Winnebago County Tax Records

Welcome to an in-depth exploration of the Winnebago County Tax Records, a comprehensive guide designed to provide an insightful overview of this important administrative domain. In Winnebago County, Illinois, tax records play a crucial role in the local government's financial planning and management. These records are not just a reflection of property values and tax liabilities but also serve as a historical archive, offering insights into the county's development and the changing landscape of its real estate market.

This article aims to delve into the specifics of Winnebago County Tax Records, offering an understanding of the processes, systems, and regulations that govern them. We will explore the intricacies of property assessment, the calculation of tax rates, and the methods through which residents can access and understand their tax obligations. By the end of this guide, readers should have a clear picture of the role tax records play in Winnebago County and how they can actively engage with these records to ensure compliance and transparency.

Understanding Winnebago County Tax Records

Winnebago County’s tax records are a detailed documentation of the county’s real estate assets, their values, and the corresponding tax liabilities. These records are maintained by the Winnebago County Supervisor of Assessments, an office that is responsible for the assessment, equalization, and administration of property taxes within the county. The tax records are a crucial resource for both the county government and individual property owners, serving as a basis for financial planning, budgetary allocation, and the determination of tax rates.

The primary purpose of Winnebago County's tax records is to ensure that property owners pay their fair share of taxes based on the value of their property. This process, known as property assessment, is a complex and meticulous endeavor that involves the evaluation of every taxable property within the county. The assessed value of these properties then forms the basis for calculating the tax rate and, consequently, the tax liability for each property owner.

In addition to their administrative role, Winnebago County's tax records also serve as a valuable historical resource. They offer a glimpse into the development and growth of the county's real estate market over time. By analyzing these records, researchers, historians, and economists can gain insights into the county's economic trends, real estate dynamics, and the overall development of the community.

Key Components of Winnebago County Tax Records

Winnebago County Tax Records encompass a wide range of information, including but not limited to:

- Property Details: Comprehensive information about each taxable property, including its address, legal description, and physical characteristics such as size, number of rooms, and special features.

- Assessment Information: The assessed value of the property, determined through a detailed evaluation process, and the classification of the property for tax purposes (e.g., residential, commercial, agricultural).

- Tax Rates: The tax rate applicable to the property, which is determined by the county and other taxing bodies, and the corresponding tax liability for the current year.

- Tax History: A record of the property's tax payments and any changes in assessed value or tax rates over the years.

- Exemptions and Special Assessments: Details about any exemptions or special assessments that apply to the property, such as homestead exemptions or special assessments for improvements like sewer connections.

These records are typically available to the public, subject to certain restrictions to protect the privacy of property owners. Access to tax records can be a valuable tool for researchers, real estate professionals, and individuals interested in understanding the county's real estate market and their own tax obligations.

The Assessment Process in Winnebago County

The assessment process in Winnebago County is a critical step in determining the tax liabilities of property owners. This process involves a detailed evaluation of each property to determine its fair market value, which then forms the basis for tax assessments.

Steps in the Assessment Process

- Data Collection: The assessment process begins with the collection of data about each property. This includes physical inspections, where assessors visit properties to gather information about their physical characteristics, as well as the collection of data from public records and other sources.

- Property Classification: Once the data is collected, properties are classified based on their use. Common classifications include residential, commercial, industrial, and agricultural properties. Each classification has its own set of valuation standards.

- Valuation: The actual valuation of the property is the next step. Assessors use various methods, including the cost approach, the sales comparison approach, and the income approach, to determine the fair market value of the property. This value is then used to calculate the assessed value for tax purposes.

- Review and Appeal: After the initial assessment, property owners have the right to review the assessed value of their property. If they believe the assessment is inaccurate, they can file an appeal with the Winnebago County Board of Review. This board conducts hearings and makes decisions on appeals, ensuring that assessments are fair and accurate.

Factors Influencing Property Assessment

Several factors influence the assessment of properties in Winnebago County. These factors include:

- Market Conditions: The local real estate market plays a significant role in property assessments. Assessors consider factors such as supply and demand, recent sales prices of similar properties, and the overall economic climate when determining property values.

- Property Characteristics: The physical attributes of a property, such as its size, age, condition, and any special features, are taken into account during the assessment process. For example, a newly renovated home may have a higher assessed value than an older, less maintained property in the same neighborhood.

- Location: The location of a property can significantly impact its assessed value. Properties in desirable neighborhoods or those with easy access to amenities and services often command higher assessments.

- Improvement Costs: If significant improvements or additions have been made to a property, these costs can affect its assessed value. For instance, a property owner who adds a new wing to their home or upgrades major systems may see an increase in their property's assessed value.

Calculating Tax Rates and Liabilities

Once the assessed values of properties in Winnebago County are determined, the next step is to calculate the tax rates and liabilities for each property. This process involves the application of tax rates set by various taxing bodies, such as the county, school districts, and municipalities, to the assessed values.

Tax Rates and Their Determination

Tax rates in Winnebago County are set by the various taxing bodies that have jurisdiction over the county. These bodies include the Winnebago County government, local school districts, and municipalities. Each of these entities determines its own tax rate based on its budgetary needs and the assessed values of properties within its jurisdiction.

Tax rates are typically expressed as a percentage or a millage rate (mills per dollar of assessed value). For instance, a tax rate of 10% or 10 mills per dollar means that for every $1,000 of assessed value, the property owner would owe $10 in taxes. These rates can vary significantly across different areas within the county, depending on the needs and financial obligations of the taxing bodies.

Calculating Tax Liabilities

To calculate the tax liability for a property, the assessed value of the property is multiplied by the applicable tax rate(s). If a property has multiple tax rates (for example, a county tax rate and a school district tax rate), the assessed value is multiplied by each rate to determine the liability for each taxing body. These individual liabilities are then summed to arrive at the total tax liability for the property.

| Taxing Body | Tax Rate | Assessed Value | Tax Liability |

|---|---|---|---|

| Winnebago County | 7.5% | $150,000 | $1,125 |

| Rockford School District | 12.0% | $150,000 | $1,800 |

| Total Tax Liability | $2,925 |

In the above example, the property has an assessed value of $150,000. The tax rates for Winnebago County and the Rockford School District are 7.5% and 12.0%, respectively. By multiplying the assessed value by each tax rate, we can calculate the tax liability for each taxing body, which totals $2,925.

Accessing and Understanding Winnebago County Tax Records

Accessing and understanding Winnebago County Tax Records is a crucial step for property owners, researchers, and other interested parties. These records provide valuable information about property values, tax liabilities, and the functioning of the county’s tax system.

Where to Access Tax Records

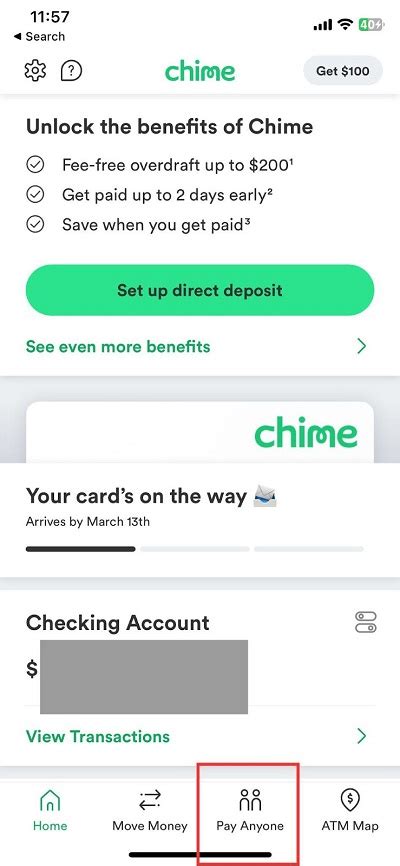

Winnebago County Tax Records are typically available online through the Winnebago County Supervisor of Assessments website. This website provides an online portal where users can search for and access tax records for individual properties. The portal often includes tools for property searches, assessment data, tax rate information, and payment details.

In addition to the online portal, tax records can also be accessed in person at the Winnebago County Supervisor of Assessments office. This option is particularly useful for those who need assistance or have specific queries that require direct interaction with staff.

Understanding Tax Records: A Step-by-Step Guide

- Identify the Property: Start by identifying the property for which you want to access the tax records. This can be done by searching for the property using its address, parcel number, or other unique identifiers.

- Locate the Record: Once you’ve identified the property, locate the corresponding tax record. This record will typically include details such as the property’s assessed value, tax rates, and tax liability for the current and previous years.

- Understand the Assessment: Take time to understand the assessed value of the property. This value is a key component of the tax calculation and is influenced by various factors, as discussed earlier. Compare the assessed value with recent sale prices of similar properties to ensure it is fair and accurate.

- Review Tax Rates: Review the tax rates applicable to the property. These rates are set by various taxing bodies and can vary significantly across the county. Understanding these rates can help you calculate the tax liability for the property and anticipate future tax obligations.

- Analyze Tax History: Tax records often include a history of tax payments and any changes in assessed value or tax rates over the years. Analyzing this history can provide insights into the property’s value trajectory and the stability of tax rates.

- Check for Exemptions: Review the tax record to see if any exemptions or special assessments apply to the property. These can significantly impact the tax liability and are often based on factors such as the property’s use, ownership, or improvements made.

Future Implications and Conclusion

Winnebago County Tax Records serve as a vital tool for the county’s financial planning and management, offering a transparent view of property values and tax liabilities. As the county continues to grow and develop, these records will play an increasingly important role in shaping the county’s fiscal policies and strategies.

Looking ahead, there are several key implications and considerations related to Winnebago County Tax Records. These include:

- Technology and Innovation: The continued development and adoption of technology in the assessment and tax collection processes can enhance efficiency and accuracy. This includes the use of advanced data analytics, GIS mapping, and online platforms for tax record management and public access.

- Market Dynamics: Changes in the local real estate market, such as shifts in supply and demand, economic trends, and the impact of external factors like interest rates, can significantly influence property values and, consequently, tax assessments. Staying abreast of these market dynamics is crucial for accurate assessments and fair taxation.

- Community Engagement: Effective communication and engagement with the community regarding tax records and assessments can foster transparency and trust. This includes providing educational resources, holding public forums, and ensuring that the tax assessment process is well-understood and accessible to all residents.

- Policy and Regulatory Changes: The tax landscape is subject to changes in policy and regulations at the local, state, and federal levels. Staying informed about these changes and their potential impact on tax assessments and liabilities is essential for both government officials and property owners.

In conclusion, Winnebago County Tax Records are a critical component of the county's administration and financial management. They provide a detailed view of property values, tax rates, and liabilities, serving as a foundation for the county's fiscal planning and operations. By understanding and effectively utilizing these records, property owners, researchers, and community members can actively participate in the county's fiscal processes and contribute to its ongoing development and prosperity.

How often are property assessments conducted in Winnebago County?

+Property assessments in Winnebago County are conducted annually. This means that the assessed value of properties is updated each year to reflect changes in market conditions, property characteristics, and other relevant factors.

Can property owners contest their assessed value or tax liability?

+Yes, property owners in Winnebago County have the right to appeal their assessed value if they believe it is inaccurate or unfair. Appeals can be made to the Winnebago County Board of Review, which reviews the assessments and makes decisions based on the evidence presented.

What happens if property taxes are not paid on time in Winnebago County?

+Unpaid property taxes in Winnebago County can lead to significant penalties and interest charges. In extreme cases, the county may place a tax lien on the property, which can ultimately result in the property being sold at a tax sale to recover the outstanding taxes.

How are tax rates determined for different areas within Winnebago County?

+Tax rates in Winnebago County are determined by various taxing bodies, such as the county government, school districts, and municipalities. These bodies set their tax rates based on their budgetary needs and the assessed values of properties within their jurisdictions. Tax rates can vary significantly across the county, reflecting the different financial obligations and needs of these taxing bodies.