Do Government Agencies Pay Taxes

Government agencies and entities operate within a unique financial framework, often distinct from that of private businesses and individuals. Understanding their tax obligations is crucial for a comprehensive grasp of the economic landscape. This article delves into the intricate relationship between government bodies and taxation, exploring the legal, economic, and practical aspects that shape this complex topic.

Taxation of Government Agencies: A Complex Legal Framework

The tax obligations of government agencies are governed by a complex web of legal provisions and regulations. These entities, including federal, state, and local government bodies, often have specific tax exemptions and responsibilities outlined in constitutional provisions, statutes, and case law. For instance, the Internal Revenue Code in the United States provides explicit guidelines on the tax status of government entities, delineating the circumstances under which they are subject to federal taxes.

Constitutional Provisions and Tax Exemptions

Many constitutions around the world grant certain tax privileges to government agencies, primarily to ensure their financial autonomy and promote the efficient functioning of public services. For example, Article I, Section 9 of the U.S. Constitution prohibits Congress from taxing states, a principle that has been upheld in numerous legal precedents, including the landmark case of M’Culloch v. Maryland.

In this case, the Supreme Court ruled that the state of Maryland could not tax the Second Bank of the United States, a quasi-governmental entity, as it would impede the federal government's ability to carry out its constitutional duties. This principle has been extended to cover various federal entities, including government-sponsored enterprises and certain public corporations.

Taxation at Different Levels of Government

The tax landscape for government agencies varies significantly across different levels of government. Federal agencies, due to their constitutional privileges, are often exempt from a wide range of taxes, including income, property, and sales taxes. This exemption, however, is not absolute and can be subject to certain conditions and limitations.

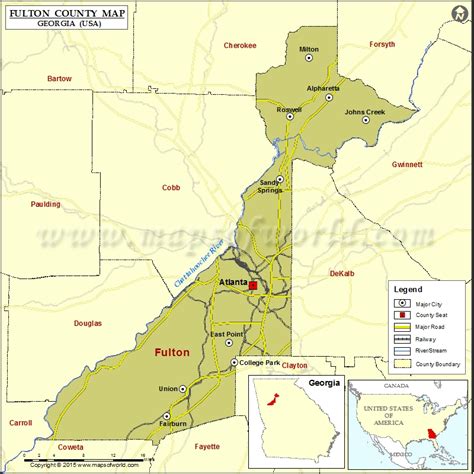

State and local government agencies, on the other hand, may face different tax obligations. While they are typically exempt from federal taxes, they are often subject to their own state and local taxes. This can include property taxes, which are a significant source of revenue for many state and local governments. For instance, state-owned lands, such as those used for parks or wildlife reserves, are often taxed at a local level to contribute to community infrastructure and services.

| Type of Tax | Federal Government Agencies | State/Local Government Agencies |

|---|---|---|

| Income Tax | Generally exempt | May be subject to their own income taxes |

| Property Tax | Exempt in most cases | Often subject to property taxes |

| Sales Tax | Exempt | May be subject to sales taxes |

Practical Considerations: How Government Agencies Navigate the Tax System

While the legal framework provides a foundation for understanding the tax obligations of government agencies, practical considerations play a significant role in how these entities interact with the tax system.

Revenue Generation and Budgetary Constraints

Government agencies, especially those at the state and local level, often face budgetary constraints and revenue shortfalls. While they are exempt from certain taxes, they are also limited in their ability to generate revenue. This can lead to creative strategies for funding, such as the use of user fees, fines, and other non-tax revenue sources.

For example, many state-run universities and colleges charge tuition fees to generate revenue, which helps offset the costs of providing education. Similarly, government-owned utilities, such as water or electricity providers, often set rates that cover their operational and maintenance expenses, effectively generating revenue through user fees rather than taxes.

Intergovernmental Relations and Tax Policies

The relationship between different levels of government can also impact the tax obligations and strategies of government agencies. In a federal system like the United States, the interplay between federal, state, and local governments can be complex. For instance, federal grants and aid to state and local governments may come with tax-related conditions, such as requirements to maintain certain tax rates or structures.

Furthermore, state and local governments often engage in tax competition, trying to attract businesses and residents by offering favorable tax rates or incentives. This can lead to a delicate balance between the need to maintain revenue streams and the desire to create an attractive business environment. Government agencies, in this context, may find themselves navigating a complex web of tax policies and incentives, both at the national and regional levels.

The Future of Taxation for Government Agencies

The tax landscape for government agencies is constantly evolving, influenced by changing economic conditions, political priorities, and legal interpretations. As governments around the world grapple with issues like budget deficits, economic growth, and social welfare, the tax obligations and privileges of government entities are likely to remain a subject of scrutiny and debate.

Potential Reforms and Policy Shifts

There is a growing recognition of the need for tax reforms that address the unique challenges faced by government agencies. This includes proposals to clarify and simplify the tax rules applicable to these entities, ensuring that they contribute fairly to the overall tax system without unduly impeding their ability to function effectively.

Additionally, there is ongoing discussion about the role of government agencies in promoting economic development and social welfare. Some argue for a more proactive role for these entities, including potential tax incentives or exemptions to encourage specific behaviors or outcomes. Others advocate for a more streamlined and consistent approach to taxation, emphasizing the need for simplicity and fairness across the board.

Global Trends and Comparative Analysis

Comparative analysis of tax policies across different countries can provide valuable insights into best practices and potential reforms. For instance, the European Union has a unique system of taxation for government agencies, with a focus on harmonizing tax rules across member states to facilitate the free movement of goods, services, and capital. This approach offers a contrast to the more decentralized tax systems seen in federal countries like the United States.

As governments continue to navigate economic challenges and pursue their policy goals, the taxation of government agencies will remain a critical issue. Balancing the need for financial autonomy and efficiency with the broader goals of fiscal responsibility and fairness will continue to shape the legal and practical framework governing these entities.

How do government agencies generate revenue if they are exempt from taxes?

+Government agencies generate revenue through a variety of means, including user fees, fines, and grants. They may also receive funding from the government or other public entities.

Are there any instances where government agencies pay taxes?

+While federal government agencies are generally exempt from most taxes, state and local government agencies may be subject to their own state and local taxes. This can include property taxes, sales taxes, and income taxes in some cases.

What are the potential implications of tax reforms for government agencies?

+Tax reforms for government agencies can have a significant impact on their financial health and operational capabilities. While some reforms may aim to increase revenue by subjecting these entities to new taxes or increasing existing tax rates, others may seek to provide tax incentives to encourage specific behaviors or outcomes. The balance between revenue generation and operational efficiency is a critical consideration in these reforms.