What Is Oasdi Tax On Paycheck

Understanding the intricacies of taxes is crucial, especially when it comes to your paycheck. One term you might have encountered is OASDI tax, which stands for Old-Age, Survivors, and Disability Insurance. In this comprehensive guide, we will delve into the world of OASDI taxes, breaking down its components, its impact on your paycheck, and its significance in the broader context of social security.

The OASDI Tax: Unlocking the Basics

OASDI tax is a mandatory contribution made by employees and employers to fund the Social Security program in the United States. This tax is a vital component of the nation’s social safety net, providing financial support to retirees, individuals with disabilities, and families of deceased workers.

The OASDI tax is often referred to as the Social Security tax or the FICA tax (Federal Insurance Contributions Act). It is an essential part of the U.S. tax system, designed to ensure the financial stability and well-being of millions of Americans.

Key Components of OASDI Tax:

- Old-Age Insurance: This component supports retirees who have reached the eligible age for Social Security benefits.

- Survivors’ Insurance: It provides financial assistance to the families of deceased workers, ensuring their financial stability.

- Disability Insurance: OASDI tax funds disability benefits for individuals who become disabled and are unable to work.

Now, let's explore how this tax impacts your paycheck and the broader implications it has on the economy and society.

OASDI Tax and Your Paycheck: A Detailed Breakdown

When you receive your paycheck, you might notice various deductions, including the OASDI tax. Here’s a closer look at how this tax affects your earnings:

Tax Rates and Calculations:

The OASDI tax rate is set by the federal government and is subject to periodic adjustments. For the year 2023, the tax rate is 6.2% for employees and an additional 6.2% for employers, totaling 12.4% of an employee’s earnings. However, there is an earnings cap, known as the Social Security Wage Base, beyond which the tax is not applied.

For instance, in 2023, the Social Security Wage Base is set at $160,200. This means that earnings above this amount are not subject to the OASDI tax. This cap is adjusted annually to account for inflation and changes in the economy.

Impact on Take-Home Pay:

The OASDI tax deduction directly affects your take-home pay. As an employee, you contribute 6.2% of your earnings up to the wage base limit. This means that a portion of your income is set aside to fund the Social Security program. While it might seem like a reduction in your earnings, it is an investment in your future and the well-being of your community.

Let's consider an example. If you earn $50,000 annually and the OASDI tax rate is 6.2%, you will contribute $3,100 towards Social Security. This amount is deducted from your gross income, resulting in a net pay of $46,900. While this might seem like a significant deduction, it is essential to remember that this contribution provides a safety net for you and your loved ones in times of need.

Employer Contributions:

It’s important to note that employers also have a responsibility to contribute to the OASDI tax. For every dollar an employee contributes, the employer matches it, ensuring a collective effort in funding the Social Security program. This shared responsibility is a cornerstone of the program’s sustainability and success.

The Broader Impact of OASDI Tax

The OASDI tax extends beyond individual paychecks and plays a vital role in the overall social and economic landscape of the United States.

Social Security Benefits:

The funds generated through the OASDI tax are a primary source of revenue for the Social Security program. This program provides a range of benefits, including retirement income, disability support, and survivors’ benefits. These benefits offer financial security to millions of Americans, ensuring a decent standard of living during their golden years or in times of hardship.

| Benefit Type | Description |

|---|---|

| Retirement Benefits | Monthly payments to eligible retirees, ensuring a stable income during retirement. |

| Disability Benefits | Financial support for individuals who become disabled and can no longer work. |

| Survivors' Benefits | Provides income to the families of deceased workers, offering stability during a challenging time. |

Economic Stability and Growth:

The OASDI tax contributes to the overall economic stability of the nation. By providing a safety net for retirees and individuals with disabilities, the tax encourages a more productive workforce. It ensures that individuals can plan their retirement securely, knowing they have a reliable income source. Additionally, it supports families during challenging times, reducing financial strain and promoting economic growth.

Intergenerational Equity:

The OASDI tax system is designed to maintain intergenerational equity. Current workers contribute to the program, ensuring that current retirees receive their benefits. As time progresses, the contributions of today’s workers will fund the benefits of future retirees. This cyclical process ensures that the program remains sustainable and that the benefits are available for generations to come.

FAQs

How is the OASDI tax rate determined?

+The OASDI tax rate is set by the federal government and is subject to periodic adjustments. It is determined based on various economic factors, including the cost of living, inflation, and the need to maintain the solvency of the Social Security program.

Are there any exceptions to the OASDI tax?

+Yes, there are certain exceptions and limitations to the OASDI tax. For instance, self-employed individuals have different tax rates and calculation methods. Additionally, earnings above the Social Security Wage Base are not subject to the tax.

How does the OASDI tax contribute to Social Security benefits?

+The OASDI tax is a primary source of funding for Social Security benefits. The tax revenue is used to provide retirement, disability, and survivors’ benefits to eligible individuals, ensuring financial stability during various life stages.

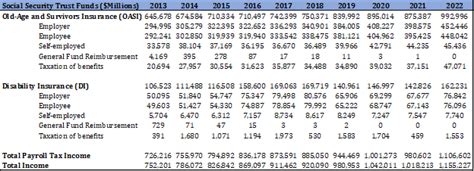

What happens if the OASDI tax revenue falls short?

+If the OASDI tax revenue falls short of the program’s needs, the Social Security Trust Fund steps in. This fund, built from surplus tax revenue over the years, provides a financial buffer to ensure the continuity of benefits. However, long-term funding challenges may require policy adjustments to maintain the program’s solvency.

Can I opt out of paying the OASDI tax?

+No, the OASDI tax is a mandatory contribution for most employees and employers. It is a legal requirement to fund the Social Security program, and failure to pay can result in penalties and legal consequences.