criminal prosecution in severe cases.

To mitigate the risk of audits and penalties, businesses should stay updated on sales tax regulations, seek professional advice when needed, and implement robust internal controls for sales tax compliance.

The Future of Sales Tax in Miami

As Miami continues to evolve and adapt to changing economic landscapes, the sales tax system is likely to undergo transformations as well. The city’s dynamic nature and its role as a hub for innovation and tourism present unique challenges and opportunities for sales tax reform.

Potential Reforms and Initiatives

There have been discussions and proposals for sales tax reforms in Miami and Florida as a whole. These reforms aim to simplify the tax structure, reduce compliance burdens, and promote economic growth. Some potential initiatives include:

- Simplifying the sales tax rate structure to make it more uniform across the state.

- Expanding or reducing the scope of exemptions to support specific industries or reduce tax burdens on consumers.

- Implementing technology-driven solutions for sales tax collection and compliance to enhance efficiency.

- Exploring the possibility of a destination-based sales tax, which could impact tourism and e-commerce industries.

Impact on Businesses and Consumers

Any reforms to the sales tax system in Miami would have significant implications for businesses and consumers alike. For businesses, simplified rates and streamlined compliance processes could reduce administrative burdens and improve cash flow. However, changes to exemptions or tax rates could also impact pricing strategies and profitability.

Consumers, on the other hand, would experience changes in the final cost of goods and services. While some reforms might reduce tax burdens on certain items, others could lead to increased prices for specific purchases. It's crucial for consumers to stay informed about these potential changes to make informed decisions.

Preparing for the Future

As the sales tax landscape evolves, businesses and consumers in Miami must stay agile and adaptable. Staying informed about potential reforms and their implications is essential for making strategic decisions. For businesses, this may involve reassessing pricing models, exploring new technologies for compliance, and engaging with industry associations to advocate for favorable tax policies.

Consumers, too, can benefit from staying informed about sales tax changes. By understanding the impact of these reforms, they can make more conscious purchasing decisions and plan their budgets accordingly. Additionally, engaging with local government representatives and expressing their preferences can influence the direction of sales tax reforms.

Conclusion: Embracing the Miami Sales Tax Landscape

Miami’s sales tax system is a complex yet essential component of the city’s economic ecosystem. From state and local taxes to exemptions and special considerations, understanding this landscape is crucial for businesses and consumers alike. By navigating the intricacies of sales tax, both parties can contribute to Miami’s vibrant economy while ensuring compliance and financial stability.

As the city continues to thrive and evolve, staying informed about sales tax regulations and potential reforms is vital. Whether it's for business success or making smart purchasing decisions, embracing the Miami sales tax landscape is a step towards thriving in this dynamic and exciting metropolis.

How often do businesses need to remit sales tax in Miami?

+Businesses in Miami typically remit sales tax on a monthly or quarterly basis, depending on their sales volume and tax liability. However, certain businesses with high sales volumes may be required to remit more frequently.

Are there any online resources to help businesses calculate and remit sales tax accurately?

+Yes, the Florida Department of Revenue provides an online sales tax calculator and resources to assist businesses in calculating and remitting sales tax accurately. Additionally, there are third-party software solutions available that can simplify the process.

What are the consequences of non-compliance with sales tax regulations in Miami?

+Non-compliance with sales tax regulations in Miami can result in penalties, interest charges, and even criminal prosecution in severe cases. It’s crucial for businesses to ensure compliance to avoid these consequences and maintain their reputation.