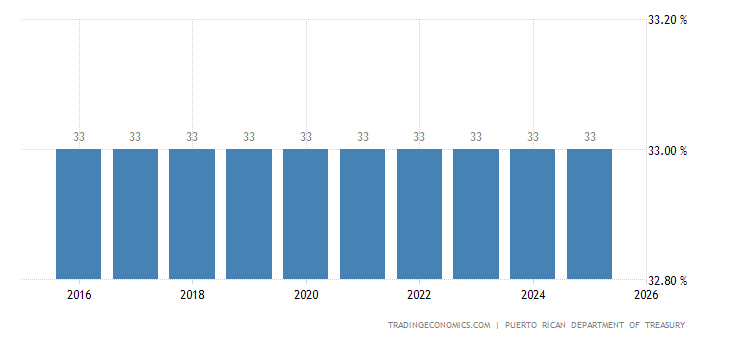

Puerto Rico Tax Rate

The Puerto Rico tax rate is a complex system that has undergone significant changes and reforms in recent years, impacting both individuals and businesses on the island. As an integral part of the U.S. tax system, Puerto Rico has a unique set of rules and regulations that influence the financial landscape and investment opportunities.

Understanding the Puerto Rico Tax System

The tax system in Puerto Rico is designed to promote economic growth and attract foreign investment while also generating revenue for the government. It is influenced by its unique political and economic status as a U.S. territory, which provides certain tax benefits and challenges.

The primary tax laws in Puerto Rico are governed by the Puerto Rico Internal Revenue Code (PR Code), which outlines the various taxes levied on income, property, and other sources. Additionally, the Internal Revenue Service (IRS) of the United States plays a significant role in overseeing tax compliance and providing guidance to taxpayers in Puerto Rico.

Key Tax Rates and Structures

For individuals, the tax system in Puerto Rico is based on a progressive tax rate structure, similar to the U.S. federal tax system. The PR Code sets out different tax brackets with corresponding rates, which are applied based on an individual’s taxable income.

| Tax Bracket | Tax Rate |

|---|---|

| Up to $30,000 | 10% |

| $30,001 - $40,000 | 15% |

| $40,001 - $50,000 | 20% |

| Over $50,000 | 25% |

However, it's important to note that the tax brackets and rates are subject to periodic adjustments and may vary based on the individual's filing status and other factors. Additionally, certain deductions and credits are available to reduce the taxable income, including the Earned Income Tax Credit (EITC) and the Child Tax Credit.

For businesses, the tax landscape is more diverse, with different structures and rates depending on the entity's legal status and nature of operations. Corporations, partnerships, and sole proprietorships are subject to various tax obligations, including income tax, payroll tax, and excise taxes.

Corporate Tax Rates

The corporate tax rate in Puerto Rico is generally lower compared to the U.S. mainland, which has been a significant factor in attracting businesses to the island. As of the latest reforms, the corporate income tax rate is set at 7% for most entities.

However, certain incentives and tax exemptions are available to specific industries and sectors, such as the pharmaceutical and manufacturing sectors, through the Puerto Rico Incentives Code. These incentives aim to stimulate economic growth and job creation in targeted areas.

Sales and Use Tax

In addition to income taxes, Puerto Rico also imposes a Sales and Use Tax (SUT), which is a consumption tax applied to the sale of goods and services within the island. The SUT rate varies depending on the type of product or service and can range from 7% to 11.5%.

The SUT is administered by the Puerto Rico Department of Treasury, and it applies to both local and imported goods. Certain exemptions and discounts are available for essential items like food and medicine, as well as for specific sectors like tourism and hospitality.

Tax Incentives and Economic Development

Puerto Rico has implemented various tax incentives and programs to encourage economic development and foreign investment. These initiatives aim to boost the local economy, create jobs, and promote innovation.

Act 20 and Act 22

Two notable tax incentive programs are Act 20 and Act 22, which offer significant tax benefits to individuals and businesses that relocate to Puerto Rico. Act 20, also known as the Export Services Act, provides a 4% corporate tax rate for certain service-based businesses that export their services outside of Puerto Rico.

On the other hand, Act 22, or the Individual Investors Act, offers a 0% tax rate on long-term capital gains for individuals who establish bona fide tax residency in Puerto Rico. This has attracted high-net-worth individuals and investors seeking tax-efficient opportunities.

Other Tax Incentive Programs

Beyond Act 20 and Act 22, Puerto Rico offers a range of other tax incentive programs aimed at specific industries and sectors. These include:

- Act 273 - This act provides tax benefits for companies establishing international headquarters or regional offices in Puerto Rico.

- Act 73 - Focused on stimulating research and development, Act 73 offers tax credits and incentives for R&D activities conducted in Puerto Rico.

- Act 223 - Aimed at promoting the film and entertainment industry, this act provides tax credits for qualified film and television productions.

Impact on the Economy and Future Prospects

The unique tax system in Puerto Rico has had a significant impact on the island’s economy. The tax incentives and lower corporate tax rates have attracted a diverse range of industries, including manufacturing, technology, and finance. This has led to job creation, increased investment, and a more diversified economy.

However, the island's economic challenges, including a high debt burden and limited access to federal programs, have also shaped the tax landscape. The Puerto Rico government has had to balance the need for revenue generation with the goal of attracting investment and promoting economic growth.

Looking ahead, the future of the Puerto Rico tax system is closely tied to the island's economic recovery and development plans. Continued reforms and a focus on sustainable economic growth will likely shape the tax policies and incentives going forward.

What are the key differences between Puerto Rico’s tax system and the U.S. mainland tax system?

+Puerto Rico’s tax system operates within the framework of the U.S. tax system but has certain key differences. These include lower corporate tax rates, unique tax incentives like Act 20 and Act 22, and the application of the Internal Revenue Code of Puerto Rico (PR Code) alongside the Internal Revenue Code of the United States.

How does the Sales and Use Tax (SUT) work in Puerto Rico?

+The SUT is a consumption tax applied to the sale of goods and services in Puerto Rico. The rate varies depending on the product or service, with certain exemptions and discounts available. It is administered by the Puerto Rico Department of Treasury and plays a significant role in generating revenue for the government.

What are the primary tax incentives available in Puerto Rico for businesses and individuals?

+Puerto Rico offers a range of tax incentives, including Act 20 for service-based businesses and Act 22 for individuals seeking tax-efficient residency. Other programs like Act 273, Act 73, and Act 223 target specific industries and activities, providing tax credits and reduced tax rates to stimulate economic growth.