Property Tax Scott County

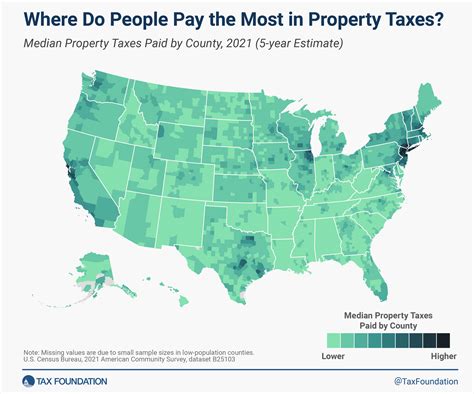

Property taxes are an essential part of a community's revenue stream, and understanding their assessment and impact is crucial for homeowners and investors alike. This comprehensive guide will delve into the specifics of property taxes in Scott County, Minnesota, offering an in-depth analysis of the process, rates, and their influence on the local economy.

Understanding Property Taxes in Scott County

Property taxes are a primary source of revenue for local governments in the United States, and Scott County is no exception. These taxes are used to fund essential services such as education, public safety, infrastructure development, and more. The process of property tax assessment is complex, but it plays a vital role in determining the economic health and growth of a community.

The Assessment Process

The property tax assessment in Scott County is a meticulous process overseen by the County Assessor’s Office. This office is responsible for evaluating the value of all properties within the county, including residential, commercial, and agricultural lands. The assessment is typically conducted every year, and it involves a thorough examination of various factors that influence property value.

The assessment process begins with a physical inspection of the property. The assessor considers the property's size, age, condition, and any recent improvements or additions. They also take into account the local market conditions, including recent sales of similar properties, to ensure that the assessed value is fair and accurate. This data-driven approach ensures that property owners are taxed based on the true market value of their assets.

Once the assessment is complete, the County Assessor's Office calculates the property tax rate, which is then applied to the assessed value of the property. This rate is determined by the local government and can vary from one county to another. In Scott County, the property tax rate is set annually by the county commissioners, taking into consideration the budget requirements of various county departments and services.

Tax Rates and Classification

Scott County employs a two-class property tax system, classifying properties into either homestead or non-homestead categories. This classification significantly impacts the tax rates applied to each property.

| Property Type | Tax Rate |

|---|---|

| Homestead | Varies annually, but typically lower than non-homestead rates |

| Non-Homestead | Varies based on property type and location |

Homestead properties, which are typically owner-occupied residences, benefit from a lower tax rate. This classification aims to encourage homeownership and stabilize the local housing market. On the other hand, non-homestead properties, including rental properties, commercial spaces, and vacant lands, are taxed at a higher rate.

The tax rates for non-homestead properties can further vary based on their location within the county. For instance, properties located in the urban areas of Scott County might have slightly different tax rates compared to those in rural regions. This differentiation takes into account the varying levels of services and infrastructure required for each area.

The Impact of Property Taxes on the Local Economy

Property taxes are a critical component of the local economy in Scott County. They not only provide funding for essential services but also influence investment decisions and community development.

Funding for Public Services

The revenue generated from property taxes is a primary source of funding for various public services in Scott County. These services include:

- Education: Property taxes are a significant contributor to the county's education budget, ensuring that schools have the resources needed to provide quality education to students.

- Public Safety: From police and fire protection to emergency medical services, property taxes help maintain a safe and secure community.

- Infrastructure Development: Taxes are invested in maintaining and improving roads, bridges, and other public infrastructure, enhancing the overall quality of life in the county.

- Recreational Facilities: Tax revenue supports the development and maintenance of parks, recreational centers, and other community spaces, promoting a healthy and active lifestyle.

By adequately funding these services, Scott County ensures the well-being and prosperity of its residents, making it an attractive place to live, work, and invest.

Influencing Investment and Development

Property taxes also play a crucial role in shaping the investment landscape of Scott County. A well-managed and transparent tax system can attract investors, leading to economic growth and job creation. Here’s how property taxes influence investment decisions:

- Stability: Consistent and fair tax rates provide stability for investors, making it easier to plan and forecast returns on investment.

- Incentives: Lower tax rates for homestead properties can encourage homeownership, leading to a stable housing market and a sense of community.

- Development Opportunities: Strategic tax incentives, such as tax abatement programs, can be used to attract businesses and stimulate economic development in targeted areas.

- Community Engagement: Transparent tax policies and effective communication can foster trust between the county government and residents, leading to collaborative community development efforts.

Strategies for Managing Property Taxes

Property taxes can be a significant expense for homeowners and businesses. Here are some strategies to effectively manage and plan for these taxes in Scott County:

Homestead Registration

Homeowners can benefit from the lower tax rates offered to homestead properties by registering their primary residence as a homestead. This simple process can result in substantial savings over time.

Tax Deductions and Credits

Scott County offers various tax deductions and credits to eligible taxpayers. These include:

- Homestead Market Value Credit: A credit that reduces the taxable value of homestead properties, providing relief to homeowners.

- Property Tax Refund: A program that provides a refund based on income and property taxes paid, benefiting low- and moderate-income homeowners and renters.

- Other Deductions: Deductions are available for elderly or disabled homeowners, veterans, and those with qualifying medical expenses.

Appealing Property Assessments

If a property owner believes their assessment is inaccurate, they have the right to appeal. The process involves submitting an appeal to the County Board of Appeal and Equalization, presenting evidence to support their case. This can lead to a reduction in the assessed value and, subsequently, the property taxes owed.

Conclusion

Property taxes in Scott County are a vital part of the local economy, funding essential services and shaping the community’s future. By understanding the assessment process, tax rates, and their impact, homeowners and investors can make informed decisions and actively contribute to the county’s growth and prosperity.

How often are property assessments conducted in Scott County?

+Property assessments in Scott County are conducted annually to ensure the property values are up-to-date and accurately reflect the current market conditions.

What factors influence the property tax rate in Scott County?

+The property tax rate in Scott County is influenced by the budget requirements of various county departments and services. It is set annually by the county commissioners, taking into consideration the cost of providing essential public services.

Are there any tax relief programs available for senior citizens in Scott County?

+Yes, Scott County offers tax relief programs for senior citizens. These programs include the Senior Citizen Property Tax Deferral Program and the Senior Citizen’s Property Tax Refund. Eligibility and application details can be found on the county’s official website.