Wayne County Property Tax Lookup

Property taxes are an essential aspect of local government finances, providing crucial funding for various services and infrastructure within a community. For homeowners, understanding their property tax obligations and the assessment process is vital to their financial planning and overall engagement with their local government. This article delves into the world of property taxes in Wayne County, offering an in-depth exploration of the assessment process, payment options, and the various resources available to taxpayers.

Navigating Property Taxes in Wayne County

Wayne County, known for its vibrant communities and diverse real estate landscape, employs a systematic approach to property tax assessment and collection. The process is designed to ensure fairness and transparency, taking into account the unique characteristics of each property within the county.

The Assessment Process

The journey of a property through the tax assessment process in Wayne County begins with a thorough evaluation conducted by the county’s Assessor’s Office. This office is responsible for appraising the value of all properties within the county, including residential, commercial, and industrial properties. The assessment is based on several factors, including:

- Market Value: The Assessor's Office considers the property's market value, which is the price the property would likely sell for in an open market.

- Property Type and Size: Different types of properties (e.g., single-family homes, apartments, commercial buildings) have distinct assessment methods, taking into account factors like square footage and number of units.

- Location: Properties in desirable neighborhoods or with access to amenities may have higher assessments due to their location.

- Recent Improvements: Any significant improvements or renovations made to the property can influence its assessed value.

- Tax Rate: The county's tax rate, set by local authorities, is applied to the assessed value to determine the property tax liability.

Once the assessment is complete, property owners receive a notice detailing the assessed value and the calculated tax amount. This notice is typically sent out before the start of the tax year, allowing homeowners to plan their finances accordingly.

Understanding Tax Rates

The tax rate in Wayne County is determined by the local government and can vary from year to year. It is often expressed as a percentage or a millage rate, where one mill represents 1 of tax for every 1,000 of assessed value. The tax rate is used to calculate the tax liability for each property, which is then distributed among various taxing authorities, including the county, school districts, and special districts.

| Taxing Authority | Tax Rate (Millage) |

|---|---|

| Wayne County | 12.5 mills |

| Wayne County Schools | 15.2 mills |

| Local Municipality | 8.7 mills |

| Special Districts (e.g., Fire Department) | Varies |

The above table provides a simplified example of how tax rates are applied. In this scenario, a property with an assessed value of $200,000 would owe:

- Wayne County: $2,500 (12.5 mills x $200,000)

- Wayne County Schools: $3,040 (15.2 mills x $200,000)

- Local Municipality: $1,740 (8.7 mills x $200,000)

- Special Districts: Varies based on the specific district's millage rate.

It's important to note that tax rates can change annually, influenced by factors such as budget requirements and local economic conditions.

Payment Options and Deadlines

Wayne County offers flexibility in terms of property tax payment options, allowing taxpayers to choose the method that best suits their preferences and financial situation. Here are the primary payment methods:

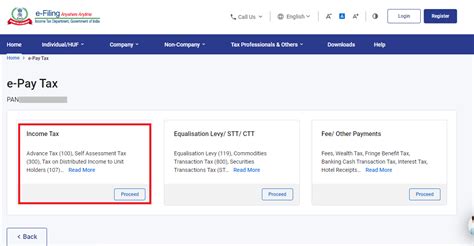

- Online Payment: Taxpayers can make secure payments through the county's official website, which offers a user-friendly interface and the option to schedule payments in advance.

- Mail-in Payment: Those who prefer traditional methods can send their payment via mail to the designated address, ensuring it reaches the tax office before the deadline.

- In-Person Payment: For immediate payment, taxpayers can visit the county tax office during business hours. This option provides the benefit of receiving instant confirmation and resolving any queries directly with the staff.

It's crucial to adhere to the payment deadlines to avoid penalties and interest charges. Typically, Wayne County provides two installments for property tax payments, with specific due dates communicated on the tax notice. Failure to pay by the deadline may result in late fees and potential legal consequences.

Resources and Support for Taxpayers

Wayne County understands that property taxes can be a complex matter, and as such, provides a range of resources and support services to assist taxpayers:

- Online Tax Lookup: The county's website offers an interactive tool where taxpayers can enter their property details to retrieve their assessment information, tax rates, and payment history.

- Assessor's Office Assistance: Taxpayers with questions or concerns about their assessment can reach out to the Assessor's Office. The office provides expert guidance and clarifies any discrepancies or unique circumstances.

- Tax Relief Programs: Wayne County recognizes the financial challenges some homeowners face and offers tax relief programs such as homestead exemptions, veterans' exemptions, and senior citizen discounts. These programs reduce the tax liability for eligible individuals.

- Payment Plan Options: For taxpayers facing temporary financial difficulties, the county may offer payment plan arrangements to help manage their tax obligations over a longer period.

Conclusion: Empowering Homeowners

Understanding the property tax landscape in Wayne County empowers homeowners to navigate their financial obligations effectively. By familiarizing themselves with the assessment process, tax rates, and available resources, taxpayers can ensure they meet their obligations while also leveraging the support and relief programs offered by the county. It’s a vital aspect of responsible homeownership, contributing to the sustainability and growth of the local community.

How often are property assessments conducted in Wayne County?

+Property assessments are typically conducted every year to ensure the tax liability is aligned with the current market conditions and property values. This yearly assessment allows for accurate and fair taxation.

Can I dispute my property’s assessed value?

+Yes, if you believe your property’s assessed value is incorrect, you have the right to appeal. The process involves submitting an appeal to the Assessor’s Office, providing evidence to support your claim, and potentially attending a hearing to present your case.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline may result in late fees, interest charges, and potential legal actions. It’s advisable to contact the tax office to discuss payment options and avoid further penalties.

Are there any tax relief programs for low-income homeowners in Wayne County?

+Yes, Wayne County offers various tax relief programs, including the Circuit Breaker Program, which provides a credit for eligible low-income homeowners. It’s recommended to check the county’s website or contact the tax office for detailed information on eligibility and application processes.