Status Of Ny State Tax Return

The Status of Your New York State Tax Return: A Comprehensive Guide

The process of filing taxes can be complex, especially when it comes to understanding the status of your tax return. In this comprehensive guide, we will delve into the intricacies of the New York State tax return process, providing you with valuable insights and a step-by-step breakdown. Whether you are a resident of New York or have business dealings within the state, having a clear understanding of the tax return status is crucial.

New York State, known for its bustling cities and diverse economy, imposes a range of taxes on its residents and businesses. From income tax to sales tax, understanding the status of your tax return ensures compliance with state regulations and helps you navigate any potential issues smoothly.

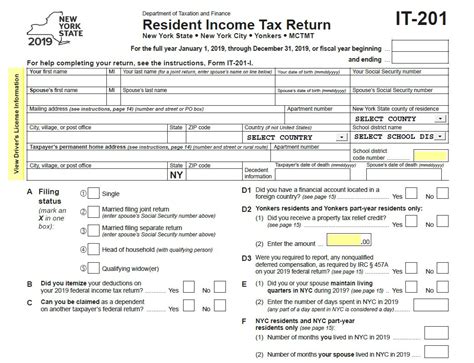

Filing Your New York State Tax Return

Filing your New York State tax return is the first step towards understanding its status. The process typically involves gathering relevant financial documents, such as W-2 forms, 1099 forms, and any applicable business records. It is essential to ensure the accuracy of these documents to avoid any potential penalties or delays.

For residents of New York, the tax filing process is generally straightforward, with the state providing user-friendly online platforms and resources to guide taxpayers through the process. However, for non-residents with business activities in the state, the process may involve additional complexities, such as registering for a New York State tax ID and understanding the specific tax obligations associated with their business operations.

Understanding the Processing Timeline

Once you have filed your New York State tax return, the processing timeline becomes a critical factor in determining the status. The state aims to process tax returns efficiently, but various factors can influence the time it takes for your return to be processed and any potential refunds to be issued.

| Processing Stage | Average Timeline |

|---|---|

| Initial Receipt | Within 2 weeks of filing |

| Processing and Review | Varies based on complexity, typically 4-8 weeks |

| Refund Issuance | Refunds are generally issued within 6-8 weeks of filing |

It is important to note that these timelines are approximate and can vary based on factors such as the accuracy of your return, the volume of returns being processed, and any potential issues identified during the review process.

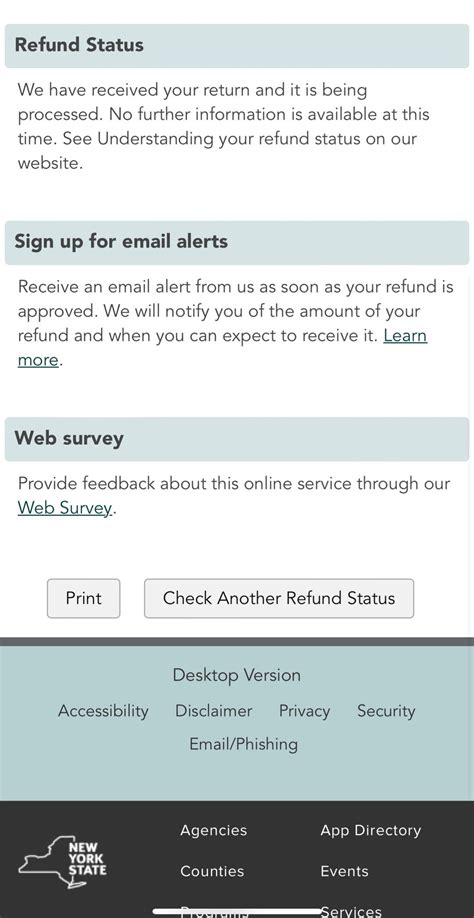

Checking the Status of Your Return

New York State offers convenient online tools to help taxpayers check the status of their tax returns. The Department of Taxation and Finance provides a secure online portal, known as My NY Tax, where registered users can access their account information, including the status of their tax returns.

To check the status of your return, log into your My NY Tax account and navigate to the “Return Status” section. Here, you will find real-time updates on the progress of your return, including whether it has been received, is being processed, or if any issues have been identified.

Common Issues and Resolutions

During the processing of your New York State tax return, various issues may arise that can impact the status. Some common issues include missing or incorrect information, mathematical errors, and discrepancies between federal and state returns.

| Issue | Resolution |

|---|---|

| Missing Information | Provide the missing documentation or contact the Department of Taxation and Finance for guidance. |

| Mathematical Errors | Recalculate the figures and ensure accuracy. If the error persists, contact the department for assistance. |

| Federal-State Discrepancies | Review both returns and identify any differences. Address any inconsistencies and provide additional documentation if needed. |

It is crucial to address these issues promptly to avoid further delays in the processing of your tax return. The Department of Taxation and Finance provides detailed guidance and resources to help taxpayers resolve common issues efficiently.

Staying Informed: Updates and Notifications

New York State understands the importance of keeping taxpayers informed about the status of their returns. To ensure you stay updated, the state offers various communication channels and notifications.

You can opt to receive email or text message notifications regarding the status of your tax return. These notifications provide real-time updates, alerting you to any changes in the processing timeline or potential issues. Additionally, the My NY Tax portal allows you to set up personalized notifications, ensuring you are promptly informed of any developments.

Navigating Complex Scenarios

In some cases, the status of your New York State tax return may involve more complex scenarios. These could include audits, additional tax liabilities, or issues related to business tax obligations.

For audits, it is essential to respond promptly to any notices or requests for information. The Department of Taxation and Finance provides guidance on the audit process and offers resources to help taxpayers prepare and respond effectively.

In the event of additional tax liabilities, the state offers payment plans and installment agreements to help taxpayers manage their obligations. These options provide flexibility and allow taxpayers to fulfill their tax responsibilities over time.

Future Implications and Planning

Understanding the status of your New York State tax return is not only important for the current tax year but also has implications for future tax planning. By staying informed and addressing any issues promptly, you can ensure compliance with state regulations and avoid potential penalties or interest charges.

Furthermore, the insights gained from understanding your tax return status can help you make informed decisions regarding tax planning strategies, such as optimizing deductions, exploring tax credits, or adjusting business operations to minimize tax liabilities.

Conclusion

The status of your New York State tax return is a critical aspect of your financial journey. By following the comprehensive guide outlined above, you can navigate the tax return process with confidence, understanding the timelines, potential issues, and available resources. Remember, staying informed, addressing issues promptly, and seeking guidance when needed are key to a smooth and successful tax return experience.

FAQ Section

How long does it typically take for a New York State tax return to be processed and refunded?

+

The processing time for a New York State tax return can vary based on factors such as the complexity of the return and the volume of returns being processed. On average, it takes approximately 4-8 weeks for the state to process a return and issue any refunds. However, it is important to note that these timelines are approximate and can be influenced by various factors.

What should I do if I receive a notice from the Department of Taxation and Finance regarding my tax return?

+

If you receive a notice from the Department of Taxation and Finance, it is important to respond promptly. The notice will provide specific instructions and guidance on how to address the issue. It may require you to provide additional documentation, respond to inquiries, or take corrective actions. Review the notice carefully and follow the instructions provided.

Are there any online tools available to help me calculate my estimated tax payments for New York State?

+

Yes, New York State provides online tools and calculators to help taxpayers estimate their tax payments. These tools consider factors such as income, deductions, and tax obligations. By using these resources, you can gain a better understanding of your estimated tax liability and plan your payments accordingly. Visit the Department of Taxation and Finance’s website for more information and access to these tools.