Pay My Property Taxes

An Expert Guide to Understanding and Navigating Property Tax Payments

Navigating the world of property taxes can be a complex journey, often filled with questions and uncertainties. From understanding the assessment process to exploring payment options, the path to fulfilling your property tax obligations can be a challenging one. This comprehensive guide aims to shed light on the intricacies of property tax payments, offering expert insights and practical tips to help you navigate this essential aspect of property ownership with ease and confidence.

Understanding Property Taxes

Property taxes are a crucial component of local government revenue, primarily used to fund essential public services and infrastructure projects. These taxes are levied on both residential and commercial properties, with rates varying depending on factors such as location, property value, and local tax policies.

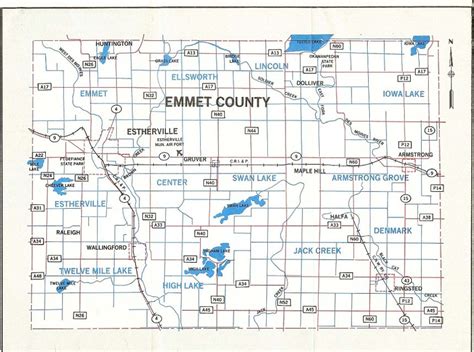

The assessment process is a critical aspect of property taxes. Local governments typically hire assessors to evaluate properties and determine their taxable value. This value is then used to calculate the tax amount owed by the property owner. Assessments are typically conducted annually, but some jurisdictions may perform them more frequently.

Property taxes are an essential source of funding for local governments, enabling them to provide vital services such as education, public safety, healthcare, and infrastructure maintenance. By paying your property taxes, you contribute to the overall well-being and development of your community.

Tax Assessment Process

The assessment process involves a detailed examination of various factors, including the property’s physical characteristics, location, and market conditions. Assessors may consider aspects such as the property’s size, age, condition, and recent sales of comparable properties in the area. This information is used to estimate the property’s fair market value, which forms the basis for tax calculations.

Once the assessment is complete, property owners receive a tax assessment notice, outlining the assessed value and the corresponding tax amount. This notice serves as a crucial document, providing transparency and enabling property owners to understand the basis for their tax obligations.

| Assessment Type | Description |

|---|---|

| Full and Partial Assessments | Full assessments are conducted when a property changes ownership or undergoes significant improvements. Partial assessments, on the other hand, are more frequent and focus on minor changes or adjustments. |

| Market Value Assessments | This method assesses property value based on recent sales of similar properties in the area, taking into account factors like location, size, and amenities. |

| Cost Approach Assessments | The cost approach considers the cost of replacing or reproducing the property, factoring in depreciation and other costs. It's commonly used for unique or specialized properties. |

Tax Rates and Calculations

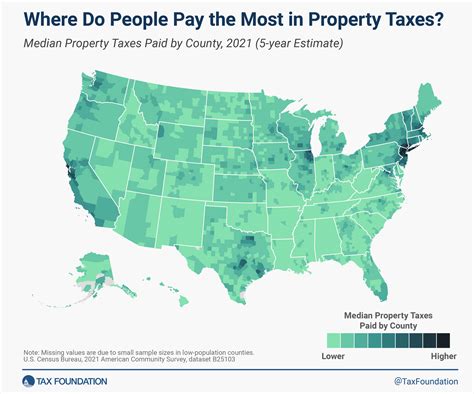

Tax rates are established by local governing bodies, such as city councils or county boards, and are expressed as a percentage of the property’s assessed value. These rates can vary significantly from one jurisdiction to another. For instance, a property in a suburban area might have a tax rate of 1.5%, while a property in a bustling city center could have a rate as high as 3%.

To calculate the tax amount, the assessed value of the property is multiplied by the applicable tax rate. For example, if a property has an assessed value of $200,000 and the tax rate is 2%, the annual tax bill would be $4,000.

It's important to note that tax rates can change annually, influenced by factors such as budget requirements, economic conditions, and voter-approved initiatives. Property owners should stay informed about any changes to tax rates in their area to accurately estimate their tax obligations.

Payment Options and Deadlines

Paying your property taxes is a critical responsibility, and understanding the various payment options and deadlines is essential. Different jurisdictions offer a range of payment methods to cater to diverse preferences and needs. Here’s a comprehensive overview to help you navigate the payment process with ease.

Online Payment Portals

Many local governments now offer convenient online payment portals, allowing property owners to make tax payments securely from the comfort of their homes. These portals typically provide a user-friendly interface, enabling you to access your tax account, view your current balance, and make payments using credit cards, debit cards, or electronic checks. Some portals even offer the option to set up automatic payments, ensuring you never miss a due date.

To utilize this payment method, you'll need to locate your jurisdiction's official website and navigate to the designated tax payment section. Here, you'll be prompted to create an account, which typically requires basic information such as your name, address, and tax identification number. Once your account is set up, you can log in and access your payment options.

Mail-In Payments

If you prefer a more traditional approach, you can opt to mail in your property tax payments. This method involves sending a check or money order, along with the appropriate remittance form, to the designated tax office. It’s crucial to ensure that your payment reaches the office before the deadline to avoid late fees and potential penalties.

When making a mail-in payment, be sure to include your tax bill or assessment notice, which provides essential details such as your account number and the total amount due. This information helps the tax office accurately process your payment and ensures that your payment is credited to the correct account.

In-Person Payments

For those who prefer face-to-face interactions, many tax offices offer the option to make payments in person. You can visit the designated tax office during their operating hours and present your tax bill or assessment notice. The staff will assist you in making the payment, which can be made through various methods, including cash, check, or credit/debit card.

It's important to note that not all tax offices accept cash payments due to security concerns. In such cases, you may be required to use alternative payment methods, such as money orders or cashier's checks. Always verify the accepted payment methods before visiting the tax office to avoid any inconvenience.

Payment Plans and Installment Options

Recognizing that property tax payments can be significant, many jurisdictions offer payment plans or installment options to provide flexibility and ease the financial burden. These plans allow property owners to spread their tax payments over a specified period, typically in equal installments.

To qualify for a payment plan, you may need to meet certain criteria, such as demonstrating financial hardship or providing documentation supporting your need for an installment option. The terms and conditions of these plans can vary, so it's essential to review the details carefully before enrolling.

| Payment Plan Type | Description |

|---|---|

| Semi-Annual Installments | Some jurisdictions offer the option to pay your property taxes in two installments, typically due in January and July. |

| Quarterly Installments | In certain areas, you can opt for quarterly payments, dividing your annual tax bill into four equal installments. |

| Monthly Installments | For those with larger tax obligations, monthly payment plans can help spread the cost over a longer period. |

Deadlines and Penalties

Meeting tax payment deadlines is crucial to avoid late fees and potential penalties. Local governments typically impose late payment penalties, which can significantly increase the total amount owed. These penalties are designed to encourage timely payments and ensure a steady flow of revenue for essential public services.

It's essential to stay informed about the specific deadlines in your jurisdiction. Tax notices usually include the due date for payment, and many local governments also provide online resources or send reminder notices to help property owners stay on track. By staying organized and aware of these deadlines, you can ensure timely payments and avoid unnecessary financial burdens.

Special Circumstances and Exemptions

Property tax systems often recognize special circumstances and offer exemptions to certain groups or properties. These provisions aim to provide relief and support to those who may face financial challenges or contribute significantly to the community. Understanding these special circumstances and exemptions can help you navigate the property tax landscape more effectively.

Homestead Exemptions

Homestead exemptions are a common form of property tax relief, designed to assist homeowners in meeting their tax obligations. These exemptions typically reduce the taxable value of a property, resulting in lower tax bills. To qualify for a homestead exemption, you must meet specific criteria, such as owning and occupying the property as your primary residence.

The eligibility criteria and benefits of homestead exemptions can vary widely from one jurisdiction to another. Some areas may offer a flat reduction in taxable value, while others may provide a percentage-based reduction. Additionally, certain jurisdictions may have age or disability-related requirements, offering additional benefits to seniors or individuals with disabilities.

Veterans and Military Exemptions

Many jurisdictions recognize the service and sacrifice of veterans and active-duty military personnel by offering property tax exemptions. These exemptions can significantly reduce the taxable value of their homes, providing much-needed financial relief. To qualify for these exemptions, veterans and military members typically need to meet specific service criteria and provide documentation supporting their eligibility.

The extent of these exemptions can vary, with some jurisdictions offering a complete exemption from property taxes, while others provide a partial reduction. Additionally, certain areas may have additional benefits for disabled veterans or those with service-related disabilities, providing further support and recognition for their service.

Senior Citizen and Disability Exemptions

Local governments often provide property tax relief to senior citizens and individuals with disabilities, acknowledging their unique circumstances and contributions to the community. These exemptions can help alleviate financial burdens and ensure that these individuals can continue to live comfortably in their homes.

Eligibility for senior citizen and disability exemptions typically requires meeting age or disability-related criteria. Some jurisdictions may also consider income levels, ensuring that the exemption benefits those who need it most. The benefits of these exemptions can vary, ranging from a reduction in taxable value to complete exemption from property taxes.

Other Special Circumstances

Beyond the exemptions mentioned above, there may be other special circumstances that qualify for property tax relief. For instance, some jurisdictions offer exemptions for properties used for specific purposes, such as religious worship or charitable activities. Additionally, properties damaged by natural disasters or undergoing significant renovations may be eligible for temporary tax relief.

It's essential to research and understand the specific exemptions and relief programs offered in your jurisdiction. Many local governments provide detailed information on their websites or through dedicated tax offices, helping property owners navigate these special circumstances and access the support they deserve.

Challenging Your Property Tax Assessment

If you believe your property tax assessment is inaccurate or unfair, you have the right to challenge it. The process of challenging an assessment, known as an assessment appeal, allows property owners to present their case and potentially reduce their taxable value, resulting in lower tax bills.

Reasons for Appealing

There are several valid reasons for appealing a property tax assessment. One common reason is when the assessed value of your property significantly exceeds its fair market value. This can occur due to errors in the assessment process, such as incorrect property characteristics or outdated market data.

Another reason for appealing is if your property has unique features or characteristics that may not be accurately reflected in the assessment. For instance, if your property has significant structural issues or is located in an area with declining property values, these factors may not have been adequately considered during the assessment.

The Appeal Process

The appeal process typically begins with gathering evidence to support your case. This may include recent sales of similar properties in your area, professional appraisals, or expert testimony. It’s crucial to thoroughly research and gather as much evidence as possible to strengthen your appeal.

Once you have gathered your evidence, you'll need to submit an appeal to the appropriate authority, which is often the local tax assessment board or a similar entity. The appeal should clearly outline your reasons for disagreement with the assessment and provide detailed supporting documentation.

After submitting your appeal, the assessment board will review your case and may request additional information or schedule a hearing. During the hearing, you'll have the opportunity to present your evidence and argue your case. It's essential to be prepared and present a strong argument to increase your chances of a favorable outcome.

Outcomes and Next Steps

The outcome of your appeal can vary. In some cases, the assessment board may agree with your argument and reduce your property’s assessed value. This reduction will result in lower tax bills for the current and future tax years. However, it’s important to note that the board may also decide to uphold the original assessment, especially if your evidence is not convincing or if the assessment is found to be accurate.

If your appeal is successful, you'll receive a revised tax bill reflecting the reduced assessed value. If you disagree with the board's decision, you may have the option to appeal further, depending on the laws and regulations in your jurisdiction. It's crucial to understand the appeal process and your rights to ensure a fair and transparent outcome.

Future Implications and Trends

The landscape of property taxes is constantly evolving, influenced by various factors such as economic conditions, demographic changes, and policy shifts. Understanding these future implications and trends can help property owners anticipate potential challenges and opportunities, ensuring they remain informed and prepared.

Economic Impact on Property Taxes

Economic conditions play a significant role in shaping property tax policies and rates. During periods of economic growth, local governments may experience increased revenue, allowing for lower tax rates or additional tax relief programs. Conversely, economic downturns can lead to budget constraints, potentially resulting in higher tax rates or reduced public services.

Property owners should stay informed about the economic outlook in their area, as it can directly impact their tax obligations. Understanding the local economy can help property owners anticipate changes in tax rates and plan their finances accordingly.

Demographic Shifts and Property Taxes

Demographic changes, such as population growth or aging populations, can also influence property tax policies. As communities evolve, local governments may need to adjust their tax structures to accommodate changing needs and ensure sustainable revenue streams.

For instance, in areas experiencing rapid population growth, local governments may need to invest in infrastructure and public services to accommodate the influx of residents. This can lead to increased tax rates or the introduction of new tax measures to fund these initiatives. On the other hand, aging populations may result in reduced property tax revenue, prompting local governments to explore alternative funding sources.

Technological Advances and Property Taxes

Advancements in technology are revolutionizing the property tax landscape, offering increased efficiency and transparency. Online payment portals, digital assessment tools, and data-driven analytics are transforming the way property taxes are administered and collected.

Online payment portals, as discussed earlier, provide property owners with convenient and secure payment options. These portals also offer real-time transaction tracking, ensuring transparency and providing property owners with instant access to their payment history and account details.

Digital assessment tools, such as aerial imaging and advanced data analytics, are enhancing the accuracy and efficiency of property assessments. These tools enable assessors to gather detailed property information, reducing the need for in-person inspections and providing more precise assessments.

Policy Changes and Tax Reforms

Policy changes and tax reforms can significantly impact property tax systems. Local governments may introduce new tax measures, such as tax caps or exemptions, to address specific concerns or promote certain behaviors. These changes can have far-reaching implications for property owners, affecting their tax obligations and overall financial planning.

It's crucial for property owners to stay informed about policy changes and tax reforms in their area. Understanding these shifts can help property owners anticipate potential benefits or challenges, ensuring they remain compliant and take advantage of any new opportunities.

Expert Tips and Recommendations

Navigating the complexities of property taxes can be daunting, but with the right strategies and mindset, it can become a manageable and even beneficial aspect of property ownership. Here are some expert tips and recommendations to help you approach property taxes with confidence and ease.

Stay Informed and Organized

Staying informed about your property tax obligations is crucial. Keep track of important dates, such as assessment deadlines and tax payment due dates, to ensure you meet all requirements on time. Local government websites and tax offices are excellent resources for staying up-to-date with the latest information and guidelines.

Additionally, organize your tax-related documents, such as assessment notices, tax bills, and payment receipts, in a dedicated folder or digital file. This organization will make it easier to retrieve important information when needed, whether for reference or for future appeals.

Explore Payment Options and Plan Ahead

Familiarize yourself with the various payment options available to you, such as online portals, mail-in payments, and in-person payments. Consider which method suits your preferences and circumstances best. If you anticipate financial challenges in meeting your tax obligations, explore payment plans or installment options to spread the payments over a more manageable period.

Planning ahead is essential. Create a budget that accounts for your property tax payments, ensuring you have the necessary funds set aside. If you're eligible for exemptions or special circumstances, apply for them well in advance to avoid any delays or complications.

Seek Professional Advice

If you